Farmland rental prices in Ukraine are more than 10 times lower than they could be in case land and other factor markets distorts are mitigated. Such distortions include poor access to capital, farmland sales moratorium, fragmentation of land ownership etc. A straightforward conclusion is that opening up the sales market for agricultural land would benefit not only those who would decide to sell their land, but other landowners as well.

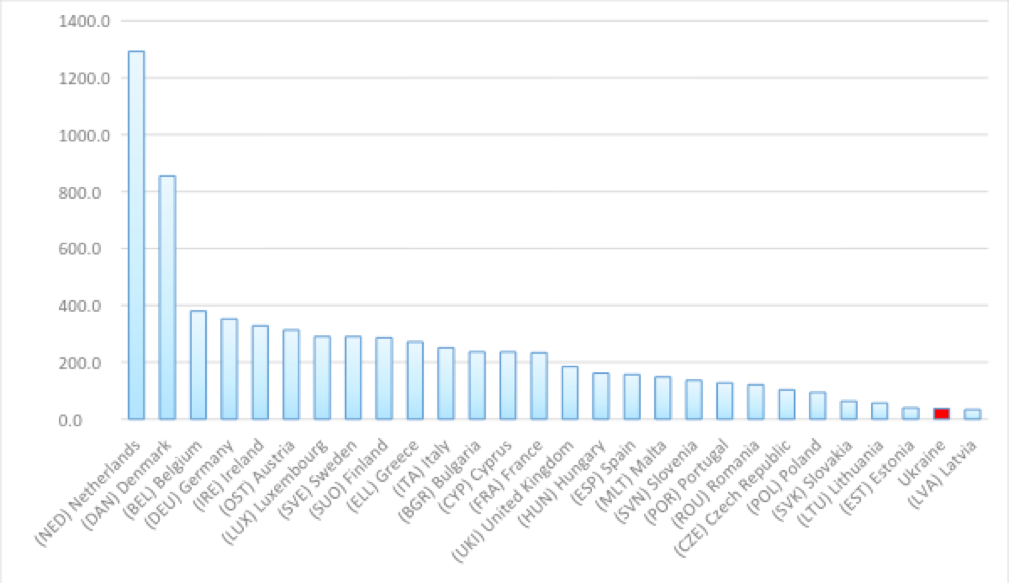

There is widely shared opinion in Ukraine that farmers pay too low rental price to the farmland owners. This conclusion is largely drawn by comparing the rental prices in Ukraine and other (neighboring) countries (Figure 1). Moreover, this is precipitated by the fact of famous fertility of Ukrainian black soils, thus the perception is that the value of land should correspond to its quality. The comparison with other countries, however, does not take into account the current economic conditions in the sector and in the country. We show that indeed the current farmland rental prices are more than 10 times lower than they could be in case land and other factor markets in Ukraine are not distorted. Such distortions include farmland sales moratorium, fragmentation of land ownership and poor access to capital.

Figure 1. Farmland rental prices in Ukraine and other countries in the EU, EUR/ha

Source: StateGeoCadastre, Eurostat

Perception of farmland rental prices in Ukraine

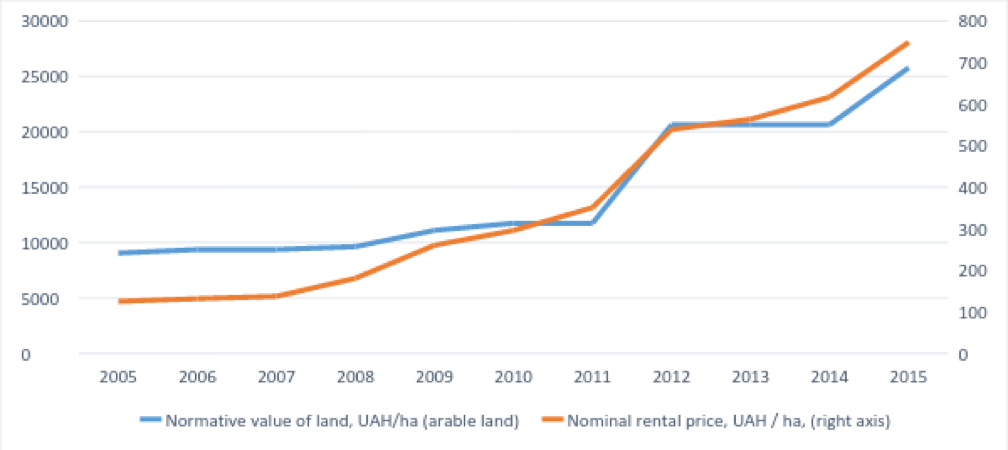

The major driver of rental prices all over the world is farming profitability. In other words, rental prices follow farmers’ incomes. Now, taking into account that farmers performed relatively good over the last decade there is an expectation of rising farmland rental prices. Indeed, they are going up (see the Figure 2). However, this increase was driven primarily by increase in normative value of land and increased competition among the producers.

Unfortunately, so far, the discussions on what the rental price in Ukraine could be if the restrictions to sell land are removed, do not turn into evidence based discussion, but rather opinions and speculations. Using simplified economic framework and available empirical evidence we demonstrate below that: 1) the current rental prices do not correspond to economic return (rent) being generated by farmland, and 2) by how much the current rental prices in Ukraine could increase provided various impediments and market imperfections are removed.

Figure 2. Agriculture rental prices and normative values, UAH/ha

Source: authors’ presentation based on the data of State Land Cadaster

Simplified economic framework

Building upon the work of Ferguson et.al (2006) and Ciaian and Swinnen (2010), Nivievskyi, Nizalov and Kubakh (2016) demonstrate that given the constraints on the credit market, the marginal value product of land is higher than the marginal cost of land. Now the question is how large is this difference.

To answer this question, we rely on the parameters for crop production function in Ukraine, estimated by Deininger et al (2013). Using farm-level data they found that on average about 35% of the crop output is generated by farmland, and the rest is by such other factors, as fertilizers, labor, fuel, etc. Thus, as the average value of crop output per hectare in Ukraine was about 1300 USD in 2014, the economic return to land (economic rent) is about 455 USD per hectare. This economic rent is distributed between the land owner (in a form of rental payment), tenant (profit) and state (land tax or single tax). In the situation of well-functioning factor markets, rental price should be reaching 455 USD per hectare, but in a reality, it is only 37 USD per hectare or 11 times less than the potential.

The actual distribution of economic rent from agricultural land depends on a relative bargaining power of land owners vs. tenants, credit and other constraints on the factor markets, and availability of off-farm employment for the land-owners. In Ukraine, the combination of these factors establishes three distinctive cases:

- Land is cultivated by land owners. According to our estimates based on the StateGeoCadastre data, about 29% of cultivated agricultural land is farmed by owners. In this case, a lion share of economic rent belongs to the owner and a small portion is transferred to the state in the form of land or single tax. However, a relatively small number of owner-cultivated farms exists in Ukraine as owners lack access to capital, lack ability to cultivate (about 50% of owners are old age), or are employed in other sectors of economy. Additionally, the largest possible own plot per family is rather low, thus unable to benefit from economies of scale.

- Private land is rented to commercial farms. About 60% of cultivated agricultural land is farmed by tenants who rent land from individual owners. With an average rental payment being about 37 USD in 2015 (State GeoCadastre), producers retain the rest of the economic rent as a part of their profit and pay tax in the form of either land or single tax. The relatively low rental payment to land owners can to some extent be explained by a relatively low bargaining power of landowners as the land is highly fragmented and many owners lack ability to cultivate land by themselves. Yet another factor that keeps the rental prices low is related to high cost of maintenance for rental contracts and low protection of tenant’s rights.

- State and communal land is rented to commercial farms. Almost 9% of agricultural land is cultivated by tenants who rent this land from state or local authorities. Yet another 2% is provided to a permanent use. The average rental payment in 2015 was about 64 USD (State GeoCadastre), which is higher than payment for private land. The primary reason for this difference is that land parcels are larger and are rented for a longer period of time. However, this level of rental payment can also be higher if land is rented in more competitive and transparent way (e.g. via auction).

To conclude we showed that farmland rental prices in Ukraine are more than 10 times lower than they could be in case land and other factor markets distorts are mitigated. Such distortions include poor access to capital, farmland sales moratorium, fragmentation of land ownership etc. A straightforward conclusion is that opening up the sales market for agricultural land would benefit not only those who would decide to sell their land, but other landowners as well. More importantly, transferring land to more effective users will increase the productivity of farms and increase the economic return to land as non-effective land owners and land users will leave the sector. To realize these benefits, the country should open up the farmland market and improve access to capital for agricultural producers.

Notes

[1] Ciaian, P., d. Kancs and J. Swinnen (2010), EU Land Markets and the Common Agricultural Policy, CEPS Paperback, CEPS, Brussels.

[2] Deininger, Klaus, Denys Nizalov and Sudhir Singh (2013), Are mega-farms the future of global agriculture? Exploring the farm size-productivity relationship for large commercial farms in Ukraine – World Bank Policy Research working paper WPS 6544/ KSE working paper, http://go.worldbank.org/A5D4SB2IU0

[3] Ferguson, S., Furtan, H., & Carlberg, J. (2006). The political economy of farmland ownership regulations and land prices. Agricultural Economics, 35, 59–65. /doi/10.1111/j.1574-0862.2006.00139.x/full

[4] Nivievskyi, Oleg, Denys Nizalov and Sergei Kubakh (2016). Restrictions on farmland sales markets: a survey of international experience and lessons for Ukraine, Capacity Development for Evidence-Based Land & Agricultural Policy Making in Ukraine Project (available at http://land.kse.org.ua)

This column is a joint product of Capacity Development for Evidence-based Land and Agricultural Policy-Making in Ukraine Project and Project “The Cost of State” (http://cost.ua/). Infographics is available at here.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations