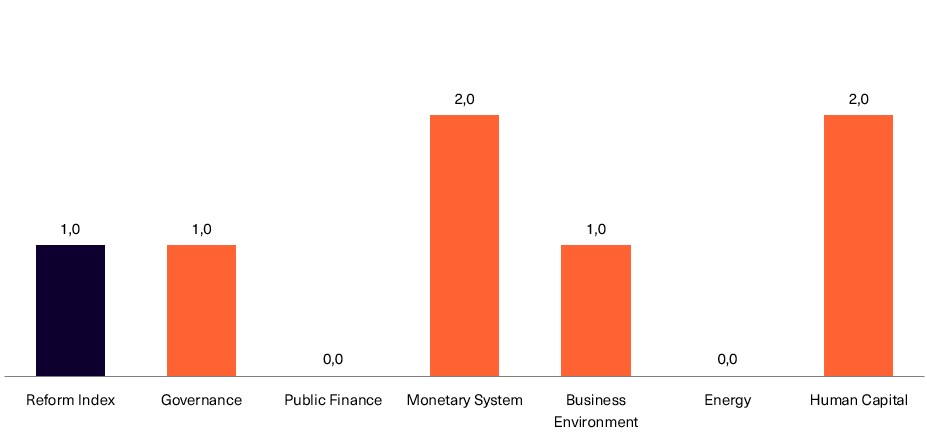

In issue 205 (issue 198 before the audit) of the Reform Index (for the period from January 30 to February 12), five regulations have been included (Chart 1). However, only the law expanding the list of areas allowing the use of electronic money scored 2 points, a score experts believe separates significant changes from less important ones.

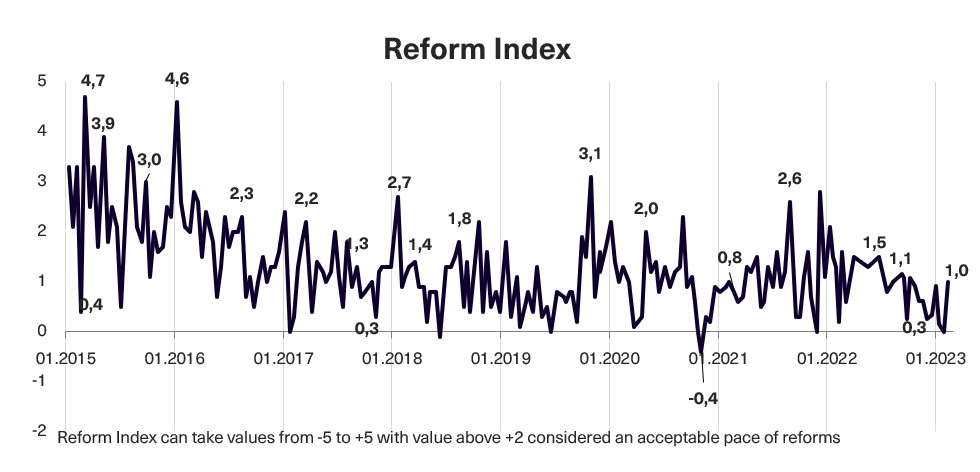

Overall, the value of the Index for this period is +1.0 points. We documented no reforms in the previous issue, so the Index remained at 0 points.

Chart 1. Reform Index Dynamics

Chart 2. Reform Index and its components in the current round

Changes to the Tax Code regarding expanding the use of electronic money, +2 points

Law 2888-IX significantly increased the possibilities of using electronic money in Ukraine. Now it can be used to pay for goods and services, receive reimbursement for travel expenses, and pay taxes (if the operator of electronic cash can convert them into fiat for the State Treasury).

With the adoption of the law, the level of control over electronic wallets by the state also increased. Before using an electronic wallet, it now must be registered with the tax authorities (the service provider must submit information about opening and closing accounts). The money in it is subject to taxation.

The money in the electronic wallet can be seized based on a court decision. These measures close the possibility of using wallets as a “gray area” to hide one’s income.

In addition to electronic money, the law regulates banking transactions. Thus, it contains a rule that the bank to which the fraudsters transferred the funds must return the money and the commission fee to the owner within ten days of confirmation of this transaction’s illegality.

During martial law, the NBU prohibited banks from issuing and distributing electronic money and replenishing e-wallets.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

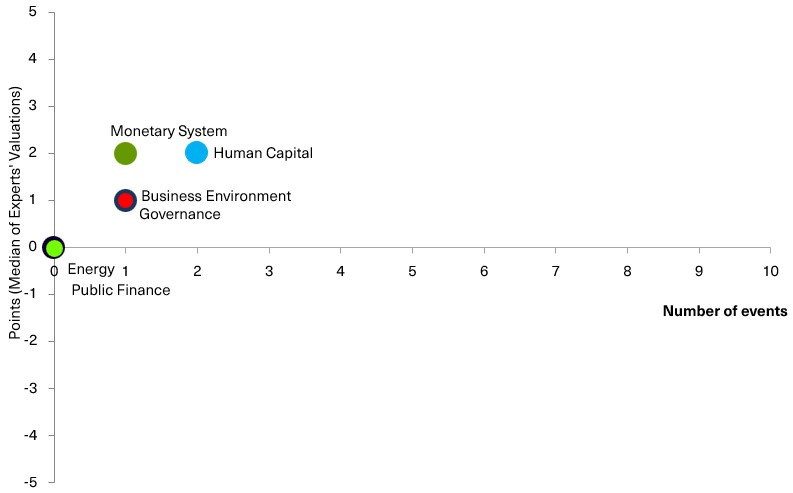

Chart 3. Value of Reform Index components and number of events

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in six areas: Governance, Public Finance, Monetary system, Business Environment, Energy, Human Capital.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations