The hryvnia demonstrates record appreciation. Many Ukrainians wonder what this means for the country and if it’s a new normal. In a highly unusual move, the Council of the National Bank of Ukraine (NBU) went to suggest that the leadership of the NBU made a mistake in keeping interest rates too high for too long, which allowed the hryvnia to get stronger and thus hurt Ukrainian exporters. The top officials of the NBU deny any wrongdoing and highlight the benefits of a stronger hryvnia such as lower prices of imported goods (including gas), lower inflation, lower interest rates, and a lower burden of public debt.

Who is right and what will happen with the hryvnia? Before we answer these questions, we should clear confusion about several things.

First, everybody should understand that the exchange rate is a price determined by supply and demand. The right price is where supply meets demand. We must rely on the market to determine the balance and so the price. The government should not define what the “right” price is.

Second, when a price moves, some people lose and some people gain. For example, if the price of milk falls, farmers lose but consumers gain. Using the same logic, one can argue that stronger hryvnia helps some agents (importers) and hurts other agents (exporters). Because of these distributional effects, the debate about “desirable” fluctuations in the exchange rate is inevitable. And this debate can get really complicated given the complexity of global value chains when firms can export and import at the same time.

Third, movements in the exchange rate are a part of how a central bank can influence the economy. If the NBU raises interest rates, it attracts foreign capital because investors earn a higher return in Ukraine. When capital flows into Ukraine, the hryvnia appreciates (there is now a stronger demand for the hryvnia) which makes Ukrainian exports less price competitive. This slows down economic activity and reduces inflationary pressures in Ukraine. In short, the mechanism is simple: the NBU raises interest rates, the hryvnia gets stronger, and inflation falls. Therefore, if the NBU is tasked with keeping inflation low, a stronger hryvnia is a natural consequence of the policy. If somebody demands both low inflation and a weak hryvnia, there is an inconsistency in these demands. These two elements cannot happen at the same time when a country has free capital mobility, a floating exchange rate, and an independent monetary policy, that is, in the regime approved by the NBU Council.

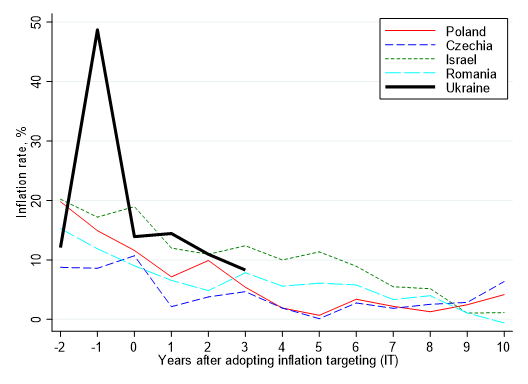

Once we are clear about these basic things, let us put the developments in Ukraine into a historical perspective. What was the experience of other countries that adopted inflation targeting (the policy regime approved by the NBU Council and implemented by the NBU since 2016) and went through a period of disinflation? Figure 1 shows the dynamics of inflation for Ukraine, Israel (adopted inflation targeting in 1992), Romania (2005), Poland (1998) and Czechia (1997) that started with relatively high levels of inflation and implemented inflation targeting (IT) to address chronically high inflation. Zero on the horizontal axis of this figure shows the time when IT was adopted. Ukraine had worse initial conditions for inflation (about 50% per year) but after 3 years with inflation targeting, the path of inflation in Ukraine roughly follows inflation trends in other countries. These time series suggest that it takes time to reduce inflation from double digits to less than 5 percent. In any case, if history is any guide, the NBU is on track to hit its 5% inflation target in the near future. Indeed, the rate of inflation in November 2019 was 5.1% and was projected to fall below 5% by the end of the year.

Figure 1. Dynamics of inflation

Source: IMF International Financial Statistics database

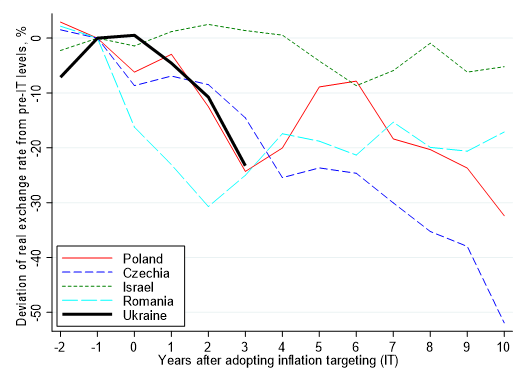

What was happening with the real exchange rate during this process of disinflation? Real exchange rate (equal to nominal exchange rate adjusted for inflation; see box below for a definition) is a key statistic measuring the strength of a currency. In a nutshell, appreciation of the real exchange rate means that the currency strengthens quicker than prices grow. Poland, Romania and Czechia had a strong appreciation of their national currencies against a basket of currencies representing the trade flow of these countries. Furthermore, the real exchange rate appreciated persistently: even ten years after adopting IT, these countries have stronger currencies. At the cost of slower disinflation, Israel had a modest appreciation of the shekel. The real exchange rate for Ukraine roughly follows the dynamics of Poland, Romania and Czechia: after three years of IT, the real exchange rate appreciated by approximately 20-25%. Therefore, what happens in Ukraine is not something extraordinary that has not happened anywhere else. Ukraine’s path is fairly typical (Figure 2).

Real exchange rate

Wikipedia: The real exchange rate (RER) is the purchasing power of a currency relative to another at current exchange rates and prices. It is the ratio of the number of units of a given country’s currency necessary to buy a market basket of goods in the other country, after acquiring the other country’s currency in the foreign exchange market, to the number of units of the given country’s currency that would be necessary to buy that market basket directly in the given country. The RER reflects the competitiveness of a country with respect to the rest of the world.

Figure 2. Dynamics of real exchange rate (national currency against a basket of currencies reflecting trade flows of a given country)

Source: IMF International Financial Statistics database

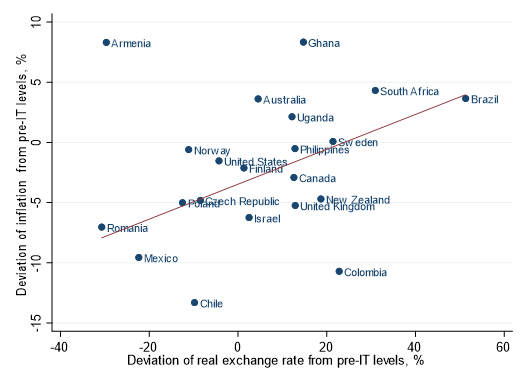

Furthermore, Figure 3 shows that stronger disinflations are associated with stronger appreciation of the domestic currency for a broad range of countries that adopted inflation targeting. For example, countries like Romania, Mexico and Chile had strong reductions in inflation two years after adopting inflation targeting and they had a strong appreciation of the real exchange rate. In contrast, countries like Brazil and South Africa failed to reduce inflation two years after adopting inflation targeting (in fact, inflation rose in these countries) and they experienced depreciation of their real exchange rate.

Figure 3. Changes in real exchange rates and inflation rates two years adopting inflation targeting

Source: IMF International Financial Statistics database

Why did real exchange rate appreciate for countries that successfully reduced inflation? Obviously, high interest rates set by central banks contributed to the observed appreciation. But it was also a reaction of the private sector: low and stable inflation supports a stable macroeconomic environment which is appealing to investors. Countries with inflation targeting attract more foreign direct investment. Because foreign capital inflows create a greater demand for a domestic currency, the private sector reinforces government policies and amplifies appreciation.

In summary, a stronger hryvnia is a sign of the NBU’s successful effort to reduce inflation. It is also a sign of financial markets’ confidence. Forecasting exchange rates is an impossible and ungrateful business but, given the historical experience, a strong hryvnia may be a new normal!

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations