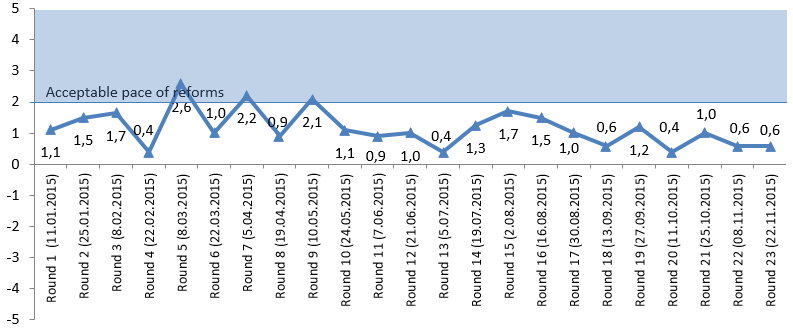

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas. Reform Index value for the 23rd monitoring period (November 9 – 22, 2015) was +0.6 point out of the possible range from -5.0 to +5.0 points. The pace of reforms remains sluggish.

Issue 23: Period of sluggish reforms still lingers

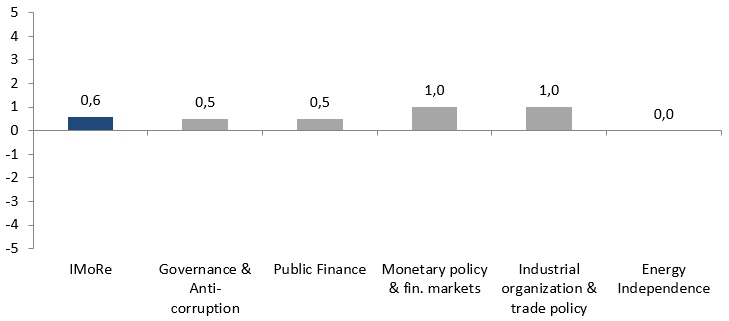

Progress in “Monetary Policy and Financial Markets” and “Industrial Organization and Trade Policy” was rated the highest in this period: + 1.0 point each. In the monetary sector, +2.0 points were given to the decision to include the National Bank of Ukraine (NBU) as a third party (along with a broker and a bank) in contracts for independent evaluation of collateral provided to the NBU for stabilization loans (NBU decree 794 from 18.11.2015). Olena Bilan from Investment Company Dragon Capital thinks that the decision

can make the assessment more adequate and avoid overvaluation to obtain a larger volume of refinancing. It will promote more effective monetary policy implementation.

We expect reforms to accelerate next round because a series of anti-corruption developments have been already signed by the President. On the other hand, these changes are driven by external demand and are closely monitored by partners and donors. The internal motivation for reforms remains low.

Chart 1. Reform Index dynamics

Chart 2. Reform Index and its components in the current round

Setting the rules for trade of government bonds on stock exchanges (NBU decree 762 of 03.11.2015) received +2.0 points as a sum of grades in Public Finance and Monetary Policy sub-indices. At the same time, experts gave only +1.0 point to the list of features of a bank’s risky activities (NBU decree 778 of 10.11.2015). The decree aims at combating fraud and capital flight. However, experts noted that the description of features of risky activities is quite vague, can be used for corrupt practices, while control mechanisms are not clear, which altogether caused the low general grade of the event.

Within the Industrial Organization and Trade Policy sub-index, the highest rating, +1.5 points, was given to introduction of electronic register of apostilles (CMU decree 890 of 04.11.2015). Register will contain information on signatures, stamps of Ministry of Justice officials authorized to issue apostilles, officials of Civil Status Registration Departments and state registrars, notaries, and judges.

Ministry of Economic Development and Trade will coordinate inspections of enterprises (CMU decree 902 from 04.11.2015). Due to coordination, the number of inspections should decrease since several government agencies will audit a company simultaneously (within the framework of a single inspection). Total grade of the event was +1.0 point, though experts’ opinions ranged from -2.0 to +2.0.

Experts assigned +1.0 point to cancelling of compulsory registration of veterinary certificate for forage grain at sea ports (CMU decree 916 of 13.10.2015), noting that this is an important but highly specialized step in deregulation. Government transferred coordination of State Service for Food Safety and Consumer Protection to the Minister of Agrarian Policy and Food (CMU decree 942 of 18.11.2015) – overall event score totaled +0.5 point, though experts gave controversial comments. In particular, according to Pavlo Kukhta from Reanimation Package of Reforms Initiative, the event actually cancels reform effort to create an independent regulator and returns the status quo, which has been characterized by high levels of inefficiency and corruption.

A cumulative grade for “Public finance” sector was just +0.5 point. Although two events in the sector received high individual grades, experts considered their impact on the sector reforms insignificant. Apart from the NBU decree on the rules of stock exchange trade in government bonds, experts gave +2.0 points to the decrease in the number of State Fiscal Service inspections (CMU decree 892 from 04.11.2015) (this event received +1.0 point in each Governance and Public Finance sub-index).

In Governance and Anti-Corruption sector, which also scored +0.5 points, apart from the reduction in the number of State Fiscal Service inspections, other events received controversial assessment. For example, the news that the government ordered all government agencies to coordinate themes and objectives of their negotiations abroad, and subsequently report to the Ministry of Foreign Affairs (CMU decree 903 from 04.11.2015) received an overall grade of 0.0 points, though individual grades ranged from -2.0 to +2.0.

Finally, Energy Independence sector scored 0.0 since no significant events were recorded there during the monitoring period.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

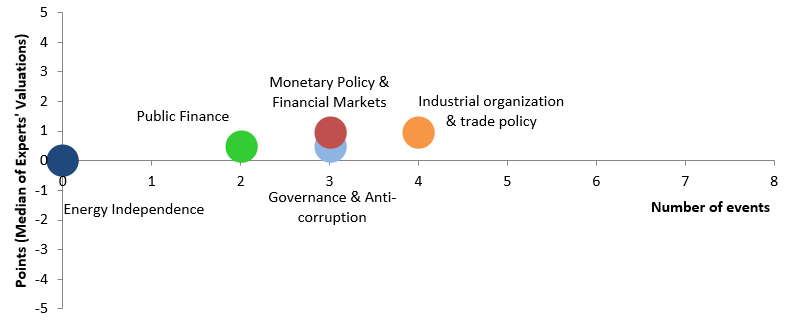

Chart 3. Value of Reform Index components and number of events November 9 -22, 2015

Main media partner Project partners

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations