On April 28, the NBU Council approved the assessment of the Monetary Policy Guidelines for 2022. While the NBU’s efforts can be succinctly described in military terms as “holding the macro-financial line,” a more detailed analysis is necessary considering the past year’s events. The starting conditions for implementing the monetary policy during wartime can hardly be called favorable. The central bank’s crucial decisions drew starkly contrasting reactions from politicians and experts.

Delays in monetary or regulatory responses likely stem from a more intricate policy coordination framework that emerged in response to the realities of martial law characterized by the centralization inherent to such conditions. Nonetheless, the NBU demonstrated that key decisions to ensure macro-financial stability were made in accordance with its mandate, which has only increased in public value. The delays in strengthening monetary transmission are evidently being compensated for in 2023.

The starting conditions of 2022: epicenter of the global inflation

The outset of 2022 presented numerous challenges for the NBU’s monetary policy. Inflation in 2021 surpassed the target by a considerable margin, and the strengthening of the nominal exchange rate offered very limited compensation for the surge in commodity prices. Moreover, geopolitical risks and substantial outflow of capital via dividend payments influenced the nominal exchange rate, posing risks to the NBU’s currency reserves. The January 2022 decision to raise the key rate to 10% contained a certain level of ambiguity, reflecting the accumulation of significant challenges for monetary policy.

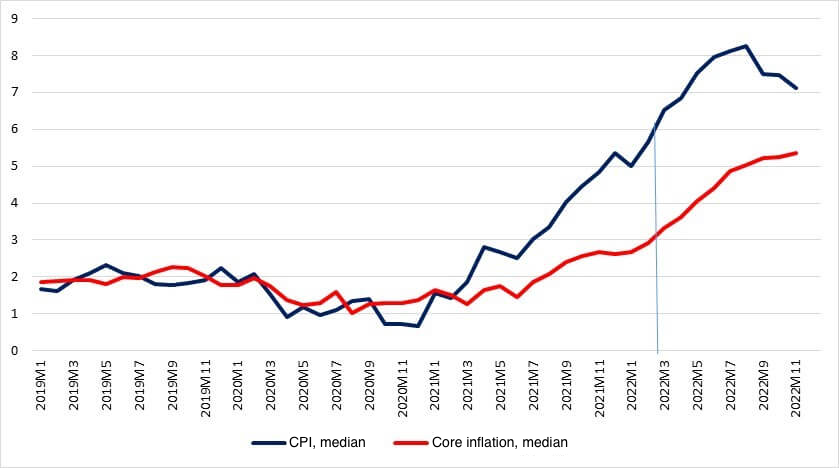

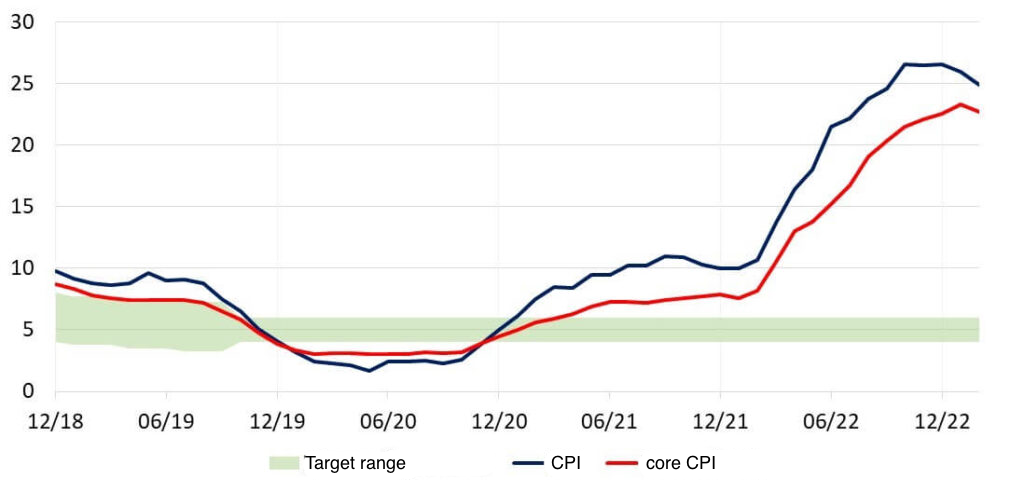

For the global economy, 2022 presented a formidable challenge in the form of high inflation. Figure 1 illustrates the acceleration of inflation’s rebound following the Covid-19 pandemic throughout 2021. The continuous upward trajectory of inflation became apparent even prior to the full-scale aggression carried out by the Rushists against Ukraine. Despite some experts and politicians expressing the view that the war fueled global inflation, it did not have that effect. On the contrary, inflation started to decline after the decisive, albeit delayed, actions taken by leading central banks to normalize monetary policy, including raising key interest rates.

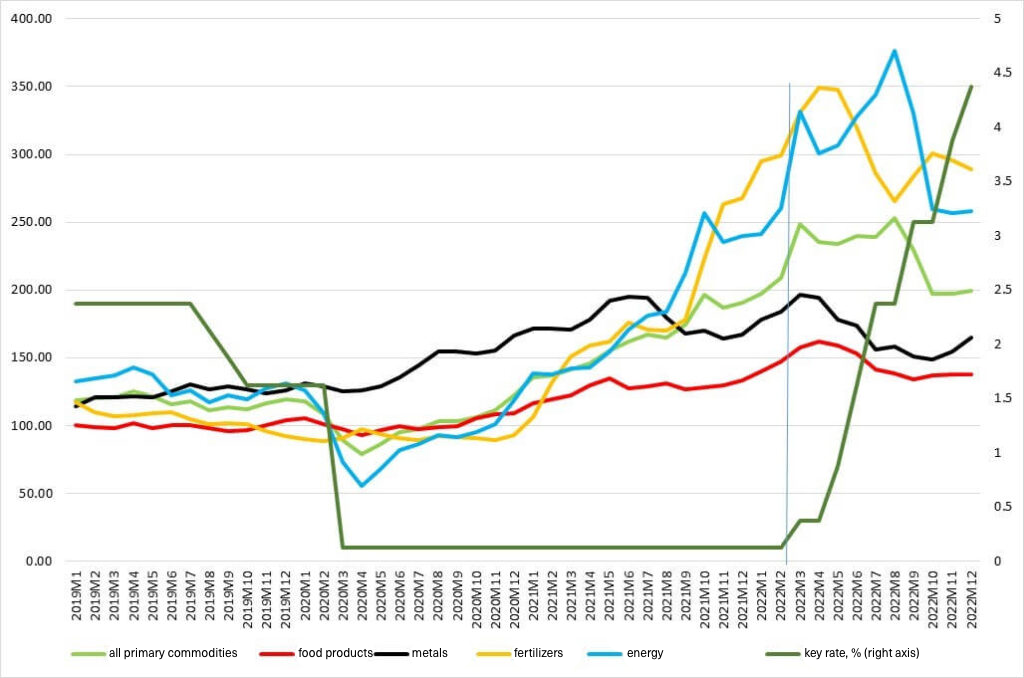

Commodity prices, which serve as the focal point of the global shock, provide further evidence of a similar pattern. Their upward trajectory commenced even before the onset of the “great” war between Muscovy and Ukraine. Figure 2 illustrates that the surge in raw material prices causing distress to the most vulnerable nations was not a result of Ukraine’s endeavor to safeguard its independence. Raw material prices started adjusting during the first quarter of the previous year. Only energy prices began to decline later, likely due to the tighter monetary conditions established by the Federal Reserve (Figure 2).

Figure 1. Global inflation, % year-on-year

Source: IMF

Figure 2. Commodity price indices (2016=100) and the Fed key rate

Source: IMF, BIS

The impact of commodity price shock and the delayed tightening of global monetary conditions would inevitably complicate the NBU’s path towards the inflation target. The war disrupted the feasibility of implementing an inflation-targeting policy. The shift in the monetary regime and the shock transformation of the economy’s structure and balance of payments created a new environment for the NBU to navigate. However, the remarkable resilience displayed by the banking system during the initial months of the war can be attributed to substantial reforms implemented in previous years.

Wartime monetary challenges

The shock impact of the war necessitated the NBU to adopt drastic and resolute measures to safeguard financial stability. These measures included a shift in the monetary policy regime, the implementation of currency restrictions, and a significant easing of requirements pertaining to micro- and macro-prudential regulations. Simultaneously, the NBU ensured access to liquidity through blank refinancing (Figure 3). Such a countercyclical response effectively prevented the collapse of short-term liquidity within the banking system, ensuring that the outflow of funds did not jeopardize the solvency of banks and the payment system. Actions of this nature, aimed at stabilization, were implemented to a significant extent for the first time. Traditionally, in the past, reactions to shocks tended to be predominantly pro-cyclical.

Figure 3. Refinancing of banks, UAH billion

Source: NBU

The protracted war necessitated significant fiscal adjustments. The NBU’s involvement in financing the budget deficit, with UAH 400 billion issued to buy government bonds on the primary market in 2022, created conditions for a substantial deterioration in the situation concerning the structural liquidity surplus within the banking system. This, combined with notable pressure on foreign exchange reserves resulting from hryvnia card transactions abroad and the outflow of hryvnia cash into foreign currency, led to an apparent conflict between exchange rate stabilization, interest rate levels, and the imperative to support the budget. As confirmed by Figure 4, approximately half of the liquidity impact resulting from government operations was sterilized by the NBU due to the depletion of foreign exchange reserves. Given the inevitability of fiscal dominance during the initial year of the war, the pressure on reserves needed to be alleviated through alternative channels, which proved to be an exceedingly non-trivial task amidst the structural liquidity surplus that only continued to intensify.

Figure 4. The relationship between the Government’s operations and the NBU’s currency interventions, UAH billion

Source: NBU data, author’s calculations

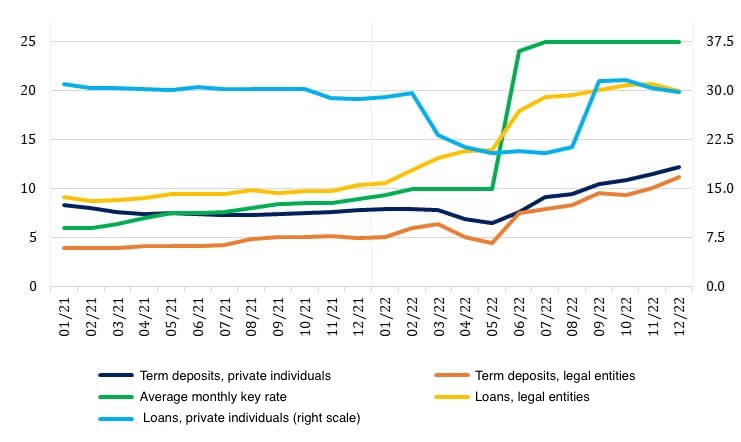

The decision to raise the key rate and the one-time adjustment of the exchange rate can be viewed as pivotal factors that influenced the creation of conditions necessary for future stabilization. The decline in nominal interest rates (Figure 5) resulted from a significant contraction in loan demand and a surplus of liquidity fueled by the budget deficit and the corresponding monetary easing. However, this situation started to pose risks of capital outflows from the banking system and a decline in foreign exchange reserves.

Figure 5. Weighted average interest rates on time deposits and new loans in hryvnias

Source: NBU

Why was such a significant rate hike deemed necessary? First, it was a clear signal that the NBU was prepared to support macro-financial stability and counteract the potential risks of a banking crisis and hyperinflation, thus preserving the country’s macro-financial defense capabilities. Second, in the face of declining nominal interest rates and heightened expectations of devaluation, incremental and unconvincing key rate adjustments would unlikely have been effective in altering the perception of the benefits associated with holding hryvnia-denominated assets. Third, nearly all rates were approaching negative territory, and even the increase to 25% in June did not guarantee that rates would remain positive by year-end.

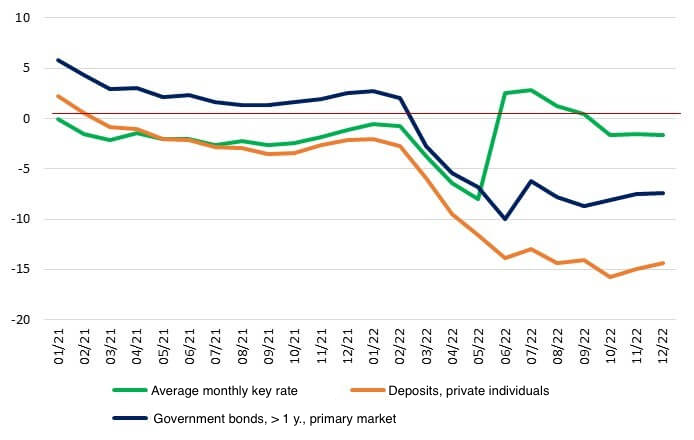

Furthermore, decisions related to interest rates under a fixed exchange rate regime differ in functionality from those made under an inflation-targeting framework. Similarly, the nature of inflation during wartime differs from inflation experienced during the various phases of a normal business cycle. If not making real rates positive, a significant key rate increase was supposed to at least keep them from further declining into red. This objective was indeed achieved (Figure 6). The accounting rate ex post (considering the actual level of inflation) briefly turned positive but eventually fell below zero by the end of the year. Nevertheless, the downward trajectory of real rates for hryvnia-denominated assets ex post was successfully mitigated. Although neither the discount rate nor other hryvnia asset rates reached a positive real dimension ex post, the monetary response to inflation was administered in a controlled manner.

Figure 6. Key rate and rates on hryvnia assets in real terms ex post, %

Source: NBU

The absence of any forecasts indicating a swift return to the inflation target by the end of 2022 or the beginning of 2023 suggests that the monetary response during 2022 was optimal and not exclusively focused on disinflation. Taking into account significant economic potential losses, logistical challenges, and security risks, deviating from the forecast horizon for achieving the inflation target appears to be the prudent choice for the disinflationary trajectory. Attempting to stimulate economic recovery effectively through looser policies is questionable, just as implementing tighter monetary measures is unlikely to yield immediate results in terms of reaching the target inflation level. The risk of substantial financial destabilization poses a much greater threat to economic growth in the absence of actions aimed at safeguarding currency reserves and hryvnia assets. Preserving macroeconomic stability and the financial system’s stability lays the groundwork for a faster recovery of the economy.

The effectiveness of the NBU’s decisions in preserving macro-financial stability is evident in discrepancies observed in the forecast trajectories of inflation (Figure 7). Notably, the difference between the July and October inflation forecasts is relatively minor, whereas the deviation of actual inflation values from the trajectory of the unreported April forecast is significant. Furthermore, the actual inflation trajectory turned out to be lower than what was projected in both the July and October forecasts. And the October forecast showed an improvement compared to the July forecast.

Figure 7. Overview of NBU inflation forecasts, annual change, %

Source: NBU

This distribution of forecast values indicates that events could have unfolded in an extremely undesirable scenario without radical measures to stabilize the macro-financial situation. However, the inflation dynamics suggest that such a scenario was effectively prevented. Towards the end of the year, there was a noticeable slowdown in the growth of the CPI and core inflation in annual terms (Figure 8).

Figure 8. Inflation and inflation targets of the NBU in 2019-2022, % year-on-year

Source: NBU

Does the significant deviation from inflation target in Ukraine align with trends observed in many countries, especially in Central and Eastern Europe? Formally, yes. A 26% inflation rate in Ukraine during the war may not seem excessively worrisome compared to similar inflation figures in Poland, Hungary, and the Baltic states. However, the moderate inflation levels in Ukraine and most Central and Eastern European countries create a misleading impression of the “underestimated opportunities” of employing emission to support the economy. Unlike the countries mentioned above, where increased energy tariffs had a notable impact on inflation, Ukraine did not adjust its tariffs to market prices, which had significantly increased already in 2021. The relatively moderate consequences of the emission can be attributed to the NBU sterilizing the situation by selling currency reserves and immobilizing liquidity in certificates of deposit.

Additionally, the arrival of international aid played a significant role in enabling currency interventions and reducing the Government’s pressure on the NBU for more emission. The understanding between the NBU and the Ministry of Finance regarding the futility of financing the budget deficit through emission fuels optimism. It sends a positive signal for further expectation stabilization and inflation reduction.

Monetary communications

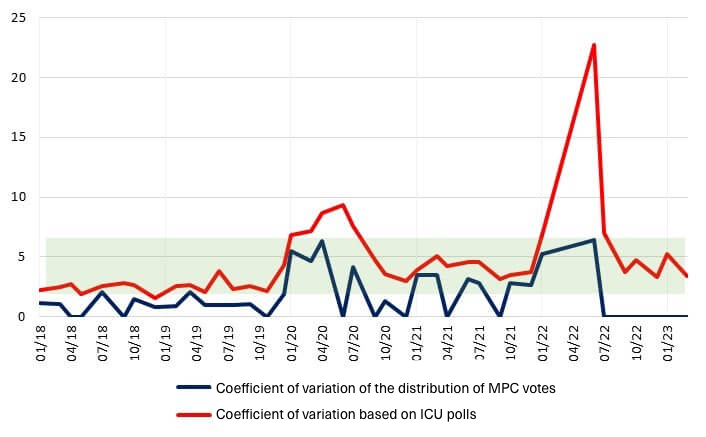

Overall, the level of uncertainty in the macroeconomic environment has a similar effect on those who make decisions about the discount rate and those who anticipate it. Figure 9 illustrates that the coefficients of variation of the distribution of votes from the members of the Monetary Policy Committee and votes of the interviewed experts exhibit very similar patterns. This indicates that, given the NBU’s transparency in communications, experts comprehend the dilemmas faced by the NBU and the challenges of uncertainty when determining the discount rate. Furthermore, the NBU ensures that its decisions are not systematically unexpected, thus avoiding “monetary surprises.”

Figure 9. Assessment of the degree of uncertainty regarding monetary policy (coefficients of variation of the distribution of votes of MPC members and forecasts of participants in ICU polls, %)

Source. Author’s calculations based on NBU data and data provided by Mykhailo Demkiv.

However, the war disrupted this established pattern. The unexpected decision in June to raise the key rate to 25% surprised experts. This could be attributed to the previous formal communications, which led to the interpretation that the rate would remain unchanged at 10%. Additionally, the worsening situation in terms of interest rates, emissions, and foreign currency reserves further contributed to the uncertainty surrounding the NBU decision. Nevertheless, once the NBU resumed its usual communication practices regarding monetary policy decisions, the variation in experts’ votes returned to its pre-war levels. This demonstrates that, despite the war, the NBU did not consider a reduction in transparency as a long-term option.

Conclusions

Wartime monetary policy played a crucial role in preventing significant macro-financial destabilization, particularly by ensuring the continuity of banking and payment systems. Confidence in the regulator played a vital role in avoiding a trigger event for hyperinflation and a potential bank run despite large-scale emissions to support the budget and a one-time exchange rate adjustment. However, imperfect communication decisions on raising the discount rate, the delayed implementation of capital controls, and slow adjustment of monetary policy operational design highlight the need for adaptation not only in technical aspects but also in the institutional framework to respond effectively to the realities of war.

Attention

Автор не є співробітником, не консультує, не володіє акціями та не отримує фінансування від жодної компанії чи організації, яка б мала користь від цієї статті, а також жодним чином з ними не пов’язаний