Ukraine now is very close to lifting the moratorium on agricultural land sales that has been in place for the past 16 years. However, it is still widely debated (unfortunately, without any hard evidence) who much land should be expected on the market after the opening, what is the willingness and capacity to buy, is it realistic that price will drop because of dis-balance between the supply and demand for land. A derivative of these questions are the conditions, that should be reflected in the Law on land turnover – what would affect the balance between the supply and demand and prices, who will be able to buy land, in particular whether only physical or physical and legal entities should be allowed to do so. This will affect the likelihood that land owners who wish to sell in the early phases of market opening will be able to do so at a fair price. As this is an issue on which little analytical work has been done, we focus on it in this note.

The volume of land markets in European countries varies between 1% and 3% of total volume of private land.[1] Prices allow demand for and supply of land to balance and are affected by agricultural productivity, global food prices, subsidies/taxes and the interest rate. Every year some land owners decide to dispose their property for various reasons (e.g. old age, going out of agricultural business, need for cash) and new owners decide to buy this property because they want to start a new business, expand existing one or would like to invest capital into land assets. There is no reason to expect that Ukrainian land market should be much different, after an initial period of transition and stabilization, and adjusting for the demographic structure and relatively high average age of land owners.[2]

There is, however, a concern that after lifting of the moratorium a combination of accumulated supply and limited demand may imply that markets will need time to reach the equilibrium. Supply accumulated for 16 years, during which agricultural land could not be sold, could be considerable. On the other hand, most agricultural producers are credit constrained which could initially limit demand especially if they need to access mortgage lending to buy land but banks do not have the required financing instruments in place. Although predicting land demand and supply in such a situation is difficult, we explore different scenarios to help inform policy options and suggest how to avoid imbalances, and allow full and quick realization of the benefits from land reform by a wide range of stakeholders.

To avoid price drops and dominance of speculative over productive demand in the initial phases of the market opening, three specific provisions in the Law on Agricultural Land Turnover will be important. First, the law should allow, subject to temporary size restrictions, demand for agricultural land by Ukrainian agricultural producers organized as legal entities. Second, existing producers will need to use land as collateral to access credit, something that will require protection of creditors rights, in particular banks’ ability to take foreclosed land into ownership with mandatory disposal via e-auctions within a limited period of time. Finally, to allow banks to increase loan to value ratios, the prices for land rental and sales should be recorded in the Registry of Rights and be available to banks, valuators and the regulator to allow a valuation of land pledged as collateral that is more realistic than the rates currently used.

Expected Demand for and Supply of Farmland

Based on survey of land owners commissioned by the USAID Project Agroinvest in 2015, about 8% of land owners would like to sell their land within the first two years of market opening. Another 3% of the owners would consider selling their land over a longer period of time. Given the average size of individual land parcel of about 4 ha and 6.9 mn of current land owners, we arrive at the estimated supply of about 2.2 mn to 3.0 mn ha if no restrictions on the supply side are applied (without temporary occupied territories of Crimea and Donbass , this size would range between 1.9 and 2.6 mn ha).[3] Adding annual sales of at least 100,000 ha of state farmland[4] would result in overall supply of farmland of 2.3 – 3.1 mn ha (or 2.0-2.7 mn ha respectively).

Supply of land will be matched by demand from three sources, namely (i) individuals cultivating land; (ii) legal entities involved in agricultural production; and (iii) individuals or legal entities not involved in agricultural production, possibly for speculative purposes. Each category is affected by different factors and thus requires separate analysis.

Agricultural demand by individuals

Based on the KIIS 2015 survey, about 1.9% of rural land owners are willing to buy of an average of 11 ha of land, which is equivalent to 1.4 mn ha demand for land (about 1.25 mn ha without temporary occupied territories). About 80% of the respondents want to expand an existing or to start a new agricultural business while the remaining 20% (or 0.3 mn ha) indicate that they would want to rent their land out. While the extent to which such potential demand translates into actual purchases will depend on access to resources and expected revenues from self-cultivation, we can estimate a productive demand from current land owners at some 1.1 mn ha (0.95 mn ha correspondingly).

Agricultural Demand by legal entities

To explore the productive demand from current agricultural producers, we use farm level data from State Statistics (Forms 50 SG and 2-Ferm) for the 2013-15 period to compute 3-years average gross margins. We generate a conservative lower-bound estimate of land demand by assuming that producers have to finance the down payment for land purchases from the current earnings (i.e. without access to accumulated savings) In this setting, effective demand for land purchase depends on agricultural productivity, expected farmland price (estimated as capitalized rental price), domestic financial markets conditions, down payment requirements[5] and legal restrictions on the amount of land that can be acquired by legal entities.

Without bank financing or subsidies (an equivalent of 100% down payment for land) or in a situation of a completely illiquid farmland market,[6] and under the assumption of 200 ha ownership cap[7] and 5% capitalization rate[8], the farmland demand is estimated at 0.14 mn ha. About 60% of this demand comes from medium and small agricultural producers, primarily in Ukraine’s Southern regions. With higher liquidity or better financial markets (as reflected by a down-payment of 30%) estimated farmland demand from legal entities increases to 0.88 mn ha (see Table 1 for more details and alternative scenarios on interest rate and down payment requirements). An initial land ownership cap of 200ha for legal entities would thus significantly limit current producers’ land demand.

Table 1. Expected farmland demand under assumption of 200 ha ownership cap, mn ha

| Capitalization rate, % | ||||||

| Down payment, % of farmland value | 1 | 3 | 5 | 7 | 10 | 13 |

| 10 | 0.40 | 1.65 | 2.29 | 2.57 | 2.78 | 2.89 |

| 20 | 0.13 | 0.75 | 1.41 | 1.87 | 2.29 | 2.52 |

| 30 | 0.08 | 0.40 | 0.88 | 1.31 | 1.79 | 2.12 |

| 50 | 0.04 | 0.17 | 0.40 | 0.68 | 1.10 | 1.46 |

| 70 | 0.03 | 0.11 | 0.23 | 0.40 | 0.70 | 1.00 |

| 100 | 0.02 | 0.07 | 0.14 | 0.22 | 0.40 | 0.61 |

Table 2 shows results of sensitivity analysis for various policy options for ownership cap, which can be established by government regulations, and the level of down payments (which stands for availability of credit resources). It is evident from the table that in a market with no available credits (100% down payment) the demand for farmland will not be high. It will range from 0.37 mn ha (with a 1000 ha ownership cap ) to only 0.14 (if 200 ha cap is applied). If government decides to ban legal entities from the market, that would effectively mean zero demand from the legal entities. If other restrictions were added (e.g. family farms only), the presented numbers would be an upper bound of the expected demand by legal entities.

On the other hand, if the access to finance is increased and ownership restriction is relaxed, farmland demand will also increase. In other words, in order to match the expected unmet farmland supply of 1.0 -1.7 mn ha with a productive demand by agricultural producers (2.0 to 2.7 mn ha of supply minus 0.95 mn ha productive demand by individuals), the policy makers have to either ensure a liquidity of the farmland market (e.g. stimulate development of bank finance products, to provide a subsidy for the interest rate or a deferred payment for acquisition of state land) or to relax the ownership cap or do both. For example, if policy makers stick to the 200 ha ownership restriction for legal entities, the expected supply will be matched by farms’ demand for land only in a very highly liquid market where only 20% of down payment is required (the demand is expected to be at 1.4 mn ha, see the Table 2). This level of liquidity is unlikely to emerge in a short run as it will take time to develop the new financial instruments by the private banking sector. Under a more realistic scenario of about 50% average down-payment requirement, productive demand at a sufficient level would emerge only with the ownership cap of 1000-1500 ha. With the restrictions on participation by legal entities currently under discussion, (e.g. if only family farms are allowed to buy land) productive demand is likely to be much lower.

Table 2 Expected farmland demand at different down payment requirements and ownership caps, mn ha

| Ownership cap, ha | Down payment, % of farmland value | ||||||

| 0 | 10 | 20 | 30 | 50 | 70 | 100 | |

| 200 | 3.24 | 2.30 | 1.42 | 0.89 | 0.41 | 0.23 | 0.14 |

| 500 | 5.99 | 4.56 | 2.90 | 1.81 | 0.81 | 0.44 | 0.25 |

| 1000 | 9.14 | 7.21 | 4.67 | 2.89 | 1.26 | 0.68 | 0.37 |

| 1500 | 11.36 | 9.09 | 5.92 | 3.67 | 1.58 | 0.84 | 0.44 |

| 2000 | 12.96 | 10.45 | 6.84 | 4.23 | 1.81 | 0.95 | 0.50 |

Source: Own calculations based on State Statistics data

Note: 5.07% capitalization rate is assumed

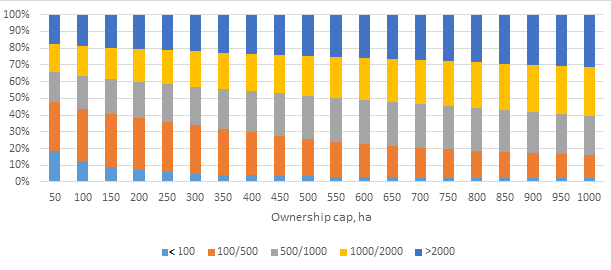

Figure 1 Distribution of demand for land among the farms for 50% effective down payment and 5.07% capitalization rate.

Figure 1 illustrates that the ownership cap would affect not only the size of the market but also the distribution of this demand across farm sizes, i.e. lower cap would decrease the share of the large agricultural producers on the market.

To recap, productive demand from individuals of 1.1 mln ha (0.95mn ha) falls short of the expected 2.3-3.1 mn ha (or 2.0-2.7 mn ha) supply of agricultural land in Ukraine. With the currently discussed 200 ha or 1000 ha ownership cap and current market conditions, legal entities could increase expected demand by additional 0.13 to 0.37 mln ha during the initial year when no financial instruments or government programs are available, which leaves a substantial share of the market to speculative buyers. Demand for land by legal entities would be expected to increase to some 1.26 mn ha if the cap is set at 1000 ha level and banks start providing mortgages. This number will increase over time with development of financial instruments and accumulating experience with assessment of land value and land related risks or in case of government support programs to agricultural producers. Expected increase in land prices would stimulate development of financial instruments and capital inflow to the sector as well as value of assets of agricultural producers.

Non-Agricultural Demand

The volume of non-agricultural demand is difficult to assess. An alternative of relying on stated willingness to buy land in surveys as done above, is to depart from individuals’ available cash savings. To do so, we assume individuals have the same amount of cash savings outside the banking sector as the amount of deposits in the banks[9]. According to NBU statistics, the monthly stock of household deposits in the banks was relatively stable over the last two years. For example, by the end of 2016 it was about UAH 445 bn or about USD 17 bn. The expected increase in land prices and rental payment at a level of at least 10% of the land price will make the land an attractive asset for investment. Thus, it is reasonable to expect that some share of the savings will be used for speculative operations. For example, 5%-10% of this total savings could generate demand for 1.7-3.4 mn ha at an expected land price of USD 1000/ha[10]. This makes it likely that total market demand will exceed supply, causing prices to increase over time.

Two observations regarding speculative demand are relevant. First, if speculative buyers are not interested in long-term productive use, such demand is very sensitive to price, making land markets vulnerable to bubbles and bursts and introducing an additional factor of uncertainty. This can be offset by investors interested in conservative long-term investments to preserve or accumulate their wealth. Second, while such demand can help stabilize land market during the periods of high supply, it will be very sensitive to the regulatory regime. Government policies to tax speculative transactions such as the current proposal to impose 50% tax of the normative value of land if resold during the first 3 years after the purchase is likely to affect the nature of such demand. The 3 years horizon would not affect speculative investors with longer planning horizon, however could affect operations by banks and private sector development companies that may consider starting land consolidation projects.

Conclusion

Will supply and demand for land match in a situation where land market have been outlawed for more than a decade is difficult to predict, data from population and production surveys can provide some guidance. Data from 2015 suggest that there may be a gap between the initial supply of land of 2.3 – 3.1 mn ha (or 2.0-2.7 mn ha without occupied territories) and the demand for land by individuals engaged in agricultural production of 1.1 mn ha (0.95 mn ha correspondingly). This gap can be closed by allowing land acquisition by Ukrainian legal entities, which may generate a demand in a range from .13 mn ha to 1.26 mn ha and by non-productive demand of above 1.7 mn ha. Compared to the 2015 data used here, the likelihood of supply and demand for land to balance looks even more promising for later years. As economic situation in Ukraine becomes more stable in comparison to 2015 and there is a better understanding of the land market, owners will be less likely to sell their land and agricultural producers will be more likely to buy land than before, which increases chances for success of the land reform.

A key policy issue to be considered is the amount of speculative demand in the initial stages of market opening. While such demand can play a positive role in terms of increasing liquidity and smoothening out short term fluctuations of productive demand, it also introduces risks, may discourage productive investments, and affects the distribution of gains from land price increases. Having a significant share of speculative demand at the initial stages will divert the gains of land market opening from rural to urban areas and from poor land owners and farmers to wealthier individuals with access to finance. Efforts to stimulate productive demand particularly by small and medium scale agricultural producers would increase the long run benefits of reform and sustainability of rural development. Stimulation of development of new banking products for land market, training and technical assistance to small and medium producers as well as efforts, such as partial credit guarantees, that would reduce the risk for banks to provide credit to this clientele, should accompany a careful design of the land turnover parameters.

On the other hand, applying restrictions on productive demand by legal entities and speculative demand by individuals may lead to the least attractive scenario when the demand stays below the supply for land, prices could drop during the initial phases of market opening, and financial institutions would find land as a collateral not very attractive. A balanced approach on the other hand (e.g. by allowing land purchases by individuals and agricultural producers with simultaneous development of land finance and some curbs on speculative demand) could result in a successful introduction of the land market with all the expected benefits. Government and Members of Parliament are called upon to make the right policy choices that can help stimulate development of the agricultural sector and rural areas in Ukraine by liberalizing the market for agricultural land supporting access to finance for agricultural producers, particularly small and medium ones.

Notes:

[1] As we have demonstrated in previous publication “Land Prices and Size of the Market: What to Expect for Ukraine”

[2] Based on the survey of land owners conducted by Kyiv International Institute of Sociology (KIIS) on request of USAID Agroinvest Project at the end of 2015.

[3] The survey results indicate that the supply of land by legal entities is likely to be very low and, thus, is not taken into account. Supply of private land for subsistent agriculture is not taken into account as it is relatively small and is not restricted by the moratorium.

[4] Currently the Government considers selling via e-auctions of about 8 land parcels with an average size of 30 ha in each of 440 rayons outside of temporary occupied territories during the initial year after the moratorium is lifted.

[5] The requirement for down-payment reflects NBU’s reserve requirements. Currently 35% of the value of tradable non-developed land and 0% for land affected by the moratorium is permissible.

[6] See “Where Will Demand for Land Come From? Evidence from Farm Models” ( )

[7] Likely scenario currently discussed for individual owners.

[8] Capitalization rate is based on return on government bonds (in USD) minus annual growth in agriculture. Currently the capitalization rate is equal to 5.07%

[9] see the basis for this assumption here

[10] see this link or more detailed study

Main photo: depositphotos.com / simplephoto

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations