The Ministry of Finance of Ukraine has recently initiated a review of government budget spending in a number of other ministries. According to the Budget Code of Ukraine, reviews like these include an analysis of how efficiently the government policy is implemented using the budget funds and how effectively, efficiently and reasonably the budget funds are used.

Though this initiative might be unassuming, it is one of the most important steps (along with the introduction of medium-term budget planning) that can significantly increase the efficiency of budget funds usage (i. e. to get more value for money).

What is the spending review for, what should it focus on and what results can it produce if carried out to the fullest?

The importance of spending reviews. Foreign practices

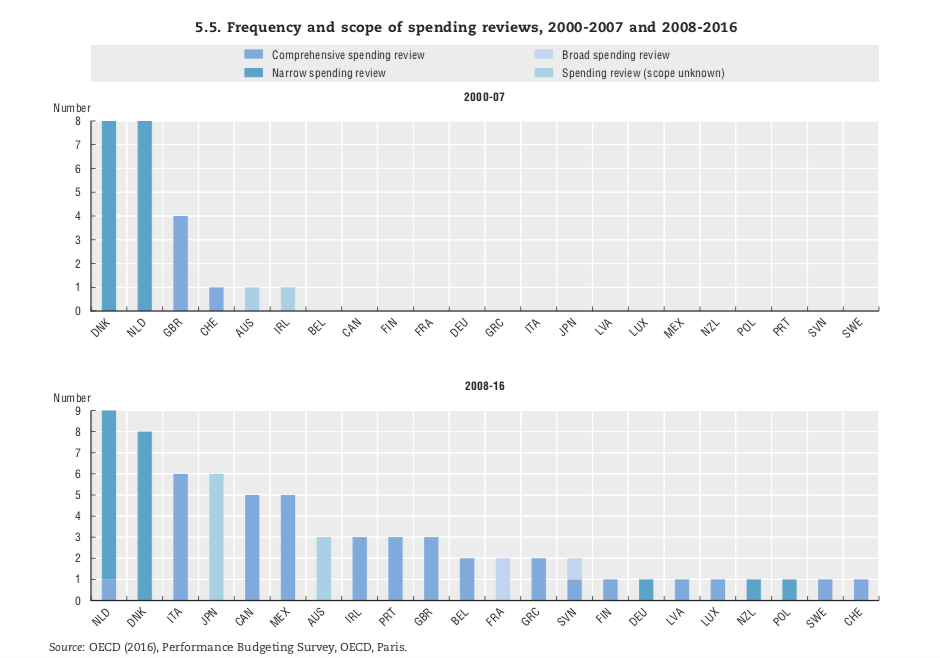

Spending reviews are an established practice that is extensively used in many OECD countries. For instance, in 2011, 16 OECD countries conducted spending reviews and by 2016 this number increased to 23 (OECD, Government at a Glance 2017)

According to McKinsey, in Denmark, this procedure helped to save more than €1 bn per year over the past 5 years. In Slovakia, in 2017, the spending reviewed amounted to 7,3% of the country’s GDP and the review helped to identify potential savings of €277 mn (about 4,4% of the total spending reviewed).

There are two main models of spending reviews. The first one is “forward-looking”.

This model is used in the United Kingdom, among others, where the Comprehensive Spending Review is conducted on a regular basis. CSR, implemented in 1998 by the Gordon Brown’s government, requires that Her Majesty’s Treasury (i. e. the ministry of finance) plans the spending for the next 3–4 years based on the policy goals for this period and optimal action plans to reach these goals.

The second model assesses the spending of the past period and focuses only on the areas that are identified every time by the government or the ministry of finance. This model is used, among other countries, by the Netherlands since 1981.

Ukrainian context

Ukraine chose the second model and uses it not for planning, but foremost to gauge the efficiency of select budget programmes. According to the Order of the Cabinet of Ministers of Ukraine №211, this year the spending review will cover only 5 ministries and 9 areas that include one or more budget programmes (1–3 areas per ministry).

This is the second attempt to implement spending reviews in Ukraine. The first attempt was made in early 2018 and basically flopped. One of the problems at the time was the deadline for the review: only 1,5 months with no methodology recommendations from the Ministry of Finance.

This year the Ministry of Finance fixed its mistake. The decision regarding the spending reviews was made in late March and the deadline was set for December 1st, 2019. The Ministry of Finance also sent out methodological recommendations in April. Working groups have already started working on this task in most of the ministries. Each working group consists of 10–15 members, including representatives of the ministry in question, the Ministry of Finance and external experts.

As is the case with most of the new system processes, currently there is no internal expertise regarding such a task in Ukraine. Having studied international recommendations, researched the reasons for the inefficiency of Ukraine’s budget programmes, and worked in a number of spending review working groups, the author of this article can give some short recommendations.

These recommendations can be divided into two groups:

- Analysis and optimization of budget programmes’ structure aimed at increasing their efficiency as an instrument for planning, monitoring and assessing the state policy implementation.

- Assessment of the efficiency of programmes’ spending and identification of opportunities for optimizing it.

This approach is used for spending reviews and budget programmes formation by developed countries and the most successful countries of Central and Eastern Europe.

Practical advice. Part 1: Analysis and optimization of budget programmes’ structure

“Spending reviews constitute one of the instruments of public policy evaluation. Placing spending reviews in a broader policy assessment context provides a useful preamble to exploring their specific preconditions and features,” wrote Caroline Vandierendonck in her 2014 research paper “Public Spending Reviews: Design, Conduct, Implementation” that was prepared for the European Commission.

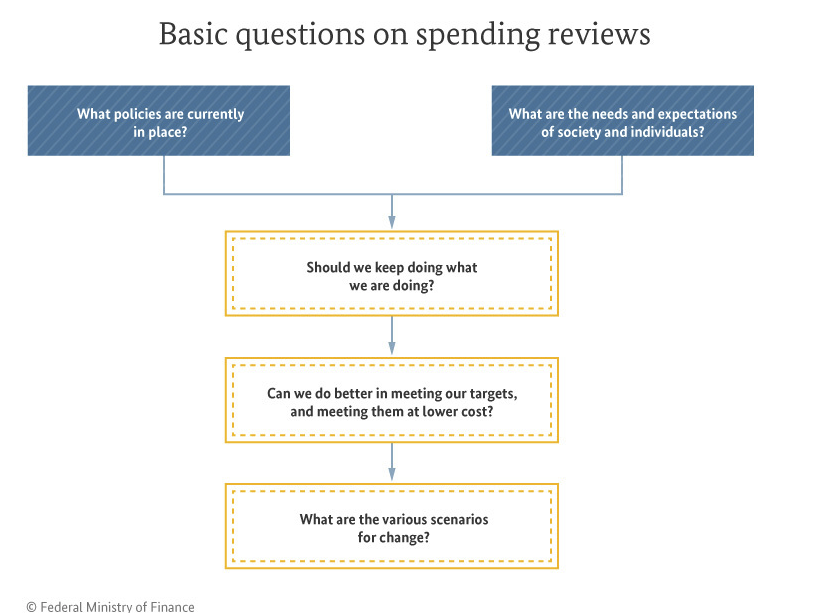

This point is extremely important for understanding the essence and the key tasks of spending reviews: to increase the extent to which state policy goals are achieved in a certain policy area and to boost the efficiency of spending on this policy. Spending review processes used by the ministries of finance in Germany, Latvia or Ireland are based on this very logic.

The same approach was used in Ukrainian document called “The Organizational and Methodological Fundamentals for State Budget Spending Review” that was expertly developed by the Ministry of Finance.

According to this document, one of the key steps in the review process is “the assessment of efficiency of state policy implementation and corresponding state budget spending”. What is more, one of the expected results of a spending review is “an increase in efficiency and effectiveness of budget spending, i. e. an increase in performance indicators of budget programmes and the level of state policy goal achievement in the corresponding area”.

Figure 1. The experience of the Federal Ministry of Finance of Germany. Basic questions on spending reviews

To explain this point, we can study other countries’ experience in conducting spending reviews. For example, in Slovakia, the Ministry of Finance has a special “Value for Money” department that prepares the terms of reference for each spending review and supervises the spending review processes in the government.

The goal for one of the healthcare budget programme reviews in 2017 was: to ensure that over the next four budget years the amenable mortality level (i. e. the number of deaths that could be prevented by providing specialized health care) among Slovak citizens decreased to the average level among the other Visegrád Group countries. This goal required additional funding for the construction of state-of-the-art hospitals and these funds were supposed to be found by identifying inefficient spending via a spending review and avoiding it.

The biggest problem for Ukraine is that in many areas state policy does not provide clearly-defined goals that could be measured. As a result, it is not possible to assess whether the goal was achieved using budget spending.

In some cases, budget programmes’ spending does not correlate with the policy at all, with programmes being just a set of separate unrelated measures.

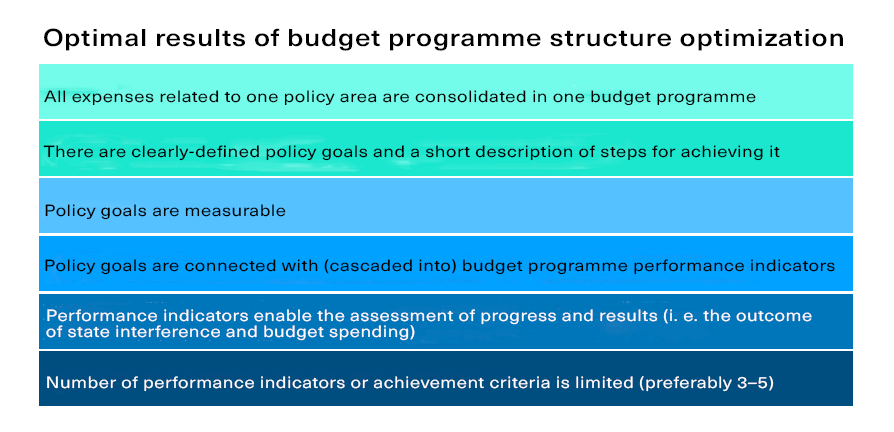

That is why one of the first and the most important tasks in the spending review process is the optimization of the budget programmes’ structure and the approach to their formation.

When performing this task, it is important to:

(1) Identify the goal of the policy being reviewed.

The easiest way to do that is to analyse budget programmes in similar policy areas in other countries, especially the ones that are considered to be experts in programme and medium-term budget planning. These countries include the United Kingdom, Canada, New Zealand, Australia, etc. These countries mostly organize the operations of their ministries by policy areas according to the Classification of the Functions of Government making it easier to compare the goals set by different countries.

In Ukraine, the Medium-Term Priority Action Plan can be used as a hint regarding the policy goals since it includes a clearly-defined vision for policy goals and tasks in many areas.

(2) Identify clear and measurable criteria used to determine that the goals of the budget programme and the policy are achieved.

Even though the current budget programme passport approved by the Ministry of Finance makes no provision for that, the optimal approach to identifying the achievement criteria for policy goals is to focus not on the next budget year but at least on the medium-term budget period. I. e. to identify the achievement criteria both in the future and in the planning budget period as well as base values for the criteria.

There should not be many criteria (3–4, according to international recommendations) but they should measure the achievement of the programme goals from different angles.

For example, France uses three types of criteria for each budget programme that “represent” the interests of taxpayers, citizens and consumers of public services (OECD, 2018). For the legal system these criteria are:

– Effectiveness as perceived by the taxpayers. For example, the number of cases tried by a judge per year.

– Social and economic efficiency or efficiency as perceived by the citizens. For example, the level of recidivism (percentage of convicted offenders returning to crime) as an indicator of the effectiveness of correctional services.

– Quality of services as perceived by the consumers. For example, the average period of waiting for a court ruling.

(3) Review and often reduce the number of efficiency and quality criteria.

One traditional feature of Ukrainian programme budgeting that significantly limits the efficiency of budget planning is that in most budget programmes goal achievement criteria simply describe the product or the service provided by the ministry and have little relation to the strategic goals of the corresponding policies. Therefore, it is impossible to use these criteria to assess whether the spending is effectively used to reach the policy goals.

It seems that in some budget programmes the majority of criteria make no sense at all. Most likely, they indeed do not. These criteria are traditionally copied from one programme into another. Usually, the “older” the programme is, the more criteria it includes (with most of them being irrelevant).

(4) Identify whether the budget funding for the policy being reviewed is focused on one budget programme or spread across a number of different programmes. Consolidate all expenses that relate to the defined goal in one programme.

Clear the budget programme of all expenses that do not relate to this goal.

(5) Form a clearly-defined request to create a new set of data needed for high-quality analysis, monitoring and assessment of the policy area in question.

In some cases, ministries refuse to replace criteria in budget programmes citing the lack of official statistics needed. However, the spending review process creates a perfect time to discuss the sets of statistical data needed to monitor the policy implementation.

To do that, it is needed to:

(1) Identify what data is needed to calculate the target, interim and base values for the policy goal achievement criteria.

(2) Identify which government bodies have the information needed for calculations and develop a process for receiving this data.

(3) If needed, prepare the regulations (orders or instructions) that would ensure that the data is transferred.

Part 2: Assessment of the efficiency of programmes’ spending and identification of opportunities for optimizing it

This part is significantly more industry-specific and requires a unique approach to every policy area. However, the general steps for retrospective analysis of programmes’ results are to:

(1) Gather information (as complete as possible) from the holder and the receivers of budget funds to analyse how effectively and efficiently they are used.

This information can include reports, budgets, reports of the Accounting Chamber and the State Audit Service.

(2) Identify whether budget funding helps the lower-level holder and/or the receivers of budget funds to achieve the real state policy goals that were identified in part 1.

(3) Analyse how spending on each expense item of the budget programme changed over time to identify unexpected trends and fluctuations.

(4) Compare the distribution of spending among different receiver of budget funds. For example, the average spending per employee. This step can help to discover outliers in some expense items.

The average funding per employee received by state enterprises from one of the budget programmes of the Ministry of Healthcare can differ by a factor of 2. However, there is one institution in that very programme that spends 10 times more per employee than the other institutions.

(5) Analyse the reasons and factors that influence the budget programme’s list of types and numbers of products and services provided by the holders and the receivers of budget funds. There are a number of questions that can help to do that:

- How was it determined that this number of products should be provided? Can the holders or the receivers of budget funds provide the calculations behind this number?

- What is the quality level of this product, who determines it and how?

- Where is this product used and what needs does it satisfy? Is this product or piece of data really used? Is this the number of products that is needed?

The optimal result of these steps is an assessment of to what extent the budget programme’s distribution of funds helps to achieve the identified policy goals. Focus on the achievement of goals is essential to the review of existing spending. Here is an example of a good question for a spending review: does the funding of this state institution help to increase Ukraine’s rank in international education quality rankings?

There is no definitive information regarding the format of the final spending review report that the Minister of Finance or the Prime Minister would like to receive. However, Ukrainian experts can use reports prepared in other countries, such as Slovakia or Ireland as a reference.

At the same time, it is important to understand that it is unlikely that all of the spending review reports prepared in Ukraine in 2019 will be exemplary. Spending reviews are a complicated task that Ukraine is only starting to master. Successful spending review cases are needed to show to the policymakers (ministers and deputies) and the society that this politically and technically complicated procedure is important and useful. However, if there are no perfect reports after the first attempt it will be important not to give up and to continue improving their quality year after year instead of abandoning this practice.

Further reading: additional literature on spending reviews

- OECD (2013) 3’th annual meeting of OECD senior budget officials. Spending reviews. http://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=GOV/PGC/SBO(2013)6&doclanguage=en

- OECD (2017), Government at a Glance 2017, OECD Publishing, Paris http://dx.doi.org/10.1787/gov_glance-2017-en

- (United Kingdom) Institute for Government (2018). Martin Wheatley, Bronwen Maddox, Tess Kidney Bishop. The 2019 Spending Review. How to run it well https://www.instituteforgovernment.org.uk/sites/default/files/publications/IfG_2019_%20spending_review_web.pdf

- International Monetary Fund (1999). Barry H. Potter and Jack Diamond. Guidelines for Public Expenditure Management. https://www.imf.org/external/pubs/ft/expend/index.htm

- European Commission (2014). Caroline Vandierendonck. Public Spending Reviews: Design, conduct, implementation http://ec.europa.eu/economy_finance/publications/economic_paper/2014/pdf/ecp525_en.pdf

- Suzanne Flynn, Fazeer Rahim, and Natalia Zbirciog-Vandenberghe. Ten Lessons from Spending Reviews in Eastern Europe https://blog-pfm.imf.org/pfmblog/2018/12/lessons-spending-review-eastern-europe.html

- Government of Ireland. Spending Review Papers. https://www.gov.ie/en/collection/f516ff-spending-review-papers-from-2017-and-2018/

- Ministry of Finance of the Slovak Republic (2017). Terms of Reference for Healthcare Spending Review

- The Parliament of the United Kingdom. Transport Committee Eighth Report ‚Bus Services after the Spending Review‘ (2011) https://publications.parliament.uk/pa/cm201012/cmselect/cmtran/750/75002.htm

- Federal Ministry of Finance, Germany. (2018) Spending reviews in the federal budget https://www.bundesfinanzministerium.de/Web/EN/Issues/Public-Finances/Spending-Reviews/spending-reviews.html

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations