Why did hryvnia fell so much in 2014 and yearly 2015? Who should be blamed for it? Many Ukrainians seek answers to these basic questions.

Many experts (here or here), politicians (here , here, or here), and even the Council of NBU blame the National Bank of Ukraine (NBU). Specifically, they claim that the NBU provided liquidity (refinancing) to a selected group of lucky banks. These banks then used the liquidity to buy dollars. As a result, a high dollar demand from banks caused the price of the dollar to increase and the price of the hryvnia to fall.

In this post, we use graphs and a little of statistics to show that the data has little support for blaming NBU’s refinancing for hryvnia’s fall. To be clear, we are not saying that the NBU did not play a role in the hryvnia’s fall. We just examine one specific channel and find little evidence to support the claim that refinancing caused the depreciation of the hryvnia.

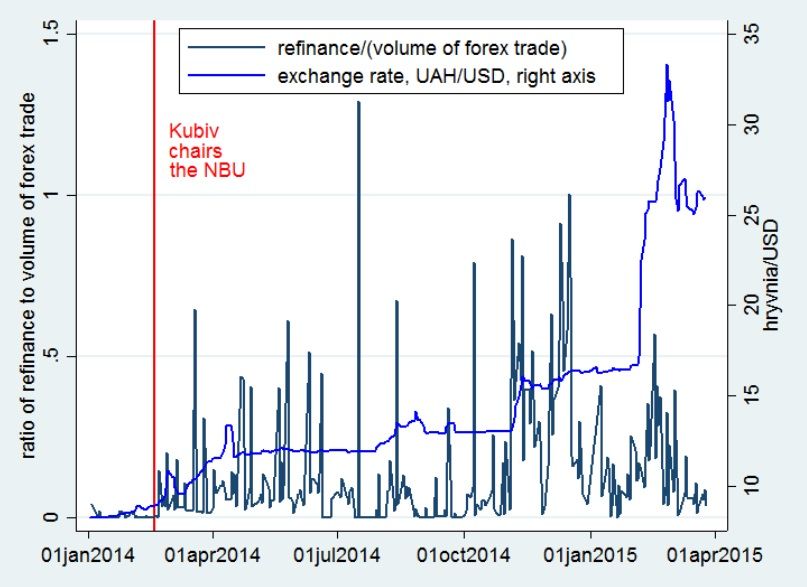

Fact #1. Figure 1 shows the ratio of NBU’s refinancing to the volume of dollar trade in the foreign exchange market. The average of the ratio is 20% and thus refinancing was not big enough to move the hryvnia radically. However, this ratio did increase in the end of 2014 and beginning of 2015. This temporary spike in refinancing may prompted some to conclude that refinancing is linked to the rise of the dollar relative to the hryvnia.

Yet, the timing of jumps in refinancing does not appear to systematically coincide with big jumps in the price of the dollar. Figure 1 shows increases in refinancing only sometimes fall on the days when the hryvnia depreciated considerably. One such episode happened in November of 2014. However, there are many other episodes when big increases in refinancing did nothing to the dollar price.

Figure 1

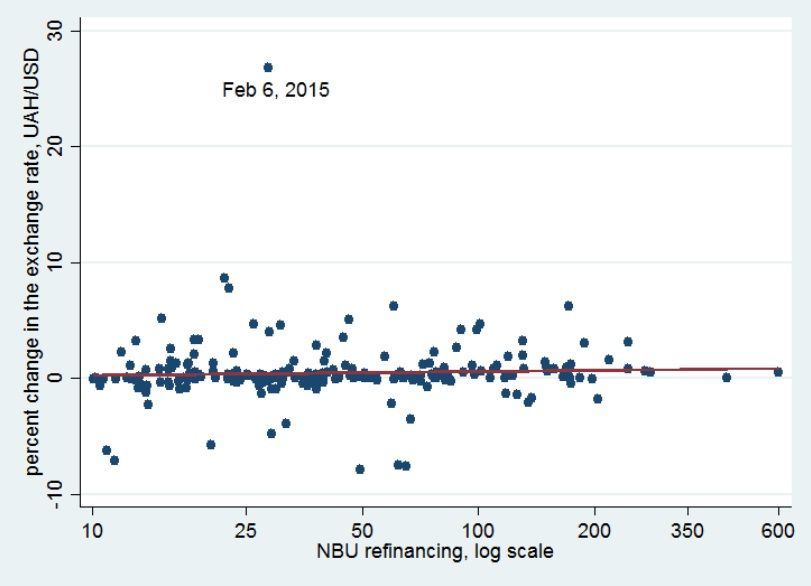

Fact #2. We can show a weak link between refinancing and dollar price with a different graph. Figure 2 plots daily percent changes in the exchange rate against the NBU’s refinancing. While the fitted line is slightly positive, the magnitude of the slope is small. In other words, the exchange rate is largely insensitive to refinancing. Note that the largest increase in dollar (more than 20%, February 6, 2015) happened on a typical day in terms of refinancing.

Figure 2

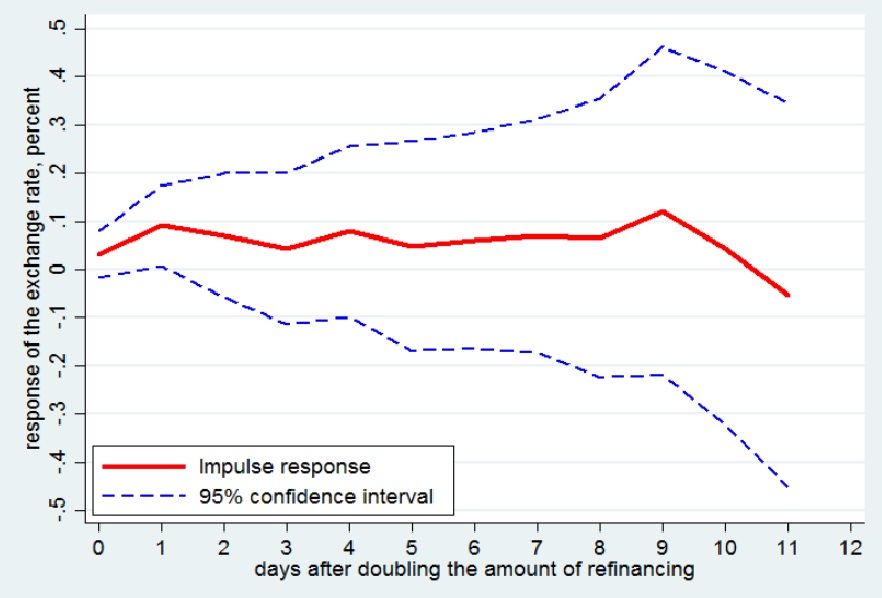

Fact #3. Maybe the effect of refinancing materializes with a delay. To explore this possibility, we use the method of direct projections (see Jorda (2005) for more details). Specifically, we regress cumulative change in the exchange rate between day t and day t+h on the (log) refinancing on day t as well as lagged values of refinancing and daily changes in the exchange rate. For this regression we use data after January 1, 2014. Figure 2 shows the response to the exchange rate to an unexpected increase in refinancing (approximately double the amount of refinancing). The response is statistically different from zero only with one day delay; at all other horizons we cannot reject the null hypothesis that the response is zero. In other words, statistically the link between refinancing and exchange rate is weak. Furthermore, even if we ignore the imprecision of the estimates, the size of the response is small. Doubling refinancing (100 percent increase) raises the UAH/USD exchange rate by only 0.1 percent.

Figure 3

In summary, the NBU did give loans to banks. But the data gives us little support to claim that those loans caused massive depreciations of the hryvnia. Jumps in refinancing rarely coincided with changes in the exchange rate. Most of the time, changes in refinancing were not associated with changes in exchange rate either on the same day or in the next two weeks.