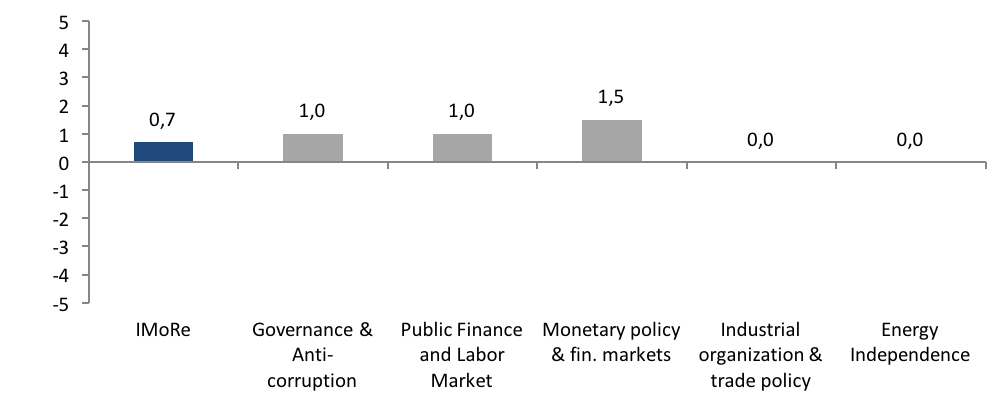

Reforms has accelerated slightly in late May, but proceed slowly: Reform Index stood at 0.7 point out of possible 5.0. Major positive changes include expansion of electronic public procurement, gradual easing of currency exchange controls and measures aimed at strengthening banks’ discipline in complying with capital requirements.

The pace of reforms revived somewhat in late May – early June, but the overall picture remains the same – gradual steps in selected directions. Reform Index stood at +0.7 point on May 23 – June 5, compared with a minimum of +0.4 point in the previous period. It should be noted that several important bills on judicial system reform were not included in this survey round, as they are yet to be signed into laws. Noteworthy regulatory changes in this round include the law on peculiarities of public procurement for defense, which was rated the highest by experts, and a number of resolutions in Monetary Policy and Financial Markets direction aimed at further strengthening the banking system and easing foreign exchange restrictions.

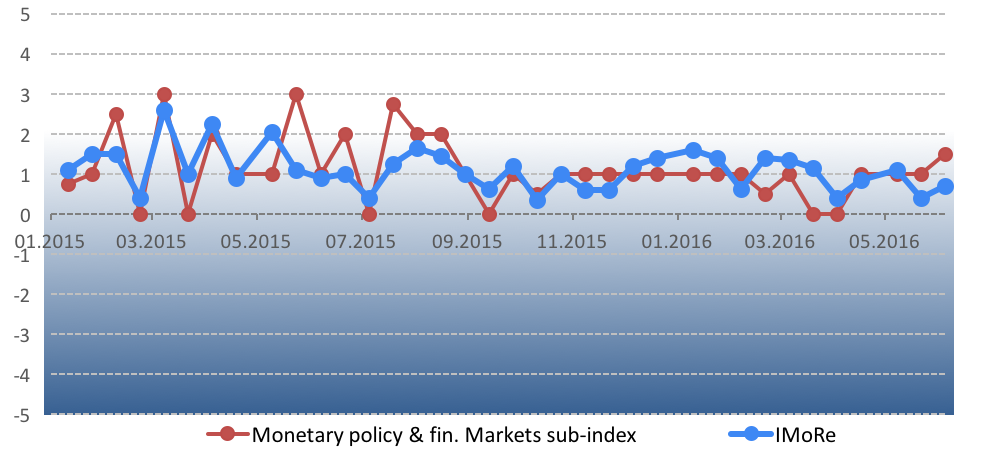

Chart 1. Reform Index dynamics

Reform Index team considers index value of at least 2 an acceptable pace of reform

Chart 2. Reform Index and its components in the current round

The most important positive developments

1) The law on the peculiarities of public procurement for defense: +2.0 points

The law (1356-VIII of 12.05.2016) regulates the peculiarities of procurement of goods and services for military purposes during special contingency, the anti-terrorist operation and the state of emergency.

Separate public procurement law for defense sector was required because of military sphere peculiarities, such as higher speed of the tender and less stringent transparency requirements for reasons of national security. On the one hand, the law aims at ensuring the speed and efficiency of procurement tender by reducing the maximum length of negotiation to two weeks and increasing liability for violation of the procurement procedure, supply disruption or poor quality product delivery. On the other hand, the selection of participants through electronic auction of ProZorro system still ensures transparency and openness of procurement procedures and reduce the level of corruption.

The Defense Ministry was one of the early adopters of electronic public procurement system ProZorro, and perhaps the most active participant. However, taking into account the specific conditions and military aggression, some of its procedures required adjustments to the needs of the Defense Ministry. The Law “On Peculiarities of Procurement of Goods and Services for Ensuring Defense Needs” was developed to take account of these circumstances. For instance, as an exception, the law reduced the minimum term of procurement for defense purposes and introduced responsibility for suppliers for the failure to deliver purchased products on time, which is critical for the Defense Ministry.

Approval of the law will help the Defense Ministry to establish effective supply of goods and services in this difficult period for the country. Still the key principles of ProZorro – equal conditions, transparency of procedures and easy access to tenders – remain intact.

Maxim Nefyodov, Deputy Minister of Economic Development and Trade of Ukraine

All public procurement should be transferred into ProZorro system as soon as possible. Without it, only limited public control of procurement is possible. Purchase orders in state defense has always been opaque, uncompetitive and difficult to control due to different levels of access permits (secrecy). It is even much more difficult than regular purchases, so corruption risks are higher. Openness in state defense order will allow for public control over large purchases and reduce corruption risks.

Tetyana Tyshchuk, Institute of Economics and Forecasting, National Academy of Sciences of Ukraine

2) Gradual deregulation and liberalization of the foreign exchange market

Capitalizing on the favorable situation on the foreign exchange (FX) market, the National Bank of Ukraine (NBU) gradually eases FX restrictions. Such steps are positively perceived by the experts. This survey round contains two NBU resolutions dealing with FX rules:

The NBU resolution 331 of 24.05.2016 removed a number of bureaucratic restrictions for FX market participants: +1.3 points

In particular, the National Bank has simplified the procedure for the return of foreign investment from Ukraine. It canceled a requirement to submit the note on actual inflow of foreign currency in Ukraine or other documents confirming the money came in Ukraine for investment purposes.

The NBU also simplified the procedure for issuing permits for FX operations. Customers of banks are no longer obliged to submit documents that are publicly available (notes from State Register of Enterprises and a copy of the certificate of evaluation activity issued by the State Property Fund). The requirements for some extraneous translations were also canceled.

In addition, the National Bank has simplified FX transactions under the credit agreements between international financial institutions and residents. No additional risk control measures will be applied to such transactions.

Bureaucratic obstacles complicate FX operations to same extend as anti-crisis administrative restrictions imposed in 2014-2015. For this reason de-bureaucratization is an important part of the currency regulation framework being currently developed by a NBU working group involving local and international consultants. The NBU Resolution No.331, dated 24 May 2016, On Amendments to Some Regulations of the National Bank of Ukraine is intended to simplify the procedure for issuing permits to conduct foreign exchange transactions. It removes the requirement to provide documents, to which the National Bank already has access either from other public sources, or in a different form. The former refers to documents that are already publicly available. The latter refers to translation of SWIFT messages and documents, the text of which is stated both in foreign and Ukrainian (or Russian) languages. These steps simplify business transactions in foreign currency, without destabilizing currency market.

Press Service of the National Bank of Ukraine

These steps simplify bureaucratic procedures for the businesses, while incurring no additional costs for the regulator for their implementation.

Dmytro Yablonovskyy, GfK Ukraine

The NBU Resolution 332 of 25/05/2016 reduced waiting period of FX purchases on the interbank market from two days to one: +1.0 point

This is another step towards easing tight administrative measures introduced during the crisis. In April, the banks were allowed to purchase foreign currency for customers only on the fourth day after provisioning necessary amount of local currency (mode T + 3). In early May, the National Bank reduced this “parking” period by 1 day (mode T + 2). And on May 25 NBU loosened restrictions again – now purchase can be made on the next business day (mode T + 1). As before, conversion can be performed only after NBU approval.

3) Resolution that allows NBU to treat banks as problematic if they fail to meet charter capital requirements: +1.5 points

Such changes are envisaged in NBU Resolution 336 of 30.05.2016. Earlier, the NBU has adopted a schedule according to which banks have to increase the capital to USD 500 million by mid-2024. The current development will strengthen banks’ discipline when complying with capital requirements.

The development will encourage banks to adhere to approved programs of additional capitalization; generally will contribute to the stability of the financial sector.

Irina Piontkivsky, Centre for Economic Strategy

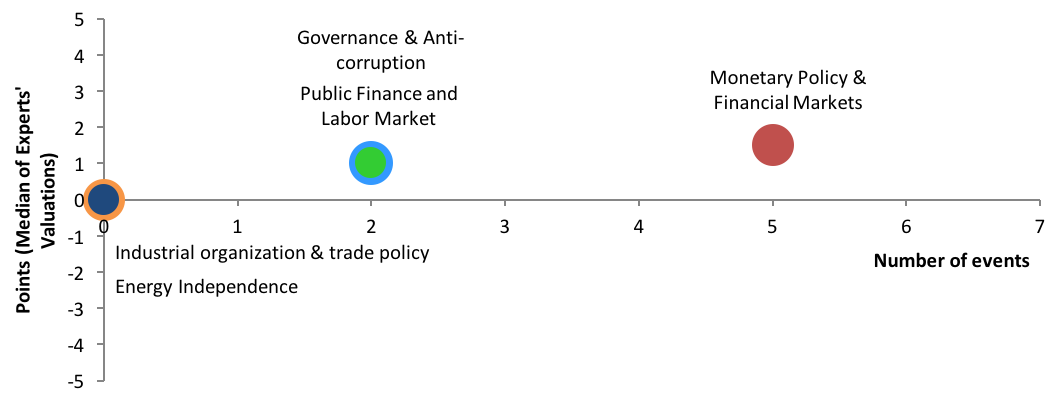

Chart 3. Value of Reform Index components and number of events May 23 – June 5, 2016

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations