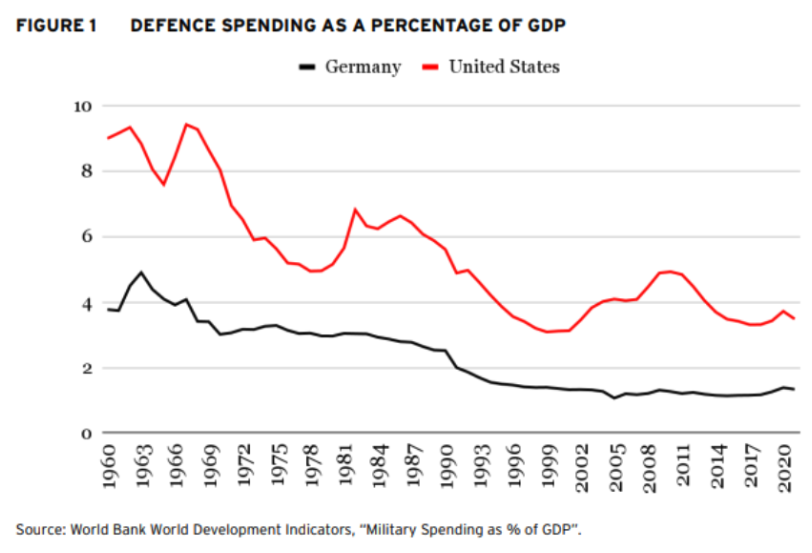

If you start from the economic fundamentals, Russia’s decision to invade Ukraine seems hard to fathom. A country whose GDP is roughly equal in dollars to that of Belgium, the Netherlands, and Luxembourg combined, and less than 5% of the combined GDP of the US and the EU, decides to invade Ukraine and indirectly take on the EU and the US. But it is perhaps less surprising once you dig into the details. What matters for deterrence is defence spending. In 2021, the US spent 3.3% of its GDP on defence, but Germany spent only 1.1% of its GDP on military expenditures. That’s one-third of the US spending/ GDP ratio. This puts Germany roughly in the middle of the EU pack. Countries like the Netherlands and France spend more, but others like Belgium, Austria, and Portugal spend even less. All of these countries are NATO members. All have pledged to spend at least 2% of their GDP. Only the UK, Lithuania, Estonia, Latvia, Norway, and Greece kept their 2% promise in 2021.

Since the fall of the Berlin wall, the US has spent an average of 2.6% more of its GDP each year than Germany on defence. If Germany had spent as much as the US on defence over this period, then, all else equal, it would have been running large deficits in excess of 3% of GDP instead of small deficits of around 1% of GDP. Germany has benefited tremendously from a large US defence subsidy, as have other NATO countries.

Six decades of spending cuts reduced German defence spending from 4 % of GDP in 1960 to 1% of GDP in 2021 (see Figure 1). These cuts have taken a toll. When the invasion started in March of 2022, the commander of German Army forces, Alfons Mais, stated unequivocally that his troops were not battle-ready: “And the Bundeswehr, the army that I am allowed to lead, is more or less broke. The options we can offer policymakers to support the alliance are extremely limited.” German soldiers even lacked basic equipment, such as helmets and backpacks. At the start of the Ukraine war, Europe’s largest army, the Bundeswehr, was effectively declared to be of no practical use by its own commanding officer. Putin may have made some mistakes in invading Ukraine, but underestimating Europe’s defence posture was not one of them. Since then, the German Chancellor has announced significant increases in defence spending, but the German government has been slow to execute.

According to the Ukraine Support Tracker at the Kiel Institute for the World Economy, even now, the EU’s overall support for Ukraine is barely keeping up with the US at about $55 billion in 2022, less than 0.3% of its GDP, even though Ukraine is in the EU’s backyard. And when it comes to direct military support, the EU countries’ efforts again fall short compared to those of the US. Looking at bilateral aid as a percentage of GDP between January and August in 2022, the UK and the US outspent all other European countries except for those bordering on Russia (Estonia, Latvia, Poland, Norway, and Lithuania). In spite of the rhetoric coming out of Paris, France itself spent less than 0.05% of GDP on direct aid to Ukraine, as did Italy and Belgium (Antezza et al. 2023: 24).

Incentives matter. After WWII, many NATO countries decided to free-ride on US defence spending, betting that the protection afforded by the NATO umbrella renders their own national defence efforts moot. This is a textbook example of ‘moral hazard’. Joining NATO was like getting fire insurance. Once you have acquired fire insurance for your property, you might be less inclined to clear the brush around your house to prepare for fire season.

Some European countries failed to maintain and renew their fleet of military aircraft and helicopters, and their tanks. European countries have even pursued policies that have actively endangered their national security and that of others. The German, Italian, and Austrian energy policies that fostered dependence on Russian gas are one example of this. Another example comes from the shipping industry. Incredibly, for much of 2022, European shipping companies were transporting Russian oil to Asia, helping to fund Putin’s war.

Going forward, the US-backed insurance policy may prove not to be as valuable, because the insurer’s financials are less sound than they used to be. To understand why, the EU’s defence ministers should start by studying the US federal government’s fiscal situation. The US federal government is not on a fiscally sustainable path.

The US Treasury can borrow at lower rates than other governments because Treasuries play a unique role in the international financial system. Even after accounting for the extra seigniorage revenue the Treasury earns from its role of safe asset provider to global investors, it is hard to rationalise the current valuation of Treasuries (Jiang et al. 2019). Bond market investors desperately need safe assets, and this need may lead the bond market to ignore the country’s own fiscal fundamentals for long periods of time. But eventually, bond market investors will return to the US’ fiscal fundamentals. That is what happened to the Dutch Republic at the start of the 18th century and the UK at the start of the 20th century. Both countries were the safe asset suppliers of choice in their respective eras (Chen et al. 2022).

The fiscal fundamentals of the US are not sound. The US federal debt exceeds its GDP. Once you add state and local debt as well as unfunded pension liabilities, the US general government debt-to-GDP ratio exceeds that of most European countries. The Congressional Budget Office (CBO) just released its latest budget projections for the federal budget a few days ago. Starting from the laws currently on the books, the CBO currently projects average federal deficits of 8% of GDP after interest expense, and a debt/GDP ratio of 195% by 2053. These are projections of future spending and tax revenue based on current law. They are not the best forecasts conditional on all available information, but they still serve as a helpful benchmark. Over the past two decades, tenyear projections have been overly optimistic relative to what actually happened to the debt/output ratio and deficits.

These projections imply that Congress will likely have to consider unprecedented spending cuts in the near future. And it seems unlikely that US taxpayers will continue to subsidise Europe’s defence when they face cuts to Social Security and Medicare. Politicians on both sides of the political aisle in the US are increasingly reluctant to spend US taxpayer dollars on foreign ‘military adventures’.

There are other reasons for Europeans to look askance at the US protective umbrella. The US faces more significant national security threats elsewhere. Its foreign policy continues to pivot to the Pacific, and away from the Atlantic. The US political system has become increasingly polarised and dominated by populists on the left and the right, making each presidential election a high-stakes gamble that could portend the end of the US protection Europe has benefited from.

The invasion of Ukraine serves as a reminder to Europeans that there is nothing inevitable about the survival of liberal democracies. The most effective way to preserve the security and freedoms of future generations of Europeans is to permanently degrade the military threat posed by the Russian Federation. Ukraine’s defence forces have shown themselves to be willing and able to accomplish this task. Ukrainian soldiers are actively containing Russia, buying the rest of Europe time to get its own defences back in shape after years of underinvestment. It is hard to understand why the EU does not provide significantly more direct military support to Ukraine.

There is a clear self-interested fiscal rationale for Europe to invest more in its own defence, starting by stepping up its aid to Ukraine. It also happens to be the right thing to do. When it comes to national defence, Europe has been behaving like that friend who always runs to the restroom when the check arrives. It’s time for Europe to start picking up its own tab, beginning with Ukraine. It’s time for Europe and the US to ‘go Dutch’ on defence.

References

Antezza, A, A Frank, P Frank, L Franz, I Kharitonov, B Kumar, E Rebinskaya, and C Trebesch (2023), “The Ukraine Support Tracker: Which Countries Help Ukraine and How?”, Kiel Working Paper.

Chen, Z, Z Jiang, H N Lustig, S Van Nieuwerburgh, and M Z Xiaolan (2022), “Exorbitant Privilege Gained and Lost: Fiscal Implications”.

Jiang, Z, H N Lustig, S Van Nieuwerburgh, and M Z Xiaolan (2022), “Measuring U.S. Fiscal Capacity Using Discounted Cash Flow Analysis”.

Jiang, Z, H Lustig, S Van Nieuwerburgh, and M Z Xiaolan (2019), “The U.S. Public Debt Valuation Puzzle”, NBER Working Paper No. 26583.

#helpUkraine_helptheWorld

This publication is a part of a collection of essays initiated by the National Bank of Ukraine. Famous economists, political scientists and historians, experts recognized in the world, volunteered to share their thoughts and arguments on why helping Ukraine is helping the world. The complete book of essays can be found via the link.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations