What happened to the budget in September? Was the revenue plan achieved? What were the main sources of revenue, particularly from key taxes? What risks are emerging for budgetary stability, and what can be anticipated in the future? Read about these and other budgetary issues in the Budget Barometer for September 2023.

What was achieved?

- The revenue plan of the general fund of the state budget for September was exceeded due to the receipt of a grant from the United States, which was not included in the planned revenue indicators. Out of the total revenue of UAH 144.1 billion, the grant amount was 45.7 billion UAH, or 31.7%.

- The actual deficit of the state budget remains smaller than anticipated: in September, it amounted to UAH 87 billion, while for the general fund, it was UAH 85.6 billion, which is 1.8 times less than the planned target. This is primarily a result of including all international aid in the deficit financing in the planned indicators rather than as grants.

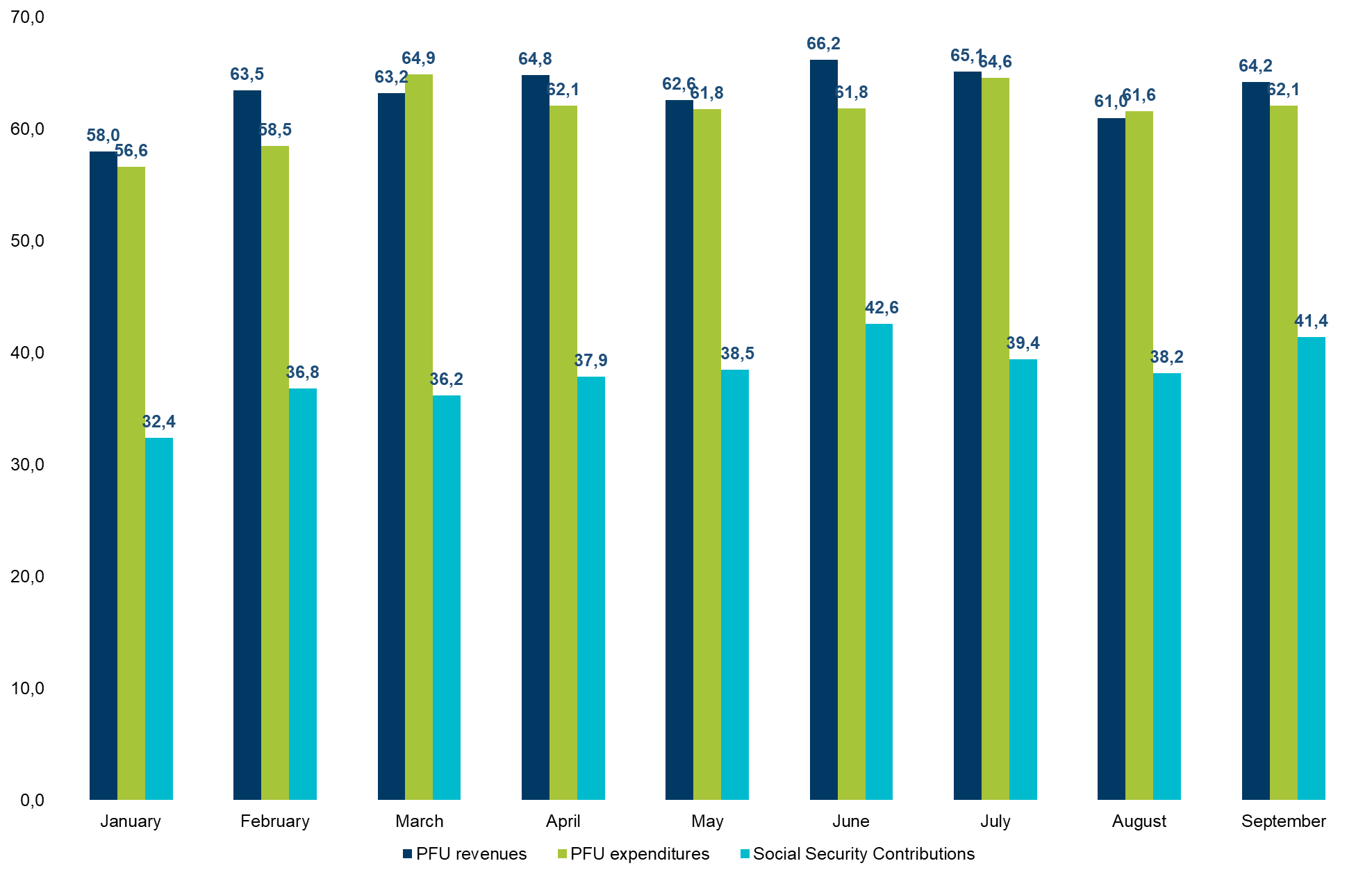

- In September 2023, the revenues of the Pension Fund increased by 15.7% compared to the same period in the previous year, reaching UAH 64.2 billion.

What wasn’t achieved?

- Tax revenues administered by the State Customs Service once again fell short of planned targets, with September’s collection at 92.4%. This is primarily due to a stronger hryvnia than what was anticipated in the state budget.

- The achievement of the tax plan for certain taxes proved elusive. In September, the revenues from domestic and “import” value-added tax (VAT), personal income tax (PIT), and rental fees were lower than expected.

What’s next?

- The Parliament has passed a bill amending the 2023 budget, which includes an increase in expenditures of UAH 371 billion (of which over UAH 300 billion is allocated to defense and security), primarily funded through domestic and foreign borrowing.

- Amendments to the Budget Code are expected to be adopted, whereby revenues from the “military” PIT will flow to the state budget instead of local budgets, starting from October 1 of the current year. According to the Ministry of Finance’s estimates, this change will add over UAH 20 billion to the state budget by the end of 2023.

- The reduction of the Key Policy Rate from 22% to 20% as of September 15, 2023, due to lower-than-expected inflation rates (with annual inflation slowing to 8.6% in August) might decrease the attractiveness of the military government bonds. The interest rate on these bonds is calculated based on the average accounting rate, potentially reducing their appeal to investors.

- The European Parliament has supported the Ukraine Facility initiative, a new financial instrument for Ukraine, with a total allocation of up to EUR 50 billion over four years. In 2024, Ukraine anticipates receiving EUR 18 billion in financial assistance to cover the budget deficit.

Key risks:

- The shortfall in revenue necessary to finance the increased budget expenditures resulting from the recent budget amendments is a significant challenge. The government anticipates covering the deficit through additional placements of government bonds (over UAH 200 billion) and the attraction of external loans (over UAH 90 billion), which may be difficult to achieve in the last quarter of the year (high risk).

- Another concern is the non-receipt of budgetary support from the United States for 2023 and 2024. On September 30, the U.S. Senate passed a temporary budget until November 17, 2023, which does not include financial assistance for Ukraine. It’s worth noting that according to the Minister of Finance of Ukraine, Ukraine expects to receive USD 14 billion in financial assistance from the U.S. in 2024 (high risk).

- Continued dependence on financial support from international partners is a critical factor. The draft Law on the State Budget for 2024 sets external borrowing at UAH 1.8 trillion or USD 43 billion at the exchange rate included in the 2024 State Budget draft. Additionally, the plan for the next year includes receiving UAH 2.4 billion in grants (high risk).

Details:

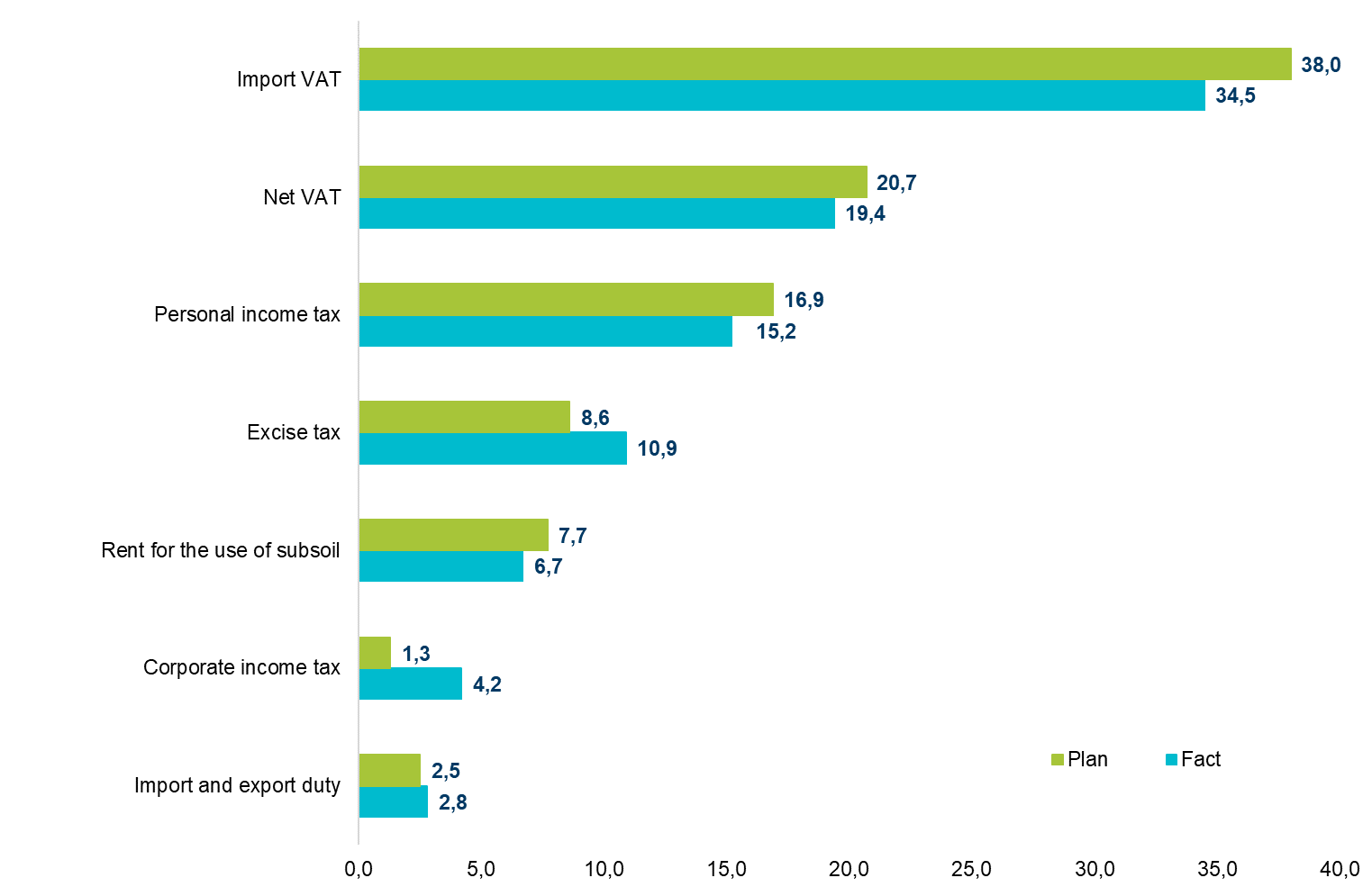

(1) In September, the revenue to the general fund of the state budget amounted to UAH 144.1 billion. Due to a grant from the United States in the amount of UAH 45.7 billion, it was possible to exceed the revenue part of the budget by 44.5%. However, the plan for tax revenues could not be met: it was projected to collect UAH 95.7 billion, but in reality, UAH 2 billion less was received (Figure 1).

Figure 1. Main tax revenues to the general fund of the state budget in September 2023, UAH billion

Source: Ministry of Finance of Ukraine

Actual revenues from the corporate income tax (CIT) exceeded expectations by 3.2 times, reaching UAH 4.2 billion. Companies, including industrial ones, have positively assessed their business results, which suggests the possibility of further exceeding CIT revenues.

The overachievement of the excise tax plan was 26.7% (revenues to the general fund reached UAH 10.9 billion against the planned UAH 8.6 billion). Additionally, UAH 2.8 billion from international trade taxes (primarily import duties) was collected for the general fund, which was 12.0% higher than the plan, as observed in August. This increase is likely due to a higher volume of taxable goods in the import structure for September.

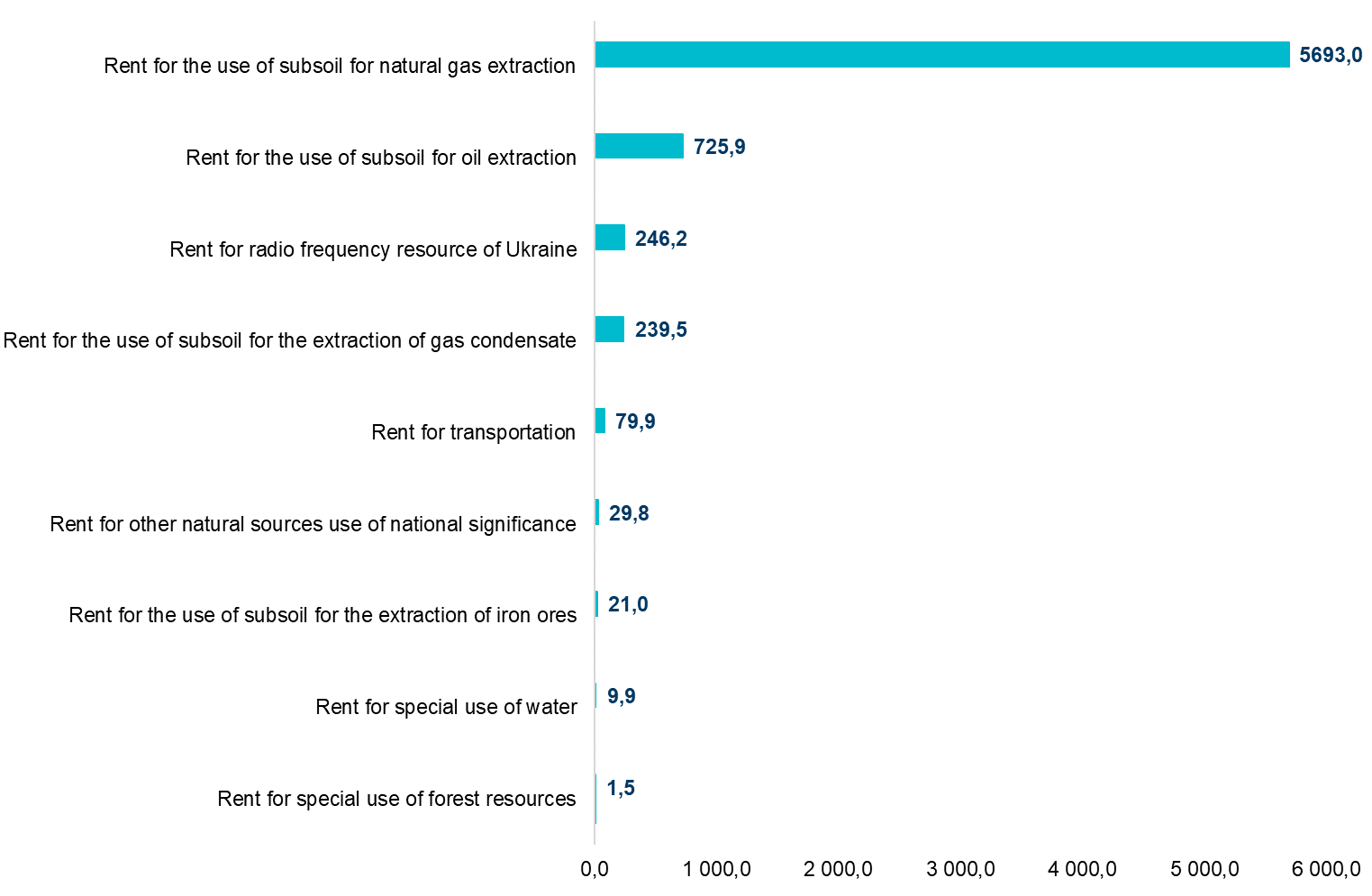

In September, there was again a notable underperformance of planned targets for 4 out of the 7 major taxes. The most significant relative underperformance was related to rent payment for subsoil use (-13%). Total rent revenues in September, based on operational data, amounted to UAH 7 billion, while the plan was UAH 7.9 billion, although this was significantly higher than the previous month (for comparison, UAH 4.7 billion was collected in August). This could be associated with increased natural gas consumption in September compared to August. Traditionally, the most fiscally significant components of rent revenues remain rent for subsoil use in the extraction of natural gas (81% of all rent revenues to the general fund of the state budget; in September, UAH 5.7 billion was collected, which was 87.5% of the monthly plan) and rent for subsoil use in oil extraction (10% of all rent revenues; in September, UAH 0.7 billion was collected, which was 86.4% of the plan).

Figure 2. Rent income in September 2023, UAH million

Source: State Tax Service of Ukraine

In September, the revenue from the PIT did not reach the planned target, amounting to UAH 15.2 billion, which is 10.1% lower than the plan. This decrease might be associated with a smaller-than-expected growth in salaries. Nevertheless, this figure is UAH 600 million higher than in August. Revenue from PIT on earned income constituted over 60%, while revenue from PIT on the monetary support of military personnel made up more than 25% of the total.

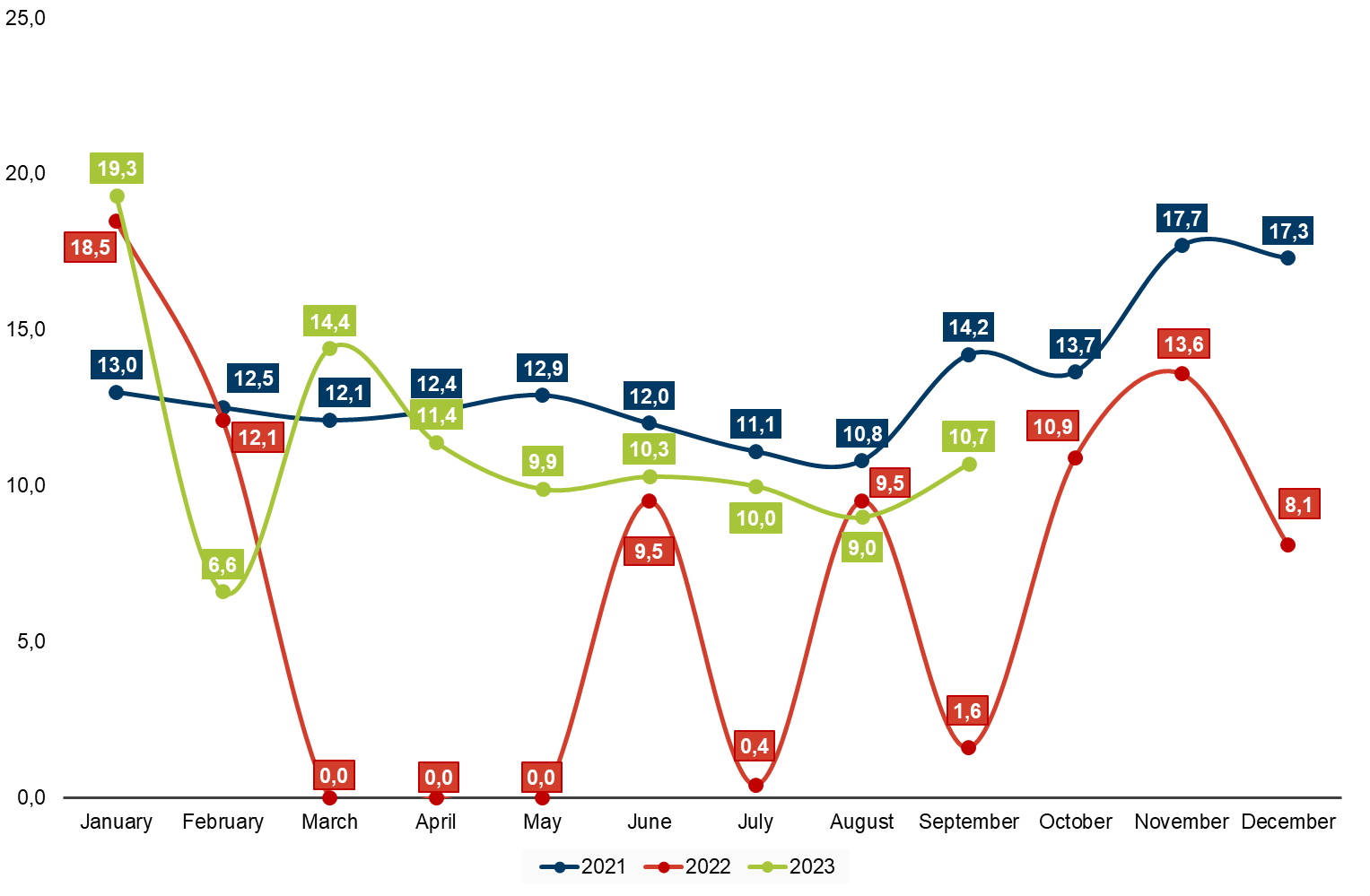

Internal VAT income was UAH 19.4 billion, which is 6.3% below the planned target. This could possibly be attributed to lower inflation than initially assumed in the budget parameters. Additionally, taxpayers were refunded UAH 10.7 billion in VAT. For import VAT, UAH 34.5 billion was collected for the general fund of the state budget, which is 9.2% less than projected. This decrease is likely due to the stronger hryvnia than anticipated during the development of the 2023 state budget.

Figure 3. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

(2) In September, the state budget of Ukraine received a grant from the United States in the amount of USD 1.25 billion (equivalent to UAH 45.7 billion). It’s worth noting that in August, no regular grant was received. These funds are allocated for financing pensions, payments to the State Emergency Service employees, healthcare worker salaries, civil servants, and educational personnel.

(3) In September, the expenditures from the general fund of the state budget totaled UAH 230.2 billion, which is 90.2% of the reported period allocation (the plan was UAH 255.2 billion). According to the plan, the largest expense category is the financing of programs of the Ministry of Defense of Ukraine (UAH 111 billion), of which 55.9% is related to personnel costs (UAH 62.1 billion). The second-largest expense category in the plan includes programs of the Ministry of Internal Affairs – UAH 37.4 billion, primarily for entities under the ministry’s jurisdiction:

- National Guard – UAH 11.9 billion

- National Police – UAH 8.6 billion

- State Border Guard Service – UAH 5 billion

- State Emergency Service – UAH 3.6 billion.

In September, the Ministry of Social Policy was expected to allocate UAH 35.4 billion, out of which UAH 22.7 billion should have been transferred to the Pension Fund.

For servicing the state debt, UAH 13.6 billion was planned, and UAH 14 billion was allocated for programs of the Ministry of Health, of which UAH 11.9 billion was intended for the State Guaranteed Health Care Program.

According to the planned indicators, approximately 58.2% of all expenditures in September were to be directed towards the defense and security sector, 13.9% towards social security, and an additional 5.3% for servicing the state debt.

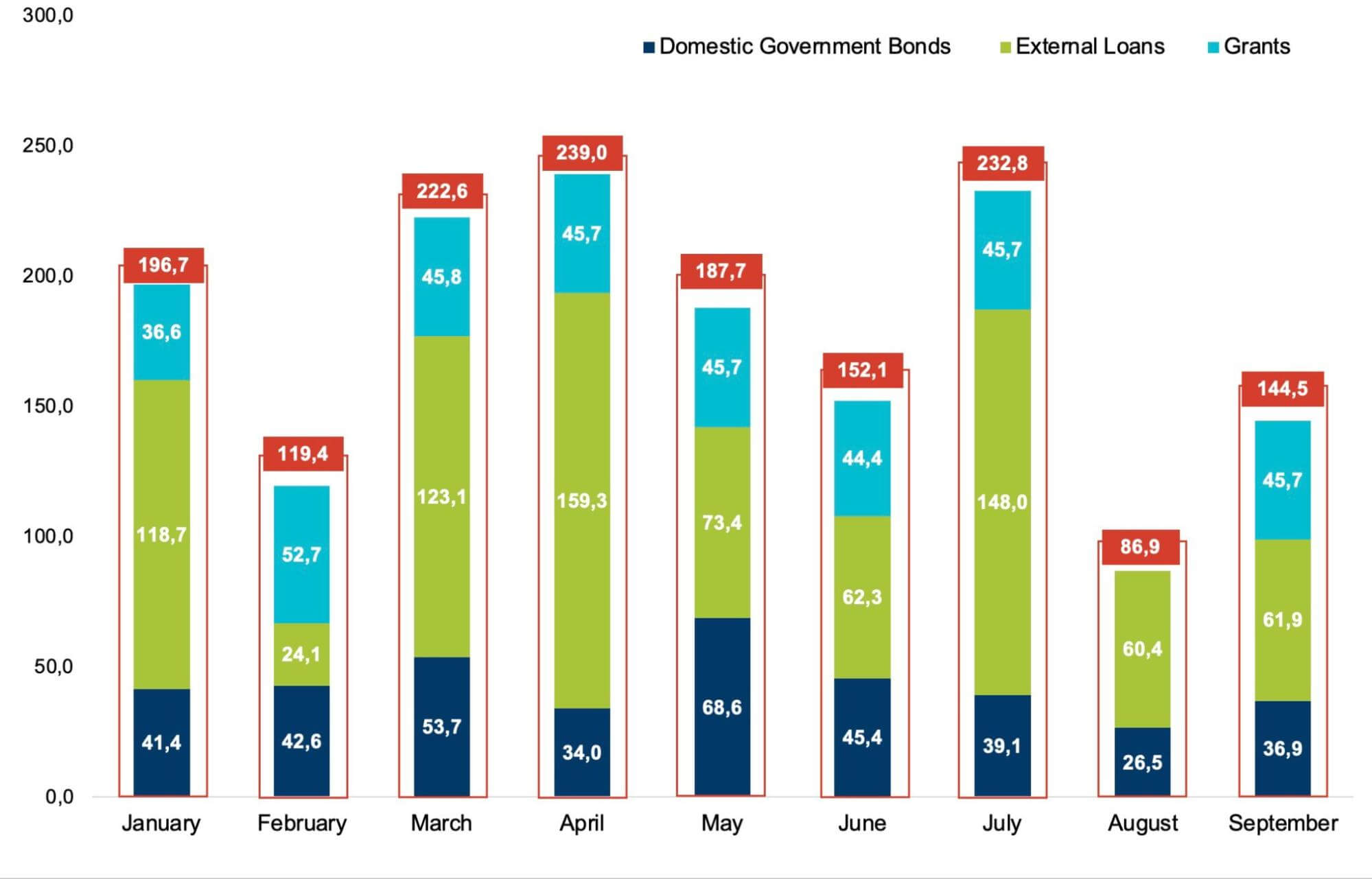

(3) The actual deficit of the state budget in September amounted to UAH 87 billion, while for the general fund, it was UAH 85.6 billion. This is 1.8 times less than the planned (UAH 155.5 billion). In total, for the first three quarters of 2023, the state budget was executed with UAH 801.6 billion deficit, and UAH 835.4 billion for the general fund. This is 1.7 times less than the budget allocation of UAH 1,384.7 billion. Such results were achieved over the course of 2023, in part, by securing financial assistance in the form of grants amounting to UAH 362.3 billion, while the original budget plan envisaged all international assistance in the form of loans.

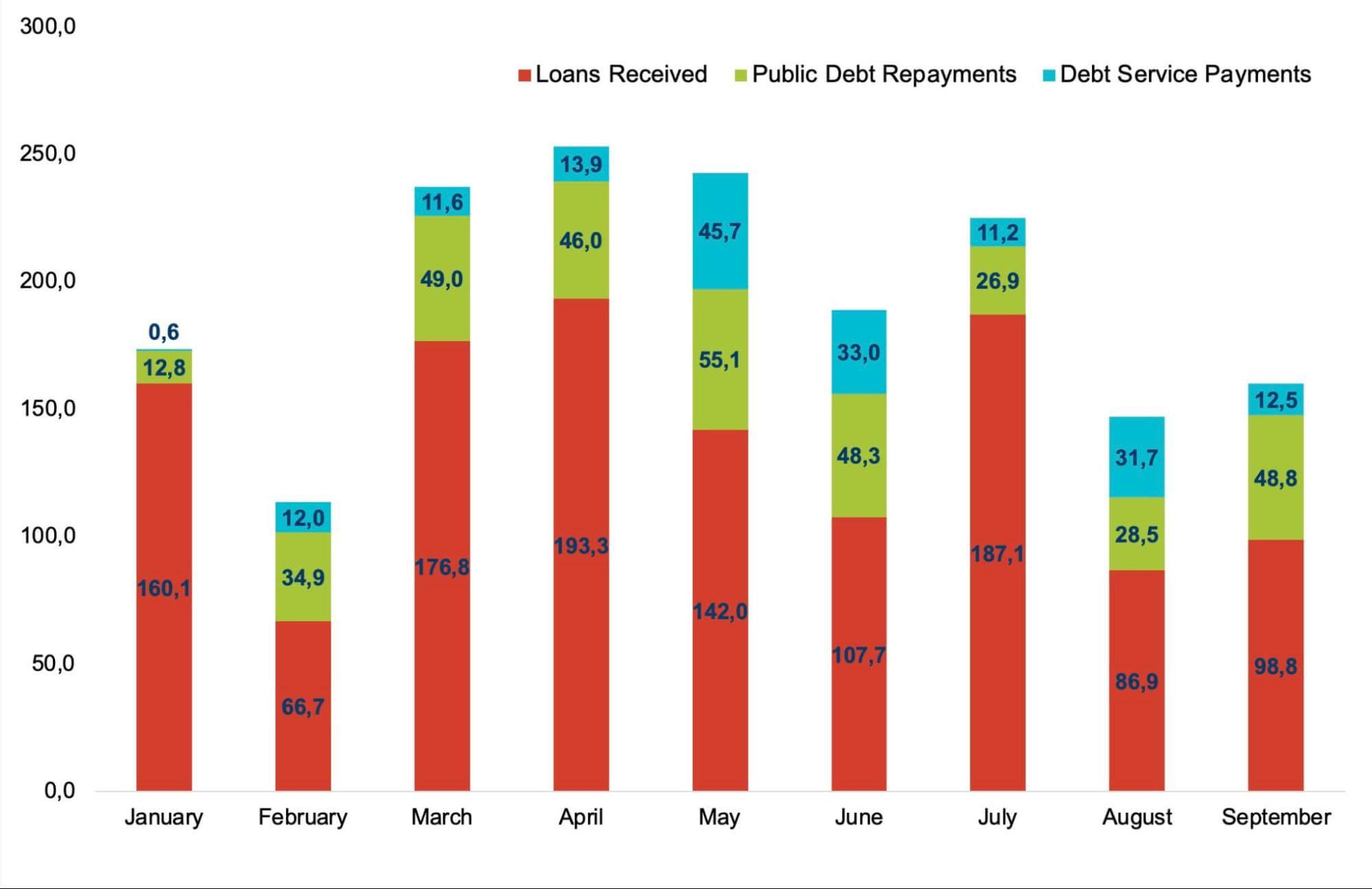

Figure 4. Budget financing for January-September 2023, UAH billion

Source: Ministry of Finance of Ukraine

(4) In September, the state budget received the eighth tranche of macro-financial assistance from the EU, totaling EUR 1.5 billion (equivalent to UAH 58.2 billion). The priority areas for the allocation of these funds are social and humanitarian programs. Additionally, in September, the general fund of the state budget received a loan of USD 100 million (equivalent to UAH 3.7 billion) under the guarantee of the United Kingdom from the World Bank. These funds are intended for partial compensation of the state budget expenditures for pension payments in July 2023. In total, external borrowing in September amounted to UAH 61.9 billion.

(5) In addition to external financing, in September, the Ministry of Finance raised UAH 36.9 billion through the issuance of government domestic loan bonds, of which UAH 10.1 billion, or 27.4%, was issued as benchmark government bonds. The maximum yield level in September was higher than in previous months, and for one of the benchmark government bonds (type UA4000228381) with a three-year maturity, it reached 19.9% (with an average weighted yield of 19.19%).

The high yield can be attributed to the extended maturity period during which inflation, devaluation, and other macroeconomic risks affecting bond yields can occur. In September, UAH 14.1 billion (equivalent to USD 334.6 million and EUR 48.4 million) were raised through bonds denominated in foreign currencies, accounting for 38.2% of the total funds raised through government domestic loan bonds in September. This percentage was significantly higher than in August, when it was only 3%. The Ministry of Finance also noted that the funds raised through government bonds placements during the first three quarters of 2023 were more than sufficient to cover the debt repayments. In particular, borrowing on the domestic debt market exceeded government domestic loan bonds payments by UAH 105.7 billion in the first nine months of 2023, with an excess of UAH 7.8 billion in September. However, the funds raised from government bonds sales in the first nine months of 2023 were UAH 50.9 billion less than the expenses for debt repayment and servicing during this period.

(6) In September, both external and internal borrowings exceeded the expenditures for debt repayment and servicing by UAH 37.5 billion. In total, UAH 61.3 billion was spent on debt repayment and servicing in September, of which 68% (UAH 41.6 billion), was allocated to the internal state debt.

Figure 5. Volume of borrowings, repayments and servicing of public debt of Ukraine for January-September 2023, UAH billion

Source: Ministry of Finance of Ukraine

(7) In September, local budget revenues from payments administered by the State Tax Service amounted to UAH 36.9 billion, which is 13.7% higher than in September of the previous year. As of September 1, 2023, local government accounts had significant balances of UAH 201.8 billion, including funds from the military PIT received up to that point. However, the approval of a bill is expected to transfer further revenues from a portion of the military PIT from local budgets to the state budget from October 1 of this year. This will require local government authorities to make budget amendments and reduce expenditures.

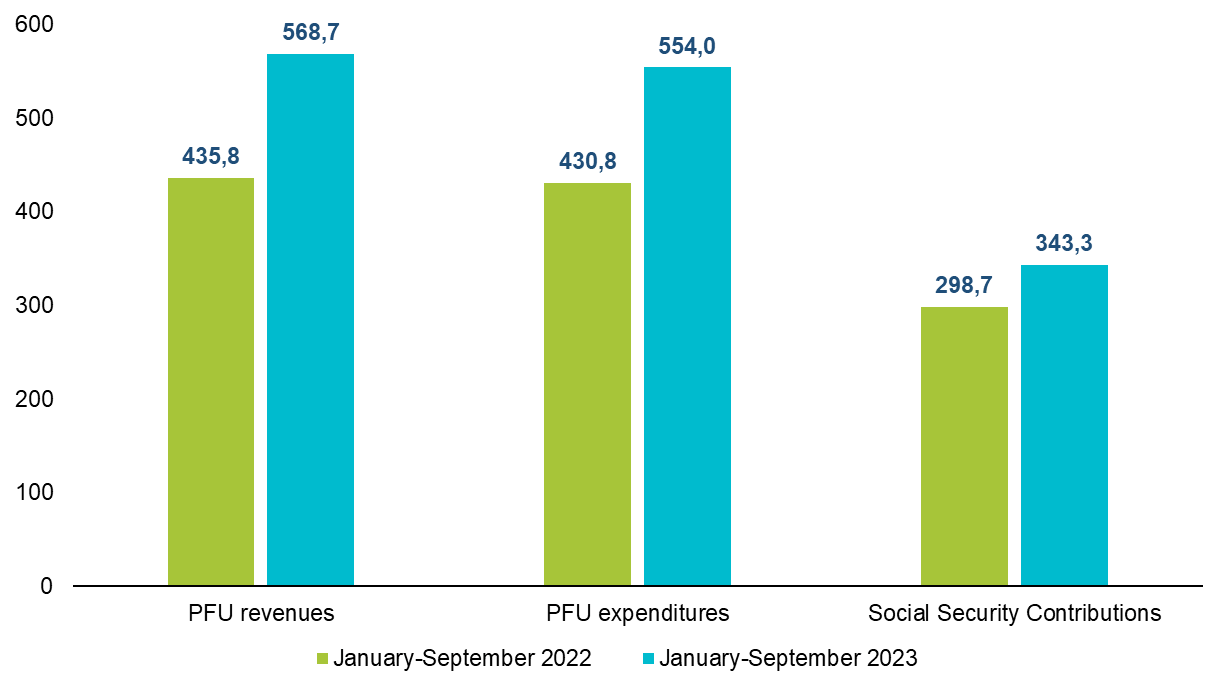

(8) Aggregate revenues from the social security contributions (SSC) in September 2023 increased by 10.4% or UAH 3.9 billion compared to the same period in 2022, reaching UAH 41.4 billion. This growth is associated with the gradual economic recovery, a higher minimum wage in September 2023 compared to September 2022 (UAH 6,700 vs UAH 6,500), and increased contributions from military salaries.

(9) In September 2023, the revenues of the Pension Fund increased by 15.7% or UAH 8.7 billion compared to the same period in the previous year, reaching UAH 64.2 billion. This increase was due to higher own revenues of the Pension Fund from the SSC and the expanded powers of the Fund for providing assistance under social insurance programs. The state budget allocated UAH 21.0 billion to the Pension Fund for financing pension programs and covering the Fund’s deficit in September 2023, which is 9.9% more than the previous year. Additionally, the Pension Fund received UAH 1 billion from the state budget for the payment of subsidies and benefits for housing and communal services, and UAH 2.3 billion from the revenues of the SSC for social insurance payments. In September, UAH 58.3 billion was allocated for pensions, which is UAH 8.8 billion or 17.8% more than in the same period of the previous year. The total expenditures of the Pension Fund in September 2023 amounted to UAH 62.1 billion, exceeding the previous year’s figures by UAH 12.3 billion or 24.7%.

Figure 6. Revenues and expenditures of the Pension Fund of Ukraine, revenues of the Social Security Contributions in January-September 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Figure 7. Monthly dynamics of revenues and expenditures of the Pension Fund, revenues of the Social Security Contributions in January-September 2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | February | March | April | May | June | July | August | September | |||||||||||

| Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 | 112,4 | 162,8 | 125,3 | 184,0 | 84,1 | 133,7 | 89,4 | 136,7 | 124,7 | 124,7 | 99,7 | 144,1 | 884,0 | 1274,8 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 | 11,8 | 13,4 | 12,0 | 14,1 | 17,2 | 15,0 | 14,8 | 15,2 | 16,3 | 14,6 | 16,9 | 15,2 | 123,1 | 125,1 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 | 1,5 | 2,3 | 24,7 | 28,5 | 2,9 | 2,3 | 1,3 | 3,2 | 24,1 | 30,9 | 1,3 | 4,2 | 83,4 | 106,2 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 | 7,1 | 4,9 | 8,3 | 4,5 | 7,1 | 4,5 | 7,0 | 5,4 | 8,7 | 4,2 | 7,7 | 6,7 | 64,8 | 46,2 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 | 7,4 | 9,9 | 7,7 | 9,5 | 8,3 | 8,8 | 8,6 | 8,7 | 8,4 | 10,1 | 8,6 | 10,9 | 66,9 | 80,0 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 | 16,1 | 16,6 | 14,8 | 17,3 | 15,6 | 17,5 | 19,1 | 18,7 | 24,0 | 20,0 | 20,7 | 19,4 | 161,8 | 146,4 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 | 27,1 | 25,1 | 27,1 | 27,0 | 27,3 | 28,7 | 30,0 | 30,8 | 36,1 | 34,0 | 38,0 | 34,5 | 266,0 | 260,9 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 | 2,0 | 2,2 | 2,1 | 2,5 | 2,0 | 2,6 | 2,3 | 2,4 | 2,5 | 2,8 | 2,5 | 2,8 | 19,7 | 22,3 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 | 220,2 | 229,7 | 282,7 | 277,7 | 303,9 | 264,7 | 251,0 | 231,9 | 279,8 | 248,2 | 255,2 | 230,2 | 2312,2 | 2117,9 |

| Deficit (-) / surplus (+)* | -156,6 | -78,9 | -165,7 | -93,2 | -130,5 | -72,6 | -102,7 | -65,6 | -152,7 | -91,6 | -215,3 | -130,8 | -153,7 | -94,9 | -152 | -122,2 | -155,5 | -85,6 | -1384,7 | -835,4 |

| Sources of deficit financing | ||||||||||||||||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,8 | 195,1 | 147,3 | 67,9 | 86,9 | 169,3 | 59,4 | 82,4 | 160,2 | 67,3 | 58,4 | 50,3 | 50 | 1005,1 | 869,1 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,8 | 233,2 | 193,3 | 125 | 142 | 219,7 | 107,7 | 112,9 | 187,1 | 97,1 | 86,9 | 100,6 | 98,8 | 1370,6 | 1219,4 |

| Repayments | 13,1 | 12,8 | 37,7 | 34,9 | 58,5 | 49 | 38,1 | 46 | 57,1 | 55,1 | 50,4 | 48,3 | 30,5 | 26,9 | 29,8 | 28,5 | 50,3 | 48,8 | 365,5 | 350,3 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | February | March | April | May | June | July | August | September | January- September |

|

| Financing, including: | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 | 187,1 | 86,9 | 98,8 | 1219,4 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 82,9 | 113,6 | 49,0 | 165,7 | 89,5 | 98,2 | 89,0 | |

| From the placement of domestic government bonds (total), including: | 41,4 | 42,6 | 53,7 | 34,0 | 68,6 | 45,4 | 39,1 | 26,5 | 36,9 | 388,2 | |

| in UAH billion | 38,8 | 30,5 | 36,3 | 25,1 | 29,3 | 28,3 | 30,8 | 25,7 | 22,8 | 267,6 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴8,9

($242,6) |

39,3

($616,4+€418) |

17,1

($319,7+€136) |

8,3

($227,3) |

0,8

(€20) |

14,1

($334,6+€48,4) |

₴ 120,6

($2525,7+ €709,3) |

|

| From external sources, UAH billion | 118,7 | 24,1 | 123,1 | 159,3 | 73,4 | 62,3 | 148 | 60,4 | 61,9 | 831,2 | |

| Public debt repayments, UAH billion | 12,8 | 34,9 | 49,0 | 46,0 | 55,1 | 48,3 | 26,9 | 28,5 | 48,8 | 350,3 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 120,7 | 96,5 | 95,8 | 88,2 | 95,6 | 97,0 | 95,8 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 13,9 | 45,7 | 33 | 11,2 | 31,7 | 12,5 | 172,2 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 101,5 | 90,3 | 84,0 | 151,4 | 101,9 | 91,9 | 94,1 | |

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in January-September 2023

| Resources | Amount, UAH billion

(EUR million; USD million; CAD million) |

||

| Programs of macro-financial assistance from the EU for 2023 | ₴536

(€13500) |

||

| Loans from the Government of Canada | ₴64,2

(CA$2400) |

||

| IMF funds under the four-year Extended Fund Facility program | ₴131,4

($3590) |

||

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,3

($499,3) |

||

| IBRD Loan for Development and Recovery Policy | ₴54,9

($1500) |

||

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴16,1

(€404,3) |

||

| Loan from the IBRD within the project “Strengthening the Healthcare System and Saving Lives” | ₴1,7

(€42,3) |

||

| Loan from the IBRD within the project “Accelerating Investments in Ukraine’s Agriculture” | ₴4,8

($132) |

||

| Loan from the IBRD within the project “Additional Financing for the Health System Improvement Project” | ₴0,2

($6) |

||

| IBRD Loan under the Fifth Additional Funding for the Project “Support for State Expenditure to Ensure Sustainable Public Governance in Ukraine” | ₴3,7

($100) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | January | February | March | April | May | June | July | August | September |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,8 | 193,3 | 142 | 107,7 | 187,1 | 86,9 | 98,8 |

| Total borrowed, % for January-September | 13,1 | 5,5 | 14,5 | 15,9 | 11,6 | 8,8 | 15,3 | 7,1 | 8,1 |

| From the placement of domestic government bonds, % for January-September | 10,7 | 11,0 | 13,8 | 8,8 | 17,7 | 11,7 | 10,1 | 6,8 | 9,5 |

| Borrowed from external sources, % for January-September | 14,3 | 2,9 | 14,8 | 19,2 | 8,8 | 7,5 | 17,8 | 7,3 | 7,4 |

| Debt repayment payments, % for January-September | 3,7 | 10,0 | 14,0 | 13,1 | 15,7 | 13,8 | 7,7 | 8,1 | 13,9 |

| Servicing payments, % for January-September | 0,3 | 7,0 | 6,7 | 8,1 | 26,5 | 19,2 | 6,5 | 18,4 | 7,3 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,2 | 133,4 | 41,2 | 26,4 | 149,0 | 26,7 | 37,5 |

Source: Ministry of Finance of Ukraine, Center`s calculations

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations