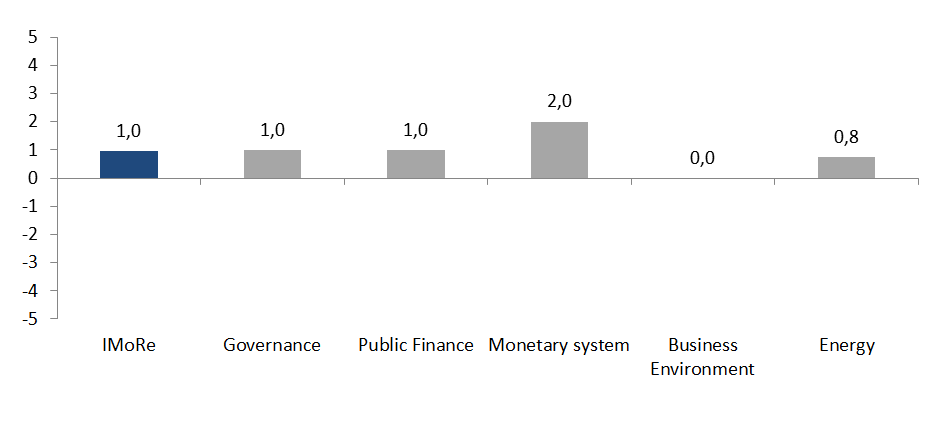

Progress in reforming the banking sector and road infrastructure has positively influenced Reform Index – the index for monitoring of reforms. For December 5 – December 18 iMoRe reached a score of +1.0 out of a possible +5 points. Experts noted the progress in the reforms of the monetary sphere, public administration, public finance and energy sector.

Chart 1. Reform Index dynamics*

*Reform Index team considers index value of at least 2 an acceptable pace of reform

Among the major events that occurred during this round are the provision of emergency banks’ liquidity assistance, the law on consumer loans, and an improvement of procedures for financing road facilities.

Also, the government adopted regulations on reforming the management system of state roadways, alternative energy sources, and the formation of supervisory boards at state research institutions.

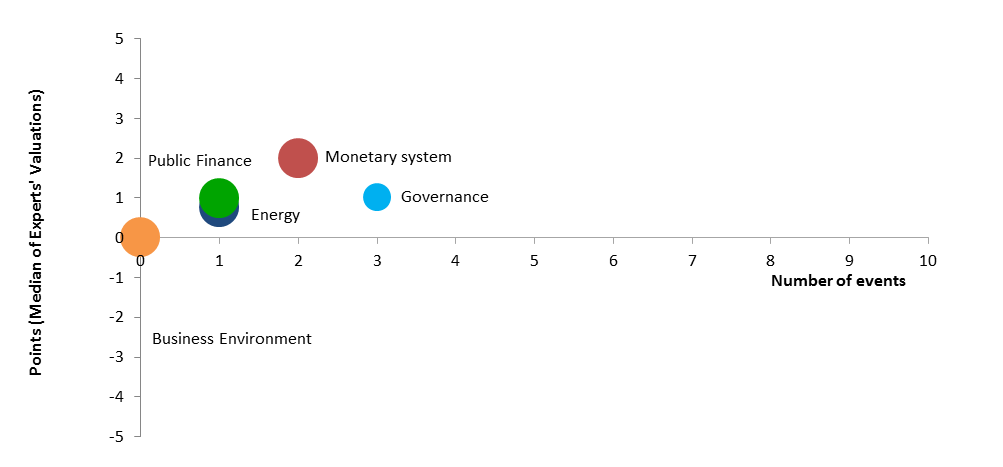

Chart 2. Reform Index and its components in the current round**

**Titles of components were shortened for convenience, while their content remained the same

The Most Important Developments

- The provision on Emergency liquidity assistance for banks, +2.0 points

The NBU Regulation #411 of December 14, 2016 introduces a new tool for emergency liquidity assistance to solvent banks – Emergency liquidity assistance (ELA). Loans, obtained by applying the new ELA tool, are meant exclusively for temporary deficiency payments of bank liquidity. They will be available in emergency situations when banks have exhausted other sources of liquidity support, particularly at the expense of shareholders and standard tools for NBU refinancing, secured by government securities and foreign exchange.

Banks will be required to use ELA loans only to meet the obligations to depositors and other creditors, except related parties. These loans cannot be used to finance a bank’s business or address structural problems facing a bank. Banks are not allowed to use ELA loans as equity injections needed to meet additional capitalization requirements.

Reformer’s Comment

“The ELA tool for financially solvent banks will promote financial system stability since it will provide the opportunity for solvent banks to promptly obtain loans for liquidity support from the National Bank. But the banks must hold preparatory work in advance, before there is a real need in the liquidity support. Holding all the preparation beforehand will allow banks not to waste time in the crisis period, including time for assessing the deposit, undergoing loan procedures, issuing documents, etc. and if necessary to quickly attract refinancing from the National Bank under ELA.”

— Oleh Churiy, NBU

Expert’s Comment

“Replacing practices of stabilization loans for emergency liquidity support with clear conditions and restrictions is positive news. In Ukraine there was a wrong practice of issuing stabilization loans not only to banks with liquidity problems, but insolvent one. In the period of monetary panic some banks used stabilization loans for speculation, which aggravated the general state of the banking system. The new tool in a great measure repeats ELA, which is used by the European Central Bank.”

— Olexander Zholud, VoxUkraine editorial board

Chart 3. Value of Reform Index components and number of events, December 5-18, 2016

- Law on consumer loans, +2.0 points

In the consumer loans regulations, there were a series of gaps. Lenders often did not fulfil the requirement of disclosure to borrowers the information on real interest rates on loans before signing a contract or used deceptive advertising.

Law #1734-VIII of November 15, 2016 aims to protect the rights of both borrowers and lenders. Now, in advertising credit products there should be the real cost of credit. Into the calculation of the effective rate should be included all interest rates on the loan and payments for banking services. Financial institutions should inform the consumer about the estimated cost of the services of third parties (insurers, assessors), if known to them. Also, the lender is obliged to evaluate the borrower. The order of repayment requirements under the contract of consumer credit has been changed: in the first place, the principal of a defaulted loan will be paid, in the second place – current payments and interests and in the third place – penalties (the principal of defaulted loan used to be paid in the third place, and penalties – in the second place).

Reformer’s Comment

“In Ukraine, there has been no specific law on consumer loan so far. Most European countries have gone this way – the development of a separate statute that regulates this type of financial activity. This law will protect the rights and legal interests of both consumers and lenders. It will help secure consumers of financial services from the risks of violations of their rights by providing them with complete information for decision making.

National Bank of Ukraine believes it is necessary to develop an integrated system for consumer loans regulation based on this law.”

— Yevhen Stepanyuk, NBU

Expert’s Comment

“The law on consumer loans clearly outlines the rights of the borrower and the lender, prohibits poor quality advertising of “interest free loans“ in compliance with EU Directive (2008/48). This is a positive step in developing a legal framework for consumer loans. In particular, now the creditor shall provide the calculation of payments on loans, the terms of early loan repayment etc.”

— Oleksandr Zholud, VoxUkraine editorial board

- Amendments to the Law “On sources of financing road facilities”, +2 points

Law # 1762-VIII of November 17, 2016 together with amendments to the Budget Code of Ukraine concerning the improvement of the road sector financing mechanism, aimed at isolating the sources of road facilities financing in the State Road Fund as a part of the special fund of the State Budget of Ukraine.

The Fund will be formed by (1) the excise tax on manufactured products in Ukraine and imported petroleum products and vehicles, (2) the import duty on petroleum products, vehicles and tires, (3) road toll for the vehicle, which weight or dimensions exceed standards.

62% of the fund will be directed to finance construction, reconstruction, repair and maintenance of principal roads, 35% – of local roads, 3% – for financing road safety activities.

Reformer’s Comment

“We are systematically implementing European standards into infrastructure regulation. Road Fund, weight control on the roads, development of border infrastructure, introduction of quality control system of road works Fidic and CoST – these standards should work in Ukraine.

Adoption of the law on the establishment of the Road Fund is one of the key elements of the road sector reform; this is the introduction of the European model of financing the road sector. Road fund is a predictable and sustainable funding of the road sector. This is not just renovated roads, but the opportunity to plan and implement large-scale infrastructure projects, including construction of the new highways.”

— Volodymyr Omelyan, Ministry of Infrastructure of Ukraine

Expert’s Comment

“The Road fund was liquidated with the amendments to the Budget Code, adopted at the end of 2014. It recovers in much larger volume than it was (except import duties, Fund income will include excise and road toll). Undoubtedly, the state of highways is one of the major problems in Ukraine; therefore, the establishment of the Road Fund for their recovery is positive news. However, transparent mechanisms of money use should be introduced.”

— Ilona Sologub, KSE, VoxUkraine editorial board

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations