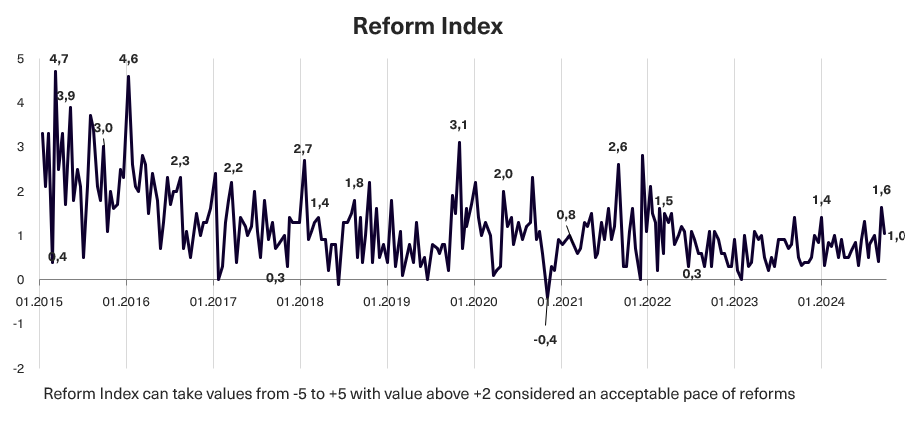

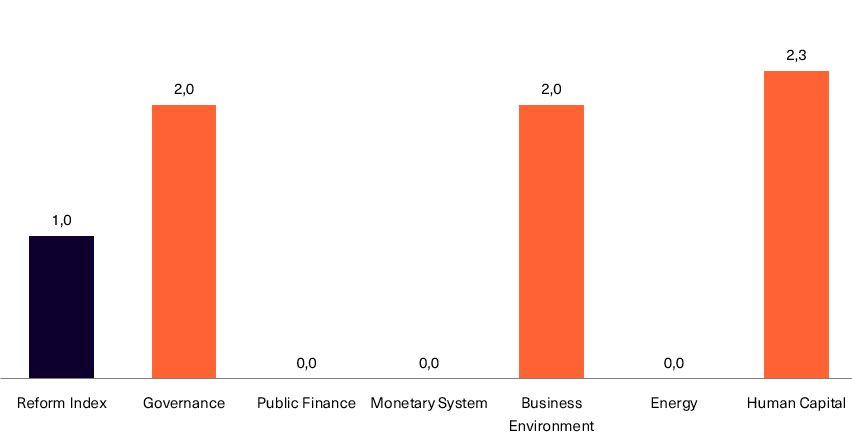

The 247th issue of the Reform Index, covering the period from September 9 to 22, includes six reforms. The issue’s overall value is +1.04 points (in the previous issue, the Index stood at +1.6 points). The key events in this release are the automation of the process for granting combatant status through an electronic system and the return to mid-term planning of local budgets.

Graph 1. Dynamics of the Reform Index

Graph 2. Values of the Reform Index and its Components in the Current Assessment Round

Combatant status will be granted automatically, +2.25 points

In September 2024, the government approved a procedure for automatically granting combatant status during martial law.

Previously, a military unit or an individual had to submit a set of documents to a commission to obtain combatant status. Now, authorized personnel appointed by the commander or chief will enter data about participation in combat operations into the Unified State Register of War Veterans within five days from the start of the combat mission in combat zones or occupied territories. The system will display personal data, the period, location, and the order under which the individual performed the combat mission. Combatant status will be automatically granted to all whose data is entered into the Register, and an electronic document will be automatically generated in the system.

The Ministry of Veterans Affairs is tasked with finalizing the Unified State Register of War Veterans and integrating it with security and defense sector agencies by the end of the year. The Ministry of Defense must also develop and maintain an up-to-date Guide to Combat Zones, which is essential for granting combatant status.

The procedure for automatic status granting applies to service members, law enforcement officers, and members of territorial community volunteer formations. An exception is made for employees of the Security Service of Ukraine (SBU) and intelligence agencies, who will continue to follow the previous procedures.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Expert commentary

Liubov Halan, Head of the Human Rights Center for Service Members “Principle”

“This resolution is implementing a previously adopted law on automating the granting of combatant status. We support this decision because such changes accelerate the process of obtaining this status. These are important changes, but they do not signify a fully automated process. Therefore, there is still room for improvement in this direction.”

Olha Termeno, Head of the Veteran Affairs Division at The Legal Hundred NGO

“The resolution establishes the procedure for submitting information to obtain combatant status in ‘automatic’ mode. There is a defined list of details that must be entered into the Register, and once everything is in order, a record of the granted status is created.

At the same time, the automatic process still involves human participation, as the data must be entered into the register by an authorized person from the relevant military unit. A specific timeframe is set for this: within five days from the start of the combat mission. This means there is a potential risk of unawareness, improper fulfillment of duties by the responsible person, or other subjective and objective factors that could hinder the timely and complete entry of information into the register.

The positive aspect is that it eliminates the need to wait for a commission decision to grant the status, as the record should indeed be created automatically. The resolution will take effect in four months, during which time the register is expected to undergo technical improvements. Thus, this algorithm is not yet operational and will likely be refined further.”

Restoration of mid-term budget planning for local budgets, +2 points

Law 3979-IX updates approaches to managing local budgets, enabling better financial management for communities. Local authorities will be required to prepare forecasts for local budgets (a requirement temporarily suspended in 2020) to ensure more effective medium-term budget policy planning. Exceptions apply to territories with active hostilities and temporarily occupied areas.

The law allows local budgets to be approved with a surplus or deficit in the general fund when purchasing government securities with a term of over one year. Local governments will be able to use temporarily available funds more efficiently by investing them in government bonds (short-, medium-, or long-term, depending on budget needs).

An important innovation of the law is the introduction of monthly reports on local budget arrears by the Treasury to the Verkhovna Rada, the President, the Cabinet of Ministers, the Accounting Chamber, and the Ministry of Finance. This will provide up-to-date information necessary for prompt decision-making regarding local borrowing and the provision of guarantees.

Expert commentary

Yuliia Markuts, Head of the Center for Public Finance and Governance Analysis at KSE

“The law on the restoration of mid-term planning at the local level is an essential step in fulfilling Ukraine’s commitments, particularly within the framework of cooperation with the IMF, as well as in harmonizing the norms of the Budget Code with the powers of local self-government. Mid-term planning of the state budget was restored last year (the Budget Declaration was approved this year), so extending this approach to local budgets was natural.

Key changes include the following:

- Restored requirements for mid-term local budget forecasting:

The restoration of mid-term local budget forecasting requirements (Article 75-1 of the Budget Code) aims to promote balanced planning and improve the efficiency of community resource management. However, risks persist, including a formal approach to forecasting in communities lacking expertise and difficulties adapting to economic instability. These challenges have led most financial specialists in local councils to view the law negatively.

- Streamlined local borrowing and guarantee procedures:

The new streamlined procedures for local borrowing and guarantees enable communities to attract resources for fulfilling debt obligations under more favorable conditions.

- Expanded opportunities for using local budget surpluses:

Local budget surpluses can now be allocated to various areas, including the social sector, infrastructure for internally displaced persons, and the purchase of long-term securities. Additionally, these surpluses can be used to cover accounts payable (which may arise at the end of the year) effectively bypassing restrictions by making purchases without paying for them in the current year. Although this method of using budget surpluses does not entirely align with the spirit of the law, it now enables the postponement of funding for certain expenditures, such as road repairs (a direction that is “interesting” to local officials from an electoral standpoint). For example, if a community wants to fund the repair of a local road, it cannot directly use surpluses for this purpose. However, it can initiate the repair work this year and take on the obligation to pay for the work but not actually pay. This means that the budget will generate accounts payable to contractors (the service providers) by the end of the year. At the beginning of the following year, these can then be financed from the budget surpluses, as such usage has become permissible. In essence, the latest changes have made it possible to create artificial accounts payable—obligations that are not immediately covered. This allows the community to commit to repair work initially and shift the actual payment to the next year, using the budget surpluses to do so, effectively circumventing the official restrictions on spending them.

- Procurement for budgetary institutions funded by other budgets:

The new provision enables the procurement of goods and services for budgetary institutions funded by other budgets, including military units. However, implementation is currently hindered by the absence of the necessary program classification code.

The following drawbacks of the law can be noted:

-

The title does not fully reflect its essence: The law includes several Budget Code amendments unrelated to mid-term budget planning.

-

Prolonged consideration before adoption: The law was introduced in March, passed its first reading at the end of July, and was adopted in full in the second half of September. As a result, the procedures for preparing local forecasts were postponed to the following year.”

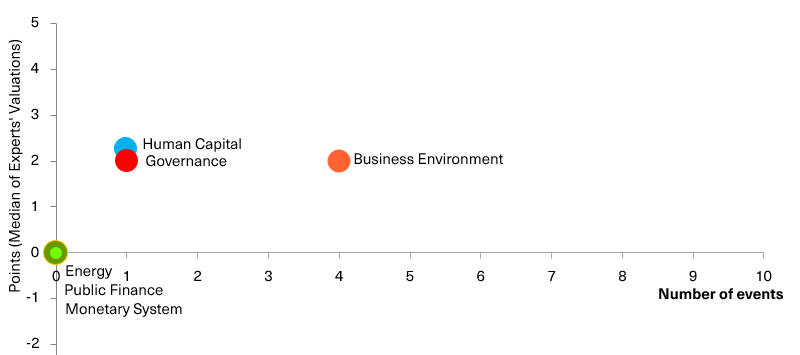

Chart 3. Value of Reform Index components and number of events

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in six areas: Governance, Public Finance, Monetary system, Business Environment, Energy, Human Capital. Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Photo: depositphotos.com/ua

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations