Businesses are looking for easier access to tenders, especially small ones. Participation in them opens up commercial opportunities for small and medium-sized enterprises (SMEs). However, in the current environment, they often are just potential.

The public procurement market provides a great opportunity for business development and expansion. With the volume of closed public sales being UAH 538 billion in 2017, it was already UAH 675 billion in 2018 and UAH 635 billion in 2019 (Fig. 1).

Figure 1.

Source: own calculations, bi.prozorro.org

We conducted a survey in ProZorro to find out the reasons why small and medium-sized businesses refuse to participate in public procurement. We got predictable results: 60% of respondents refused to participate in tenders due to the long payment terms, specifically the delivery of goods with deferred payment plans of 60+ days, and sometimes 180 days or more. At the same time, 90% of respondents would be willing to use the service of cheap financing in the public procurement system ProZorro (Fig. 2).

Figure 2.

Source: ProZorro survey

A survey conducted by the European Business Association showed that about 84% of enterprises have suffered significant income losses in 2020, with an increase in receivables. Given the great degree of uncertainty about the commercial market, public procurement can become a safe haven for businesses, offering cheaper financing and making more accessible participation in government tenders.

The financial products most often chosen by small and medium-sized businesses trying their hand in state tenders are loans and overdrafts. The downside of taking a loan is the collateral requirement, or, in the case of an overdraft, a good track record with the servicing bank. For SMEs, such restrictions are often critical and, consequently, they cannot use those financial instruments.

Additional, simple and affordable, financing will reduce barriers to SMEs’ participation in the tenders. Recently, at the initiative of the Ministry of Economy and the colleagues from the Ministry’s Office for Support of Reforms, and the Office for Support of Small and Medium Enterprises, a pilot project was launched allowing entrepreneurs to get access to funding through a new tool – factoring.

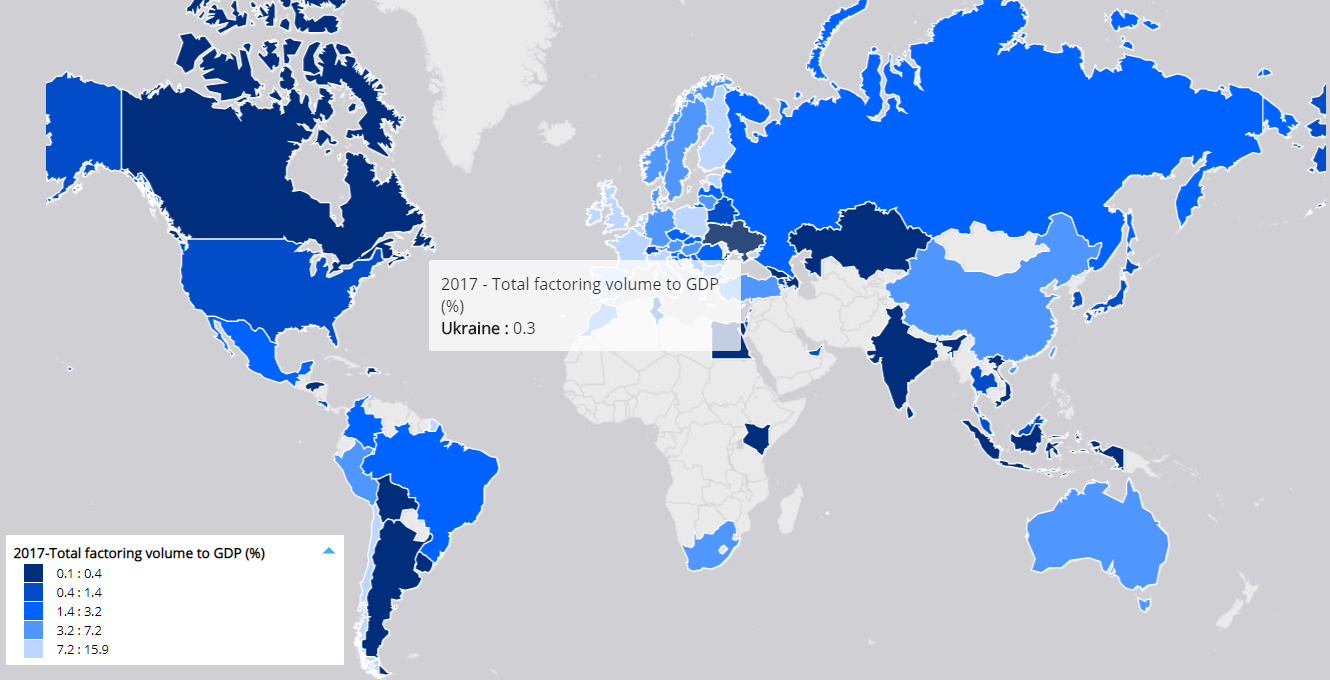

According to the World Bank, the total factoring volume to GDP in Ukraine is 0.3%, while in neighboring Poland, it is 11%, with the EU average being 10.9% of GDP, which is 37 times more than in Ukraine (Fig. 3).

Figure 3.

Source: databank.worldbank.org/

Factoring is an alternative to credit and overdraft facilities, being a convenient tool for managing receivables.

The mechanism of factoring is as follows: the seller (SME), delivering the goods but not yet receiving payment for it, can transfer the right to demand payment under a supply contract to the factor (bank). The factor pays the seller immediately following the transfer of the right of claim, expecting repayment of the debt from the tender’s organizer (debtor). Such an agreement is beneficial to both the seller and the debtor, as well as the bank (Fig. 4).

Figure 4.

Technical solution

The team of volunteer developers created the Factoring Hub online platform that makes it easier for the seller to obtain financial services, being completely free for businesses. It suffices for entrepreneurs to register, indicate the tender they want to receive funding for, and create an application before participating in the tender and submitting a proposal. The application is then sent out to banks and financial companies participating in the pilot project, registered with the platform. In response, the seller receives offers from potential factors accepting the most advantageous offer while reserving the right to decline all the terms offered. Access to the platform is free for all the pilot service participants. Among the state-owned enterprises joined in with the pilot service are JSC Ukrposhta, Boryspil International Airport, and NPC Ukrenergo. Ukrposhta has already placed its first factoring tender announcements.

How much is factoring?

At the time of writing this article (July 2020), according to the Factoring Hub platform, the average cost of the service is about 1.6% for 35 days and 3% for 65 days, or 17% per annum. That is, if the tender payment terms are 60 days after the delivery of the goods, the seller can receive about 97% of the goods’ value from the factor immediately upon receipt of the goods by the debtor, without having to wait two months. We expect that, with an increase in the number of factors in the pilot service and economic growth back on track, the factoring fees will decrease.

Since its founding, the ProZorro electronic system has been constantly improved. Today, we are working to facilitate the access of small and medium-sized businesses to public procurement. More affordable financing is one of the tools to facilitate this access.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations