After almost 20 months into the full-scale war, Ukraine’s banking sector continues to demonstrate remarkable resilience and keeps functioning as the backbone of the real economy. No bank runs have occurred, and access to cash was maintained even during electricity blackouts last winter. The capital adequacy ratio (CAR) is appropriately high, and the liquidity coverage ratio far exceeds required levels.

In addition to crucial reforms since 2014, comprehensive measures by the National Bank of Ukraine (NBU) and a strong level of digitalization are key reasons for the observed stability. However, a large liquidity buffer is not only a sign of resilience. It also reveals lack of lending. The bank loan portfolio declined by around 30% compared to pre-war levels in real terms. As lending to the private sector is an essential part of capital investment recovery, more reforms and measures are needed to prepare the sector for its key role in driving Ukraine’s economic reconstruction.

Reforms prepared the sector for the crisis

Ukraine’s banking sector had a rather low asset-to-GDP ratio of 40% in 2022. This ratio is similar to Romania, but much lower than that in Poland or Hungary. Ukraine’s banking sector is characterized by a moderate level of concentration of the Top-5 banks – similar to the aforementioned countries – but a high level of state ownership, accounting for 50% of net assets (this ratio is rather stable since 2017). These developments are the results of different past reforms since Russia’s aggression against Ukraine started in 2014. The NBU gradually has been incorporating the Association Agreement with the EU on financial sector regulation, conducting comprehensive asset quality reviews (AQR) and stress-tests, as well as increasing and enforcing (!) capital and liquidity requirement ratios. Many banks have been liquidated or nationalized, if these requirements were not met. As a result, the number of banks halved between 2015 and 2022, while CAR strongly increased, reaching 21% of risk-weighted assets in November 2021 compared to 12.3% at the end of 2015. As a result, the sector faced the consequences of Russia’s full-scale war well prepared. Privatization of banks will become relevant again after the war.

Stable deposits reveal trust in the sector

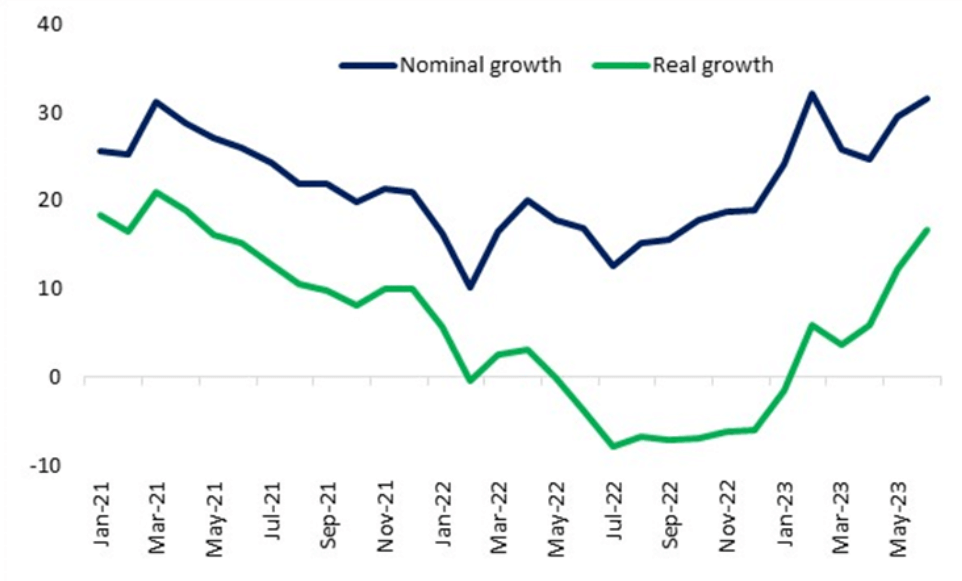

Russia’s war has massive consequences for development. Nevertheless, no bank runs occurred, and deposit growth, which was positive in nominal terms, has started accelerating even in real terms since February 2023 (figure 1). This development clearly shows reduced private consumption on the one hand. On the other hand, it shows the increased demand for time deposits and inflows to bank accounts (which are to some extent based on salaries for military personnel). This is a strong sign of trust in the sector.

Figure 1. Deposit growth

Source: NBU

The ratio of non-performing loans (NPLs) to total loans had been on a declining path before the full-scale war but has been steadily growing since the start of the war. This observation can be partially associated with an easing of NPL regulation between February and June 2022, and postponed NPL reduction operations by banks. Therefore, the resumption of resilience assessments is essential to uncover hidden risks. In addition, CAR has recovered and reached the level of November 2021 in March 2023 due to improved profitability. This is a further sign of resilience. Further profitability expectations are subject to risks from yet hidden NPLs. Having a full picture of NPL risks to profitability expectations is an important precondition for assessing windfall tax considerations for this sector. On the one hand, this policy would provide additional tax revenues of ca. UAH 10 bn p.a. (ca. USD 0.3 bn) at a time when the budget deficit of ca. USD 40 bn is unprecedentedly large and Ukraine is dependent on foreign financing. On the other hand, reduced profits would spillover into reduced room for aligning with capital requirements for resilience of the sector. Moreover, this tax would display a break on bank lending recovery. Balancing this trade-off once again highlights the need for comprehensive asset quality reviews and resilience assessments.

Crisis management

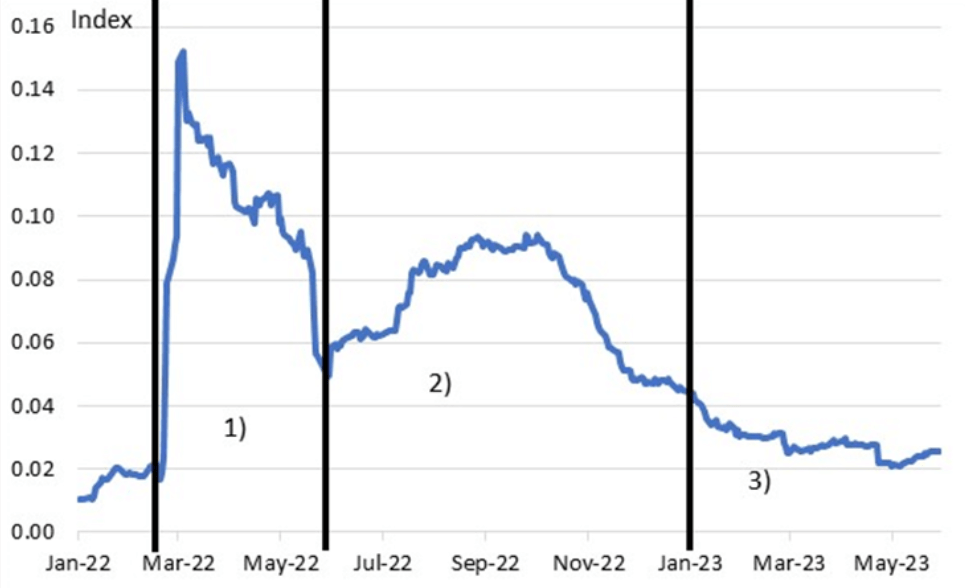

The NBU’s timely and comprehensive crisis management was the critical pillar of the stability of the sector. Its measures were decisive at the beginning of the war, as the financial stress level was higher than during the first war shock of 2014 or during the COVID pandemic (figure 2). NBU policy can be divided into three stages.

Figure 2. Financial stress index for the banking sector

Source: NBU

- Emergency: At the beginning, the NBU introduced different measures to ensure access to liquidity, particularly launching unsecured refinancing loans to banks, while regulation changes and AQRs were postponed. Strict capital controls were introduced, the exchange rate fixed, and key policy rate decisions suspended. Moreover, the NBU financed the budget directly (seigniorage) with UAH 400 bn (~ USD 12 bn) contributing to inflation growth.

- Adjustment: A few months into the full-scale war, the NBU adjusted the exchange rate from approx. UAH/USD 29 to UAH/USD 36.57 responding to trade imbalances and hiked the key policy rate from 10% to 25% p.a. Later in 2022, measures were implemented to maintain cash access at the time when Russia’s attacks caused electricity blackouts.

- Recovery: Since the beginning of 2023, the NBU has stopped funding the budget while banks are incentivised to play a larger role in state government bond purchases. Moreover, the NBU gradually liberalised capital controls since then and started a policy rate easing cycle due to declining inflation. Reserve requirements have been increased and a resilience assessment schedule has started. The macro-financial stability allowed the NBU to return to a managed flexible exchange rate regime on 03 October – a remarkable step towards the market mechanisms. This has been a significant move revealing trust of households and businesses to the overall economy.

Digitalisation

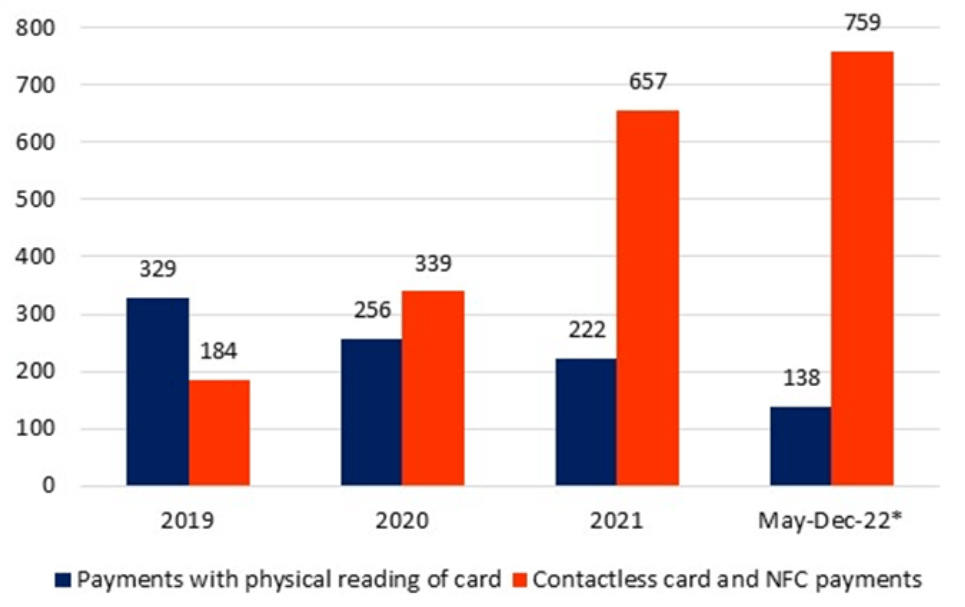

Another reason for the unimpeded functioning of the sector is the strong digital transformation in recent years accelerated during COVID. Contactless card and NFC payments rose at least fourfold between 2019 and 2022 (figure 3). Also, Apple Pay access is available in 75% of all commercial banks in June 2023 – more than in Poland or Hungary. According to international experience, digital transformation advances communication and increases access to bank services for customers. This is particularly vital during the war, as millions of Ukrainians are internally displaced or migrated abroad. The continuation of communication and services is a key element of maintaining trust in the sector and it keeps the economy functioning.

Figure 3. Card and digital transaction volume in Ukraine

Source: NBU, *no data for Jan-Apr-22

The sector’s future role in Ukraine’s reconstruction

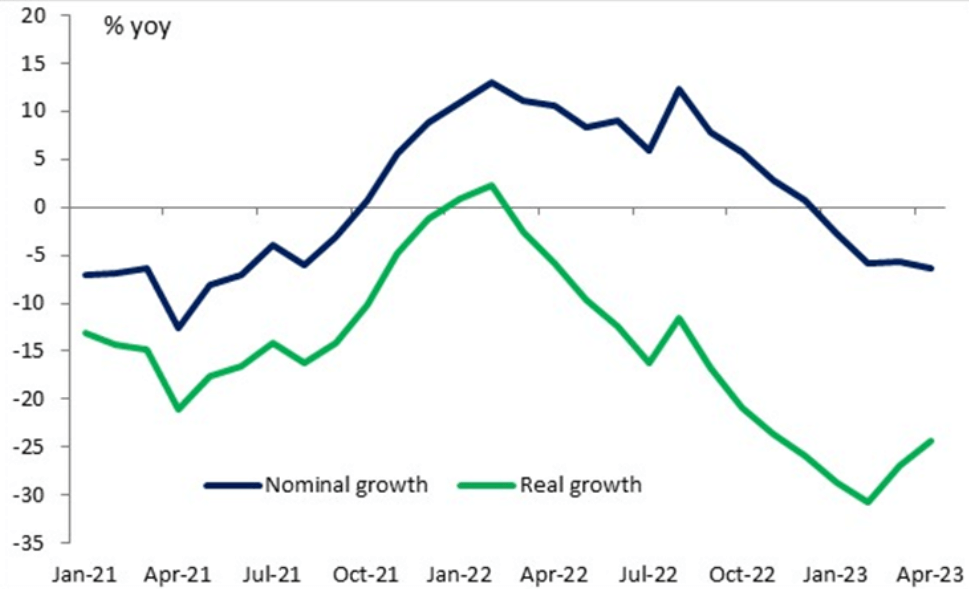

The NBU recently published a financial sector development strategy to prepare the sector for its future role in macroeconomic and financial stability as well as in economic recovery. Improvements in corporate governance practice, adjustments of regulation to EU standards as well as comprehensive resilience assessments are set to be vital. Globally, banks usually play a powerful role in financing investments for economic growth. This is not the case in Ukraine yet (figure 4). Lending has fallen similar to GDP (by nearly 30%) in real terms and the decline would have been even stronger without the state subsidy programme (1/3 of corporate lending in UAH, and 90% of new loans, are subsidised by the state). As the key policy rate has been cut from 25% p.a. to 16% p.a. between July-October 2023, a reactivation of non-subsidised lending may have a window of opportunity to reduce fiscal costs and state crowding-out. A first step in this direction could be extending state lending guarantee instead of state lending subsidy programmes.

Figure 4. Lending growth

Source: NBU

Banks charge risk premia and prefer low-risk assets like government bonds to lending. As a result, the liquidity coverage ratio has grown strongly, exceeding the required norm by 330%.

Outlook

Overall, banking sector stability is a necessary, but not a sufficient condition for it to be able to take the key role in Ukraine’s reconstruction. More measures and international support are needed for the sector to reduce lending costs and boost lending volumes. Thereby, the enlargement of public guarantee schemes for private investment can be considered as an instrument to back up banks’ risks in financing private investment. Concrete steps in this regard would undoubtedly mark a milestone for the sector’s participation in Ukraine’s reconstruction.

This article is based on the Banking Sector Monitor Ukraine written in cooperation with the Institute for Economic Research and Policy Consulting and the Centre for Economic Strategy.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations