The central bank influences the economy through various channels known as the monetary policy transmission mechanism. By adjusting the policy rate, the NBU aims primarily to shape the desired dynamics of short-term interbank rates and expectations and subsequently affect rates on loans, deposits, bonds, and other hryvnia instruments to respectively shape trends in the exchange rate, inflation, and other macroeconomic indicators.

However, market rates react differently to comparable impulses from changes in the policy rate under different market conditions. Therefore, understanding the strength and speed of transmission and the factors that determine them is crucial for shaping optimal monetary policy and enhancing the NBU’s ability to effectively influence the economy.

What are today’s most effective monetary transmission channels?

The exchange rate channel is the most powerful in Ukraine, as exchange rate dynamics traditionally have a significant impact on expectations, inflation, and other key macroeconomic indicators that are in the focus of the NBU’s attention. Even under the inflation targeting regime, which the NBU adhered to before the onset of full-scale war, smoothing excessive fluctuations in the foreign exchange market helped improve exchange rate and inflation expectations, contributing to achieving the NBU’s goals. During the full-scale war, maintaining exchange rate stability became a key tool for reducing uncertainty and ensuring macrofinancial stability.

The NBU maintains control over exchange rate dynamics not only through currency interventions funded by international reserves but also by transforming the hryvnia into an attractive savings instrument. For this, the NBU has used another transmission channel – the interest rate channel.

In June 2022, as the psychological shock gradually subsided and administrative restrictions crucial for adapting the economy to the war were softened, the NBU significantly increased the policy rate and announced its intention to maintain it at this higher level for an extended period. This policy was necessary to boost the real returns on hryvnia instruments (deposits and government bonds) and consequently increase demand for these instruments while reducing demand for foreign currency. The increase in the policy rate became a crucial element in maintaining exchange rate stability and reducing inflation. The attractive hryvnia policy became particularly significant after the transition to managed floating in October 2023.

Transmission strength: How large is the impact of NBU decisions?

One indicator of effectiveness of the interest rate channel which determines the central bank’s ability to influence bank rates is the transmission mechanism’s strength. For instance, interbank rates typically fully and immediately respond to the NBU’s policy rate changes. However, the strength and speed of further transmission to retail and business lending rates vary. Therefore, it is essential for the NBU to evaluate the strength of the transmission mechanism to formulate effective interest rate policies.

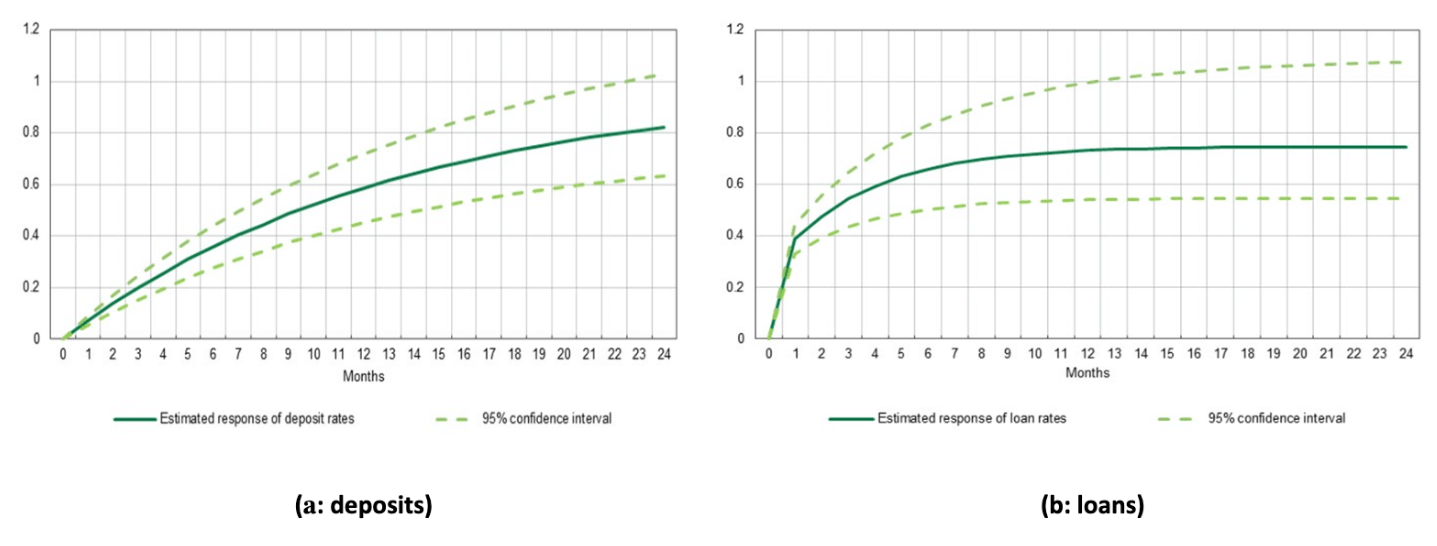

According to our assessments, interest rate transmission in Ukraine is less than one, meaning that a one-percentage-point change in the policy rate results in less than a one-percentage-point change in deposit and lending rates (hereafter, deposits refer to households’ term deposits in hryvnia, and loans refer to credit issued to non-financial corporations in national currency). Such results are normal in a market economy. It is crucial that the transmission mechanism continues to operate despite the war, significant uncertainty, and other challenges.

Interestingly, from a long-term perspective, deposit rates on average tend to respond more strongly to fluctuations in interbank rates than lending rates. At the same time, banks are much quicker and more willing to adjust lending rates than deposit rates.

Figure 1. Reaction of deposit rates (a) and loan rates (b) to changes in the overnight interbank rate, in percentage points

Note: Estimates were conducted using ARDL (Autoregressive Distributed Lag) models, where the dependent variable is the weighted average deposit and loan rates, and the independent variable is the overnight interbank rate. Monthly data for the period 2015-2023 were used for the estimation.

Is the transmission mechanism equally strong during interest rate cuts and hikes?

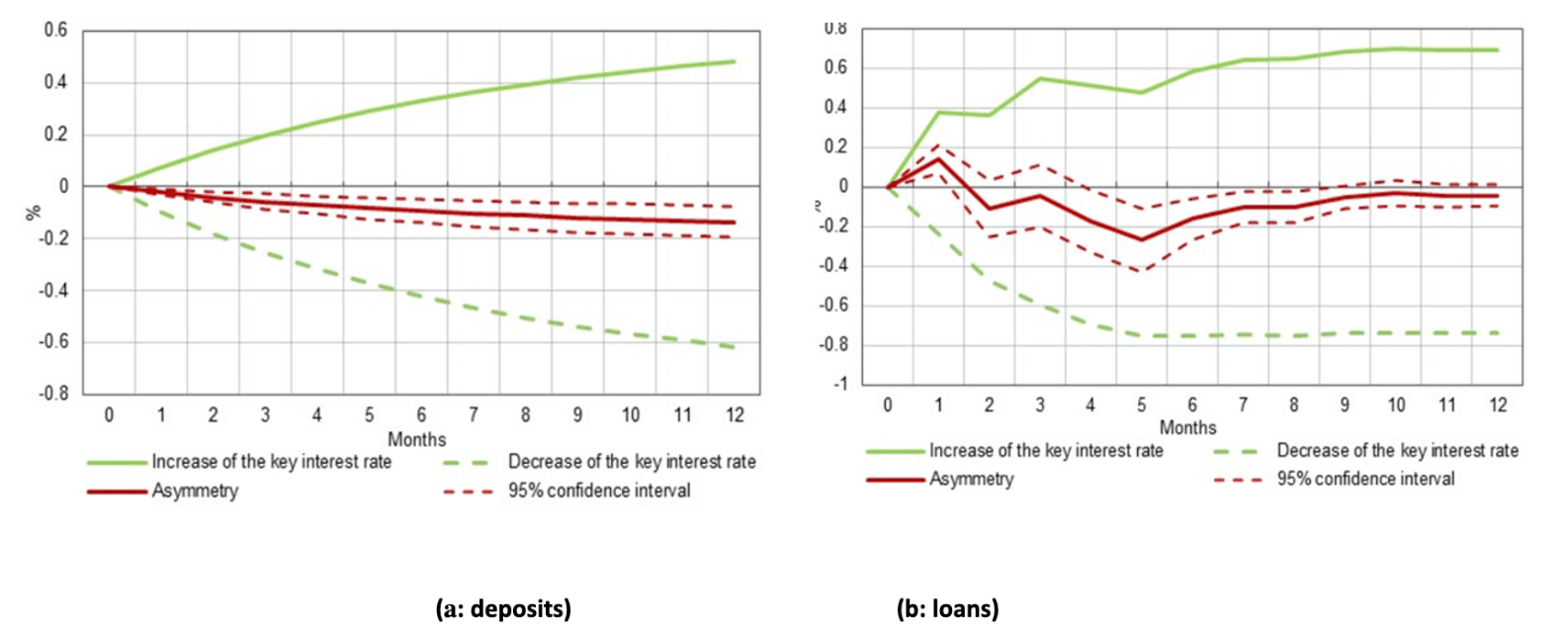

The reaction of bank interest rates largely depends on whether the NBU’s monetary policy is tightening or loosening. In Ukraine, banks are more inclined to decrease deposit rates than to increase them in response to respective changes in the interbank rate (Figure 2). This is partly explained by banks’ desire to minimize their interest expenses.

Therefore, increasing hryvnia investment attractiveness is more challenging than decreasing it. The NBU considers these effects when deciding how much to raise or lower the policy rate or whether to keep it unchanged.

Figure 2. Response of deposit (a) and loan (b) rates to changes in the overnight interbank rate, percentage points

Note: Estimates using NARDL (Nonlinear Autoregressive Distributed Lag) models, where the dependent variables are the weighted average deposit and loan rates, and the exogenous variable with an asymmetric effect is the overnight interbank rate. Monthly data for the period 2015-2023 were used for calculations.

The interest rates on loans also tend to react more actively to decreases in the policy rate than to its increases. At the first glance, this downward-shifted asymmetric reaction of lending rates may seem somewhat counterintuitive. The profit-maximization motive would imply that banks should raise lending rates faster following a policy rate hike and decrease them more slowly in case of monetary policy easing.

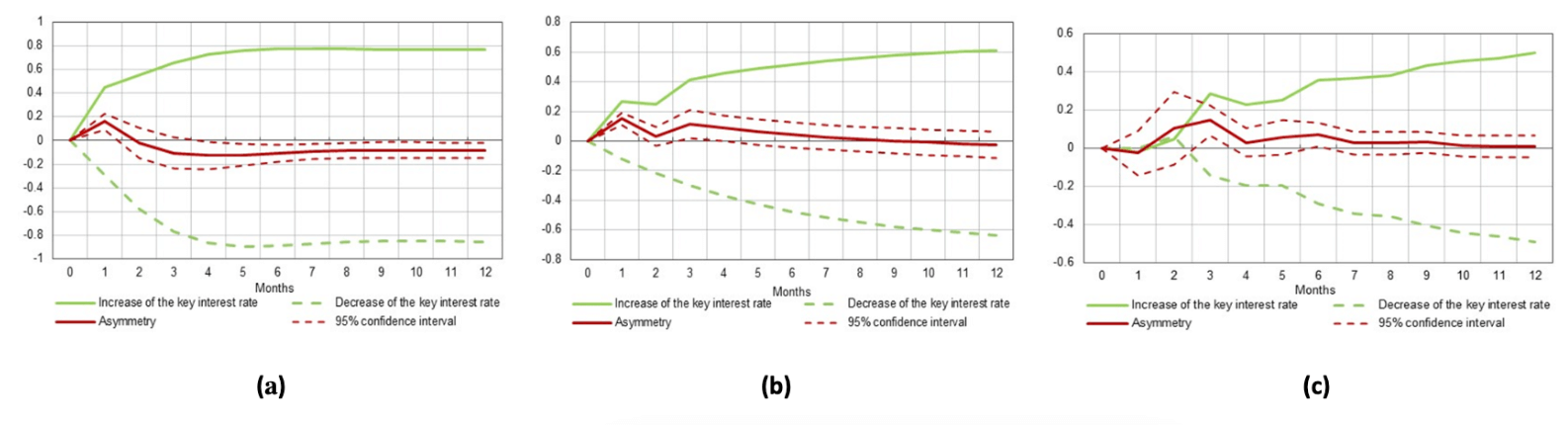

Our estimates suggest that this is indeed the case for loans to medium and small enterprises: the asymmetry in lending rates’ reaction is shifted upwards. However, for large enterprises, banks are more willing to decrease lending rates than to increase them (Figure 3).

This is due to competition among banks for high-quality borrowers. Banks risk losing clients by actively raising lending rates, whereas by actively lowering rates they attract new borrowers. Therefore, the “market power” of reliable borrowers, whose numbers are limited, has a significant impact. In addition to the advantage of reliability, large corporations have stronger negotiating positions with banks because their loans are easier to administer (including the ability to borrow larger amounts for longer terms). Thus, since the volume of loans provided to large enterprises is higher than that provided to small and medium-sized enterprises, overall lending rates rise more slowly than decrease.

Figure 3. Response of loan rates to changes in the overnight interbank rate for large (a), medium (b), and small (c) enterprises, percentage points

Note: Estimates were conducted using NARDL (Nonlinear Autoregressive Distributed Lag) models, where the dependent variable is the weighted average interest rates banks charge on new loans to non-financial corporations, segmented by the borrower’s size. The exogenous variable with an asymmetric effect is the overnight interbank rate. Monthly data from October 2017 to December 2023 were used for calculations.

How did the transmission strength evolve over time and what influences it?

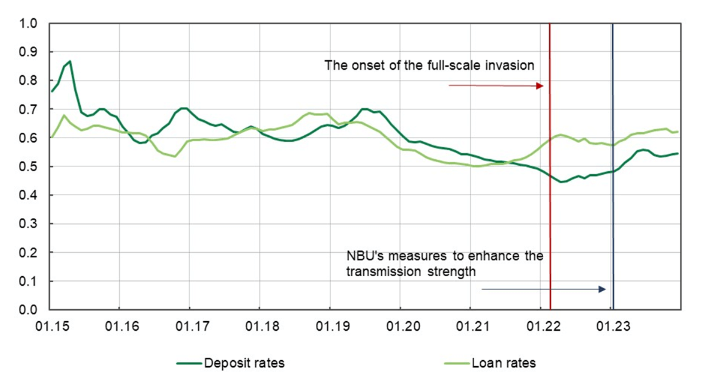

Transmission to both lending and deposit rates weakened in a few years before the full-scale invasion (Figure 4). Specifically, signs of high liquidity surplus in the banking system and significant market concentration in banking loans and deposits were evident. In addition to the demand and supply of loans and deposits, the transmission is influenced by inflation and uncertainty. Let’s consider how these factors affect changes in the bank interest rates.

Figure 4. Long-term transmission strength in bank credit and deposit rates, percentage points

Note: The results are based on the Bayesian estimation of ARDL’s TVP (Time-Varying Parameters), where each coefficient can vary over time. The evolution of coefficients allows for calculating changes in transmission strength over time. Estimates were conducted using monthly data from 2015 to 2023.

The impact of liquidity surplus

In a situation of liquidity surplus, the need to attract additional depositors diminishes, so banks are not eager to raise deposit rates after an increase in the policy rate. Conversely, they lower deposit rates quite quickly after a decrease in the key rate. Under liquidity surplus, there is also a decrease in transmission to lending rates. The impact of this factor is indirect, as liquidity accumulation typically occurs during periods of weak demand for loans and/or when banks perceive credit risk to outweigh the potential profitability of lending. Under such conditions, banks are less responsive to changes in the policy rate.

The impact of bank credit and deposit market concentration

Significant monopolization of the banking system generally weakens transmission from changes in the key rate. However, the reaction to rate increases and decreases is different. If market-making banks, due to their market position, do not need to offer more favorable terms to clients, then in response to an increase in the policy rate, the cost of loans will increase relatively quickly, while that of deposits will increase slowlier. In the case of a decrease in the policy rate, the situation will reverse. As market power increases, banks are less inclined to lower lending rates in response to a decrease in the policy rate than to raise rates in response to an increase in the key rate.

The impact of inflation

Higher inflation typically requires a higher increase in deposit rates to maintain their attractiveness in real terms. Transmission to lending rates acts similarly: rising inflation forces banks to raise rates more actively to protect against inflation. At the same time, lower inflation enables banks to reduce deposit rates more aggressively without facing the risk of deposit outflows. It also makes it possible to offer loans at lower interest rates due to the decreased inflation premium.

The impact of uncertainty

Economic uncertainty weakens transmission to deposit rates. Under turbulence, banks are less inclined to sharply change deposit rates due to the risk of deposit outflows and significant interest expense increases. At the same time, under such conditions, banks embed higher risks in lending rates, which enhances the impact of an increase in the key rate. The risk premium restrains the lowering of lending rates in response to the central bank’s monetary policy easing.

Demand and supply of loans and deposits

The increased propensity to save (and thus an increase in household deposit supply) has a noticeable impact. Since banks do not need to actively raise rates to attract resources, the transmission strength decreases. Consequently, the increased demand for business loans enables banks to set higher rates, thus enhancing transmission.

Thus, liquidity surplus and monopolization of the banking system weaken transmission. Uncertainty strengthens transmission to lending rates due to changes in the risk premium, while deposit rates become less sensitive to central bank actions. Increased inflation strengthens transmission.

What measures did the NBU take to enhance the transmission strength to deposit rates?

With the onset of full-scale war, the NBU faced the challenge of quickly raising hyvnia’s attractiveness to reduce the demand for foreign currency and protect international reserves, which were rapidly depleting due to significant budgetary needs for defense.

The NBU realized that banks would not rush to raise deposit rates amid significant liquidity surplus and market concentration in deposits. At the same time, the population, amidst unprecedented uncertainty and rapid inflation growth, would be reluctant to deposit money into hryvnia accounts.

An unusually powerful monetary impulse was needed to offset the adverse impact of these factors. Therefore, in early June 2022, the NBU raised the policy rate by 15 percentage points. This move caused a significant increase in the interbank rate and reversed the multi-year trend of weakening transmission to rates for term hryvnia deposits (Figure 4).

Since the beginning of 2023, the NBU has taken a series of additional measures to strengthen transmission to deposit rates and the corresponding volume of hryvnia term deposits. In January-March 2023, the NBU significantly increased the reserve requirements for individual on demand accounts and current accounts in national and foreign currencies, and in May it introduced changes to the mechanism for calculating mandatory reserves. This increased the cost for banks to fund resources on demand and short-term deposits. Risking loss of income, banks intensified competition for longer-term deposits.

Furthermore, since April 2023, the NBU allowed banks to purchase three-month deposit certificates with higher yields. The NBU linked banks’ opportunities to purchase these instruments to the volume of hryvnia deposits held by banks for a term of at least three months and to the success of increasing such portfolios.

Thanks to these measures and NBU verbal interventions, competition among banks for term hryvnia deposits with a duration of more than three months intensified. As statistical assessments confirm (page 39), this increased the strength of transmission via the interest rate channel. Thus, the rate hike for term hryvnia deposits during the first half of 2023 considerably accelerated.

After the NBU started lowering policy rate in July 2023, these instruments helped hold back the decrease in interest rates for household long-term hryvnia deposits. This makes it possible to maintain sufficiently attractive rates for hryvnia instruments and strengthens trust in hryvnia. Simultaneously, it curbs demand for foreign currency, reduces pressure on the exchange rate, prices, and international reserves, and allows the NBU to gradually ease currency restrictions.

Today, the favorable macro-financial conditions allow for a shift in priorities towards increasing lending. However, it is necessary to keep in mind that high uncertainty weakens transmission caused by the policy rate reduction. This specific impact largely determines the consistent and cautious approach of the NBU to easing its policy amidst full-scale war. A sharp decrease in the policy rate during periods of high uncertainty would have a weak effect on lending rates. At the same time, it might undermine trust in the central bank’s policy and its commitment to ensuring price stability, which would have a negative long-term impact on the economy.

Authors:

- Artem Vdovychenko, Lead Economist, Modeling Division, Monetary Policy and Economic Analysis Department, NBU

- Mykhailo Rebryk, Head of the Monetary Policy Office, Monetary Policy and Economic Analysis Department, NBU

- Yuliia Kuzmenko, Senior Economist, Money Market Analysis Division, Monetary Policy and Economic Analysis Department, NBU

- Nadiia Shapovalenko, Lead Economist, Modeling Division, Monetary Policy and Economic Analysis Department, NBU

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations