In this essay I outline a strategic vision for the state of Ukraine. I begin with the main principles of the role of the state.

I then argue that the Ukrainian state has largely failed to fulfill its role. I rejoice in seeing spontaneous volunteer efforts outside the failed state structures and suggest that instead of trying to administer a multitude of these efforts, the state needs to set a strategic overall direction so that its people can rally behind it. I suggest that this direction is ensuring independence from direct foreign interference now and in the future. Then, I argue that the place to start is with energy independence. I show that there are not enough resources in the entire domestic financial system to support Naftogaz in its current incarnation and that it cannot continue without external technological and financing resources. I argue that because of their systemic importance, the decisions on Naftogaz are inherently political and then outline options on dealing with the decision paralysis at the top, as well as a possible process for getting things started. I then suggest that once a political decision is made, the process would start with a standard problem of valuing risky cash flows. I outline the main sets of cash flows and describe potential but not insurmountable difficulties in valuing them. I then remark that once the risky cash flows are valued, policymakers can be presented with the recommendations about what to keep, what to sell off and for how much, and what to get rid of. I conclude with thoughts on other types of independence that need to be achieved in tandem.

What is the role of the state?

The state exists to serve the will of its people. The state is supposed to protect the life, liberty and property of each individual: that’s what police forces and state prosecutors are for. The state is supposed to help resolve disputes among individuals and between individuals and the state: that’s what the courts are for. The state is supposed to protect its people against enemies foreign and domestic: that’s what military and security services are for. The state is supposed to protect fundamental human rights – freedom of speech, freedom of religion, freedom of movement and others: that’s what elections are for.

The state, if required by its people, is supposed to protect the quality of life – infrastructure, communication, environment, education, healthcare, eldercare: that’s what state ministries, departments, boards, and utilities are for.

To do so, the state can use its powers to take away the life, liberty and property of those who violate the rules; to use force against enemies both foreign and domestic; to use economic tools — tax and spend, issue currency and debt, set the terms of trade with other states, create and destroy economic entities, and develop and enforce product, financial and labor regulations.

Has the Ukrainian state been fulfilling its role?

The events of the last several months have revealed fundamental failures of the state: no effective military, no effective police or security forces, no effective governance structure, no effective macroeconomic management.

The failures of the state are fundamental but uneven: total failures in the Crimea, nearly total failures in parts of the Donbass, some degree of failures in and around Kharkiv and Odessa, a lesser degree of failures along the Dnipro and west of Kyiv. These failures had created a power vacuum that has been exploited by foreign and domestic enemies.

How has the power vacuum been filled?

The events of the last several months have also revealed that in spite of the mishaps, there are elements of a spontaneous social contract outside of the failed state structures: volunteer units use force to protect against enemies foreign and domestic; volunteer patrols protect life, liberty and property; networks of volunteers gather and distribute resources in the areas where the failure of the state is nearly complete to supply the fighters, free the prisoners of war, and aid the refugees; experienced private sector managers essentially volunteer their skills to reform the federal and state governments.

Most importantly, while a lot of these efforts may have started out as helping their immediate relatives and neighbors who were abandoned by the state–wives buying and transporting helmets, bulletproof vests, suitable uniforms and appropriate food to their husbands; sons evacuating their sisters, mothers and grandmothers from the war zones; neighbors conducting patrols and protection watches—they quickly developed into spontaneous contractual obligations among unrelated individuals (you fight – I bring supplies, you protect – I oblige and support, you command – I follow).

While there is a lot of intuitive desire to direct these spontaneous volunteer efforts, they should not be directed, especially by a superimposed state structure of suspect design. They will quickly lose their credibility, effectiveness, and appeal.

What’s needed is an overall strategic direction so that failed state institutions should transform into something that serves the will of the people, while the people endow the state with what they believe are enough powers to do so. There needs to be a strategic overall direction so that its people can rally behind it and determine the tactical steps on how to get it done.

What is the strategic direction for reform?

First and foremost, the state needs to ensure its own independence from direct foreign interference now and in the future. Without independence from direct foreign interference, state institutions will continue to fail at serving their people and people will continue removing representatives of failed state institutions by using civil disobedience, social discourse, and violence.

Where to start?

Start with the biggest item – energy independence.

Currently, the country does not have enough internal resources to sustain Naftogaz in its current incarnation.

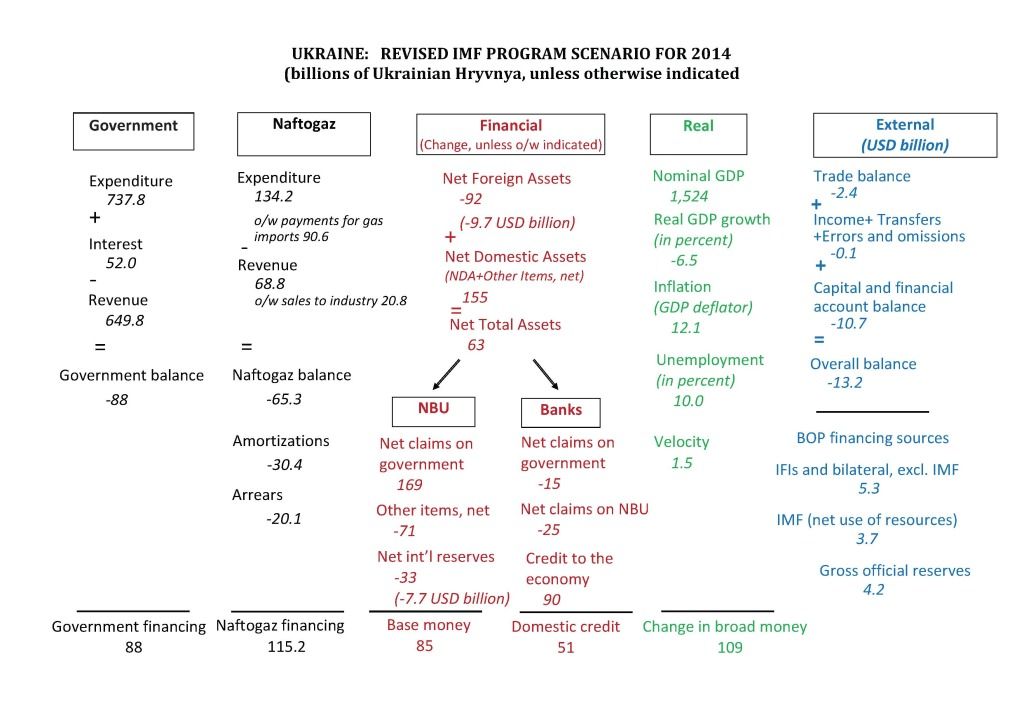

In September 2014, after concluding its first review, the IMF projected the financing needs of Naftogaz for 2014 (including repayment of arrears) to equal UAH 115.2 billion; these needs were to be covered entirely by issuing new government debt. In contrast, the change in the net assets of the entire financial system of the country (change in net foreign assets, change in net domestic assets and change in other items, net) for the same period was estimated at UAH 63 billion. In other words, the financing needs of Naftogaz are nearly twice as large as the available financing capacity of the entire domestic financial system, including the National Bank of Ukraine. Another domestic financial system of about the same size and capacity needs to be built just to finance Naftogaz.

In fact, as the graphical representation of the revised IMF program for 2014 (at the end of this article) shows, Naftogaz financing is the single biggest item in the country’s whole economy. It is bigger than government financing needs (at UAH 88 billion) and the amount of notes and coins that the National Bank of Ukraine plans to issue to keep the economy going (at UAH 85 billion). It is almost three times more than what the government and the NBU plan to spend to keep the banking system afloat (at UAH 15 billion and UAH 25 billion, respectively). It is even larger than the projected increase in monetary aggregates (at UAH 109 billion).

But that’s not all. The financing needs of Naftogaz are very risky. As an illustration, the projected financing needs of Naftogaz nearly doubled between IMF assessments in April 2014 (when they were estimated to amount to UAH 61.6 billion) and September 2014. No one really knows how much money would be really needed to finance Naftogaz – it is an opaque structure with a complex web of contracts. Perhaps UAH 90 billion would be needed (UAH 90 billion is what the IMF projected as the new bank credit to the entire private sector) or UAH 150 billion (or about three times what the National Bank of Ukraine needs to spend out of its official reserves in 2014 closing the balance of payments gap). Either way, there is not enough money in the entire domestic financial system to cover risks of this magnitude. External financial resources are needed (presumably to help facilitate access to these resources, the IMF program requires quarterly audits of Naftogaz).

This means that the country is the opposite of independent – it is highly dependent on outsiders because of its energy financing needs.

For now, it looks like the short-term solution is to patch the Naftogaz financing gap using the IMF money. In fact, the IMF program looks more and more like the bailout of just Naftogaz. According to the revised IMF program, during 2014-2015, UAH 151.4 billion is needed for Naftogaz (115.2 billion in 2014 and 36.2 billion in 2015). This amount is about equal to 10.8 billion dollars that IMF plans to inject into the country during the same two years (3.7 billion dollars in 2014 and 7.1 billion dollars in 2015). For this to work out while leaving no IMF money for anything else, the exchange rate needs to be about 14 – probably a rather optimistic number given how massive the issues are elsewhere.

Why has so little been happening?

If the Naftogaz issues are so huge that even a casual outside observer quickly recognizes them as systemic, why has so little been done about them by the people in the know? This has been going on for so long that it is more than likely that the issues are not only known, but that there are concrete plans (explained in multicolored slide presentations) on how to deal with them. After all, teams of international consultants have been toiling away on it for years.

It is because the Naftogaz woes are so big – after all they undermine the independence of the state – that dealing with them has long ago become a political issue. In a country with democratic politics punctuated by extra elections due to street protests, it is extremely hard for any political leadership, however caring and patriotic, to make tough decisions on these issues.

It’s not that the current political leadership is unaware of the issues, incompetent, weak, lazy or poorly incentivized. Judging by their recent piecemeal actions and statements, the leadership is well aware of the problem; it is probably the most competent leadership a country can put together right now; the top leadership is street-tested and far from weak; they do appear to supply a good deal of effort; and it’s hard to think of additional monetary incentives for billionaires and millionaires. Yet, after decades of incompetence, fraud, and clandestine efforts by scheming neighbors, the best short-term political action continues to be to do essentially nothing while trying to appear decisive but hamstrung by some recent obstacle.

There are two ways to deal with the decision paralysis at the top. First, political leaders can ask the stakeholders (the voters) to give their designated problem solvers a temporary immunity to deal with the issue – commit to not fire them for the next two to three years, provided there is a verifiable effort. This is possible, but unlikely, judging by the revolving door among top government officials due to cliquish party politics. Consequently, it would be hard to convince a qualified local professional, let alone a solid team, that a political commitment to make big decisions without being sacked in mid-flight would be fulfilled.

Second, there is a time-tested approach of inviting the Vikings, i.e. foreign strategic specialists. This typically gets the job done, but accumulates an enormous amount of specialized knowledge and influence in the hands of outsiders. This approach has backfired many times in the past and, with a wrong choice of the Vikings (beware of the gamblers, adventure-seekers or pretend friends), has a strong risk of backfiring again, but it might work. The production, distribution, investment in and sales of energy products is the world’s largest business sector measured in tens of trillions of dollars annually. There is a lot of technological, business and security knowledge on the matter. This knowledge needs to be tapped.

The country also does have the wherewithal on how to engage with the global community with the goal of restructuring Naftogaz (not just its debts, but the whole company). It has completed at least one large restructuring deal that involved navigating complicated legal and financial waters, while keeping scores of both domestic and global stakeholders engaged: the sovereign debt restructuring of 1998-2000. It was not a deal that particularly pleased the IMF at the time, but the IMF’s thinking on debt restructuring has since evolved.

How to go about it? Political decision.

The restructuring of Naftogaz can be done in stages, like the sovereign debt restructuring deal, if the political commitment to get it completed is perceived as credible. Without credibility, the restructuring would need to be done at once, “shock therapy”-style. Since the political repercussions of such a decision would be particularly massive, the political leadership is likely to only commit to do it if it could somehow be insulated from blame for the aftershock.

This is why the recent emergence of volunteer efforts is particularly encouraging. If volunteers can establish complex logistical structures to supply the National Guard units (also composed of volunteers), negotiate the exchange of prisoners of war, and organize refugee camps, volunteer experts should certainly be involved in overseeing a complete overhaul of Naftogaz.

Organizationally, the effort could be structured similarly to the U.S. Presidential Transition process. As background, there is something called the U.S. Presidential Transition Act of 1963, which was subsequently amended in 1988, 2000, and 2010. The Act creates the legal basis for technical experts, policy advisors, and other interested parties to participate in the needed overhaul of the executive powers in a transparent and smooth manner.

Similarly to the process of a smooth presidential transition, the restructuring of Naftogaz is a matter of national security, especially at a time when the country is involved in military operations. Thus, instead of making huge politically-costly decisions, the country’s top leadership need only be made responsible for keeping the process in motion: making sure that an inclusive transition team is formed, mandating the sharing of all requested information with the transition team, setting firm deadlines for the transition team to make recommendations, and then approving a proposed team of executives to implement the recommendations. This might just work because being responsible for the process is a lot less politically risky than being responsible for the outcome.

How to go about it? Technical issues.

Following a political message to begin with the restructuring of Naftogaz, the actual process would start with a standard, albeit complex, problem of valuing risky cash flows.

From a financial perspective, Naftogaz is a collection of cross-subsidizing cash flows associated with different business lines. First, there is a stream of future revenues from selling gas to the industry, households and utilities (currently, average tariffs for selling gas to the industry, households and utilities are US$341, US$110, and US$110 per thousand cubic meters, respectively). The amounts in the future will change and the projections would have to account for that. Second, there is a stream of future revenues from transfer fees (which are also uncertain). Third, there’s a stream of payments for gas imports, for which both the prices and the amounts bought at those prices are uncertain. The IMF assumes that average gas supply price from the EU is US$357 per thousand cubic meters, but the number could be a bit smaller or much larger than the IMF estimate. Gas may continue to flow but perhaps in smaller amounts than projected and less evenly. Fourth, there is a stream of future cash flows to pay for the cost of doing business. These payments are probably discounted at the rate at which the government can borrow domestically (since Naftogaz is fully owned by the government), which is too low, given that the taxpayers are involved in paying for it.

There will be difficulties in putting a fair value on the cash flows. Putting a fair value on the stream of future revenues is very hard in the absence of credible market prices. Thus, it seems that at the very least, there should be a domestic market for some amount of natural gas with credible prices determined by market forces. Market prices should determine where the marginal cubic meter of natural gas goes to; be it households, large or small businesses or power and heating plants. There should not be multiple tariffs for natural gas; much less tariffs that are below average gas supply prices. It leads to a waste of scarce energy resources, which, as the numbers show, has reached ruinous levels.

Similarly, putting a fair value on the stream of payments to pay for the cost of doing business would also be hard. For certain, though, these costs should be significantly higher than the government-borrowing rate because the financing of Naftogaz is putting a huge systemic burden on the rest of the economy, essentially crowding out most other economic activity. And, let’s not forget about valuing the future stream of payments that can suddenly kick in if some clause in some murky agreement is triggered, the so-called off-balance sheet liabilities. These items are probably valued very low, if at all, while their impact might be very large (financial crises have resulted from such events).

Once the risky cash flows are valued, policymakers can be presented with the recommendations about what to keep, what to sell off and for how much, and what to get rid of. In addition, recommendations could be made about the degree of cross-subsidization, as well as direct subsidies to certain targeted groups of customers. All of these recommendations though would be based on more or less fair value calculations rather than good, but unsustainable intentions. The policymakers would then reach a political compromise on what can be done and how to go about it while (hopefully) keeping in mind that although the restructuring of Naftogaz will be a painful and costly process that will likely cause great suffering and increase inequality in society, it’s no mere energy reform, it’s a struggle for independence.

Instead of a conclusion.

Energy independence is a starting point. There are three main types of independence that need to be achieved in tandem. Independence of ideas: ability to decide on information and communication technology. Trade independence: the ability to choose trade partners. Factor independence: the ability to access product, financial, and labor markets.

Unlike the energy sector (and the military sector that was not discussed in this essay), the transfer of the information and communication technology, contract and law enforcement technology, as well as product and financial services technology, would to some extent occur organically in these sectors once the obsolete functions of state bodies (sometimes with the bodies themselves) are removed.

For all three of these, it is best not to try to administer, but to enable the power of markets and other ways to gather local knowledge to work. While all branches of power – the executive, legislative and the judicial – have so far not lived up to the task, the society itself has proven to be highly capable of creating parallel, highly efficient, often quite complex operational structures that get the job of governance done. There is a good deal of understanding at the local level on what exactly needs to be done, as well as enormous potential for creative ways of getting results.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations