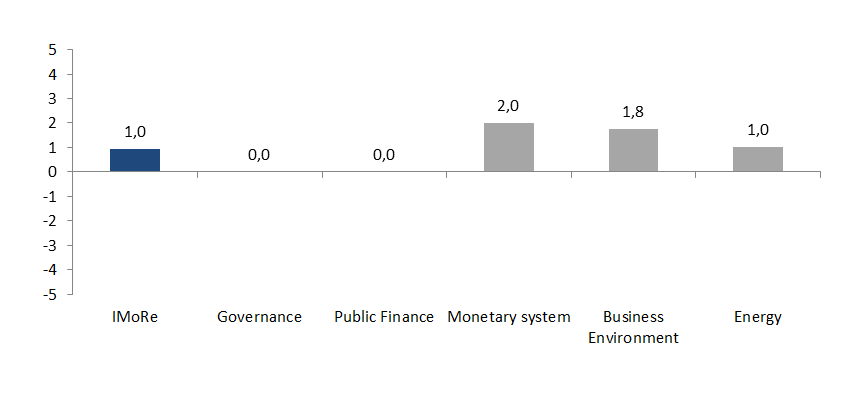

Reform Index again demonstrated a slight recovery. An assessment of the progress of reforms for the period of February 20 – March 5, 2017 is +1.0 point on a scale of -5.0 to +5.0. The shift was recorded in the areas of monetary sector reform, business environment and energy.

Among the major events that occurred during this round are simplification of foreign operations for Ukrainians, foreign currency exchange procedures by the bank customers, and laws on a simplified application process for special water use and the only access to the infrastructure for the development of telecommunication networks.

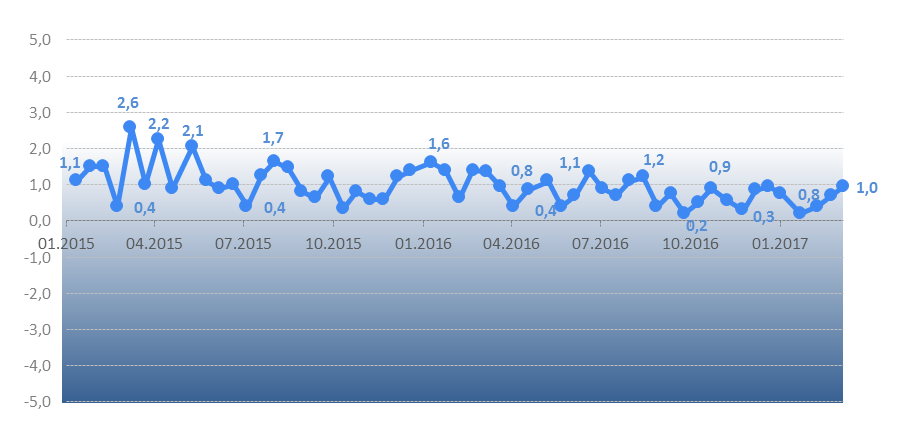

Chart 1. Reform Index dynamics*

* Reform Index team considers index value of at least 2 an acceptable pace of reform

Chart 2. Reform Index and its components in the current round

Top-reforms of the release

The liberalization of foreign exchange transactions regulation

The Decree of the Cabinet of Ministers of Ukraine of February 19, 1993 #15-93 «On Currency Regulation and Currency Control” is still functional in Ukraine. Its rules create excessive over regulation, complexity and bureaucracy of currency regulation in the country. This, in his turn, negatively affects the business environment in the country and its investment attractiveness. Gradual liberalization of currency regulation is provided by a new concept of currency regulation, developed by the NBU.

Simplification of Ukrainian foreign operations, +4.0 points

The NBU Board Resolution #14 of 23.02.2017, which simplifies foreign operations for Ukrainians, is one of the first steps towards the liberalization of currency regulation.

Now, individuals can place foreign currency on foreign accounts, sourced outside Ukraine without individual licenses from the NBU. Also individual NBU licenses will be unnecessary to invest abroad with funds outside Ukraine.

Reformer’s Comment

“New, less bureaucratic approaches to licensing particular transactions of individuals will give Ukrainians the possibility to place foreign currency on foreign accounts sourced outside Ukraine without individual licenses from the NBU. For example, without licenses from the NBU, Ukrainians will be able to place funds on foreign accounts they receive outside Ukraine as salaries, scholarships, pensions, alimony, dividends etc. Also, individuals will be able to invest abroad with funds outside Ukraine without individual licenses from the NBU. For example, to conduct investment from foreign accounts, reinvest funds outside Ukraine, to trade financial instruments in foreign markets etc. However, as we have repeatedly emphasized, this simplification from the NBU does not exempt individuals from the obligation to declare income and pay taxes on them to Ukraine in accordance with national law.”

— Oleg Churiy, the NBU

Chart 3. Value of Reform Index components and number of events, February 20 – March 5, 2017

Simplification of currency transactions by bank customers, +2 points

With the Board Resolution #15 of 28.02.2017, the National Bank simplified the transaction procedures for bank customers when purchasing foreign currency and transferring funds from Ukraine to non-residents, and also changed the procedures for monitoring such operations.

Reformer’s Comment

“With this decision we have allowed bank customers not to wait for confirmation from the NBU to purchase foreign currency and transfer funds from Ukraine to non-residents. Authorized banks will immediately inform the regulator of such clients’ operations. Thus, it will simplify such operations for the business while maintaining a thorough review of operations to prevent unproductive capital outflows. If the National Bank has doubts about the legality of certain foreign currency transactions, the requirement to suspend their implementation can be sent to the bank. To restore such operations the bank can only after receiving a specific message from the NBU.”

— Igor Bereza, the NBU

Expert’s Comment

“Both shifts on the liberalization of regulations on foreign currency transactions are significant and emblematic not only for its impact on the simplification of international payments. Both shifts are the real “small revolutions” in mind, parting with the Soviet repressive heritage and final recognition of Ukraine’s place in the globalized world.

First, individuals are allowed to have accounts abroad and receive funds without the need to request individual license from the NBU. By this time the population has never, neither in the Soviet nor in post-Soviet Ukraine, officially been allowed to have foreign accounts, unless the person is living abroad or did not receive an individual license (which was completely futile). Now one can use this account to receive salaries, money from the sale of goods or services sourced from outside Ukraine, and direct those resources for any goal – saving funds, stock market game, consumption, and transfer to Ukraine etc.

Secondly, companies-importers now don’t have to ask the NBU for permission every time to buy foreign currency to pay for goods or services. The bank that the company turns to, can decide whether the transaction falls under the criteria of risk, and whether sell the foreign currency or refuse, without wasting time and actions of the controller. In fact, it means the transition to risk-based supervision, replacement of the licensing system for informative (regulator will still see the transaction and receive “information file” that contains all the data), it significantly simplifies trade operations and improves the business climate for the companies engaged in foreign economic activities. In the future, simplifying of currency exchange and its transfer should improve the investment climate and a difficult currency regulation should stop being an obstacle to foreign investments. Importantly, how this change will prove itself in practice, but expectations for the results is positive.”

— Maria Repko, Center for Economic Strategy

Notes:

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas: (Please see other charts here and here)

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations