What happened to the budget in April? Which taxes were on target and which were off? Is international support still stable? What are the risks to the sustainability of the budget system? Discover these and other details of the budget’s implementation in the Budget Barometer for April 2023

Authors: Yuliya Markuts, Lina Zadorozhnia, Taras Marshalok, Inna Studennikova, Dmytro Andriyenko, Center of Public Finance and Governance at the Kyiv School of Economics

What was achieved?

- In April, the general fund revenues plan [1] was exceeded by 4.2%. Overall, the general fund revenues amounted to UAH 162.8 billion (UAH 10.6 billion more than in March). Excluding international aid, the total revenues amounted to UAH 117.1 billion (UAH 112.4 billion was planned).

- Record amounts of international support were received in April. The United States provided a grant of USD 1.25 billion. Borrowings amounted to UAH 157.9 billion, including USD 2.7 billion from the IMF and EUR 1.5 billion from the EU. The IMF provided USD 2.7 billion and the EU EUR 1.5 billion.

- In addition to external financing, in April the Ministry of Finance raised UAH 34 billion from domestic government bonds, of which UAH 15.1 billion was benchmark bonds. The government continued to refrain from financing expenditures through direct emission of funds by the National Bank.

What wasn’t achieved?

- In April, the State Customs Service (SCS) failed to meet its targets (the budget received 8.2% less customs revenues than planned). In particular, SCS collected UAH 25.1 billion of import VAT during the month, compared to the planned UAH 27.1 billion.

- Revenues from rents were lower than planned (by 31.1%). This may be due to the lower than planned actual price of natural gas, which is used to calculate the rent for the use of subsoil for natural gas production.

- S&P lowered Ukraine’s credit rating from CCC+ to CCC due to the government’s plan to restructure its debt in 2024.

What’s next?

- Macroeconomic assistance from external partners will remain an important factor in the sustainability of public finances. In addition to financial support from the US, EU, IMF, and other countries, Japan has committed to provide Ukraine with USD 3.5 billion in direct budget support in 2023.

- The government will continue to sell government bonds and is likely to increase their volume due to the need to finance expenditures that have increased significantly since the budget amendments came into effect in April.

Key risks:

- Lower-than-expected employment, which negatively affects household incomes, as well as a higher-than-expected level of integration of migrants abroad, pose a risk of a shortfall in non-military PIT revenues in the next tax periods (medium risk).

- Incomplete implementation of the structural benchmarks set out in the Memorandum with the IMF, in particular the failure to adopt Draft Law 8401 of 31 January 2023 on the return to the pre-war taxation model (medium risk).

- Decrease in revenues (compared to the planned) due to potentially lower inflation than originally predicted (NBU revised its inflation forecast for 2023 from 18.7% to 14.8%) (medium risk).

- Complications or termination of the grain corridor, as well as aggravation of problems related to restrictions on imports of Ukrainian food by some European countries, which will mean lower taxes paid by exporters (but also a lower need for VAT refunds) (medium risk)

Details:

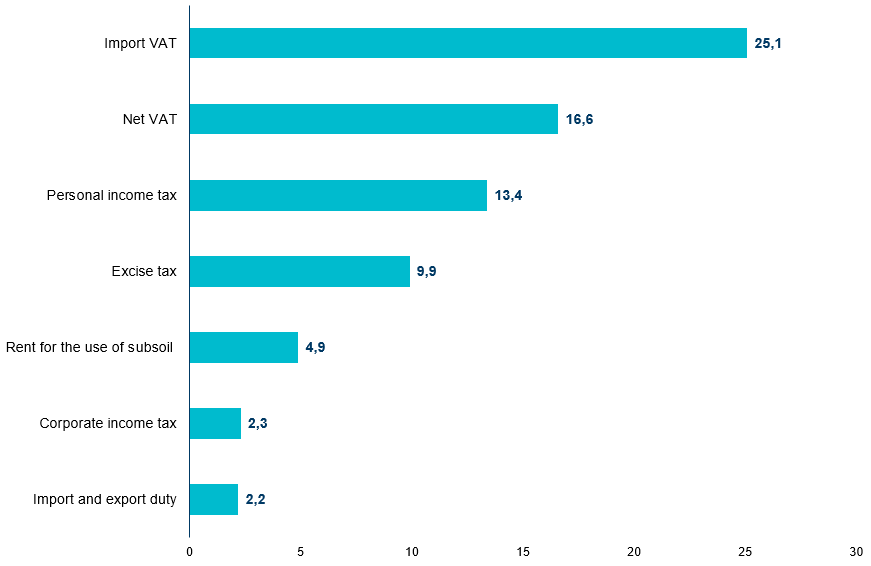

(1) In April, the general fund of the state budget received UAH 162.8 billion (UAH 112.4 billion was planned), including international aid. The grant from the US in April amounted to UAH 45.7 billion. According to the monthly plan of the Ministry of Finance, tax revenues were expected to reach UAH 73.3 billion, while the general fund of the state budget was replenished by UAH 74.4 billion due to main taxes (Fig. 1).

Figure 1. Main tax revenues to the general fund of the state budget in April 2023, UAH billion

Source: Ministry of Finance of Ukraine.

In April, the Ministry of Finance of Ukraine exceeded its plan for the revenues of the general fund of the state budget from payments administered by the State Tax Service by 6.9%.

The grant received from the United States contributed to exceeding the planned indicator of general fund revenues by 44.8%, since in the planned indicators, almost all international aid is taken into account in financing, not in revenues. The second factor of exceeding actual revenues over planned was the overfulfillment of the tax revenue plan by 7.3%.

In terms of tax revenues, the largest over-performance in April was in corporate income tax, up 58.6% (UAH 2.3 billion), which may be due to some taxpayers paying their liabilities in advance. Also, UAH 9.9 billion of excise tax was received, which means that the revenue plan was exceeded by 33.1%. This may be due to the increased domestic production of excisable goods. Personal income tax revenues exceeded the target by 13.8% to UAH 13.4 billion, which, in addition to traditional military reasons, can be explained by the fact that 21% of businesses, according to the EBA survey, make advance and bonus payments to their employees.

Revenues from rents amounted to only UAH 4.9 billion (UAH 7.1 billion was expected according to the schedule, i.e., a 31.1% underperformance), which may be due to a decline in the actual price of natural gas, which is used to calculate rents for the use of subsoil for natural gas production.

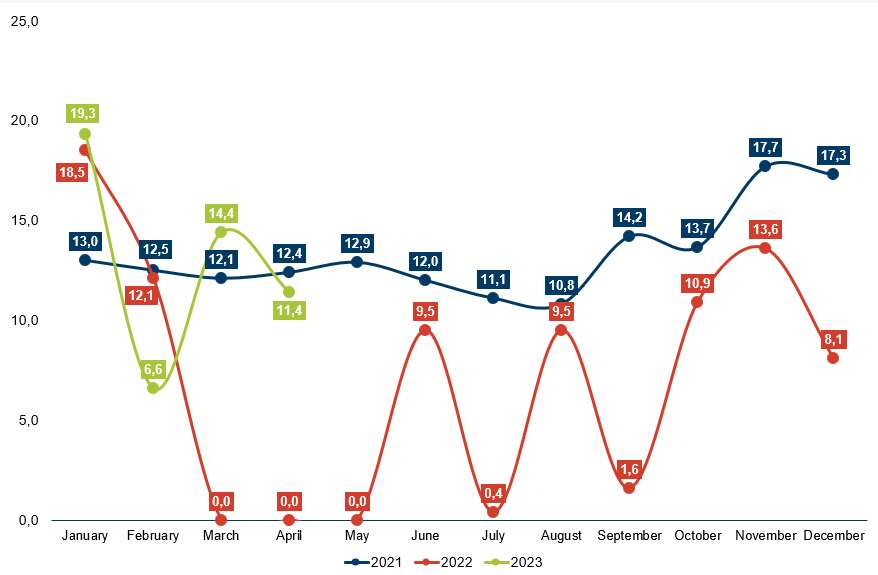

At the same time, in April, the government again failed to meet its VAT revenue targets. In particular, UAH 25.1 billion of “import” VAT was collected against the planned UAH 27.1 billion, which is likely to be due to a decline in household income and a gradual decline in consumption of imported goods. At the same time, the revenues from the “internal” VAT (net) exceeded the target: UAH 16.6 billion was received, while the expected UAH 16.1 billion was received (+3.1%). In April, VAT refunds amounted to UAH 11.4 billion, which is UAH 1 billion less than in April 2021, while in April 2022, no refunds were made at all (Figure 2).

Figure 2. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

(2) In 2022, NBU’s distributable profit reached UAH 91 billion, of which a record UAH 71.9 billion was transferred to the state budget in April. The general fund received a portion of UAH 35.9 billion (UAH 35.5 billion was planned to be transferred according to the plan). The same amount of profit was transferred to the special fund of the state budget. It will be used to finance the expenditures of the Fund for the Elimination of the Consequences of Armed Aggression, namely the restoration of critical infrastructure and compensation to the population for lost housing.

(3) In April, cash expenditures of the general fund of the state budget amounted to UAH 229.7 billion or 104.3% of the plan for the reporting period. In April, the general fund expenditures of the state budget were planned [2] at UAH 220.2 billion, and the largest item was the financing of the programmes of the Ministry of Defence of Ukraine (UAH 100.8 billion), of which 51.2% was wages (UAH 51.6 billion). UAH 40.4 billion was planned to be allocated to the programmes of the Ministry of Social Policy (UAH 22.7 billion or 56.1% of which was a transfer to the Pension Fund). The Ministry of Health was to receive UAH 13.5 billion, of which UAH 11.8 billion (87.1%) was to be allocated to the state healthcare guarantee programme. Another UAH 13.7 billion was to be used to service the public debt. In total, according to the plan, 52.8% of all expenditures were to be allocated to the defence and security sector in April, and 18.3% to the programmes of the Ministry of Social Policy.

(4) The actual state budget deficit in April was UAH 32.6 billion, and the total for the first four months of 2023 was UAH 252.9 billion. The deficit of the general fund in April was UAH 65.6 billion, which is 1.6 times lower than the plan. In January-April, the general fund of the state budget was executed with a deficit of UAH 310.3 billion, which is 1.8 times less than the plan (UAH 560.1 billion). The lower state budget deficit in April compared to the planned was achieved, in particular, by attracting grants in the amount of USD 1.25 billion or UAH 45.7 billion. The lower state budget deficit in April was achieved, in particular, by attracting grants in the amount of USD 1.25 billion or UAH 45.7 billion, which accounted for 28.1% of the general fund revenues in April.

(5) In April, the state budget received UAH 159.3 billion (USD 4.3 billion in equivalent) of macro-financial assistance. In particular, USD 2.7 billion (UAH 98.7 billion) was received. USD 2.7 billion (UAH 98.7 billion) from the IMF and EUR 1.5 billion (UAH 60.6 billion) from the EU.

(6) In addition to external financing, in April the Ministry of Finance raised UAH 34 billion from the placement of domestic government bonds, of which UAH 15.1 billion was for benchmark bonds. The maximum yield of the placement was 19.6%. In April, the Ministry also raised UAH 8.9 billion from foreign currency-denominated bonds. However, the repayments on the bonds were UAH 6.2 billion higher than the amount raised on the domestic debt market.

(7) In April 2023, local budget revenues from sources administered by the State Tax Service amounted to UAH 36.3 billion (45.0% more than in April 2022). The Cabinet of Ministers has expanded the list of priority expenditures for which payments are made by the Treasury and its territorial bodies under a special regime during martial law. The list now includes expenditures for the restoration of facilities damaged or destroyed as a result of armed aggression that support the vital functions of territorial communities.

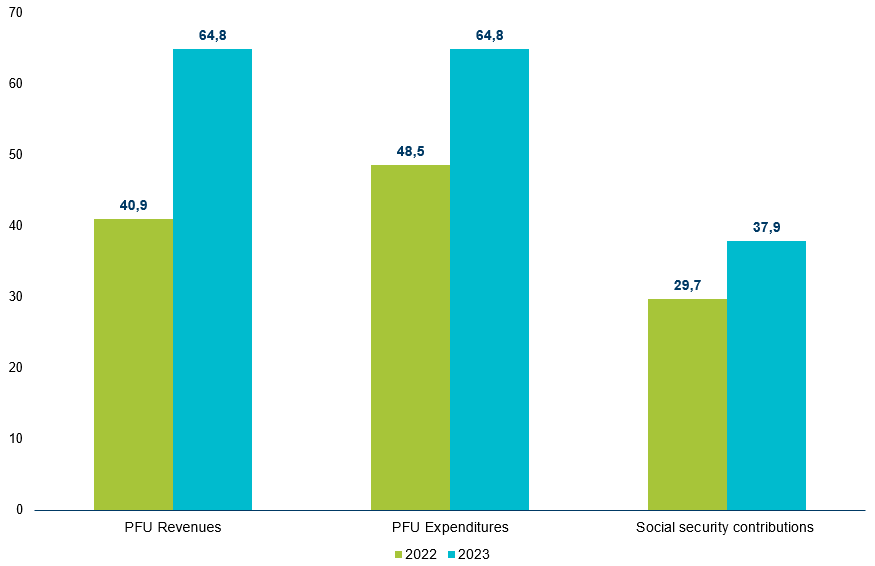

(8) In April 2023, total social security contributions (SSC) revenues increased by 27.6% or UAH 8.2 billion compared to April 2022 and amounted to UAH 37.9 billion (Chart 3). The increase was due to three factors: 1) the base effect – in April 2022, there was a decline in social security contributions revenues due to the war; 2) higher contributions for military personnel due to an increase in their number; and 3) a higher minimum wage in April 2023 than in April 2022, which amounted to UAH 6,700.

Figure 3. Revenues and expenditures of the Pension Fund of Ukraine and the SSC in April 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

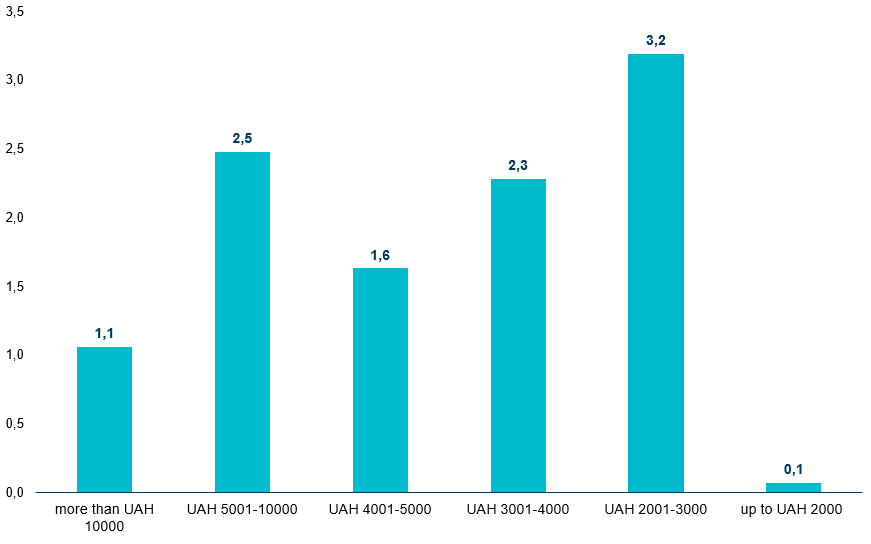

(9) In April 2023, the Pension Fund’s revenues increased by 58.4% compared to the same period in 2022 to UAH 64.8 billion due to an increase in the Pension Fund’s own social security contributions revenues and the new powers of the Fund to pay housing and utility subsidies and social insurance benefits. Thus, the Pension Fund received UAH 5.3 billion from the state budget to pay subsidies and benefits for housing and communal services, and UAH 2.3 billion from the social security contributions revenues to pay social insurance benefits. In April 2023, the Pension Fund received UAH 20.8 billion from the state budget to finance pensions and other related payments, which is 42.8% more than last year. Already in April, the Pension Fund allocated UAH 57.1 billion for pension payments, which is 17.7% more than in the same period last year (Fig. 3). As of 1 April 2023, the average pension is UAH 5,238.25, which is UAH 867.8 higher than last year due to pension indexation, and the total number of pensioners is 10.7 million (Fig. 4).

Figure 4. Distribution of pensioners by the amount of their pensions as of 1 April 2023, million people

Source: Pension Fund of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | February | March | April | ||||

| Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 | 112,4 | 162,8 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 | 11,8 | 13,4 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 | 1,5 | 2,3 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 | 7,1 | 4,9 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 | 7,4 | 9,9 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 | 16,1 | 16,6 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 | 27,1 | 25,1 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 | 2,0 | 2,2 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 | 220,2 | 229,7 |

| Deficit (-) / surplus (+)* | -158,6 | -78,9 | -168,0 | -93,2 | -144,6 | -72,6 | -106,6 | -65,6 |

| Sources of deficit financing | ||||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,8 | 195,1 | 147,3 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,8 | 233,2 | 193,3 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 | -58,5 | -49,0 | -38,1 | -46,0 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | February | March | April | Cumulative (Jan-Apr) | |

| Financing, including | 160,1 | 66,7 | 176,8* | 193,3 | 596,9 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 82,9 | 83,4 | |

| From the placement of domestic government bonds (total), including | 41,4 | 42,6 | 53,7 | 34,0 | 171,7 | |

| in UAH | 38,8 | 30,5 | 36,3 | 25,1 | 130,7 | |

| in foreign currency in UAH billion

(USD million + EUR million) |

₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴8,9

($242,6) |

₴41,0

($1027,7+€86,9) |

|

| From external sources | 118,7 | 24,1 | 123,1 | 159,3 | 425,2 | |

| Public debt repayments | 12,8 | 34,9 | 49,0 | 46,0 | 142,7 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 120,7 | 96,8 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 13,9 | 38,1 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 101,5 | 92,7 | |

*indicator updated due to arithmetic correction of rounding of the amount

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in January-April

| Resources | Amount, UAH billion

(EUR million; USD million; CAD million) |

| Macro-Financial Assistance in accordance with the Memorandum of Understanding between Ukraine and the EU | ₴237,7

(€6000) |

| Loans from the Government of Canada | 64,2

(CA$2400) |

| IMF funds under the four-year Extended Fund Facility program | ₴99

($2700) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,3

($499,3) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴6,0

(€152) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | January | February | March | April |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,8 | 193,3 |

| Total borrowed, % for January-April | 26,8 | 11,2 | 29,6 | 32,4 |

| From the placement of domestic government bonds, % for January-April | 24,1 | 24,8 | 31,3 | 19,8 |

| Borrowed from external sources, % for January-April | 27,9 | 5,7 | 29,0 | 37,5 |

| Debt repayment payments, % for January-April | 9,0 | 24,5 | 34,4 | 32,2 |

| Servicing payments, % for January-April | 1,6 | 31,5 | 30,5 | 36,5 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,1 | 133,4 |

Source: Ministry of Finance of Ukraine, Center`s calculations

[1] All planned indicators in the budget barometer are taken into account in accordance with the monthly plan of the State Budget 2023 as of 1 May 2023.

[1] All planned indicators in the budget barometer are taken into account in accordance with the monthly plan of the State Budget 2023 as of 1 May 2023.

[2] Information on the actual execution of budget expenditures in terms of programs will be published later and analyzed additionally.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations