Gas price issue is sensitive. We need to have proper and transparent discussion about it, in which all arguments should be presented and weighed. Ideally, arguments should be economically sound and non-populist (“we will all starve/freeze to death”). The goal is not to argue for or against hike in gas tariffs, but for everyone to fully understand pros and cons of this step. The decision will still be after the policymakers, whom we pay from our taxes. If policymakers decide not to hike, they should be ready to explain to the public why and how they will tackle consequences of this decision. If they decide to hike, they also should be ready to explain why and how they will tackle consequences of this decision.

In Ukraine, gas tariffs for households are 5 times lower than imports price. Recently, many experts began calling for an abrupt gas tariffs hike to the “market” level regarding this as one of the most important reform priorities. Importantly, this is also one of the demands of the IMF program and other donors’ support.

We elaborate on the pros and cons of this step and conclude that without simultaneous steps towards liberalization of the gas market, gas tariffs hike, while painful but necessary, will degenerate to a one-off fiscal measure aimed at curbing overall budget deficit. Therefore a comprehensive energy sector reform should follow shortly to create conductive environment for the economy to benefit from the gas price hike.

Brief context

Ukraine’s gas market functions as a centrally planned distribution system.

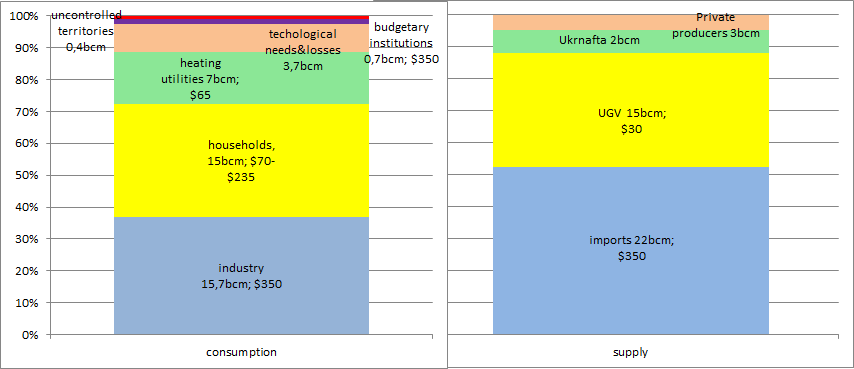

In 2014 Ukraine consumed 42.6 bcm of gas (15% less than in 2013), out of which industry – 15.7 bcm, heating utilities – 7 bcm, households – 15 bcm, technological needs and losses – 3.7 bcm, budgetary institutions – 0.7, uncontrolled territories – 0.4. Consumers were buying the gas at differential tariffs ranging from UAH 5900 ($350) per 1000 cm for industry, to UAH 1100 ($65) for heating companies, and to UAH 1089-4011 ($70-$235) for households.

The production side of the gas market is monopolized by the state. Private production totalled just 3 bcm, and it catered only to the industry segment*. Semi-private Ukrnafta, with 51% owned by the state but actually controlled by the second-largest owner, Privat group, extracted another 2 bcm, having sold it to industry as well. The remainder, 37 bcm, was distributed through the largest SOE in Ukraine, Naftogaz. Naftogaz sourced gas from its domestic subsidiary Ukrgazvydobuvannya (UGV) – 15 bcm paying $30 per tcm, and from imports sources – 22 bcm, paying an average of $350 per tcm. The next diagram illustrates the above two paragraphs**.

Data source: Naftogas

Historically, the gas balance was constructed in such a way that domestic gas (the cheap one) was used to cover population needs, while imported gas (the expensive one) was sold to the industry. Domestic gas supply was not enough to cover population needs (households and heating), so Naftogaz used imported gas to cover the deficit (about a third of subsidized consumption). As it charged a fraction of gas import cost, its financial deficit ballooned. Non-payments and fraud also contributed to weaker revenue collection, and hence, to the deficit. Non-transparent Naftogaz structure and financials do not allow determining which losses resulted from subsidizing households and which stem from fraudulent schemes.

Therefore, Naftogaz financials were always dire***, and it required continuous aid from the state. In 2014 the Naftogas deficit expanded from 1.5-2% of GDP to an estimated 6% of GDP. The budget treated these operations as off-balance sheet, but in the essence the funding of the Naftogaz’s gap was a part of the broader government deficit. The easiest way to reduce this deficit is raising revenues, i.e. gas prices for the population.

Below we provide a simplistic cost-benefit analysis of hiking gas price.

| Pros of hiking gas prices | Counter-arguments to pros |

| 1. Hike will serve as a powerful incentive to start reforms in the gas sector. Without a price increase, it will be difficult or even impossible to push market-oriented gas reforms through. After people begin to pay more, there will be much more pressure on politicians to speed up changes, bring more transparency and accountability. | Political landscape today is highly populist and economically ignorant. Populists will gain political score by criticizing the government. Politicians and wider public will not lead constructive discussions about complex reforms, and Ukraine has never succeeded in complex reforms done in gradual manner. Naftogaz and UGV, as monopolists, will also be not interested in pushing further reforms which will deprive them of market share and revenues. |

| 2. Higher price will incentivize households to pursue energy saving and will contribute to overall energy efficiency. Currently, because of the subsidized price, energy consumption is profligate. High cost of energy will force people to use energy rationally, e.g. turn off heating when not needed, and to invest in energy saving, i.e. in insulation of their homes, new windows, better radiators, proper gas meters etc. This will reduce gas and energy consumption in the future. Moreover, people in private houses may start considering switching to different fuels, as other energy sources will become more attractive relative to gas. | People’s response to the price shock may be different, ranging from cutting spending on other goods or accumulating arrears to more efficient use of energy. In any case, modernizing for better efficiency will require substantial individual investments which may be problematic given economic crisis and limited funding opportunities. |

| 3. Gas has been long underpriced in Ukraine both in nominal and relative terms (e.g. compared to income levels). People are paying less than they can actually afford because of low price. Thus, hiking gas prices should eliminate this mispricing. | It is difficult to estimate a “fair” price of gas without a functioning market. |

| 4. Huge energy subsidies divert government spending from other important areas. Instead of spending on inefficient subsidies UAH 70 bln ($4.1 bln) or 4% of GDP annually (2014 estimate), the government could spend this money on healthcare, education, defence. | The state is unable to identify what is the best usage of people’s money. Ukraine has proven that the government is inefficient in providing public goods, and more government interference breeds only distortions and corruption. |

| 5. Equalizing of the tariffs coupled with targeted social assistance (in the monetary form) will remove shortcomings of the current subsidy system which benefits wealthier households. In the current system, household are all subsidized equally (via the price they pay) rather than based on their actual needs. Wealthier households pay the same low price as poorer ones. In this respect the system is unfair. Shifting to needs-based assistance will make it more efficient and less costly for the budget. | Exact design and scope of subsidies are yet to be known. |

| 6. A hike in gas tariffs will eliminate Naftogaz deficit, hence, improve overall public deficit. Ukraine’s 2015 budget envisages overall government deficit of around 9.3% of GDP. Also, gas price hike is one of the IMF requirements in the current program. | Technically, Naftogaz deficit is not financed from people’s taxes. It is funded as an off-balance sheet item of budget through debt issuance, which is subsequently monetized by the NBU. As a result, the economic cost of the deficit is shared by people indirectly, through higher inflation and/or devaluation. In this respect, tariff hike will be similar to a new direct tax on people’s incomes. |

| 7. Balancing Naftogaz finances will remove pressure from the National Bank of Ukraine (NBU), which is forced to monetize government debt being issued to plug Naftogaz gap. This, in turn, will relax devaluation pressure on hryvnia. Last year, out of $12.9 bln of reserves drawdown, $8.6 bln was spent on Naftogaz (so that it could pay for imported gas), while UAH 97 bln ($5.7 bln) of debt was monetized. | While the pressure on monetary base expansion will be removed, tariff hike will not remove Naftogaz from being the biggest importer. Naftogaz will still need $6-8 bln annually to import gas. |

| 8. Equalizing the tariffs will close scope for fraudulent schemes. Anecdotal evidence suggests that regional gas distribution companies submitted excessive plans for gas usage by population and heating companies than was actually needed. This was done because of deficiencies in gas consumption measurement system. In the end, they bought cheap gas and resold it at market prices to industrial users reaping huge arbitrage profits. With unified price for each consumer category this will be impossible. | While we know little details about exact design of these schemes, their elimination will not affect total consumption of gas. The gas that was previously accounted as “gas for households” will be accounted as “gas for industry ” thus decreasing Naftogas deficit.The schemes that profit on pocketing unaccounted gas or on overstating gas consumption and overcharging population for that will not be affected by a tariff hike. |

| 9. Financially viable Naftogaz will be attractive for foreign investments. Naftogaz and its extracting unit UGV will get enough revenues and profits to fund exploration and extraction related capex, and to gain appeal for foreign investors’ participation. | Appeal for investors will depend not only on financials, but also on general business, tax, and regulatory environment. |

Cons and counter-arguments to cons of hiking gas prices

| Cons of hiking gas prices | Counter-arguments to cons |

| 1. Political cost. Gas price hike in an unpopular measure that will hit confidence and damage political capital of the government. This may impair and effectively stall any further reforms. In the worst case it may lead to political and/or social turmoil amid ongoing war and crisis. | Many people are intrinsically ready for the decision. The largest “enemies” of such decision are rent-seekers who benefit from current mispricing. The price hike will raise less protests if the government acts to reduce Naftogaz cost, increase its transparency, proceeds with unbundling (i.e. separating extraction and transportation), allow private extraction companies access the Naftogas pipes network, reduce Naftogas overheads etc. |

| 2. Gas market remains unreformed. Price hikes work differently in the monopolistic markets – they do not incentivize supply increase. Ukraine’s market remains closed (Naftogaz share in domestic gas sales is 92%): exports of gas are forbidden, imports are done exclusively via Naftogaz, internal trading is severely restricted, UGV sells its gas to Naftogaz only etc. Essentially, there is no market where a fair gas price could be determined and could function as an incentive for suppliers. | Gas price hike is the first step towards establishing a proper functioning market. It is impossible to break up a state monopoly with subsidized prices. A price hike will speed up reforms in the sector by making it attractive for new entrants. |

| 3. Efficiency gain from lower gas consumption (by households) may be limited. First, many people don’t have technical (infrastructural) opportunity to cut consumption. Many urban building blocks are customized for central heating. Many of buildings and heating utility companies don’t have gas and heating meters installed, and incur large heating losses. Second, in the absence proper metering, gas tariff hike may incentivize free-rider behaviour and accelerate non-payments, instead of incentivizing efficiency. | It’s better to have a limited gain than none at all. People in private houses will economize. People in apartment blocks may think about establishing less expensive building heat meters first, and then cooperating to reduce heat consumption and losses by the building. Here the government can step in – for example, if dwellers install new windows the government installs isolation on the house walls. |

| 4. Household incomes are low and falling to accommodate for immediate tariff hike. Ukraine has the lowest official salaries in Europe (around US$ 150 per month at market exchange rate). Real salaries went down by 14% y/y in December 2014 and the downward trend is accelerating with economic crisis ongoing. An immediate increase in utility bill will decrease living standards substantially, and worsen economic recession. | This is an evergreen argument. First, part of the price hike may be covered by subsidies. Moreover, if people install meters and start saving energy, they actually may end up paying less (or only slightly more) than before the price hike.To soften its impact, some time should be provided between the price hike announcement and its actual introduction, so that people have time to prepare. |

| 5. Social safety net capacity might not be able to absorb the demand and non-payments may grow. Currently about 1.2 million households (of 17 million total) receive communal subisdies. With the increased tariffs, the number of people requiring aid may grow to 15-20 million, according to the Prime Minister, and the Ministry of Social policy will not able to efficiently process the increased demand for subsidies. Even with current low prices and subsidies, the population is covering 92% of their total utility bill (in 2014), with payment rate for central heating and water/wastewater running as low as 87-93%. If the social net fails to absorb demand, non-payments will grow exponentially. In turn, lack of proper payment enforcement may stimulate the emergence of long term opportunistic behaviour. | This will be an incentive for the Ministry of Social policy to increase its efficiency and to test shifting to target-based monetary subsidies in the broader sense. Ministry of Social policy should follow and build on the experience of the Tax administration that has developed more or less efficient procedures and databases. |

| 6. Higher tariffs will generate higher inflation. Inflation, which is already running as high as 28% y/y, will be further pushed by administrative price increases. Higher inflation will be difficult to tackle as it will be cost-push. Also, cost-push inflation may lead to wage-price spiral. High inflation is very negative for the economy as it creates large redistribution of wealth and purchasing power from receivers of fixed incomes (pensioners, wage earners) to owners of real assets. It also disincentivizes savings and investments. | Unless tariffs are hiked and Naftogaz financial gap closes, there will be pressure on the NBU to print money. This is more inflationary than a one-off tariff hike. Moreover, tariffs for industry are already high and will not pass-through to prices. |

| 7. Consumer surplus will shift from the households to SOE or budget. Currently households are paying little for gas and spend this money in their own way. After the gas price hike, this economic surplus valued at around $5 billion in UAH equivalent will shift either to Naftogaz/UGV, or to the budget. Windfall revenues in the SOE will create the scope for corruption (e.g. funding costly capital expenses or contracting third parties), as governance standards, transparency and accountability are lacking. If the surplus is expropriated by the state through dividends or taxes, this will be even worse: Naftogaz/UGV will not gain investor appeal while the government will spend money even less efficiently | Eligible consumers will be compensated by the direct subsidy from the budget, thus, surplus will not be affected. Also, there will be more incentives to demand Naftogaz transparency and accountability. |

| 8. Incentives for Naftogaz to cut costs and to be more efficient will be lost. Currently, Naftogaz is operating with “semi-hard budget constraints”, i.e. it is forced to find cheaper gas, sue the Gazprom, diversify gas supply routes, cut capital spending (which is not necessarily good), adopt zero-tolerance for arrears and non-payments etc. This, however, is partly offset by the government aid. If all prices are automatically equal to import costs and monopoly position is maintained, incentives to increase efficiency will disappear. | There are many efficient ways for governments to regulate monopolies (the most efficient is, of course, dismantling it).A state-owned monopoly, theoretically, does not have any incentives to cut cost anyway since any additional profits will go to the state. The only way to make a state-owned monopoly to cut costs is (1) making it fully transparent and (2) making remuneration of management of this monopoly dependent on its profit. |

Conclusion

Hiking tariffs is a painful but necessary step for reform in the gas sector to happen. It is a binary solution, which, however, does not create a market by itself.

In the current circumstances, tariff hike will serve as a deficit reduction measure, but its broader effect will be incomplete without immediate liberalization of gas trade, creation of legislation framework for industry development, targeted subsidies system in place, and a radical improvement in the governance of state monopolies. These challenges are much more complex and can’t be solved overnight.

Unfortunately, historically Ukraine has a very poor track record in handling complex, multi-staged reforms. Inter alia, unless a comprehensive reform effort in the sector is quickly implemented, Ukraine might end up with higher costs and greater distortions than before the hike. If the reform package is put in place fast enough following the tariff hike, Ukraine may easily become energy efficient and self-sufficient within the five-year timeframe.

* In November 2014 the Cabinet issued decree No.647 by which it ordered 170 large industrial enterprises to purchase gas exclusively from Naftogaz until end-February 2015. This step was severely criticized by the Energy Community as discriminatory.

** All figures presented here may differ from actual numbers due to rounding, exchange rate fluctuation and data revision.

*** Here we exclude operations other than gas sale. Before unbundling started, along with gas marketing Naftogaz performed gas transmission, gas distribution, gas storage, downstream and other activities. As we don’t have consolidated company results for 2014, we may assume that, on balance, these operations were breaking even. Anyway, their contribution to company’s statements may have been insignificant.

By Olena Bilan (Dragon Capital), Volodymyr Bilotkach (Newcastle U.), Tom Coupé (KSE), Yuriy Gorodnichenko (UC Berkeley), Veronika Movchan (IER), Tymofiy Mylovanov (U. of Pittsburgh), Ilona Sologoub (KSE), Dmytro Sologub (Raiffeisen Bank Aval), Oleksandr Talavera (U. of Sheffield), Oleksandr Zholud (International Center for Policy Studies) and Nickolay Myagky

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations