Russia’s actions have significantly reduced Ukraine’s production and export capabilities. Can the Export Credit Agency contribute to significant export growth?

Export plays a key role in generating foreign currency revenue, which, along with financial support from partners, allows to purchase necessary military (and non-military) goods abroad. Since exports are less sensitive to domestic market problems related to the war, export-oriented sectors support stability of employment and income generation, contributing to the reduction of social tension.

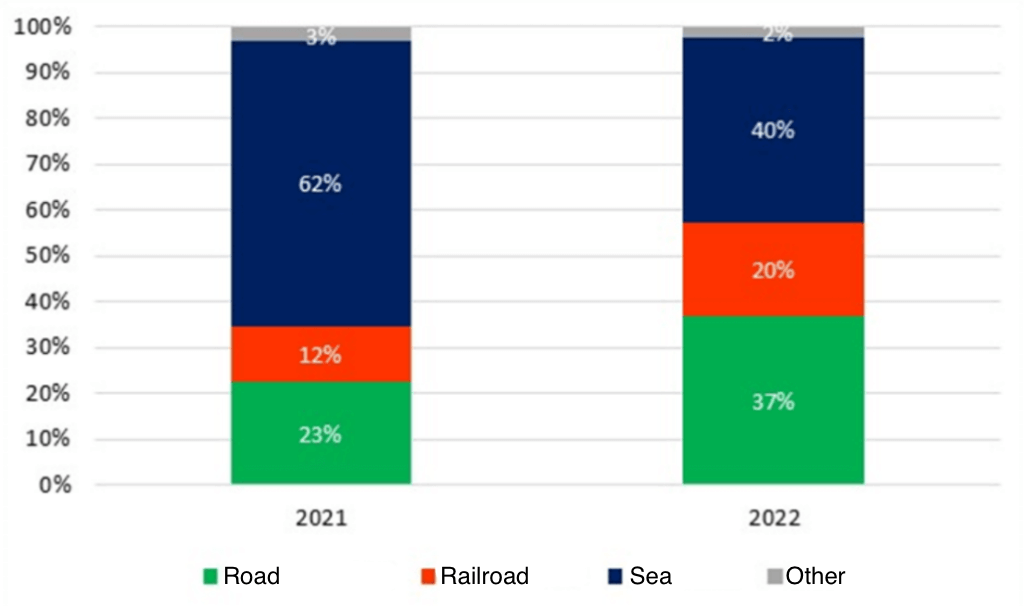

Wartime conditions have had a significant impact on the dynamics of foreign trade. According to data from the State Statistics Service, the volume of goods exports decreased from $48 billion in the first nine months of 2021 to $27.1 billion in the same period of 2023, which implies a decrease from 36% to 20% of GDP for the respective periods. This decline has been due not only to logistical constraints but also due to the destruction of enterprises, the departure or mobilization of workers, and power outages due to shelling. These factors have affected not only physical production but also the export of services, particularly in the IT sector. Additionally, Russia has managed to significantly restrict maritime exports from Ukraine, leading to a shift in the structure of goods transportation in favor of rail and road transport (see Figure 1). Alternative routes through land borders with the EU are more expensive and have lower capacity.

Figure 1. Export Structure (in billion US dollars) by Modes of Transport, %

Sources: State Statistics Service publication “Ukraine’s Foreign Trade, 2021” and State Statistics Service publication dated January 23, 2023.

What instruments does the state have to support the export of goods and services? Primarily, these are financial instruments.

Specialized financial institutions such as development banks, development funds, or export credit agencies (ECAs) work rather well worldwide. Currently, only an ECA has been established and is operational in Ukraine.

Private Joint Stock Company “Export Credit Agency” is a financial organization established in 2018, fully owned by the state (Cabinet of Ministers of Ukraine), engaged in commercial activities, and regulated by the National Bank of Ukraine (in January 2023, the NBU issued the regulation of activities of ECA as a special status insurer). The main functions of ECA include reducing the risks of export operations and expanding exporters’ access to financing. Specifically, ECA is involved in insurance, reinsurance, and providing guarantees, participating in the implementation of programs for partial compensation of interest rates on export credits under the “Affordable Loans 5-7-9%” state program. ECA’s partner banks do not need to set up additional reserves for export financing because ECA’s guarantees and insurance contracts serve as loan guarantees. Additionally, starting from January 1, 2024, ECA will be able to provide insurance for export credits and investments against war risks. However, despite legal enabling of this activity, ECA will need to secure funds for this purpose, such as capital from the public budget or external investors.

Today, the volume of operations carried out by ECA is relatively small, but it is gradually increasing. For instance, ECA supported export contracts worth UAH 82.3 million in 2021, UAH 3.2 billion in 2022, and a whopping UAH 5 billion in the first ten months of 2023. However, this still represents less than 0.5% of Ukraine’s exports. For comparison, member countries of the Berne Union, the International Union of Credit & Investment Insurers, insure payment risks of banks, exporters, and investors for approximately $2.5 trillion per year, which is equivalent to 13% of global cross-border trade in goods and services.

Developed countries provide the largest volumes of export financing

In 2021, the top five countries that provided the largest volume of official medium- and long-term financial export support were: China ($11 billion), Italy ($10.9 billion), Germany ($7.2 billion), France ($5.9 billion), and Sweden ($5.4 billion). As of the first half of 2023, 25 ECAs are operating in 21 EU countries, which in 2020 provided exporters with loans totaling EUR 85 billion and insured risks worth EUR 362 billion.

In our opinion, with appropriate changes to the legislation, ECA can expand its activities as a financial institution by attracting funds and providing guarantees not only for exports but also for projects that will enhance the capacity of logistic routes for Ukrainian exports. These projects could include:

- Participating in or attracting investors into projects of reconstruction of railway transshipment points from broad gauge to standard gauge with corresponding elevators and warehouse facilities.

- Guaranteeing or attracting international financing for developing railway infrastructure and border control points of neighboring countries, taking into account long queues of wagons, especially due to physical constraints at customs control points.

- Financing the construction or expansion of key export highways in Ukraine to speed up the turnover of cargo transport.

- Projects for logistics infrastructure construction (e.g., a logistics hub construction project) could be expedited with ECA support.

In addition, as a coordinator for fund mobilization and/or risk insurance, ECA could participate in reconstruction projects, including “green” reconstruction. For example, in South Korea in 1969, the construction of a nuclear power plant was partially financed with assistance from the Export-Import Bank of the United States. Similarly, in China, the local ECA (Export Credits Guarantee Department) provided guarantees for expanding power plant construction by Shandong Zhongua Power Company.

In the face of challenges related to the physical movement of goods, export of services, particularly IT services, has become a lifeline for the Ukrainian economy. In 2022, the share of IT services in total exports reached 12.9%, and exceeded 45% in the export of services. However, in 2023, there was a decline in the real volume of exports in this sector, highlighting the importance of providing support to sustain it.

The challenges faced by the IT sector can be divided into external (such as global job cuts in the IT sector and a corresponding decrease in demand for IT services during 2022-2023) and internal (some companies refusing to work with Ukraine due to the war, and the relocation and change of residency of Ukrainian IT professionals). One of the main internal challenges that IT company executives see is the reservation of specialists, which ECA cannot currently address. However, it could potentially take on certain organizational aspects to help mitigate this issue.

Firstly, the challenges related to traveling abroad for meetings with foreign clients are particularly important for companies providing outsourcing or outstaffing services, as well as for attracting investments and setting up joint projects. ECA could potentially play a role in verifying companies and providing lists for permits for such trips (similar to the mechanism in place for religious, cultural, and sports organizations). Such a mechanism would be relevant not only for the IT sector but also for other industries where in-person communication is crucial, including companies in the creative industry. For companies registered in Diia City or GIG contractors, this mechanism could also be extended to individual entrepreneurs – a critical need recognized by leaders in the Ukrainian IT market.

Secondly, the challenges related to expanding into new markets could benefit from ECA’s active marketing support for Ukrainian developers in global IT and other service markets. While Ukrainian legislation does not explicitly state this, many foreign ECAs perform this function. Including marketing support into ECA’s tasks, especially within the framework of the law’s provisions aimed at “enhancing the competitiveness of Ukrainian products (works, services) in global markets,” could contribute to promoting Ukrainian exports.

Is there an alternative to ECA in terms of financial support for exporters in Ukraine? In the summer of 2023, following the Ukraine Recovery Conference, the launch of the Ukrainian Development Fund was announced. The Fund would be financed by the Ministry of Economy of Ukraine and supported by Blackrock, JP Morgan, and McKinsey. Furthermore, there is a discussion about the possibility of creating a state development bank similar to successful banks in Germany (KfW), China (China Development Bank, Export-Import Bank of China, Agriculture Development Bank of China), Japan (BOJ), and Brazil (BNDES).

National development banks (there are approximately 500 of them in the world as of 2021) provide long-term loans for infrastructure and industrial projects aimed at improving energy efficiency and resilience in national economies. Development banks typically have lower liquidity risk due to their use of derivative instruments exclusively for hedging their operations, and their activities are non-profit. Both development banks and ECAs contribute to economic development but have different financing objectives. ECAs focus on export development and consequently support exporters, while development banks primarily finance domestic projects, often infrastructure development projects. In the context of weak institutions, the risks for a development bank include improper allocation and misuse of funds, which can lead to the accumulation of non-performing loans. Therefore, the feasibility of creating a Ukrainian development bank is still under discussion.

At the same time, ECA already operates as a state development institution, and one of its tasks is “cooperation with international and foreign financial organizations, including the accumulation of international financial assistance, to promote export growth and the national economy.” In other words, the Ukrainian ECA has the legislative potential to address the trade deficit, develop logistics infrastructure, and attract funds for recovery by simplifying access for export-oriented enterprises to bank financing and insurance of investments for both Ukrainian and foreign companies in Ukraine, particularly concerning military risks.

Currently, ECA provides consulting services and organizes international events in collaboration with the Entrepreneurship and Export Promotion Office. Additionally, it cooperates with foreign ECAs in terms of reinsuring investments in Ukraine. Strengthening the dialogue between ECA and businesses will demonstrate to commercial banks and private insurance companies that lending and insuring in an uncertain economic environment can be a widespread and profitable activity.

Therefore, despite the shortage of financial resources, ECA can expand its activities both within the country and on the international arena. In Ukraine, it can promote its services among Ukrainian businesses and partner banks and actively participate in addressing local issues facing Ukrainian exporters. On the international market, ECA could engage foreign ECAs and financial institutions more actively in financing and insuring military risks for projects related to the development of export logistics infrastructure, energy recovery, and other promising sectors of the economy. Additionally, it can promote Ukrainian goods and services in foreign markets.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations