VoxUkraine conducts a regular assessment of the speed of economic reforms implementation in Ukraine. Quarterly reviews help see what happened during the three month-period “from a far”. We are presenting our eighth quarterly review for the 4th quarter of 2018. For previous reviews go to (2017-Q2, 2017-Q3, 2017-Q4, 2018-Q1, 2018-Q2, 2018-Q3).

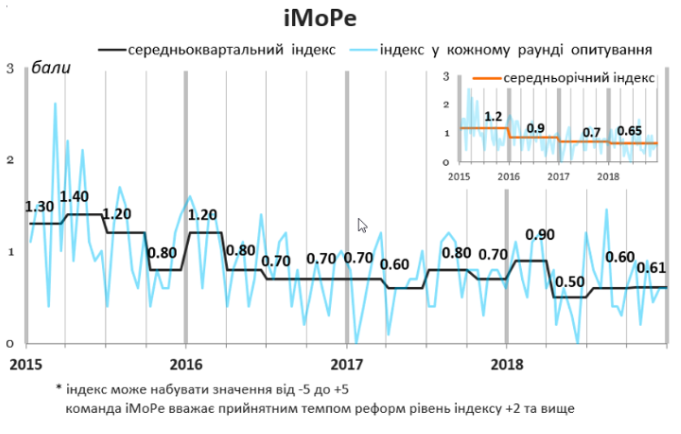

In the 4th quarter of 2018, reforms progressed slowly, average Reform Index was +0.61 points (out of the potential range of -5.0 to +5.0). Average annual speed in 2018 (+0.65) is the lowest since the beginning of monitoring. In 2015 it was +1.18%, in 2016 – +.85, in 2017 – +.70 (figure 1).

Figure 1

Brief overview: Trends

34 regulatory acts, viewed as reformatory by the experts, were adopted in the 4th quarter. Average Reform Index index of these laws and decrees made up +1.2 points (34 regulatory acts were adopted in the previous quarter having an average index of +1.2 points).

The most important events of the quarter include:

- the law on reforms of supervisory boards of banks (Reform Index #97),

- a decree allowing bank clients to open accounts remotely using BankID system (Reform Index #97),

- methodological recommendations on corporate management organization in the Ukrainian banks (Reform Index #99),

- law on liability for violating motor vehicle import procedures (Reform Index #98),

- law on ensuring transparency in extractive industries (Reform Index #95),

- law on single-window system at the customs (Reform Index #95)

- amendments to Budgetary Code referring to mid-term budgetary planning Reform Index #101),

- decree expanding the list of information which is to be disclosed by banks (Reform Index #101).

One anti-reform has been identified in this quarter (Reform Index #100). Verkhovna Rada amended Tax Code norm regulating the activities of authorized e-platforms used by appraisers to transfer information about real estate prices to the single database. Services of such e-platforms are mandatory during real estate sale and purchase in Ukraine.

4 e-platforms of this type are currently operating. Yet, according to Bihus-info research (first, second), they are all probably interlinked as they use the same software. In this connection, the Anti-Monopoly Committee of Ukraine has opened a case.

New regulations for e-platforms adopted by the parliament have made it more difficult for new players to enter this market. For a new platform to be launched it needs the consent of those already operating. It means that no company can enter this market without approval from its competitors.

Reform Initiators

People’s deputies initiated approval of 10 laws which change game play in economy and have an average index of +1.6 points. The most important laws create independent supervisory boards at two state-owned banks which have never had them before – Ukrhazbank and Ukreksimbank (Reform Index #97); increase responsibility for violation of motor vehicle import procedures – for legalization of “euro plates”(Reform Index #98); ensure transparency in extractive industries (Reform Index #95); and simplify customs control with single-window system (Reform Index #95). It should be noted that 6 reformative laws were adopted in the previous quarter with the same average index of +1.6 points.

The Cabinet of Ministers initiated 16 progressive legislative changes in the 4th quarter (average index +1.0 point), namely amendments to Budgetary Code pertaining to mid-term budgetary planning (Reform Index #101). The Cabinet also initiated amendments to the Tax Code. Some of the changes are positive, i.e. increase of excise duty and environmental tax as part of Ukraine’s commitments under EU-Ukraine Association Agreement. The others are negative, namely increased barriers in the sphere of real estate appraisal information transfer (Reform Index #100).

The government initiated 19 progressive changes in the previous quarter. The average index of the regulatory acts made up +0.9 points.

The National Bank of Ukraine passed 8 decrees with an average index of +1.5 points. They include a decree allowing bank clients to open bank accounts remotely using BankID system of the National Bank of Ukraine (Reform Index #97); methodological recommendations on corporate management organization in the Ukrainian banks(Reform Index #99); a decree expanding the scope of information that is to be disclosed by banks (Reform Index #101).

The number of decrees in the previous quarter was also 7 with the same average index of +0.9 points.

The President did not initiate adoption of any laws that would promote the reforms. There were two such laws in the previous quarter.

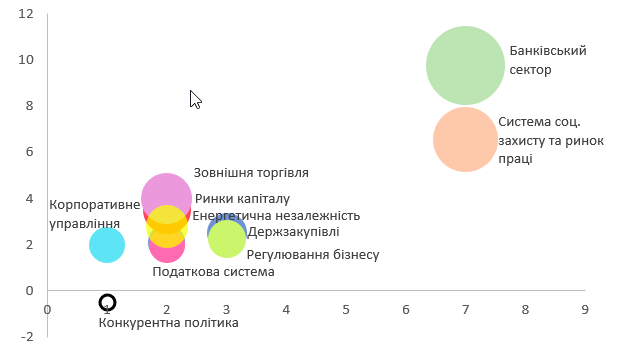

Figure 2. Main Areas of Reforms

TOP 3 Areas of Reforms in the Second Quarter

Banking

Key events in this area – a decree allowing bank clients to open bank accounts remotely using BankID system (Reform Index #97); methodological recommendations on corporate management organization in the Ukrainian banks (Reform Index #99) and a decree expanding the scope of information that is to be disclosed by banks (Reform Index #101).

NBU decree allowing bank clients to open bank accounts remotely using BankID system (of November 01, 2018, No. 116) introduces remote identification of bank clients.

Initial identification of a natural person shall be conducted by one of the BankID member-banks. As a result, an individual will be able to use bank services on the web site of any company or bank that are connected to BankID. It will give bank clients an opportunity to open accounts remotely without having to go to the bank.

In its new methodological recommendations on corporate management organization in the Ukrainian banks (Reform Index #99), NBU changed the role of supervisory board in bank management.

According to NBU recommendations of 2007, principal governing bodies of a bank include the general meeting of its shareholders, the board and supervisory board. Supervisory boards often did not have any actual authority and their role in bank management was only formal. Lack of supervision over bank activities by supervisory boards resulted in over 100 banks stopping their operation over the past 5 years.

In its new recommendations NBU introduces the principles of corporate management in banks as developed by the Basel Committee on Banking Supervision. The recommendations establish that members of supervisory board and the board should be competent in the main areas of bank activities. Besides, the recommendations define the new concept of “collective aptitude” of bank management bodies and establish a requirement for collective aptitude of the supervisory board members.

NBU has also expanded the scope of information that is to be disclosed by banks (Reform Index #101). It is another step taken by the NBU to ensure that bank clients have sufficient information before choosing a bank want to receive services from.

In May 2015 (Reform Index #10), the NBU made the banks disclose information about their ultimate owners. In January 2018 (Reform Index #79), they started publishing economic standards for each bank separately and made banks disclose their balance lists as well as information about structure and quality of credit portfolio.

This time, the NBU made banks disclose the results of their stability assessment as well as information about:

- credit distribution, with regard for unemployed persons, based on economic activities of the debtors,

- distribution of natural persons deposits based on currencies and sums of deposit,

- sum of potential reimbursement by the Deposit Insurance Fund.

Social Welfare

The most important reforms in this sphere include the law guaranteeing conditions for education of children with special needs (2541-VIII of September 06, 2018). It implements the norms of Convention on the Rights of Persons with Disabilities ratified by Ukraine in 2009, the Laws On Elementary Education, On General Secondary Education, On Out-of-School Education, On Vocational Training. The aim of the law is to guarantee the right of people with special educational needs to get education as well as psychological and teaching, correctional and developmental services.

Foreign Trade

Important laws passed in this area include increase of liability for violation of motor vehicle import procedures (Reform Index #98) and the single-window system at customs (Reform Index #95).

The law on increase of liability for violation of motor vehicle import procedures (2612-VIII dated November 08, 2018), together with the law on reduction of excise duty (2611-VIII of November 08, 2018) have been passed to solve the so-called euro plates issue.

To minimize taxes and customs duties on imported motor vehicles, some owners did not enter sale and purchase agreements. An individual or a legal entity registered abroad remained formal owners and the actual owners were driving their cars with no registration back in Ukraine. In 2017, 45,000 transit and 145,000 temporary registration cars were brought to Ukraine and never left. At the same time, according to National Police data more than 10,000 accidents involving foreign registration vehicles happened in 2017 (6% of all accidents). Absence of Ukrainian registration makes punishment of a driver violating traffic rules more complicated as according to the laws of Ukraine liability lies only with the vehicle owner.

It is expected that this law together with the law on reduction of import excise duty for motor vehicles (2611-VIII of November 08, 2018) will push euro plates owners to register their cars in Ukraine.

The law on single-window system of customs control 2530-VIII of September 06, 2018 was necessary since legislative changes were required for comprehensive introduction of single-window system.

Decree of the Cabinet on single-window system (No.364 of May 25, 2016) foresaw introduction of an electronic customs information system that would unite all types of control during goods import and export (customs, sanitation and epidemiological, veterinary, phyto-sanitation, ecological, radiological and others). It was expected that such changes would simplify customs procedures and reduce the time of customs control significantly. Yet, the advantages of single window remained limited. The procedure was slow and it was sometimes easier for companies to go through all stages themselves than use the benefits of single-window system. As a matter of fact, the main goal of single window was not achieved.

It was necessary to amend legislation to change the rules and procedures. Pursuant to the new law, within 6 months the Сabinet of Ministers shall finish work on the software required for the single information system of income and tax bodies, risk management system and customs clearance system and create a single state information web portal – Single Window for International Trade.

A couple of months are left until the presidential and parliamentary elections. Political powers wanting to win the next elections have the opportunity to prove their worth by promoting reformative laws that will have a positive impact on the future of the country.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations