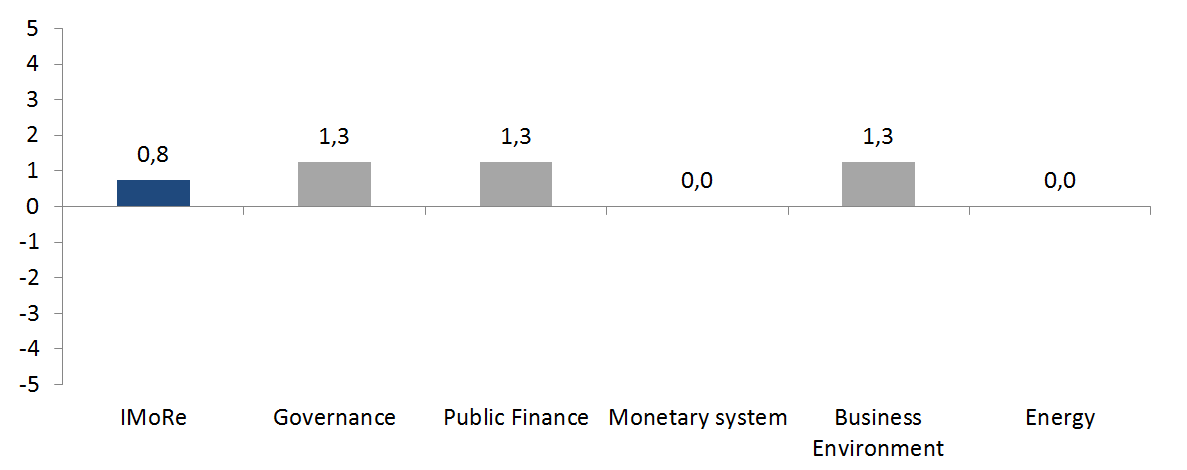

Reform Index remains low. Assessment of reforms progress for December 19, 2016 – January 8, 2017 is only +0.8 points out of a possible +5.0 points. Progress was observed in public administration reform, public finances and the business environment. Even though these areas have benefitted from a number of progressive legislative actions, the index value is low due to several anti-reforms.

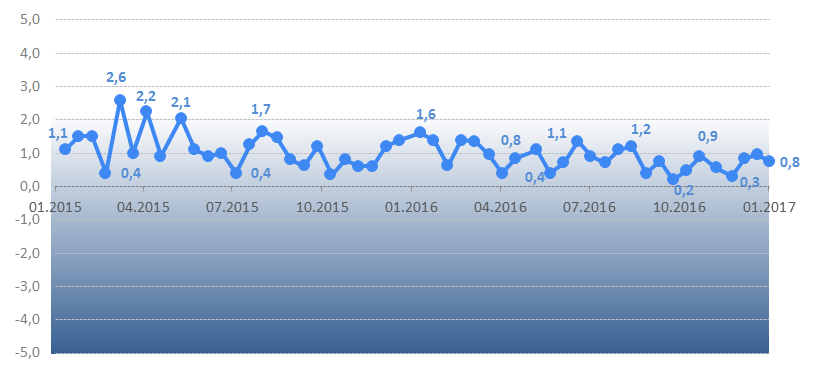

Chart 1. Reform Index dynamics*

* Reform Index team considers index value of at least 2 an acceptable pace of reform

Among the major events that occurred during this round are the law on the Supreme Council of Justice, the amendments to the Tax Code regarding the improvement of the investment climate, a package of budgetary laws, laws to support the aircraft building industry and the law on establishing the Export Credit Agency.

Chart 2. Reform Index and its components in the current round**

**Titles of components were shortened for convenience, while their content remained the same

Top reforms of the release: The Supreme Council of Justice and tax administration changes

The law on the Supreme Council of Justice, 4.0 points

Law #1798-VIII of 21.12.2016 continues the trend of judicial reform that was initiated by the constitutional amendments of June 2016. The Supreme Council of Justice (SCJ) is a joint independent constitutional body of judicial governance. It will perform a key role in establishing judicial manpower.

SCJ will decide the fate of appeals to the President of Ukraine on judges’ appointments granted by the High Qualification Commission of Judges. SCJ has the power to make final decision on the dismissal of a judge, transfer him from one court to another, give consent for arrest or judge detention, and make decisions on judges’ suspensions. Before 30 September 2016, Parliament made the decision to arrest and suspend a judge. While SCJ has not yet been created (which is to be done no later than April 30, 2019), the existing High Council of Justice already performs the functions of the new organization.

To hear cases on disciplinary responsibility of judges the SCJ will form Disciplinary Chambers from among its members.

The law also ensures the SСJ has the authority to approve the number of judges in courts, participate in defining the state budget expenditures for the maintenance of courts, and approve standards of human and financial resources of the courts.

The SCJ will consist of 21 people: 10 judges elected by the Congress of Judges from the judges or retired judges, two representatives from the President, the Parliament, the Congress of attorneys each, and will hold a nationwide conference of prosecutors and members of Congress from law schools and academic institutions. The President of the Supreme Court is a member of the Council due to the position. Its members are appointed for four years and not more than two consecutive terms.

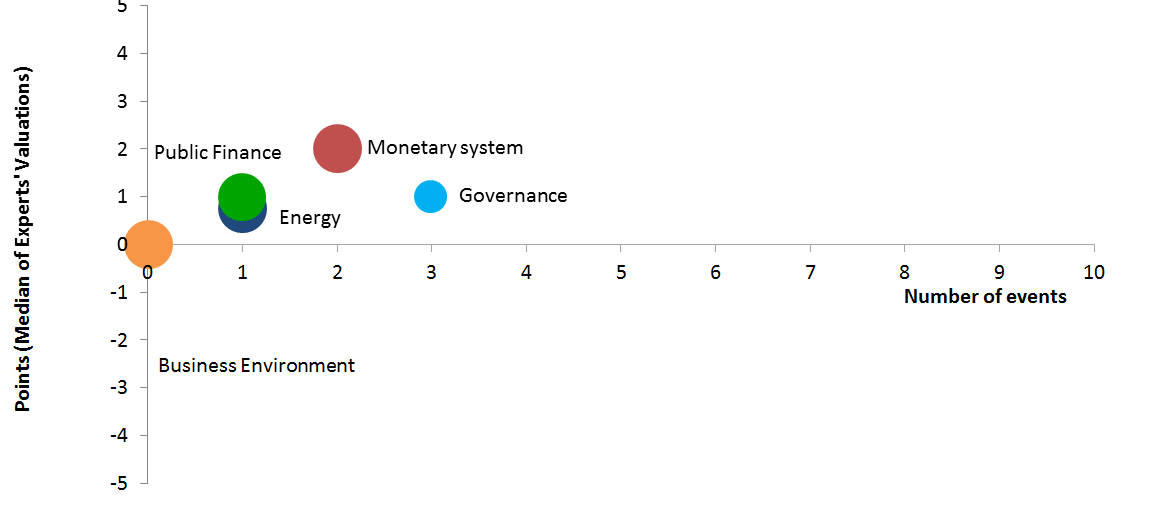

Chart 3. Value of Reform Index components and number of events, December 19, 2016 – January 8, 2017

Amendments to the Tax Code on the improvement of the investment climate +3.5 points

Law 1797-VIII of 21.12.2016 introduces a number of changes to the tax code, aimed at simplifying tax administration, reducing corruption risks in the taxation, improving the business environment.

One of the major developments of the law is the introduction of a single public register for value added tax (VAT) reimbursement requests and its automatic compensation. It should significantly reduce corruption in this area and create a level playing field.

In addition, the Law implements the electronic cabinet of a taxpayer to minimize her/his contact with fiscal authorities, and introduces a tax holiday for small businesses. The law clarifies a number of issues, including transfer pricing, income tax, VAT, tax on personal income, excise duty, land rent, water and mineral resources rent and others.

A single register of tax consulting will be publicly released on the fiscal authorities’ website, and it will help enterprises to be treated equally by the tax agency.

Anti-reform of the release: the establishment of Export Credit Agency (ECA)

The law on providing a large-scale export expansion of Ukrainian goods and services via insurance, guaranteeing and cheapening of export crediting, -1.3 points

Law #1792-VIII of 20.12.2016 provides the establishment of ECA.

According to the law, the main task of the ECA is the protection of Ukrainian exporters against the risk of non-payment and financial losses related to the implementation of foreign trade agreements (contracts) via insurance, reinsurance and guarantee.

Moreover, the agency will participate in the implementation of the program of a partial compensation of interest rates on export loans.

ECA will be organized in the form of public joint stock company with the state share of 50% + 1 share.

Reform Index experts stressed the high risk of corruption in the activities of the ECA. They also noted that although the creation of the ECA is an important export promotion measure, the law itself is very controversial. First, the law withdraws the ECA from government regulations of insurance and financial markets, which distorts competition in these markets and increases the probability of involving the agency into risky operations. Secondly, it provides that support will be assured not to all Ukrainian producers, but only to providers of services and manufacturers of certain industrial products defined by the law – for example, some kinds of food and pharmaceuticals, clothes and footwear, machinery and furniture. This discriminates against other manufacturers. Thirdly, the law provides for the possibility of partial compensation of interest rates on export loans, which is an export subsidy within the meaning of the WTO and therefore forbidden kind of state support. If this mechanism is applied, it will violate Ukraine’s commitment to the organization and may result in inappropriate actions.

Reform Index editors requested comments from the authors of the law, namely from N.Yuzhaninoi, V. Halasyuk, H.Hopko, but they could not do this before the release was published.

Other important developments: budget package

In general, budget package gained +3.5 points. The most important developments, introduced by every law, and some expert opinions on this subject are:

Amendments to the Budget Code on improving budgeting, +2.0 points

Expenditures of state and local budgets have been redistributed. In particular, local governments will finance utilities for medical and educational institutions (which may contribute to higher energy efficiency), and the state budget will finance vocational schools. It is determined that the scholarships at universities will be social and academic (with the higher level than actual one). The law also provides support for agriculture in the next five years, its level will not be less than 1% of agricultural output.

The law increases the excise tax on alcohol and tobacco, and it reduces the rent size for mining. Reform Index experts noted that the increase in excise duties on tobacco and alcohol correspond to the spirit of the EU-Ukraine Association Agreement.

Law on State Budget-2017, + 0.8 points

Experts believe that Budget-2017 reflects the aims of fiscal consolidation and, therefore, is a step toward economic sustainability. However, the size of the NBU transfer is inflated and endangers the achievement of declared aims. Also, the revenue from special confiscation looks unrealistic as the law of special confiscation has not been yet adopted.

The law on the minimum wage and mandatory payments for “sleeping” FOPs (private entrepreneurs), -0.3 points

This law has created conditions for increasing the minimum wage twice (3200 UAH) since January 1, 2017 . Also, according to it, certain categories of entrepreneurs will have to pay a monthly social contribution of 704 hryvnia per month, even if they temporarily don’t receive income.

Note:

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations