What happened to the budget in June? What is the situation with tax revenues? Which taxes have met their targets and which have not? What are the additional risks to budget stability and what can we expect from new specialised draft laws? For these and other details on budget execution, read the Budget Barometer for June 2023.

Authors: Yuliya Markuts, Lina Zadorozhnia, Taras Marshalok, Inna Studennikova, Dmytro Andriyenko, Center of Public Finance and Governance at the Kyiv School of Economics

What was achieved?

- In June, the general fund revenues plan was exceeded by 6.2% (excluding international aid). Both the State Tax Service (+1.1% or UAH 0.6 billion) and the State Customs Service (+6.8% or UAH 2.0 billion) met their monthly targets.

- In June, the first review of the IMF’s Extended Fund Facility (EFF) program was successful. As a result, on 3rd of July, the general fund of the state budget of Ukraine received the second tranche from IMF in the amount of USD 890 million.

What wasn’t achieved?

- In June, the budget failed to meet the target for certain types of revenues, including personal income tax, corporate income tax, and subsoil use rent. The budget received UAH 5.4 billion less than planned from these taxes.

What’s next?

- The Verkhovna Rada has adopted amendments to the Tax Code of Ukraine and other laws regarding taxation during the period of martial law. The amendments restore the pre-war taxation system as of 1st of August. The adoption of the draft law will help increase revenues to the state and local budgets in 2023 by about UAH 8 billion.

- On 1st of July fuel taxes returned to pre-war levels. Parliament passed the relevant law in September 2022. The excise duty on petrol has more than doubled, and on diesel fuel – by 40%. VAT was returned from 7% to 20%.

- MPs adopted as a basis the draft law No. 9346-1d on amendments to the Budget Code to ensure the predictability of budget policy and strengthen debt sustainability.

Key risks:

- Further postponement of the implementation of the structural benchmarks envisaged by the IMF agreements, in particular in terms of restoring pre-war taxation. The draft law, which was supposed to come into effect on the 1st of July, was adopted with a delay (its entry into force was postponed until the 1st of August), but draft resolutions have been registered in the Parliament that do not allow it to be promptly submitted to the Speaker and the President for signature (low risk).

- The need for additional expenditures to ensure a quality heating season. Preparations for the heating season are currently being disrupted in Ukraine. The number of appeals from municipalities to the Cabinet of Ministers to prepare heating companies for the heating season is growing. According to the Association of Cities, at least UAH 36 billion from the state budget is needed to compensate for the difference in tariffs and timely preparation for the 2023/2024 heating season. In addition, on 19th of June, SC Guaranteed Buyer filed a lawsuit against SE NNEGC Energoatom for a record UAH 32.5 billion, demanding to close the debt to compensate for the difference between market electricity tariffs and subsidized tariffs for households (medium risk).

- Lower than expected tax revenues from exporting companies. Due to Russian sabotage of the grain corridor and logistical difficulties for other sectors, economic activity in general and exports in particular may recover at a slower pace than planned in the budget (medium risk).

- Slow return of people from abroad and their adaptation in other countries that provide significant financial support (European countries have spent more than EUR 43 billion to help Ukrainian refugees, and, for example, migrants in Sweden – 56% of the active population – are employed, and majority of them do not plan to change their country`s residence). Therefore, Ukraine may face long-term imbalances in the labour market, which increases the importance of return programs for Ukrainians (in particular, the eOselia program). However, this is a risk for Ukraine’s recovery rather than for the current budget. Today, migrants pose other risks – for example, by receiving inappropriate IDP benefits (low risk).

Details:

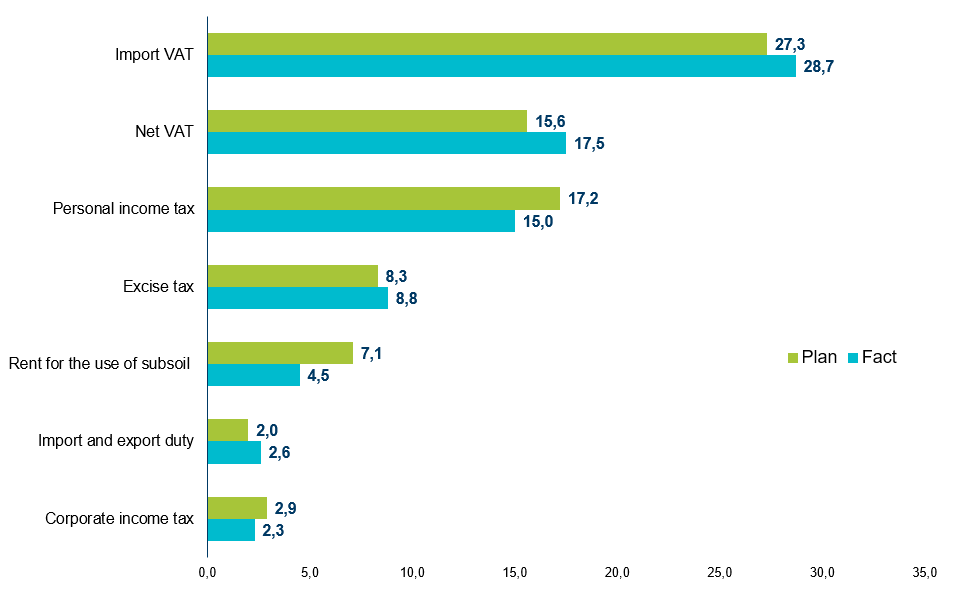

(1) In June, the general fund of the state budget received UAH 133.7 billion (including UAH 44.4 billion of international aid), while the total revenues were planned to be UAH 84.1 billion. At the same time, all international funding was planned in the form of loans, not grants, and therefore it was not included in the revenues. According to the plan of the Ministry of Finance, tax revenues to the general fund of the state budget were expected to reach UAH 80.6 billion, while in fact it was replenished by UAH 79.4 billion in terms of main taxes (Fig. 1).

Fig. 1. Main tax revenues to the general fund of the state budget in June 2023, UAH billion

Source: Ministry of Finance of Ukraine.

In June, the excise tax plan was exceeded by 6.0% (revenues to the general fund amounted to UAH 8.8 billion). The revenues could have been even higher if the large shadow market for tobacco products had been tackled (experts estimate that one in five cigarette packs is counterfeit). The general fund also received UAH 2.6 billion from taxes on international trade (primarily import duties), which is 30.0% higher than the plan.

The PIT revenues, although higher than last month, did not reach the target (they amounted to UAH 15.0 billion, which is 12.8% less than the plan). This may be due to several reasons. Firstly, it is due to the peculiarities of planning – while previously a significant share of the PIT in June was supplemented by vacation payments (including “health” and financial aid), especially to public sector employees, now the share of “vacation” payments in the overall PIT structure is much smaller because of a significant share of the PIT is payments to the military. Secondly, some companies have employees who were wounded or killed in the war, which reduces the size of the payroll (the hiring process is not fast, and a new employee is likely to be hired at a lower salary level).

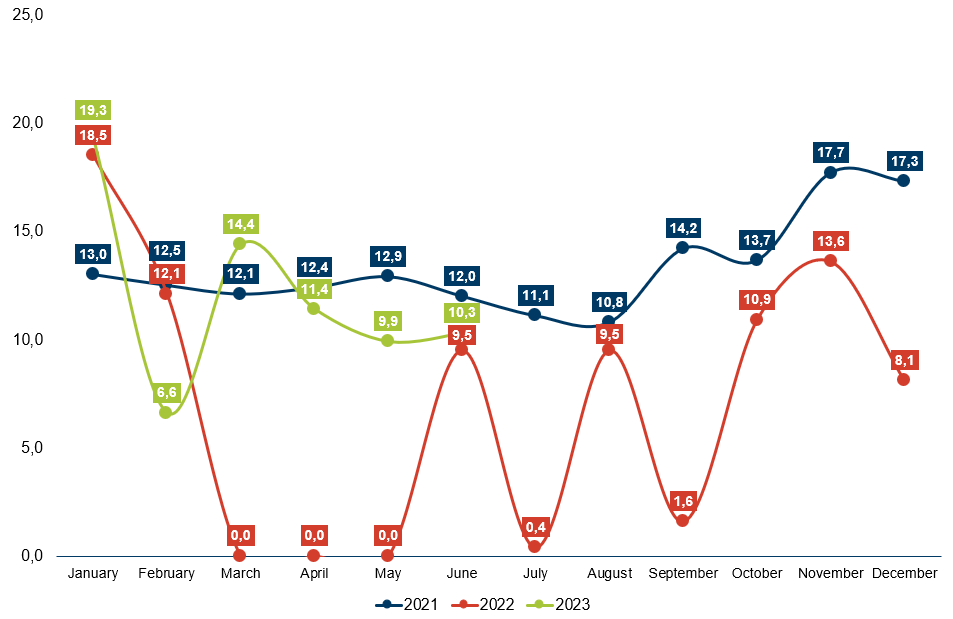

Importantly, in June, the government managed to achieve its VAT revenue targets. In particular, UAH 28.7 billion of import VAT (+5.1%) was collected. At the same time, revenues from “domestic” VAT (net) exceeded the target for the third month in a row. Thus, in June, net VAT revenues amounted to UAH 17.5 billion, while the expected UAH 15.6 billion (+12.2%). In June, VAT refunds amounted to UAH 10.3 billion, although as of 1st of June 2023, the balance of amounts claimed for refund was UAH 19.3 billion (Fig. 2).

Fig. 2. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

The revenues from rent to the general fund of the budget again amounted to only UAH 4.5 billion (UAH 7.1 billion was expected according to the budget plan, i.e. 36.6% under-execution), which is likely to be due to a larger decline in global natural gas prices than was budgeted.

(2) For the sixth month in a row, Ukraine receives a grant from the United States through the World Bank Trust Fund. In June, the state budget received a grant in the amount of UAH 43.9 billion or USD 1.2 billion. Finland also provided a grant of UAH 0.5 billion (USD 15 million) to Ukraine.

(3) In June, expenditures of the general fund of the state budget amounted to UAH 264.7 billion or 87.1% of the plan for the reporting period. In June, the general fund expenditures of the state budget were planned at UAH 303.9 billion, and the largest part was the financing of the programs of the Ministry of Defence of Ukraine (UAH 115.3 billion), of which 47% was wages (UAH 54.1 billion). UAH 38.6 billion was planned to the Ministry of Internal Affairs, including UAH 16.7 billion for the National Guard, UAH 8.5 billion for the National Police, UAH 7.9 billion for the State Border Guard Service, and another UAH 4 billion for the State Emergency Service. UAH 36.8 billion was planned to the programs of the Ministry of Social Policy (UAH 22.7 billion or 61.7% of which was transferred to the Pension Fund). UAH 14.2 billion was planned for the programs of the Ministry of Health, of which UAH 11.9 billion, or 83.8%, was to be spent on the state healthcare guarantee program. In addition, UAH 39.3 billion was planned to be spent on public debt service. Overall, according to the targets, in June, more than 50% of all expenditures were to be allocated to the defence and security sector, 12.1% to the programs of the Ministry of Social Policy, and another 12.9% to the public debt service.

(4) The actual state budget deficit in June, according to the preliminary estimate of the Ministry of Finance, was UAH 135.1 billion, and the general fund deficit was UAH 130.8 billion, which is 1.7 times lower than the planned amount of UAH 219.6 billion. The lower state budget deficit in June compared to the target was achieved, because not all planned expenditures were financed, as well grants were attracted in the amount of UAH 44.4 billion (33.2% of general fund revenues): USD 1.2 billion or UAH 43.9 billion from the United States and USD 15 million or UAH 0.5 billion from Finland. The grant contributed to the 59% overperformance of the general fund revenues target. In general, in the first half of 2023, the state budget was executed with a deficit of UAH 476.3 billion, with the general fund amounting to UAH 532.7 billion, which is also 1.7 times less than the plan of UAH 931.8 billion.

(5) In June, the state budget received UAH 62.3 billion (USD 1.8 billion in equivalent) of macro-financial assistance and loans. This included USD 0.1 billion (UAH 3.8 billion) from the World Bank and EUR 1.5 billion (UAH 58.5 billion) from the European Union.

(6) In addition to external financing, in June, the Ministry of Finance raised UAH 45.4 billion from the placement of domestic government bonds, of which UAH 7.4 billion or 16.2% were placed as benchmark bonds. The maximum interest rate remained unchanged at 19.75%. Among the placed domestic government bonds, UAH 17.1 billion was received from foreign currency denominated bonds.

(7) In June, UAH 26.4 billion more was borrowed than was spent on repayments and servicing of the state debt of Ukraine. In May, the excess was UAH 41.2 billion. The lower difference in June was due to an increase in repayments on military government bonds, primarily in the NBU’s portfolio.

(8) On 29th of June, the Board of Directors of the International Monetary Fund completed the first review of the Extended Fund Facility (EFF) program for Ukraine, paving the way for the disbursement of USD 890 million (SDR 663 million) in early July as part of a USD 15.6 billion loan under the program. The first tranche of USD 2.7 billion was disbursed in April. In addition, on 29th of June, the World Bank’s Board of Executive Directors approved a USD 1.5 billion Ukraine Relief and Recovery Development Policy Loan (DPL). The funds will be provided under the guarantees of the Government of Japan and will be used to help the most vulnerable populations through reforms, as well as to ensure the effective administration of pensions for citizens.

(9) In June 2023, local budget revenues amounted to UAH 36.2 billion from payments administered by the State Tax Service. These revenues are 18.7% higher than the corresponding revenues for the same period last year, in particular due to higher revenues from PIT, excise tax and rent. In June 2023, the Ministry of Finance transferred inter-budget transfers to local budgets in the amount of UAH 24.3 billion, which is 88.3% of the allocations envisaged in the budget plan. Between January and June 2023, the balances of local budgets and budgetary institutions in the general and special funds increased by UAH 54.3 billion and amounted to UAH 169.7 billion as of 1st of July. The unspent funds in the accounts have increased in all regions of Ukraine, mainly due to the restrictions on expenditures during martial law.

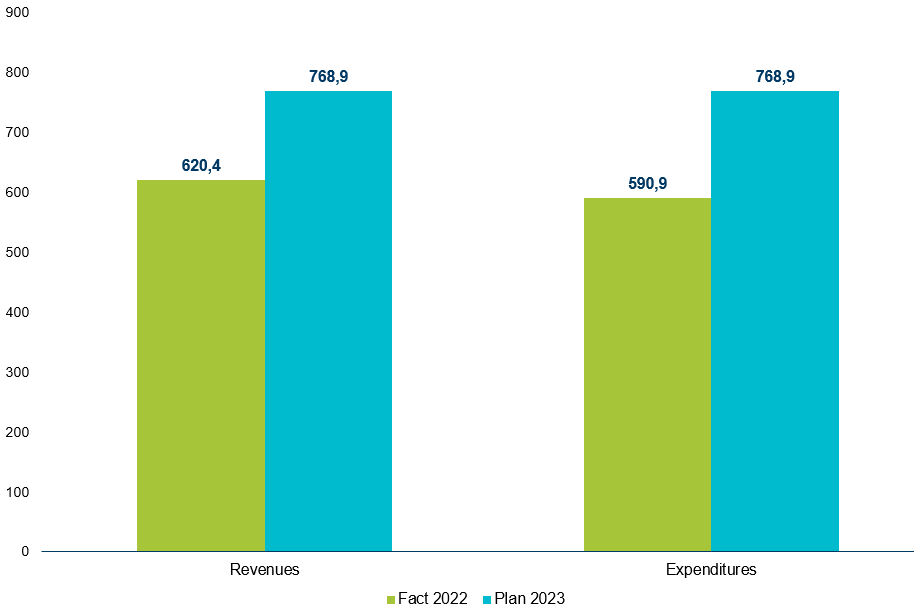

(10) In June, the Government approved the budget of Pension Fund of Ukraine for 2023, according to which the Pension Fund’s revenues from all sources in 2023 will amount to UAH 768.9 billion, which is 23.9% higher than the actual revenues of the Fund last year. According to the plan, the Pension Fund’s own revenues will amount to UAH 451.1 billion, which is UAH 47.5 billion (11.8%) more than the actual revenues received by the Fund in 2022.

To recalculate pensions for 2023, the Pension Fund’s budget gets a transfer from the state budget to pay pensions in the amount of UAH 249 billion. Compared to last year, the transfer increased by UAH 38.6 billion or 18.3%. According to the plan, the Pension Fund will receive UAH 37.9 billion from the state budget to pay subsidies and benefits for housing and communal services, and UAH 27.7 billion from social security contributions (SSC) to pay social insurance benefits. This year, the Pension Fund’s expenditures are planned to increase to UAH 768.9 billion, which is UAH 178.9 billion or 30% more than the Fund’s actual expenditures in 2022 (Fig. 3).

Fig. 3. Revenues and expenditures of the Pension Fund of Ukraine in June 2022-2023, UAH billion

Source: Pension Fund of Ukraine; CMU Resolution No. 631 of 24.06.2023 On Approval of the Pension Fund of Ukraine Budget for 2023

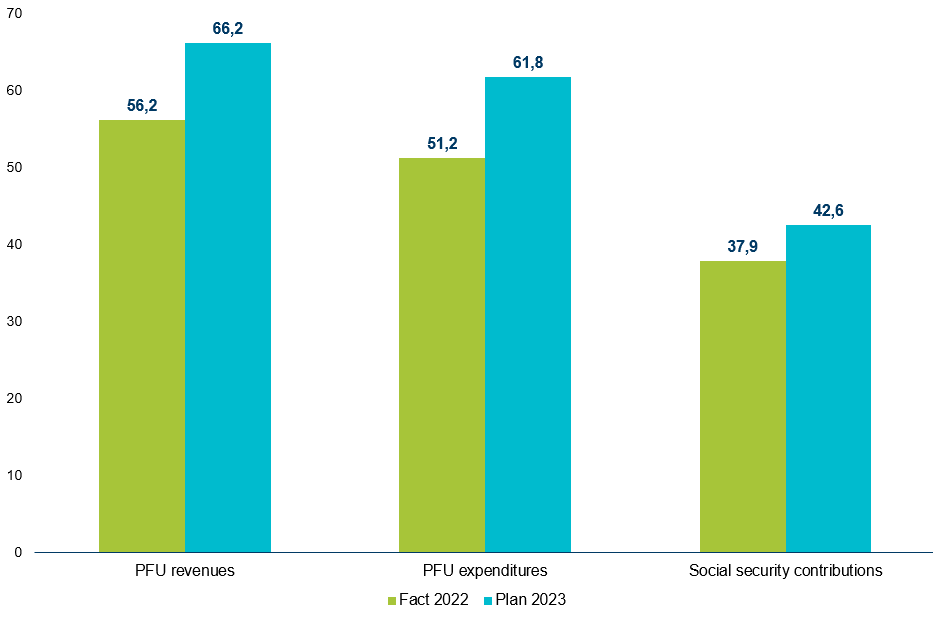

(11) In June 2023, the revenues of the Pension Fund increased by 17.8% or UAH 10 billion compared to the same period last year, reaching UAH 66.2 billion (Fig. 4). This increase can be attributed to higher own revenues of the Pension Fund from the SSC and the expanded authority of the Fund in providing social insurance benefits. The Pension Fund received UAH 2.6 billion from SSC revenues for social insurance payments. From the state budget, UAH 20.5 billion was allocated to the Fund for financing pensions and other related payments in June 2023, which is 5.7% higher than in June last year.

In June, the Pension Fund disbursed UAH 57.6 billion for pension payments, an increase of 12.5% or UAH 6.4 billion compared to the same period last year. Pension expenditures increased by UAH 89 million due to the recalculation of pension amounts for 401,000 working pensioners with supplements for April and May. The pension recalculation was carried out for several groups of pensioners to account for additional insurance periods (24 months or less) after the initial pension appointment/recalculation and to consider insurance periods and wages after the initial pension appointment/recalculation.

(12) Total revenues from the social security contributions in June 2023 increased by 12.4% or UAH 4.7 billion compared to the corresponding period in 2022, reaching UAH 42.6 billion (Fig. 4). This growth is associated with the gradual recovery of economic sectors and the higher minimum wage in June 2023 compared to June 2022 (6,700 UAH compared to 6,500 UAH).

Fig. 4. Revenues and expenditures of the Pension Fund of Ukraine and the SSC in June 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | February | March | April | May | June | ||||||

| Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 | 112,4 | 162,8 | 125,3 | 184,0 | 84,1 | 133,7 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 | 11,8 | 13,4 | 12,0 | 14,1 | 17,2 | 15,0 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 | 1,5 | 2,3 | 24,7 | 28,5 | 2,9 | 2,3 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 | 7,1 | 4,9 | 8,3 | 4,5 | 7,1 | 4,5 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 | 7,4 | 9,9 | 7,7 | 9,5 | 8,3 | 8,8 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 | 16,1 | 16,6 | 14,8 | 17,3 | 15,6 | 17,5 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 | 27,1 | 25,1 | 27,1 | 27,0 | 27,3 | 28,7 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 | 2,0 | 2,2 | 2,1 | 2,5 | 2,0 | 2,6 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 | 220,2 | 229,7 | 282,7 | 277,7 | 303,9 | 264,7 |

| Deficit (-) / surplus (+)* | -158,6 | -78,9 | -168,0 | -93,2 | -144,6 | -72,6 | -106,6 | -65,6 | -155,7 | -91,6 | -219,6 | -130,8 |

| Sources of deficit financing | ||||||||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,8 | 195,1 | 147,3 | 67,9 | 86,9 | 169,3 | 59,4 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,8 | 233,2 | 193,3 | 125,0 | 142,0 | 219,7 | 107,7 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 | -58,5 | -49,0 | -38,1 | -46,0 | -57,1 | -55,1 | -50,4 | -48,3 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine, Center`s calculations

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | February | March | April | May | June | Cumulative (Jan-Jun) | |

| Financing, including | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 | 846,6 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 82,9 | 113,6 | 49,0 | 79,9 | |

| From the placement of domestic government bonds (total), including | 41,4 | 42,6 | 53,7 | 34,0 | 68,6 | 45,4 | 285,7 | |

| in UAH | 38,8 | 30,5 | 36,3 | 25,1 | 29,3 | 28,3 | 188,3 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴8,9

($242,6) |

39,3

($616,4+€418) |

17,1

($319,7+ |

₴97,4

($1963,8+ |

|

| From external sources | 118,7 | 24,1 | 123,1 | 159,3 | 73,4 | 62,3 | 560,9 | |

| Public debt repayments | 12,8 | 34,9 | 49,0 | 46,0 | 55,1 | 48,3 | 246,1 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 120,7 | 96,5 | 95,8 | 96,6 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 13,9 | 45,7 | 33,0 | 116,8 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 101,5 | 90,3 | 84,0 | 89,2 | |

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in January-June

| Resources | Amount, UAH billion

(EUR million; USD million; CAD million) |

| Macro-Financial Assistance in accordance with the Memorandum of Understanding between Ukraine and the EU | ₴357

(€9000) |

| Loans from the Government of Canada | ₴64,2

(CA$2400) |

| IMF funds under the four-year Extended Fund Facility program | ₴99

($2700) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,3

($499,3) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴16,1

(€404,3) |

| Loan from the IBRD within the project “Strengthening the Healthcare System and Saving Lives” | ₴1,3

(€33,4) |

| Loan from the IBRD within the project “Accelerating Investments in Ukraine’s Agriculture” | ₴4,8

($132) |

| Loan from the IBRD within the project “Additional Financing for the Health System Improvement Project” | ₴0,2

($6) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | January | February | March | April | May | June |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 |

| Total borrowed, % for January-June | 26,8 | 11,2 | 29,6 | 32,4 | 19,2 | 12,7 |

| From the placement of domestic government bonds, % for January-June | 24,1 | 24,8 | 31,3 | 19,8 | 28,5 | 15,9 |

| Borrowed from external sources, % for January-June | 27,9 | 5,7 | 29,0 | 37,5 | 14,7 | 11,1 |

| Debt repayment payments, % for January-June | 9,0 | 24,5 | 34,4 | 32,2 | 27,9 | 19,6 |

| Servicing payments, % for January-June | 1,6 | 31,5 | 30,5 | 36,5 | 54,5 | 28,3 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,1 | 133,4 | 41,2 | 26,4 |

Source: Ministry of Finance of Ukraine, Center`s calculations

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations