On Thursday, July 3, Verkhovna Rada accepted the bill onto conversion of foreign currency mortgages into hryvnyas (286 votes for). According to the law some individuals can convert the dollar-denominated mortgage liability into Ukrainian currency preserving the interest rate but at exchange level effective on January 1st 2014. The law was adopted at the third attempt, after Speaker Turchynov threatened to close underground exits from Verkhovna Rada so that MPs would have to face angry debtors who meanwhile demanded adoption of the law under the walls of Parliament.

Those debtors suffered from the rapid devaluation of Ukrainian currency in the first half of 2014. When UAH/USD nominal exchange rate plunged from roughly 8 UAH per USD to slightly less then 12, dollar liabilities denominated in Ukrainian currency increased by almost a half in nominal terms. According to the new law debtors who made their payments on time and whose mortgage level is below 1 mln UAH can benefit from interest-preserving currency conversion of their loans. This episode is the second currency crisis in the last 6 years; both had adverse effects on Ukrainian mortgage market, however, the main is problem high cost of funds for Ukrainian banks that makes hryvnia lending unattractive and makes consumers borrow in foreign currency.

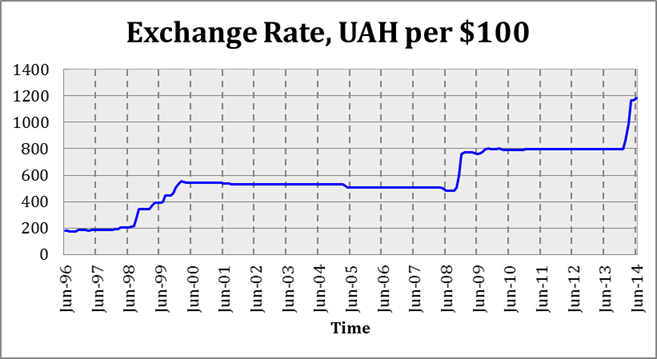

One of the goals of Ukrainian monetary policy is the “stability of national currency”, which National Bank of Ukraine (central bank of Ukraine, hereinafter NBU) has been interpreting as exchange rate stability. UAH/USD exchange rate has been effectively flat (see Figure 1), except for rapid devaluations at the end of 2008 (by approximately 60%) and at the beginning of 2014 (40%), and a crawling but substantial devaluation in 98-2000 (almost 200%). All devaluations were associated with large shocks to financial system, such as the Asian Crisis of late 1990s, the Global Financial Crisis, or current crisis in Ukraine.

It should be noted that those devaluation spikes couldn’t be considered entirely unexpected. First, Ukraine experienced at least 5% inflation every year since 1991 (with especially severe inflation in 1990s), except for 2002 (-0.6%), 2011 (4.6%), 2012 (0.2%), 2013 (0.5%), which means that cumulative inflation in Ukraine was substantially higher than in the US. Second, Ukrainian current account started deteriorating in 2005, became negative in 2006 and continued to decrease rapidly till 2008, when it reached a trough of -$12 billion. Current account rebounded in 2009 (still being negative), but decreased throughout 2010 reaching -$16 billion in 2013. During “normal” times Ukrainian businesses could borrow at international markets to cover payments for imported goods and services, but the Global Financial Crisis dried up this flow of currency; the National Bank of Ukraine had to intervene to maintain the exchange rate but its reserves were not sufficient to prevent devaluation. This created excess demand for foreign currency that NBU tried to satisfy by selling foreign reserves, which eventually fell below the cutoff value of three months of imports in 2013. The take-away is that all devaluations could have been anticipated, sooner or later, even though flat exchange rate created the illusionary feeling of currency stability.

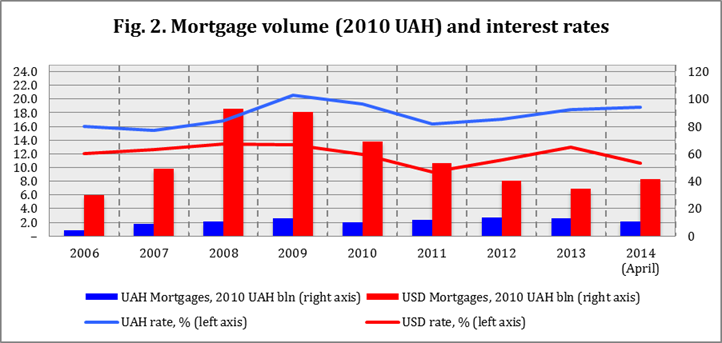

This deceptive permanency of UAH/USD exchange rate combined with low mortgage rates (as compared to hryvnia) lead to increase in mortgage dollar lending. As can be seen on figure 2, UAH mortgage rates were 3-4% higher than hryvnia mortgage rates prior to financial crisis, the gap widened even further in 2009-2014. This is not surprising, given expectations about future hrynia devaluation; bankers charged a premium for national currency mortgages to protect themselves from devaluation risk. On the consumer side, however, the risk of higher mortgage payments due to devaluation was perceived less severe: from the end of 2006 to September 2008, dollar-denominated stock of mortgages increased by almost 28 bln UAH in real terms (from 17 to 45 bln 2010 hryvnias), while hryvnia-denominated stock mortgages increased by only about 6 bln (from 2 to 8). From September 2008 to January 2009 alone stock of USD-denominated mortgage loans increased by around 40 bln UAH in real 2010 hryvnias, mostly due to devaluation.

As a result of late 2008 devaluation dollar-debtors faced a 60% increase in their liabilities (in national currency terms), which was not accommodated by a corresponding increase in their nominal income: inflation was not high enough to dilute increase in liabilities, nominal GDP per capita increased by around 30% in 2008 and even decreased slightly in 2009 as a consequence of global crisis. Taking into account recent devaluation in the first half of 2014, nominal mortgage payments of those who became debtors before financial crisis might have increased by 2.5 times, much faster than nominal income. A lot of debtors could not serve their debt anymore and banks faced increase in delinquency rates on dollar-denominated loans.

Late 2008 developments lead to complete ban of mortgage loans denominated in foreign currency by the Parliament in June 2009, the ban has never been removed and became permanent on September 22. From Figure 2 we can see that this lead to substantial (more than twofold) decrease in dollar denominated mortgages, while the stock of mortgages denominated in national currency remained virtually unchanged over the last 6 years (in real terms). Ukrainian Parliament also tried to impose a moratorium on confiscation of delinquent loans collateral in 2009, which was vetoed by President Yushchenko. President Poroshenko signed a similar law, voted on June 3rd, 2014. Even though in spring real estate market was not liquid due to events in Kyiv and other cities (thus banks had troubles with selling the collateral), the situation improved after the elections in the end of May, thus the law might have adverse effect on creditors.

Better regulation of mortgage market is needed to prevent excessive risk taking by Ukrainian borrowers, and to protect the stability of financial system. Even though the government made some steps to protect interests of debtors, those are overdue and do not solve the main problem. Specifically, the ban to borrow in foreign currency might have been a good decision as it reduces exposure to foreign exchange rate shocks; however, it is a second-best solution.

The government should focus on reducing the cost of ‘long money’ for the banks and reduce the riskiness of mortgage lending. For example, the floating exchange rate regime gives the National Bank full control over the interest rates thus making it possible to reduce the cost of funds and mortgage loan rates by adopting a more transparent policy with credible communication about long-term inflation and exchange rate goals. Policymakers should also understand that actions aimed to protect interests of debtors ex-post can harm potential borrowers ex-ante via an increased risk premium.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations