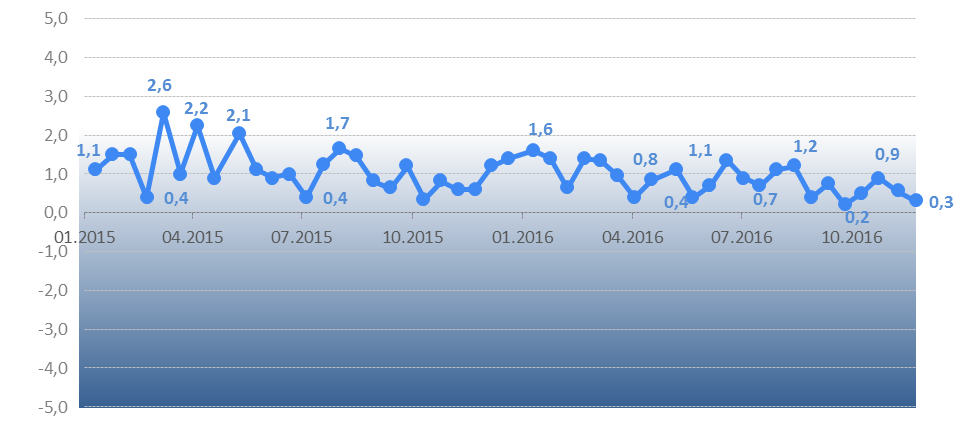

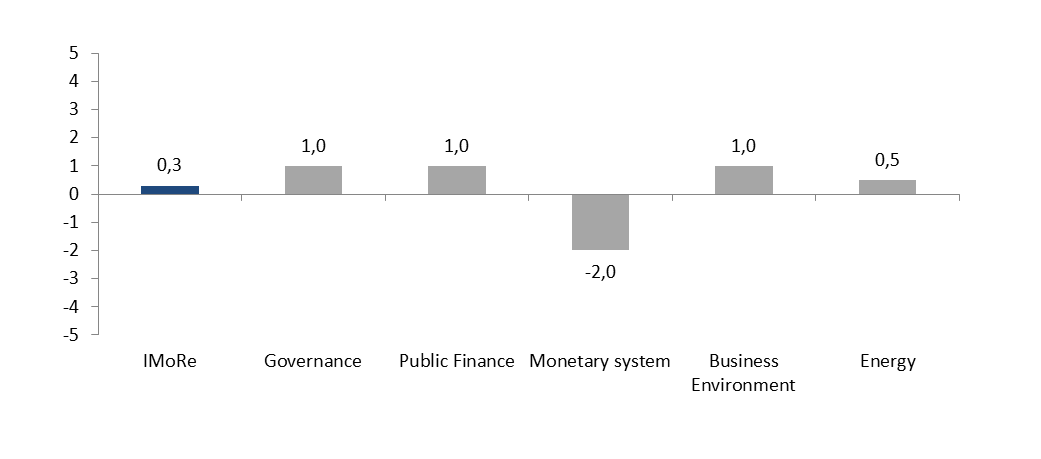

Reform Index is at a very low level, for the second consecutive time. The index for November 7 through November 20 is only +0.3 points, out of a possible +5 points. In the monetary sphere, overall reforms were actually negative, while other spheres experienced mild progress.

Chart 1. Reform Index dynamics*

* Reform Index team considers index value of at least 2 an acceptable pace of reform

Among the main developments of this evaluation period is the passing of a law on the compensation to investors affected by banking or financial fraud. Although the law resonated positively with the public, Reform Index experts negatively assessed its overall impact.

In addition, a number of regulations have been adopted that (1) allow government administrations to raise funds from local budgets to cover wages and salaries, (2) clarify the calculation and return of unused subsidies to the budget, (3) define the criteria for assessing the risk associated with hazardous waste, (4) abolish the import duty on scrap metal, (5) specify the reasons for mandatory laboratory tests of food, and (6) regulate taxes on charitable donations provided by religious organizations.

Chart 2. Reform Index and its components in the current round**

**Titles of components were shortened for convenience, while their content remained the same

The Most Important Events

1. The law on the compensation to investors affected by fraud in the banking and financial sectors is evaluated at negative -1.8 points

Recently, about 14 thousand people were defrauded for a total of 1.5 billion USD through intermediary of the bank “Mikhailivskiy”. The bank in its premises took depositor’s money on behalf of a non-bank institution at high interest rates. The non-bank institution funnelled this money into purchase of illiquide assets. Neither the bank nor the financial company returned the money to investors; however, these funds are not subject to the guarantees of compensation by Deposit Guarantee Fund of Individuals (DGFI). In fact, the bank deceived investors, exploiting their poor understanding of legal and financial issues.

Law # 1736-VIII of 15.11.2016 introduced rules to protect depositors defrauded by the bank “Mikhailivskiy”, and to prevent similar schemes in the future. In particular, reimbursement guarantees of DGFI were extended to cover this case, and liability and accountability of non-bank financial institutions was increased. Moreover, the law introduces a requirement that when a bank attracts deposits from individuals as an agent or intermediary, it must familiarize them in writing that these funds are not subject to certain rules on deposit guarantee.

Reformer’s Comment

“The National Bank of Ukraine (NBU) supports this law. We believe it will prevent abuses in the financial market in the future. Its strategic importance is due to the fact that it eliminates the opportunity for fraudulents shadow schemes that abuse depositors’ money at financial institutions.

Thanks to the law, Ukrainian banks will not be able to participate in P2P bank loans. A P2P system allows potential lenders and borrowers to meet directly through a bank intermediary. For the investor, a P2P loan means that he or she accepts all the risk concerning the loan, not the bank. This type of activity is performed worldwide and it is carried out not by the banks but by the various platforms. Thanks to the law, the NBU will be able to influence financial companies that take depositor’s money through banks, and will prevent building similar financial pyramids in the future.

This law gives NBU the right to request the following information from banks: where financial companies are being serviced, what kind of intermediary services the bank performs, and whether these services are performed properly. The draft law about splitting the functions of the National Commission for State Regulation of Financial Services Markets between the the NBU and the National Securities and the Stock Market Commission has already been for a year and a half in the Parliament. The adoption of this law would allow a single regulator to perform a comprehensive review – both for banks and for financial companies. However, the law is not being adopted by the Parliament and we do not have a complete picture of the financial companies’ activity”.

— Katerina Rozhkova, the National Bank of Ukraine

Expert’s Comment

“The negative point is that the law has been established for a specific bank that’s being liquidated and for that bank’s its practices. This is inordinate discretion and not the creation of a level playing field for all market participants. Financial companies, unlike banks, have never paid any contributions to the DGFI. There was no discussion as to whether payments of about 1.2 billion UAH to 14 thousand investors are the best option to help a particular group. This creates danger that in the future, other deceived groups of depositors will demand compensation from the state.

The positive points of the law are the norms it establishes that should prevent similar fraud in the future.”

— Alexander Zholud, the Editorial Board VoxUkraine

2. Government gives local administrations the right to receive funds from local budgets for the payment of salaries, +2 points

Decree #787 of 9.11.2016 gives local administrations the opportunity to receive funds from local budgets to pay employees for the execution of delegated powers according to the statutory powers of local government administrations.

The law provides that local administrations can get additional funds from local budgets for salaries. Up to 100% of the wage funds approved in the State Budget will be additionally financed from local budgets in 2016 and only 50% of the wage funds starting in 2017.

Expert’s Comment

“This decision fits into the logic of decentralization reform and provides opportunities for local administrations to involve the best specialists and reward employees for effective work. We hope that local authorities will responsibly take advantage of these opportunities. ”

— Ilona Sologub, Editors VoxUkraine

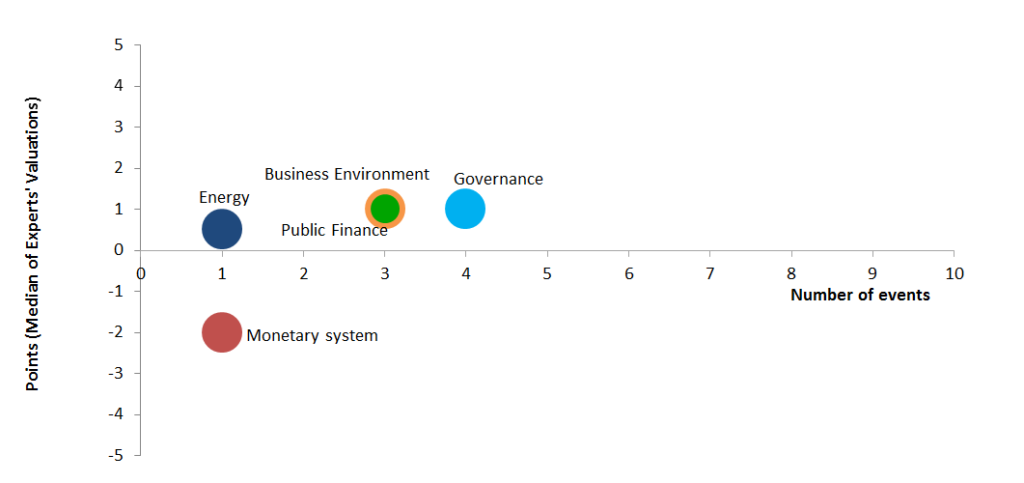

Chart 3. Value of Reform Index components and number of events November 7-20, 2016

Note:

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations