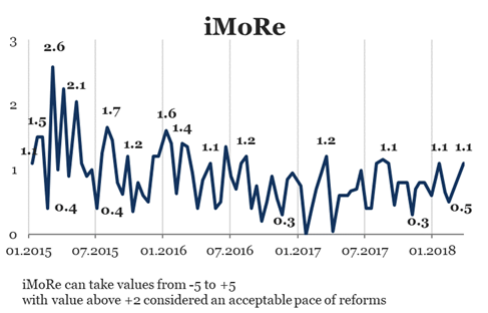

Reform Index is +1.1 points for the period from February 29 – February 25, 2018 (+0.5 in the previous round on a scale of -5.0 to +5.0). Positive developments were recorded in legislation regarding public finances, the monetary system and business environment.

The major events of the round – the law on corporate agreements, a government resolution on the procedure for analyzing budget expenditures and a resolution of the NBU on increasing the amount of mandatory disclosure of information.

Chart 1. Reform Index dynamics*

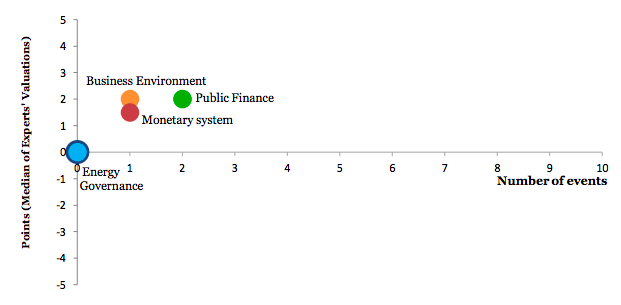

Chart 2. Reform Index and its components in the current round

The major event of the release

The Law on Corporate agreements

In the world practice, corporate agreements are used to define “rules of the game” for shareholders or founders of the enterprise. In particular, it may include rights and obligations of owners regarding important business management issues.

In Ukraine, the use of corporate agreements was formally stipulated by the law “On Joint Stock Companies”. It indicated that the use of such an agreement may be stipulated by the charter and impose additional obligations on shareholders like participation in general meetings and liability for non-compliance with the agreement.

However, this norm was not enough to allow this instrument to be used in practice. In order to conclude a corporate agreement, the owners registered companies in other jurisdictions.

The law 1984-VIII regulated the use of corporate agreements in joint-stock companies and introduced them for limited liability companies. Corporate agreements may include ways of voting at general meetings, obligation to get approval for the acquisition or alienation of shares, circumstances in which the parties should refrain from alienation of shares and the procedure for resolving disputes between owners.

It is not obligatory to conclude a corporate agreement with all parties. The legal internet portal “Protocol” provides several examples of the use of such contracts. A corporate agreement may merge exclusively minority shareholders in order to appeal to a court with a claim for compensation by the company’s official for damages caused to the company. In this case, merger is created to achieve the 10% threshold for ownership of the share capital required for the right to claim. Also, a corporate agreement may be concluded between several parties to create a major “merger participant”. Earlier, such merger was possible only through a complex system of founding companies, which necessarily included foreign jurisdictions. In addition, corporate agreement can regulate potential “dead-end situations”, in particular when owners with the same number of votes (50/50) have different positions.

Procedure for analysis of budget expenditures

At present, the expediency of the state budget expenditures is estimated during the planning process. However, cost efficiency of such expenditures is analyzed pointwise by authorities or public organizations. No one makes a systemic assessment of costs, and therefore there is no feedback on the effectiveness of policies implemented by the government.

The introduction of a comprehensive and sectoral analysis of the effectiveness and expediency of expenditures for 5 pilot ministries is foreseen by the strategy for reforming the public finance management system for 2017-2020. The CMU resolution of February 21, 2018, No. 101 launches this process in the Ministry of Education and Science, the Ministry of Agrarian Policy, the Ministry of Social Policy, the Ministry of Infrastructure and the Ministry of Regional Development.

Expenditure overview will be made by specially created working groups. They will analyze the state policy in certain areas, assess the effectiveness and expediency of expenditures, and agree on strategic and program documents in these areas.

NBU resolution on extension of mandatory disclosure of Information

Within the framework of prudential supervision, banks provide the NBU with information on economic (prudential) norms and components of regulatory capital. This information is published on the NBU’s website on the banking system as a whole.

According to the resolution of the NBU No. 11 of February 15, 2018, from March the National Bank will begin monthly publication of these indicators for each individual bank. The first publication of these data in terms of individual banks will disclose the figures for February 2018. Information about these indicators will also be published by banks on their own websites. Also, on their websites banks will publish turnover and balance sheets, information on the structure of the loan portfolio in terms of types of economic activity, as well as data on the quality of the loan portfolio.

Chart 3. Value of Reform Index components and number of events

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations