To revive lending, one needs to strengthen national institutions, primarily those related to the rule of law, rather than weaken supervisory standards for financial institutions or capital regulations. This will reduce risks and thus allow issuing more loans with the same level of banking capital.

Introduction

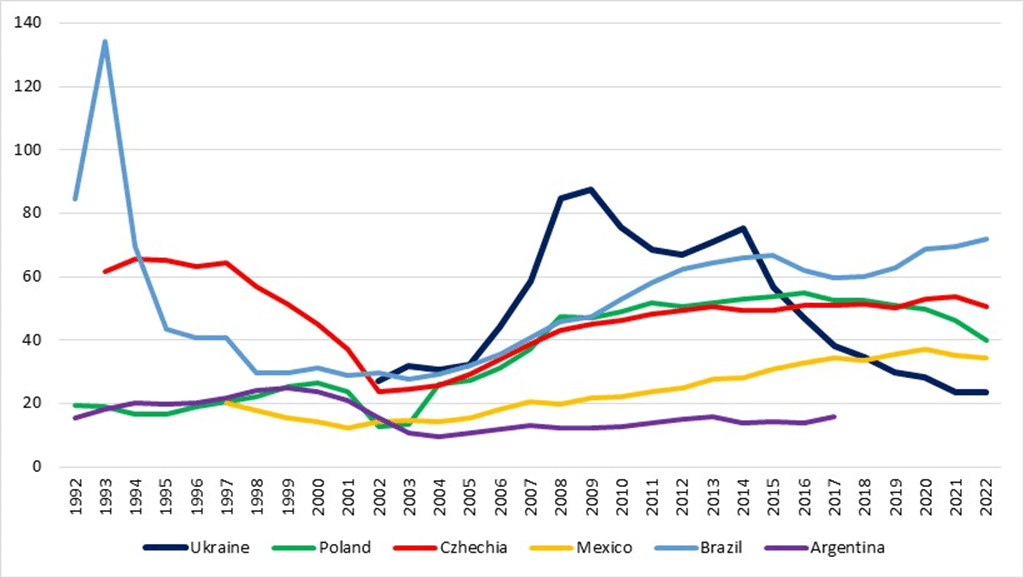

The decline of credit depth (the ratio of outstanding loans to GDP) during the war in Ukraine poses a serious challenge to the recovery and further transformation of the economy. Ukraine’s 12% of gross loans to GDP ratio is much lower than in other emerging market countries (see Figure 1). One reason is that the numerator (outstanding loans) is growing slower than the denominator (nominal GDP, which is increasing due to inflation).

However, if we look at the situation over time, there was an unusual increase in bank lending in the early 2000s, which significantly decreased due to the 2008 financial crisis and the Russian attack in 2014-2016. Loans never returned to their peak levels which suggests that some severe structural distortions inflated lending in the past and that assumptions about a rapid increase in credit depth today are wrong.

Active work on reviving lending in Ukraine is an essential prerequisite for post-war recovery and a factor in the economy’s adaptability during the war. At the same time, any lending development programs should stand on the principle that financial development is a product of structural factors, and not of the arbitrary application of financial stability regulations.

Development of lending in Ukraine

The decline in credit depth in Ukraine began in 2008. Long-term data indicates that the high ratio of loans to GDP in the early 2000s was an anomaly (“bubble”) for Ukraine rather than the norm. Among the countries shown in Figure 1, Ukraine had the highest domestic credit-to-GDP ratio at the start of the global financial crisis. Later this ratio decreased, significantly increased by 2014, but then continued to decline to a level much closer to what countries with similar institutional quality (measured by the World Bank’s Rule of Law Index) and GDP per capita have.

Clearly anomalous levels of bank lending before the radical transformation of banking regulation in 2014-2015 existed due to several institutional distortions:

- Weak protection of creditors’ rights and predatory raiding. Thus, related lending became an adaptive financing mechanism within oligarchic business groups.

- Formation of “cocoons” of financing, where an oligarchic business group builds a model of resource access based on insider control rather than market competition.

- Politically motivated lending through state-owned banks or private banks vulnerable to pressure.

- Dollarization of loans and deposits as a way to hedge against asset depreciation risks.

- Distortion of the regulatory perimeter in the financial sector and banking supervision, allowing the expansion of insider and politically motivated lending to continuously underestimate capital needs due to inadequate credit risk assessment, ultimately minimizing the risks for bank owners and beneficiaries.

The underestimation of owners’ and beneficiaries’ contributions to capital through manipulative practices controlling credit risk levels became a source of politico-economic rent.

Figure 1. Domestic Credit to the Private Sector, % of GDP

Source: World Bank Data. World Bank data may differ from the official data of national regulators. For Ukraine, data up to 2008 are from the NBU.

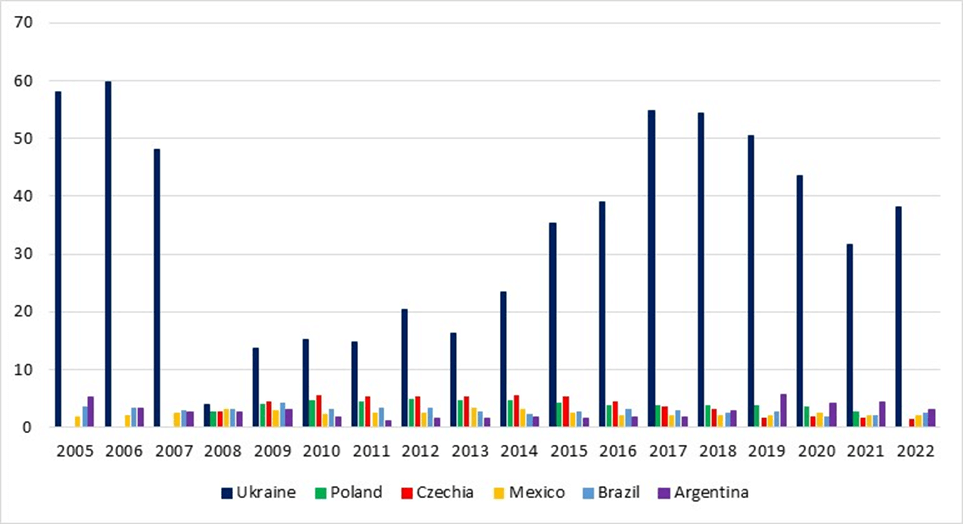

As a result, Ukraine has a phenomenal level of chronically bad debts (Figure 2). The scale of NPLs in the banking sector indicates that the entire lending system resembled rather plundering of savers and taxpayers and siphoning off capital. Such practices had nothing to do with the distributive function of credit and financial intermediation that transforms savings into investments and ultimately became a brake on financial development. Even countries in Latin America, known for the weakness of their institutions, have an NPL level similar to successful Central European countries, which is significantly lower than that in Ukraine.

Figure 2. NPL, % of Gross Loans

Source: World Bank Data. World Bank data may differ from the official data of national regulators. The significant drop in NPL in 2008 resulted from the substantial credit expansion during those years.

Therefore, it is only natural that after the transformation of banking regulations and the withdrawal of banking supervision from the “regulatory capture” perimeter, practically the entire banking system found itself in search of business models that would:

- Enable existence with growing competition in the banking market;

- Allow finding new business niches when large businesses have more than enough credit and are able to obtain external financing through non-bank channels;

- Ensure adaptation to financial stability regulations built on Basel principles;

- Guarantee survival in an environment where the rule of law is not a well-established norm, and the issue of bargaining power dominance pushes almost all banks into the segment of lending to small and medium-sized businesses.

On the other hand, Figures 1-2 show that lending is gradually recovering after the anomalous expansion and crisis. Even if, in the long term, it does not return to its highest levels, this does not indicate an exhaustion of credit depth, demonetization, or a collapse of financial development. Instead, it indicates that lending is adapting to new structural conditions, particularly those created by better regulatory practices. The absence of crises, the reduction of NPLs, and financial inclusion are better indicators of lending development than loans-to-GDP ratio, which ideally should complement the capital market rather than compensate for its absence in an institutionally distorted manner.

Banking system and the quality of institutions

The transition to Basel III has reignited the discussion on whether banking regulations negatively impact the financial system’s ability to generate credit supply. Theoretically, banking regulations are designed to ensure that the banking system maintains sufficient capital levels to absorb losses during crisis periods without significantly affecting the solvency of financial institutions.

Despite very similar capital requirements, the amount of bank capital relative to GDP varies significantly across countries. Much higher capital volumes in poorer countries compared to developed ones are often cited as grounds for criticizing the stringency of regulations as a factor behind sluggish lending. Figure 3 demonstrates an inverse nonlinear relationship between banking capital to GDP ratio and credit depth.

Figure 3. Banking capital to GDP and bank loans to GDP, %

Source: World Bank Data, author’s calculations

Criticism of financial stability regulations is often erroneously based on the inverse relationship between banking capital and credit depth. The reason for such erroneous assumptions lies in the nature of risks faced by banks in countries with different institutional profiles. In countries with higher risks, particularly those related to creditor rights protection, banks are forced to maintain higher capital reserves to meet regulatory standards. Because in these countries the probability to incur losses from defaults or adverse reclassification of loans is significantly higher.

This idea is supported by the data in Figure 4. There is an inverse relationship between the ratio of bank capital to GDP and the quality of institutions, as measured by the Rule of Law Index. This is natural, as the rule of law provides an environment with lower risks, allowing financial institutions to afford lower capital. Therefore, bank capital can be lower in countries with strong rule of law despite similar regulatory stringency.

Figure 4. Rule of Law and Bank Capital to GDP Ratio, %

Source: World Bank Data, author’s calculations

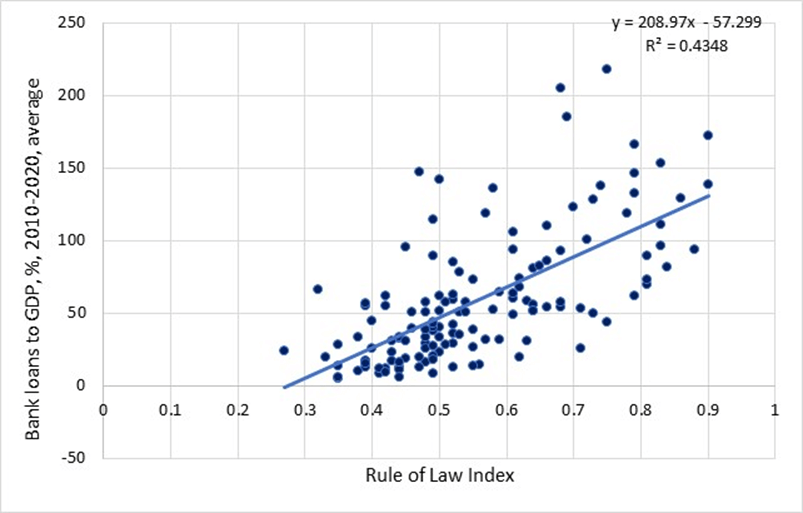

Clear positive correlation between the rule of law and credit depth (Figure 5) further demonstrates that stringent banking regulations create conditions for generating credit depth by:

- Preventing financial instability risks;

- Correctly assessing credit risks;

- Eliminating the prerequisites for politically motivated lending, manipulative insider lending practices, etc.

Quality of institutions is the factor which determines to what extent financial intermediation ensures allocation of credit to the most productive sectors. Quality of institutions also determines the ability of regulators to implement policies that steer the behavior of financial intermediaries in a socially optimal rather than predatory direction.

Institutions’ quality is an integral factor explaining why significantly larger volumes of loans per unit of banking capital can be issued in some countries compared to others. At a technical level, this relationship is mediated by the scale and profile of risks faced by financial intermediaries and borrowers. This affects decisions on accurate risk assessment, asset management, investments etc.

Figure 5. Rule of Law and Bank Credit to GDP Ratio, %

Source: World Bank Data, author’s calculations

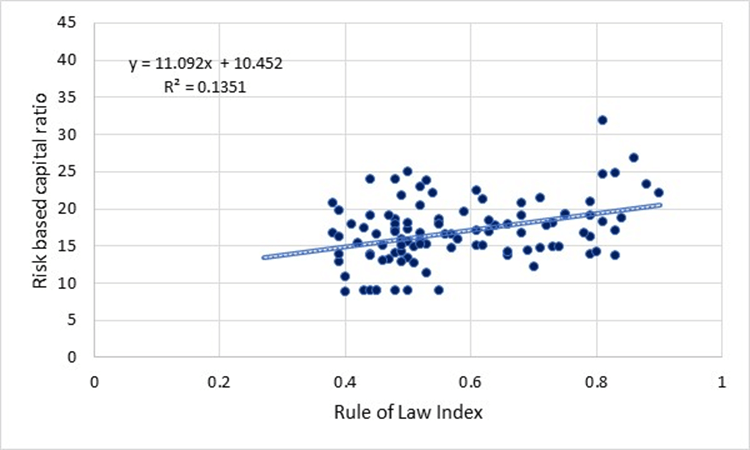

One of the banking regulatory indicators is risk-weighted capital-asset ratio. Taking risk into account significantly impacts the behavior of financial institutions in times of stress or increased risk levels. Typically, banks consider three response options: (1) avoiding investments in riskier assets, (2) increasing investments in risk-free assets, or (3) both simultaneously. In other words, the riskier the environment, the more banks will avoid lending in favor of less risky sovereign instruments. This is why the strictness of requirements for credit risk assessment is criticized from the perspective of lending incentives. However, the effective application of provisions regarding risk-weighted capital-asset ratio also relies on the quality of institutions. It shows how well banks comply with regulatory requirements and how independent banking regulators are in their ability to enforce these standards.

It is no coincidence that the volume of banking capital has an inverse relationship with institutions’ quality, while risk-weighted capital has a direct relationship with it (Figure 6).

Figure 6. Rule of Law and Capital to Risk-Weighted Assets

Source: World Bank Data, author’s calculations

At the same time, simply adhering to risk-weighted capital-asset ratio requirement is not sufficient for expanding financial depth. While banks may adhere strictly to regulations and regulators may enact appropriate policies, if the level of institutional risks in the economy is significant, banks will issue fewer loans. Conversely, when institutional quality ensures compliance with regulations and institutional risks in the economy are low, fundamental structural incentives for increasing credit depth arise. Well-capitalized banking systems that meets the capital adequacy ratio requirement will play a positive role in business financing, particularly by reducing the likelihood of costly financial shocks for taxpayers.

Therefore, it is the quality of institutions that creates incentives for expanding lending by protecting creditors’ rights, ensuring financial intermediaries’ adherence to regulations, and enabling regulators to fulfill their mandate without political interference.

Conclusions

To properly design policies that incentivize lending, it is essential to understand the initial position from which lending volumes declined. Institutional distortions are often a factor in inflated credit-to-GDP ratios, reflecting not so much credit depth but rather predatory practices that shift the burden of financing business groups onto taxpayers and depositors.

The “natural” recovery of lending occurs through strengthening the regulatory perimeter, robust and capable supervisory institutions, stronger guarantees of creditors’ rights, and a general reduction in institutional risks in the economy. This reduction creates prerequisites for expansion of the population of businesses that generate healthy demand for credit.

Regulatory stringency is not an obstacle to lending, and high bank capitalization levels are not indicative of excessive regulatory strictness. Institutional factors determine the level of risks in the economy, which is why a unit of bank capital can generate different volumes of credit in countries with different institutional profiles. In environments with high-quality institutions, a higher credit-to-GDP ratio can be accompanied by a lower banking capital-to-GDP ratio. The quality of institutions also determines the extent to which banks comply with the risk-weighted asset capital requirement.

Rebuilding the domestic economy will inevitably require restoring credit depth. However, bitter lessons of banking crises do not always create immunity against seeking credit revival in relaxation of regulations. European integration will become a powerful pressure factor for maintaining a regulatory environment that is adequate for financial stability. At the same time, constant improvement of state lending support programs design cannot compensate for the lack of progress in reducing overall institutional risks in the economy.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations