“Almost 70 deputies work for Kolomoiskyi, and another 100 for Akhmetov” reads a recent headline in Ukrayinska Pravda. The article then catalogues some of the actions in the Verkhovna Rada, the Ukrainian legislature, that these parliamentarians are said to conduct on their patrons’ behalf. But Ihor Kolomoiskyi and Rinat Akhmetov are only the most high-profile of the handful of leading oligarchs who have dominated Ukraine’s political and economic life for more than two decades, usually to its detriment.

Article was jointly published by VoxUkraine and Euromaidan Press

Oligarchs and low standards of living: two sides of the same coin

One striking feature of modern Ukraine is not just the ongoing influence in public life of such figures as Akhmetov and Kolomoiskyi, but also the resilience of the oligarchy as an institution across episodes of serious political disjuncture, including the Maidan revolution of 2013-2014, which seemed for a short time to threaten its survival.

An oligarchy is a political system dominated by a social minority of wealth holders. If wealth is the characteristic source of oligarchs’ social power, it is because it allows them to deal with the threats that great riches tend to attract. How this is done — whether mainly through hiring coercive force or professional services — depends on the political institutions in place, which affect whether the main focus of defensive strategy is directed against the confiscation of wealth or the redistribution of the income derived from it.

In Ukraine, the set-up is a bit more complicated. This is because the modern Ukrainian oligarchy is not just its leading oligarchs, but rather a structural relation to formal politics of the large business-political networks that oligarchs lead. The basic relations of post-communist political-economic power in Ukraine were established during the presidency of Leonid Kuchma in the late 1990s. Although these relations have evolved under successive leaderships, the fundamental modes of operation have remained the same.

A second striking feature of today’s Ukraine is that average incomes are much lower not just than those of Western Europe, but also compared with many of the Eastern European economies that were part of the socialist bloc. According to official figures, it is only in the past couple of years that Ukraine’s average standard of living has again approached its level at the end of the Soviet era.

Over the past three decades, a large body of economic research has been developed to account for the marked variation in economic performance among post-communist economies. Three main explanations predominate, each conditioning the prospects of the next. These are (i) differences in conditions inherited at the start of the transition, including of institutions and the level of macroeconomic distortion; (ii) the speed at which a functioning price system was introduced and stabilisation measures adopted; and (iii) the degree of success in developing the political and economic institutions needed for a market economy to work.

In Ukraine’s case, therefore, long delays in liberalisation and institutional reforms are usually presented as the main cause of its poor economic showing since independence. However, this raises questions not only of why progress on economic transformation has been so slow, but also of who has been slowing it down, and how. So it appears as an explanation in need of an explanation. This is where a political economy approach comes into its own. In particular, my argument is that the process of reproduction of the Ukrainian oligarchy and Ukraine’s current low living standards are linked, with the first feeding into the second, so that they are, in this sense, “two sides of the same coin”.

The money of the few: concentration of the wealth at the top

Because concentrated wealth distinguishes oligarchs as political actors—as opposed to, say, a proven ability to mobilise the population (successful politicians) or the occupation of a position of power in an organisation (public officials)—a relevant question becomes whether the “material resource power” of the Ukrainian oligarchs, their wealth, has declined relative to Ukrainian society between the presidencies of Viktor Yanukovych and Petro Poroshenko.

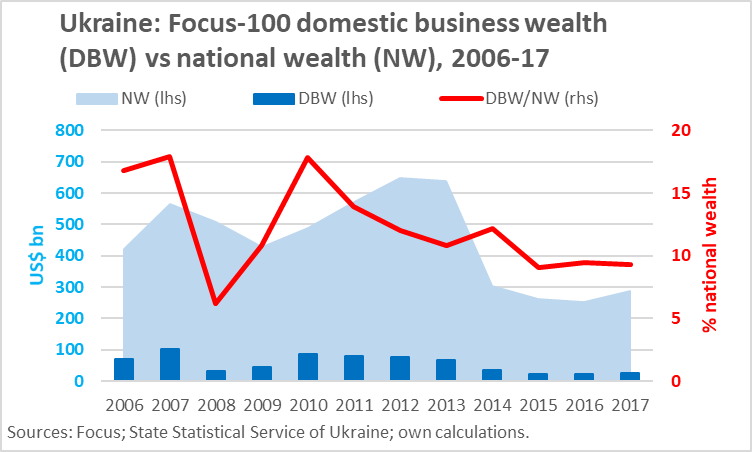

To address this, I collected data for 2006-2017 on the “richest 100” Ukrainians from the website of Focus, a Ukrainian weekly news magazine. Each year, Focus assesses the domestic business assets of the Ukrainian economic elite in terms of market capitalisation (for publicly traded firms) or “fair value” (for private ones). Although this series has its problems, it offers the most comprehensive picture available of the level and evolution of wealth at the top end of the ownership scale in contemporary Ukraine.

According to this data, the annual value of business wealth of the 100 richest Ukrainians peaked at US$101 bn in 2007, but fell to a low of US$24 bn in 2015-2016. On its own, this information does not tell us what we want to know. We need a way to compare elite business wealth to that of Ukrainian society as a whole. One way of doing this is by calculating Ukrainian national wealth, which can be done from the country’s national accounts—specifically, from the “experimental” financial and non-financial wealth accounts of the Ukrainian statistical service.

The main finding of this exercise depicted in the graph below is that, as a share of national wealth, the domestic business wealth of the 100 richest Ukrainians indeed fell from a peak of 18% in 2010 to around 9% in 2017. Interestingly, it declined more sharply during the Yanukovych presidency than under Poroshenko (it was 11% in 2013). This may be because the economic policies and predatory business practices of the elite under Yanukovych weighed on business confidence and stock-market performance (which fell sharply from 2011), thus affecting the basis on which the value of business assets is measured. It could also be because the Ukrainian elite became more adept at obscuring the ownership structures of their assets, as a tactic of wealth defence.

Graph 1. The domestic business wealth of the 100 richest Ukrainians as a share of national wealth in 2006-2017

From this broad picture, a second question arises—that is, whether a decline in material power relative to Ukrainian society implies a waning of oligarchs’ political power. This is not necessarily the case for a number of reasons. First, not all of the very rich are oligarchs: some are business people who do not pursue a role in national politics as a way of furthering their business aims.

Second, although the mean business wealth of the top 100 declined as a share of national wealth between 2013 and 2017, it actually rose for those in the top end of the list between the two years. That is, their wealth increased relative to Ukrainian society as a whole, even as it fell for others further down the ranking.

Third, the domestic business wealth of the very rich is likely to be only a portion, and possibly a small portion, of the total wealth owned by the Ukrainian elite, much of which is parked in tax havens abroad. A final point relates to the social nature of wealth itself, which is a potential power that must be realised in an institutional setting—in this case, through the political and economic structures and practices of the Ukrainian oligarchy itself, to which I will now turn.

The Rada, “Europe’s biggest business club”

Since independence, the very rich in Ukraine have found numerous ways to convert their wealth into political power, including through funding of political parties or individual deputies and media ownership. Although the Rada is just one of the influence channels, it is an important one operating as a venue for the deal- and alliance-making between the leaders of the main business-political networks. This is why Serhiy Leshchenko, an investigative journalist and former Rada deputy, describes the Rada as “Europe’s biggest business club”.

In the wake of the Maidan revolution, hard documentary evidence of the use of financial inducement to sway voting outcomes in the Rada came to light with the release of part of Yanukovych’s “black ledgers”, a set of accounts in which such payments are recorded in detail. Continuity in this mode of politics between Yanukovych and Poroshenko presidencies is indicated, for example, by the release of mobile-phone text exchanges on vote-buying between Poroshenko’s parliamentary fixers and Oleksandr Onyshchenko, an MP who fled the country in 2016 to escape corruption charges. This is the backdrop against which the results of my research on legislative voting can be read.

Specifically, across the periods of the three governments in office from late February 2014 until the end of December 2017, I analyse patterns of voting on 23 legislative bills associated in modern economic theory with the conditions required for general prosperity. To this end, I collected data sets of voting on each law by party faction from the (excellent) online Rada archive, supplementing this with Ukrainian journalists’ accounts of deputies’ informal associations with leading oligarch networks.

The kinds of laws examined encompass not just those shaping business operations—related to competition policy, for example, or to public subsidies—but also those affecting political pluralism and the effectiveness of the central state. This includes laws on party funding aimed at reducing the dependency of political parties on financial support from oligarchic networks, as well as on countering corruption in public life and bolstering the independence of the judiciary. These kinds of laws can be described as presaging a shift from “extractive” to “inclusive” institutions—that is, from situations in which elites are free to use their political dominance to tilt economic outcomes in their favour, to one in which this ability is more constrained, including by greater popular political participation.

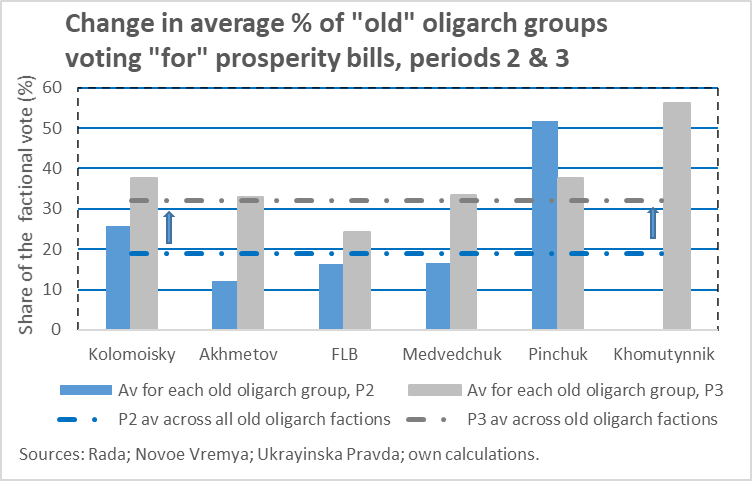

Graph 2. Change in average share of “old” oligarchs voting “for” prosperity bills

The rise in average voting shares across all of the deputies associated with old oligarchs is shown in the upward shift from the blue horizontal dot-dash line under the second Yatsenyuk administration (period 2) to the grey dot-dash line after Hroisman became prime minister (period 3). “FLB” in the legend marks the cross-factional group of MPs associated with Firtash and his close associates, Serhiy Lyovochkin and Yuri Boyko. According to media reports, Vitaliy Khomutynnik, who in 2014 was the youngest and richest Ukrainian MP, became an independent player from Period 3.

Perhaps the key finding here is some evidence of the “old” oligarchs as a group blocking “prosperity” legislation by means of the voting behaviour of the 74 cross factional deputies identified with them (which is probably an underestimate of the total number of such MPs). The ‘old’ oligarchs include not only Akhmetov and Kolomoiskyi, but also Dmytro Firtash, who made his money in the gas trade, as well as Viktor Pinchuk and Viktor Medvedchuk, the latter widely viewed as Russia’s “point man” in Ukraine.

That is, these deputies tended systematically to fail to vote for the prosperity bills more consistently than other MPs, a relationship that statistical tests show is unlikely to have occurred by chance. The most obvious explanation for this is that the laws in question are perceived by the oligarchs either to impinge on their specific sectoral business interests or, more broadly, on their customary way of doing business.

Another notable feature of this data is that there is a marked break in voting patterns between the second administration of Arseniy Yatsenyuk and that of Volodymyr Hroisman, a Poroshenko protégé. This coincides with the disintegration of the five-party parliamentary coalition, made up of parties that backed the Maidan protests, as domestic political divisions widened over continuing public corruption and attempts to incorporate into the constitution a law on Donbas autonomy.

Correspondingly, there is a clear rise in the propensity of the former-Yanukovych factions (most of them part of the Opposition Bloc or the People’s Will faction), as well as old oligarch deputies, to vote in favour of government prosperity bills. This shift in voting pattern therefore seems to have happened because the remaining government parties in parliament, the Petro Poroshenko Bloc and People’s Front, had to rely on their support to pass legislation.

The significance of this is that it appears to indicate a third stage of “reintegration” into formal politics of both the old oligarchs and their networks, as well as the remains of the Yanukovych-era elite—and so the full recreation of the oligarchy as a transactional relation between successful politicians, state officials and big business—following the brief phase of the rhetoric of “de-oligarchisation” in the immediate aftermath of the Maidan victory. Earlier stages include the appointment of leading oligarchs in 2014 to defend the east and south-east in the early days of Russia’s military incursions, and then the presidential and parliamentary elections of later that year, the campaigns for which drew on oligarch funding.

Rent-extraction schemes in the energy sector, post-Maidan

A question raised by this development is: What did the oligarchs get in return for increased backing of the Hroisman government? In particular, this seems to coincide with the “rehabilitation” of Rinat Akhmetov, the leading Donbas oligarch, who had been a key backer, and beneficiary, of the Yanukovych presidency, and who, around this time, in 2016, began to organise his lucrative “Rotterdam plus” energy pricing scheme. It also seems to coincide with a loosening in the implementation of energy regulations, originally brought in as part of sectoral reforms prompted by macroeconomic destabilisation in 2014-15.

This ties in with the third main strand of my research, which analyses the rent-extraction schemes in the energy sector by which the Ukrainian elite are able to turn their political power back into wealth, so completing the “national” circuit of institutional reproduction. (In orthodox economics, a rent is payment above the level required to induce the supply of a factor of production to the market; it can be thought of as gaining access to wealth-enhancing income, but without contributing to wealth creation.)

Gas rents have been central to the formation and wealth accumulation of the Ukrainian oligarchy since its inception in the 1990s, especially through the gas-supply link with Russia—at least up until the war of 2014.

A good example of a gas-sector rent scheme in the post-Maidan era is the award in 2017 at a knockdown price of a valuable gas-extraction permit for a gas-field in Poltava to a newly created firm with no track-record in the energy business, which the investigative journalists from the aptly named Skhemy (Schemes) TV programme show, was linked to close associates of President Poroshenko. Standing back a little, however, this can be seen as just one episode in a broader power struggle between rival business-political networks—namely, between the networks around Petro Poroshenko as the new president attempting to consolidate his leading political position, and the Privat network of Ihor Kolomoiskyi, the most successful and (at the time) celebrated of the “oligarch governors”.

In the post-Maidan period, this struggle originated in an attempt to overhaul Naftogaz, the state energy company and, in particular, to wrest management control from Kolomoiskyi and his Privat Group of Ukrnafta, the domestic oil producer, which is a Naftogaz subsidiary. This phase of the struggle for resource control between the two networks ended in a well-publicised show-down in March 2015, after Kolomoiskyi brought to the capital an armed security team to try to enforce his network’s de facto management hold over Ukrnafta, in which Privat held only a minority stake. For this, he was removed by Poroshenko from his official post as governor of Dnipropetrovsk.

As well as the Poltava gas-permit scheme, in my research on post-Maidan rent-extraction practices I also investigate two others. One involved the creation by a gas supply company in Kirovohrad region of gas accounts for non-existent households, so permitting the purchase of gas at relatively low household prices for use by connected industries. Another similar one, purportedly organised by Oleksandr Onyshchenko, a Rada deputy who fled the country in 2016, involved regional heating companies in western Ukraine buying more gas than they needed to produce heat for local households, then selling the remainder to industry.

Preliminary results from this line of research point to the Ukrainian elite adapting customary rent-extraction schemes to the new geo-political and domestic political realities of the post-Maidan era, as well as to the corresponding energy policy changes. So far, the main findings are that, with opportunities greatly reduced for the operation of traditional gas rent-extraction schemes with Russia, these have tended to become smaller in scale financially as well as more domestically focused and regionally confined. At the same time, the focus of rent extractors has shifted to energy sectors other than gas, especially after the reintegration of key oligarchs into the political process under the Hroisman administration.

Some conclusions

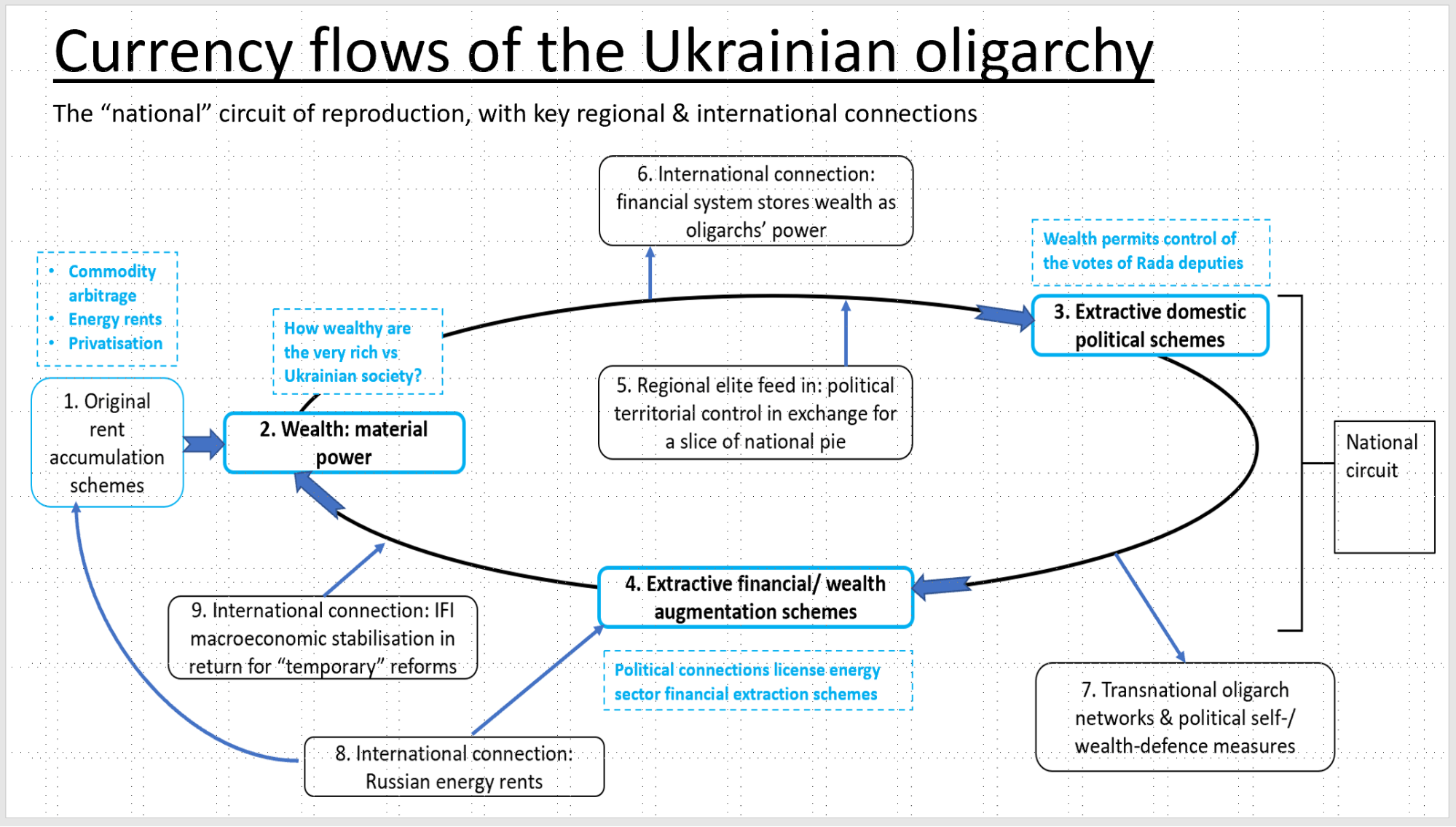

Drawing together the three strands of my research, on wealth dynamics, financial influence in the legislative process and the evolution of energy rent-extraction schemes, it is possible to address the title question of this article directly. My answer is that the Ukrainian oligarchy is able to keep going, even across phases of serious political instability, through continuation and adaptation of its habitual political and economic practices, interconnecting at the regional, national and international levels, motivated and facilitated by wealth. This set of interrelated processes and practices is depicted schematically in the diagram below, with the idea of a “currency flows” highlighting the role of wealth as an institutionally realised societal power and end-goal (figure 1).

Figure 1. The currency flows of the Ukrainian oligarchy. The parts of the process outlined in this article correspond with points 2, 3, and 4 in the chart

Key economic “side-effects” of these practices include extreme wealth inequality, a high degree of wealth “offshorisation”, low levels of investment and recurrent losses to the public finances. This suggests not only that the reproduction of the oligarchy is a key part of the explanation of Ukraine’s low average standard of living, but also that the persistent weakness of the Ukrainian state and the strength of the oligarchs’ political-business networks may be inversely related.

The cyclical conception of elite reproduction presented here is broadly in line with a growing scholarly consensus concerning patterns of elite political dynamics in the post-Soviet world, linked to the prevailing political culture. This cyclical perspective, as well as the international dimension in the recreation of Ukraine’s political economy model, are worth stressing, not least because of their practical, policy implications. That is, the periodic political disjunctures in post-Soviet politics might best be understood not as instances of democratic breakthrough or backsliding, as they are often portrayed, but rather as cycles of elite adaptation and reordering, as informal business-political networks interact with, and adjust to, changes in official politics.

From this perspective, the Maidan can be described as a revolution, but only a political one, since, despite the change in political leadership personnel—drawn mostly from the ranks of the pre-existing elite—there was also considerable carry over of elite political and economic practices, examples of which I have outlined above. Similarly, if the conditions for perpetuation of Ukraine’s sub-optimal political economy model are conceived to be rooted solely in Ukraine’s domestic conditions, and not also as supported from the outside by the international legal and financial systems, then proposals of how to bring about positive institutional and developmental change are likely to prove faulty.

Annex. The list of Ukrainian oligarchs.

| The Ukrainian “core” rich, 2006-17 | ||||

| No. | Name | Average domestic business wealth (US$ m) | Average share of national wealth (%) | Years on Focus-100 rich list |

| 1 | Rinat Akhmetov | 9,989 | 2.08 | 12 |

| 2 | Igor Kolomoiskyi | 3,005 | 0.66 | 12 |

| 3 | Viktor Pinchuk | 2,999 | 0.66 | 12 |

| 4 | Hennadiy Boholiubov | 2,898 | 0.63 | 12 |

| 5 | Vadym Novynskyi | 1,899 | 0.39 | 12 |

| 6 | Kostiantyn Zhevaho | 1,558 | 0.33 | 12 |

| 7 | Dmytro Firtash | 1,461 | 0.30 | 12 |

| 8 | Vitaliy Haiduk | 1,164 | 0.25 | 12 |

| 9 | Kostiantyn Hryhoryshyn | 1,171 | 0.25 | 12 |

| 10 | Yuri Kosiuk | 1,029 | 0.24 | 12 |

| 11 | Serhiy Taruta | 1,097 | 0.22 | 11 |

| 12 | Oleksandrr Yaroslavskyi | 860 | 0.20 | 12 |

| 13 | Petro Poroshenko | 846 | 0.20 | 12 |

| 14 | Andriy Verevskyi | 821 | 0.20 | 12 |

| 15 | Leonid Yurushev | 852 | 0.19 | 12 |

| 16 | Serhiy Tihipko | 703 | 0.16 | 12 |

| 17 | Leonid Chernovetskyi | 640 | 0.15 | 12 |

| 18 | Viktor Nusenkis | 704 | 0.14 | 10 |

| 19 | Valeryi Khoroshkovskyi | 558 | 0.12 | 10 |

| 20 | Vasyl Khmelnytskyi | 531 | 0.11 | 12 |

| 21 | Oleksiy Martynov | 510 | 0.11 | 11 |

| 22 | Vitaliy Antonov | 426 | 0.10 | 12 |

| 23 | Viacheslav Bohuslaiev | 429 | 0.10 | 12 |

| 24 | Hryhoriy & Ihor Surkis | 411 | 0.09 | 12 |

| 25 | Andriy Ivanov | 420 | 0.09 | 12 |

| 26 | Oleksandr & Serhiy Buriak | 370 | 0.08 | 10 |

| 27 | Volodymyr Kostelman | 331 | 0.08 | 12 |

| 28 | Mykola Yankovskyi | 335 | 0.08 | 12 |

| Total | 38,015 | 8.21 | ||

| Sources: Focus; Verkhovna Rada; own calculations. | ||||

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations