The law attracted a lot of attention because of its controversy: the prime minister threatened to resign, and media speculated about a conflict within the government. The public perceives the law as a success for the prime minister and, more generally, the government in its fight with the oligarchs.

This post argues that the law is ill-advised and counterproductive. The law taxes the very industires that have been the engine of the economic growth in Ukraine in the recent years and thus harms the ability of the country to resist the looming economic crisis. Furthermore, the law makes evident the time-inconsistency problem of the Ukrainian government policy, reducing the capacity of the government to influence economy and investors. Finally, it taxes industries not the oligarchs: jobs will be destroyed, investment in the infrastructure discountinued, the tax revenues will dry up, while the oligarchs will move away from developing healthy industries towards rent-seeking activities within the state.

This law is an example of a myopic and non-systemic approach to reforms in the times of economic and political crisis, which may do more harm than good.

Imagine a country with a projected 6 to 10% GPD decline. Economists play football with arguments (hereand here) discussing whether or not the country needs state-funded stimulus. And here the arbiter comes: the government files a bill with a proposal to tax five industries which were the engines of economic growth in last couple years. Yes, you are in Ukraine.

So, the Ukrainian government filed a bill to parliament in the end of July, with an aim to raise short-term tax revenues because economy slowdown and inability to reduce budget expenses were increasing state’s deficit. In the proposal, the government suggested to increase mineral extraction tax for natural gas to 70% (from 28%), to prolong indirect duties on grain export of about 20% (through non-refund of export VAT) for a year and cancel certain subsidies for agriculture (on average 5-7% of revenues) thereafter. Construction industry had to lose the ability to postpone income tax payments until real estate is completed, hotel industry was due to forget about its income tax break until 2020 (granted as stimulus before EURO 2012), green electricity projects were also losing their ten-years income tax break introduced just four years ago. All suggested tax policy changes were due to come into effect either on 1 October 2014 or on 1 January 2015.

What’s common about these five industries? Natural gas extraction, agriculture, construction, hospitality and green energy captured a significant portion of investments made in Ukraine during the last five years. Those who invested definitely took taxation into account, and no doubt a tax break or level of export duties was an important element in making an investment decision.

Initially rejected, a week thereafter the proposal was voted into law – the prime minister threatened the parliament with resignation if deputies do not accept the proposal. The mineral extraction rate hike was not as significant and temporary, and farmers kept their subsidies (while export duties were prolonged); all other tax changes were accepted as proposed.

And though the initial draft of the law was quickly deleted from parliament’s website, the message any potential investor in Ukraine is clear: Do not respond to the government policy that makes investment appear attractive because of the dynamic inconsistency problem.

Ignore or discount any tax breaks and subsidies in Ukraine, if a government says that some of the industries are their priority – for example, the government decided in 2008 that country needs alternative energy, say to be less-reliant on fossil fuel. As these projects are capex-intensive with a long payback the government would give you tax break and special green electricity tariffs, just to… cancel tax break during next economic slowdown. IMF would be an excuse.

- Do not waste time calculating payback for investment in natural gas extraction in Ukraine. No matter the country could urgently need to substitute energy imports from Russia, keep this point in mind: taxation in natural gas extraction is one of the most volatile one in Ukraine. Within only last two years parliament made five changes to the Tax Code which are related to natural gas (1, 2, 3, 4, 5, 6, 7). So either believes in good luck or start any potential project with signing an investment agreement with government where it guarantees you certain rights under English law as Shell did.

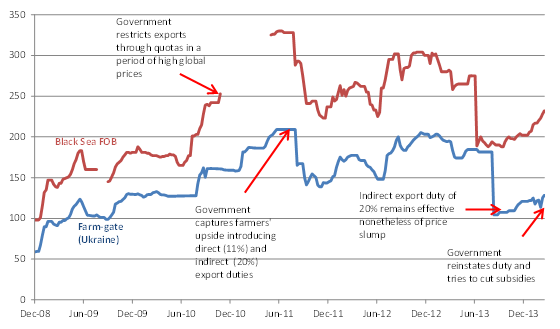

- Think seven times before investing in naturally volatile business, such as crop production. In a good year, for example because of high global prices, government would be quick to implement export duties to cut your upside (see the chart below). When cycle moves on and global prices collapse – Ukrainian government would not be there to cancel export duties. Contrary, because of the same cyclical decline in revenues the government would easily tax export of the industry which profits are already in the red.

Corn price, USD per ton

Of course, one could argue that current tax structure in Ukraine is not fair and needs a change. For instance, 28% mineral extraction tax could be low for an industry which has little to none variable production costs. And subsidies to farming sector need reform, as in their current form they stimulate farmers to pay for their inputs in cash, which is no good for the economy.

However, a government with a long-term approach would always follow several rules. First, “fiscal consolidation should be as growth-friendly as possible” (OECD). Second, any industry-specific taxation change should apply to new investment, projects, etc., it should not apply to past investments. Third, if some tax break was given to industry to stimulate investment it should not be canceled midway irrespective of whether a newly appointed government perceives it to be fair.

A better alternative. A study by OECD team about the taxes that can be increased in fiscal cliff, suggests that increasing consumption taxes and property taxes is the least harmful for economic growth. Indeed this might be a solution for Ukraine: a temporary VAT increase would affect consumers symmetrically to their consumption. And property tax is a long-discussed issue for Ukraine: why individuals do not pay real estate tax and why there is virtually no ownership cost for car-owners? And last but not the least: there are state’s assets that generate no money (to the budget), are not of strategic importance and could find their buyer. These alternatives appear to be far less detrimental than changing taxation of capital arbitrarily.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations