Capital controls implemented at the start of the full-scale Russian invasion remain an effective tool for maintaining macroeconomic stability. However, after several rounds of relaxing capital controls, the NBU is now approaching the fine line between greater freedom of capital movement and sufficiency of foreign currency reserves.

One argument in favor of liberalizing restrictions on FX operations is that it would enable companies in the real sector to attract foreign capital more actively, which could be beneficial for financing investment and recovery. The National Bank has already relaxed restrictions on payments to non-residents. However, there is ongoing pressure on the NBU to adopt a more radical approach to lifting restrictions on cross-border payments. In response to it, the National Bank is striving to implement currency liberalization while balancing potential pressures on the currency market and maintaining foreign currency reserves at a level that will not spur panic.

Specific features of the institutional context for payments from Ukraine to non-residents require more scrutiny to determine whether there is a genuine need to rush with liberalization measures. Does easing capital controls, particularly repatriation of dividends, really translate into significant inflows of new investment? Is the potential loss of several billion dollars in valuable reserves justified, especially given that the push for liberalizing payments to non-residents increasingly resonates with the oligarchic and commodities-related undertones of the domestic economic structure?

A key feature of the Ukrainian economy is the inclination of business owners to register their companies abroad. The reason is quite simple: protection of property rights, which helps mitigate such risks as raider attacks and expropriation due to political and economic considerations. This tendency is quite common in emerging markets. One of the channels for replenishing the wallets of these “foreign” beneficiaries is transfer pricing. Subsequently, these funds are transformed into foreign direct investments, which naturally require cross-border payments. Therefore, weak protection of property rights leads to a fundamental distortion of ownership structures and containing financial flows within a network of related companies. As a result, a significant portion of “resident-nonresident” operations are purely formal. However, they are reflected in the balance of payments and have a noticeable impact on FX market equilibrium and foreign currency reserves.

High share of commodities in exports contributes to maintaining stability of the structure that supports various options for capital outflows and subsequent investment attraction. By nature of their businesses commodity exporters require significant amounts of financing, often in foreign currency. Thus, the ability of commodity barons to finance their businesses depends more on the volumes of already transferred capital and small contributions from external investors rather than on the capacity of the domestic banking system to generate credit. While this is not unique to Ukraine, the scale of such operations has become particularly significant for our country.

Round-tripping of foreign direct investments (FDI), when funds are sent abroad and then returned as investments from non-residents controlled by residents, exemplifies how institutional distortions skew financing processes in the real sector. According to the NBU, from 2010 to 2023, the volume of FDI that was not genuinely foreign amounted to $10.9 billion, or 24.3% of total FDI to Ukraine during this period ($44.9 billion). In certain years, such investments were predominant. For instance, they accounted for 47.6% of all FDI in 2011, 34.6% in 2012, 34.6% in 2019, 50.9% in 2020, and 68.5% in 2021. In 2023, their share was slightly above the average for these years at 38.1%. These figures clearly illustrate why Ukraine has long failed to follow the trajectory of Central and Eastern European countries, which attracted significant volumes of FDI and integrated into the EU value chains.

Naturally, the more FDI an economy attracts, the more sensitive it becomes to payments in favor of foreign owners. This states the key question with regard to easing capital outflows from Ukraine: how have such payments behaved recently?

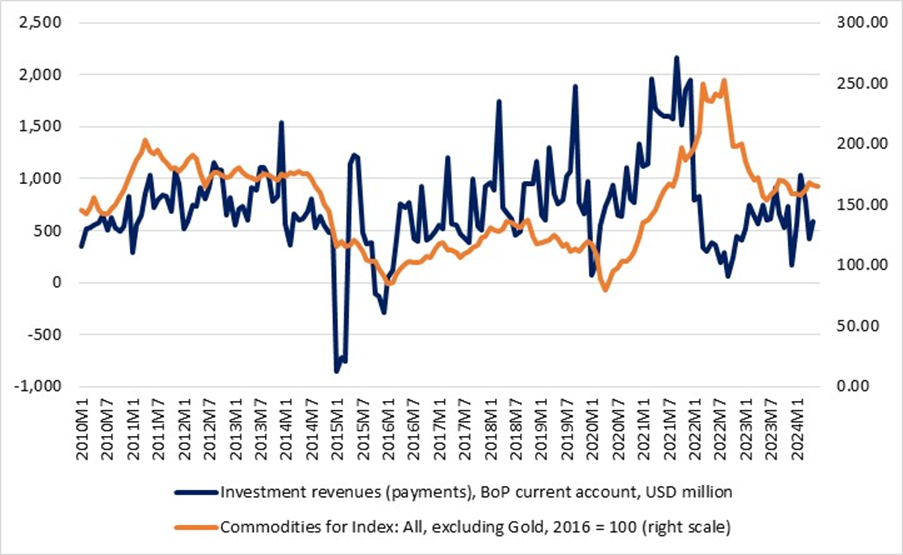

Figure 1. Foreign Investment Payments and Commodity Prices

Source: Compiled by the author based on data from the NBU and IMF

As shown in Figure 1, from 2010 to 2022, payments to non-residents followed an upward trend. Payment volumes correlate strongly with commodity prices. Almost all peaks and troughs in payment volumes slightly precede the corresponding changes in commodity prices. In other words, it seems that the ability to accurately forecast the commodity cycle results in larger outbound payments before prices collapse. This suggests that the major part of transfers to non-residents is unlikely to be strongly related to the inflow of capital into Ukraine, except for transfers associated with FDI round-tripping.

This creates a dilemma for currency liberalization policy.

Differentiating the strength of capital controls by type of activity could lead to serious regulatory distortions and undermine the principle of a unified market approach. Such differentiation might be viewed as discriminatory, potentially weakening the legitimacy of regulatory actions and exposing regulation to the risk of political and economic manipulation.

Easing restrictions for all participants would likely benefit those with significant obligations to controlled non-residents. This could further incentivize them to transfer capital abroad to mitigate military risks rather than renew investment.

Conversely, while capital controls can discourage companies that might otherwise consider productive investments in Ukraine, these companies also include military risks into their considerations.

Extremely high dependence of macro-financial stability on foreign currency reserves necessitates maintaining high interest rates. Therefore, the risk of unproductive capital outflows could further delay the normalization of real interest rates. A simultaneous rapid reduction of real interest rates and relaxing capital controls might conflict with the ability to maintain foreign currency reserves at a level that does not cast doubt on the stability of the exchange rate trajectory. Ultimately, the balance of losses and gains does not unequivocally support hasty moves to ease capital controls.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations