What happened to the budget in December? Was the revenue plan for the main taxes met? Was international support sufficient? What risks will be most relevant in the coming months? Answers to these and other budget-related questions are provided in the December 2025 issue of the Budget Barometer.

What worked?

- Cash expenditures from the general fund of the state budget reached a historic high of UAH 650 billion in December—29.6% above plan[1]. This made it possible to offset underperformance relative to the plan in previous months. The year-end concentration of expenditures was enabled by October amendments to the state budget, which were financed primarily with funds from international partners. This, in turn, allowed the government to cover the financing gap in the security and defense sector. Overall, UAH 4.19 trillion in expenditures was financed from the general fund in 2025 (+20% year over year).

- In 2025, the state budget attracted UAH 530.4 billion in grant funding (equivalent to USD 12.7 billion), six times the amount originally budgeted, reflecting the specific features of external assistance planning. Total external assistance incorporated into the budget in 2025 amounted to USD 50.5 billion (equivalent), with more than 70% provided through the G7 ERA mechanism (repaid from proceeds generated by frozen assets of the aggressor state). Together with domestic revenues, this ensured full financing of the state budget.

- In December, the government successfully completed the restructuring of GDP-linked warrants with the support of 99% of investors, fully replacing a debt instrument associated with high fiscal risks with more predictable debt obligations. As a result, the government significantly reduced potential payments in 2025–2041, strengthened debt sustainability, and increased the predictability of fiscal policy.

What did not work?

- Revenues of the general fund fell short of plan. In December, according to preliminary estimates, the budget underperformed by UAH 147.6 billion (30.9%). The main factors were lower-than-expected receipts across nearly all key taxes and lower-than-expected grant assistance. Overall, general fund revenues in 2025 reached 95.5% of the plan, reflecting somewhat overstated expectations driven primarily by insufficient consideration of heightened security risks, including attacks on energy infrastructure.

What’s next?

- The government approved the Medium-Term Public Debt Management Strategy for 2026–2028, aimed at ensuring fiscal and debt sustainability, improving the predictability of debt policy, strengthening confidence among international partners and investors, and reducing key debt risks—such as high debt servicing costs, refinancing and liquidity risks, and exposure to currency fluctuations. In line with these objectives, the debt policy priorities for 2026–2028 include increasing the share of grants and non-debt financing, reducing debt risks through optimization of borrowing costs and maturities, and maintaining investor relations while developing the domestic government bond market as a tool for economic recovery.

- The Ministry of Finance published a draft amendment to the Tax Code introducing mandatory value-added tax registration for sole proprietors (FOPs) on the simplified tax system with annual turnover exceeding UAH 1 million. Submission of this bill to Parliament forms part of Ukraine’s commitments to the International Monetary Fund related to the review and streamlining of value-added tax exemptions. If adopted, the government expects to generate approximately UAH 40.1 billion in additional tax revenues in 2027.

Key risks

- As in the previous five years, the intensity of hostilities remains the key fiscal risk—any escalation would imply the need for additional defense spending and increase pressure on the budget (low risk).

- International financial support remains critically important and is expected to cover the core budgetary needs (low risk).

- A significant risk stems from political factors: expectations of the start of a new electoral cycle may encourage an expansion of populist spending not backed by sustainable financing sources. Such a scenario would increase the need for additional revenues or borrowing and create additional risks to budget discipline (medium risk).

- Continued Russian attacks on energy facilities pose high risks of further damage, which could lead to disruptions in the energy system, higher energy import costs, and a deterioration in business conditions. This, in turn, would narrow the tax base and increase the risk of budget revenue shortfalls (medium risk).

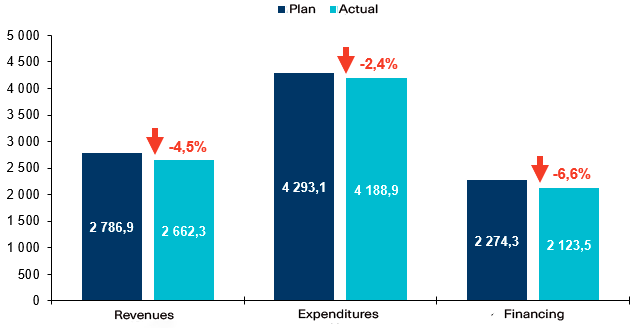

Overall execution of the state budget

Overall, in 2025 nearly UAH 2.7 trillion was credited to the general fund of the state budget (95.5% of plan). The bulk of these revenues came from tax receipts, which, according to preliminary estimates, accounted for 64.5% of total general fund revenues. Grants accounted for a further 19.9%.

A total of UAH 4.19 trillion in expenditures was financed from the general fund. The annual execution rate reached 97.6% (with UAH 4.29 trillion planned), while expenditures were 20% higher than in 2024 (UAH 3.49 trillion). During the year, the government amended the budget twice, significantly increasing expenditures—by UAH 390 billion in July and by UAH 303 billion in October. Borrowing used to finance the state budget deficit in 2025 amounted to UAH 2.1 trillion, of which UAH 1.6 trillion consisted of external loans and UAH 551.5 billion was raised through domestic government bonds (OVDPs).

In December 2025, revenues credited to the general fund of the state budget amounted to UAH 329.4 billion (30.9%, or UAH 147.6 billion, less than planned). Expenditures totaled UAH 650 billion, which was 29.6% above plan. Borrowing used to finance the state budget deficit amounted to UAH 168.4 billion, or 60.6% of the planned level.

Figure 1. Execution of the general fund of the state budget, January–December 2025, UAH billions

Source: Ministry of Finance of Ukraine

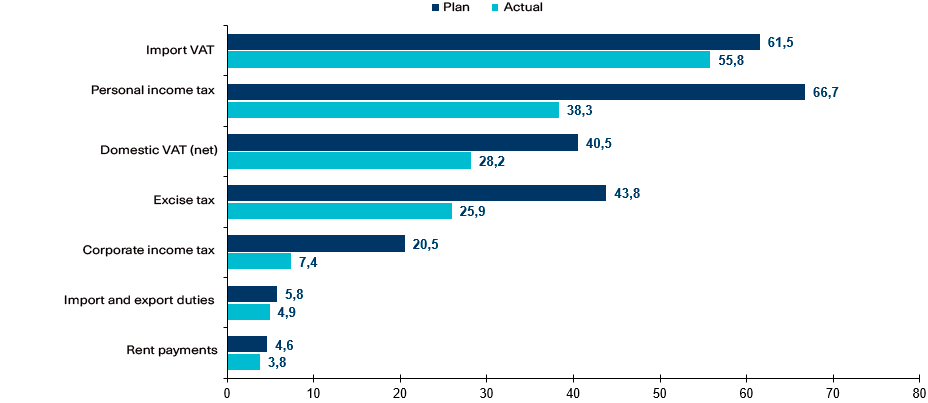

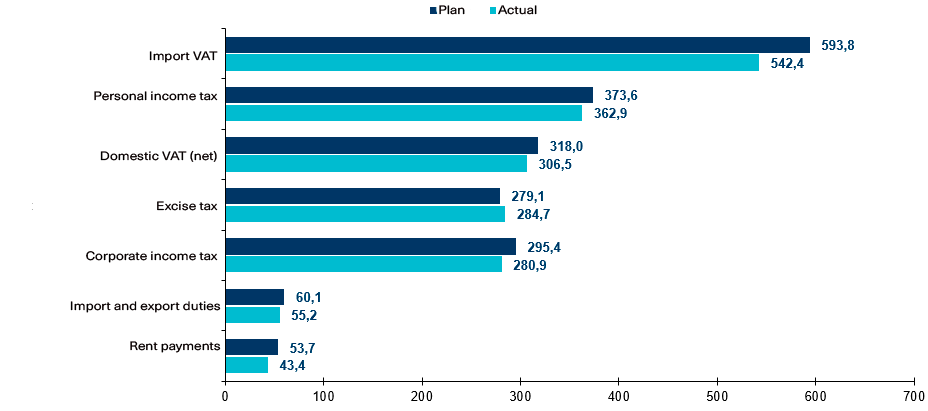

State budget revenues

- Revenues of the general fund of the state budget in December amounted to UAH 329.4 billion[2], which was 30.9%, or UAH 147.6 billion, below plan. The main reason for this underperformance was lower-than-expected receipts across nearly all key taxes, as well as lower-than-expected grant assistance. The shortfall in tax revenues was likely driven by the negative impact of ongoing attacks on energy and logistics infrastructure on business activity and, consequently, on the formation of the tax base, as well as by specific features of December budget planning. Notably, the intensity of such attacks increased significantly in November, directly affecting the level of economic activity. As a result, the government’s expectations for tax revenues proved overly optimistic. Overall, according to preliminary estimates, UAH 2,662.3 billion was credited to the general fund in 2025, corresponding to 95.5% of plan.

Figure 2. Revenues from major taxes credited to the general fund in December 2025, UAH billions

Source: Ministry of Finance of Ukraine

- Revenues from the corporate income tax credited to the general fund in December amounted to UAH 7.4 billion (–64%, or UAH 13.1 billion below plan). The likely reason for this substantial shortfall was a sharp deterioration in the security situation—particularly the critical state of energy supply due to continuous Russian attacks—which had a significant negative impact on business activity. At the same time, it cannot be ruled out that the December revenue plan incorporated overperformance of this tax in earlier months. This interpretation is supported by the annual outcome: according to preliminary data, UAH 284.7 billion in corporate income tax was credited to the general fund in 2025, exceeding the plan by 2%.

- Revenues from the personal income tax and the military levy credited to the general fund in December amounted to UAH 38.3 billion, which was 42.6%, or UAH 28.4 billion, below plan. The main reason for this shortfall—relevant over recent months—was overly optimistic planning assumptions following budget amendments, under which expected revenues from these payments (general fund only) were increased by UAH 51.8 billion. This likely led to a widening gap between planned and actual figures. Another factor was that, as in the case of the corporate income tax, the December revenue plan already incorporated overperformance earlier in the year. Overall, in 2025 a total of UAH 362.9 billion in personal income tax and the military levy was collected, which was 2.9%, or UAH 10.7 billion, below plan.

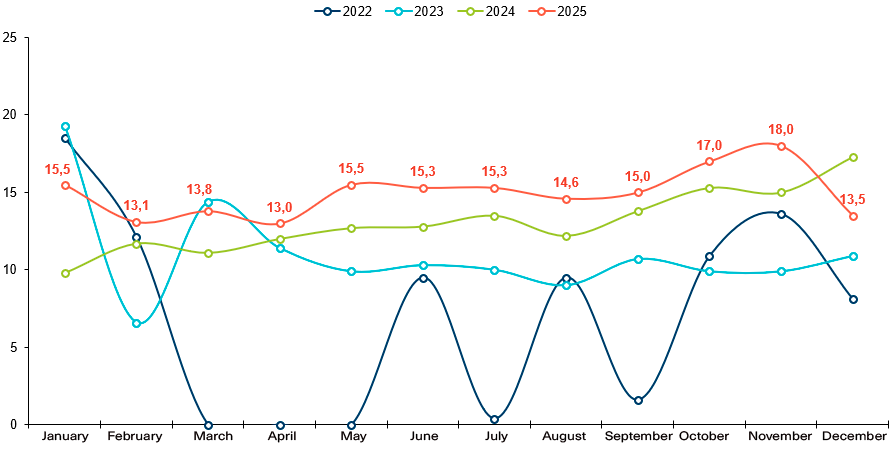

- Net revenues from domestic value-added tax in December amounted to UAH 28.2 billion (–30.5%, or UAH 12.3 billion below plan). According to the National Bank of Ukraine, intensified Russian attacks in November constrained industrial activity. Consumer sentiment also weakened, although it remained stronger than a year earlier. Another possible factor behind lower-than-expected domestic VAT revenues was the slowdown in inflation, although this effect was limited. Annual inflation declined to 9.3% in November and to 8% in December, below the 9.7% assumed in the 2025 budget. In December, UAH 13.5 billion in VAT refunds was paid, which was UAH 4.5 billion less than in November and UAH 3.8 billion less than in December 2024. At the same time, the stock of declared but unpaid VAT refunds as of December 1, 2025 amounted to UAH 35.4 billion, slightly above the annual average of UAH 30 billion. This helps explain the lower-than-usual volume of refunds in December and the government’s decision to delay refunds in order to finance expenditures. Overall, the annual plan for net domestic value-added tax revenues in 2025 was executed at 96.4%, with net revenues totaling UAH 306.5 billion.

Figure 3. VAT refunds, UAH billions

Source: Ministry of Finance of Ukraine

- Import VAT revenues amounted to UAH 55.8 billion, which was 9.3% below plan. As in previous periods, one likely reason for this shortfall was lower-than-expected volumes of taxable imports in 2025—76% of total imported goods, compared with 82% over the same period in 2024. In monetary terms, this gap in imports amounted to USD 456 million, or UAH 19.2 billion, in November 2025 alone (total imports to Ukraine in November amounted to USD 7.6 billion). In addition, the government overestimated expected revenues from all import-related taxes; in particular, the assumed hryvnia exchange rate against the U.S. dollar proved overstated—the 2025 budget assumed a rate of UAH 45 per USD, while the average exchange rate during the year stood at UAH 41.7 per USD. Overall, according to preliminary data, UAH 542.4 billion was accumulated in the general fund of the state budget in 2025, corresponding to 91.3% of plan.

- Excise tax revenues credited to the general fund amounted to UAH 25.9 billion, which was 40.8% below plan. As in the previous month, this shortfall may partly reflect reduced electricity consumption, as indicated by electricity export–import balances. Since early November, electricity exports have ceased, while imports have continued to grow; however, even under these conditions, import volumes remained below export volumes recorded in September, before Russia began large-scale attacks on Ukraine’s energy infrastructure. This dynamic reflects intensified Russian attacks on energy facilities, as a result of which households and industrial consumers received electricity in limited volumes. Another likely factor behind the shortfall in excise tax revenues is instability in the tobacco market, which accounts for approximately 68% of domestic excise receipts. According to the latest available data, the illegal tobacco market expanded to 17.8% in October (from 15.4% in July), mainly due to increased trade in tobacco products bearing counterfeit excise stamps, which may have had a negative impact on budget revenues. Overall, according to preliminary estimates, UAH 280.9 billion in excise tax was credited to the general fund in 2025, which was 4.9% below plan.

- Import and export duty revenues in December amounted to UAH 4.9 billion, which was 15.1%, or approximately UAH 900 million, below plan. This shortfall can be attributed to overstated expectations at the revenue planning stage. Overall, in 2025 the plan for revenues from these duties was executed at 91.9%, with UAH 55.2 billion collected.

- Revenues from rent payments for the use of subsoil credited to the general fund amounted to UAH 3.8 billion in December, which was 18.4% below plan. As in previous months, and likely through the end of the active phase of the war, the shortfall in rent revenues is driven by extensive shelling and destruction of extraction infrastructure across the country, as well as the occupation of territories where a significant share of Ukraine’s extraction capacity is located. This problem has become particularly acute following repeated attacks on gas extraction infrastructure in recent months. Overall, in 2025 a total of UAH 43.4 billion in rent payments was accumulated, which was 19.1% below plan.

Figure 4. Revenues from major taxes credited to the general fund of the state budget, January–December 2025, UAH billions

Source: Ministry of Finance of Ukraine

- In December, grants credited to the general fund of the state budget amounted to UAH 149.3 billion (equivalent to USD 3.6 billion[3]), which was UAH 24.3 billion less than planned. Of this amount, UAH 139.4 billion (USD 3.3 billion) was received from the World Bank under the Public Expenditures for Administrative Capacity Endurance (PEACE) in Ukraine project, UAH 9.9 billion (EUR 200 million) from the European Union under the Ukraine Facility, and UAH 37 million (USD 0.9 million) from the International Bank for Reconstruction and Development under the INSPIRE program. Overall, in 2025 the government attracted UAH 530.4 billion in grants, which was six times higher than planned.

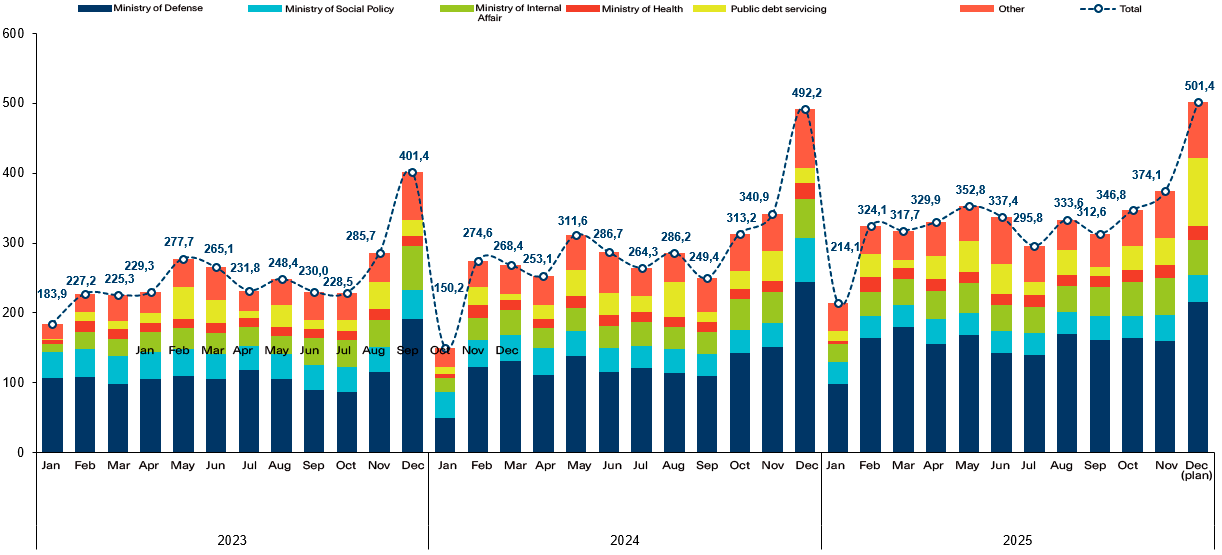

State budget expenditures

- Cash expenditures of the general fund of the state budget in December reached a record UAH 650 billion, which was 29.6% above plan. At the same time, during the month the government introduced another round of changes to the monthly spending schedule: the expenditure plan was increased by UAH 20.6 billion, meaning that, relative to the previous plan, execution would have been 35.2% above plan. The additional planned resources were intended to be distributed among the main spending units, but almost half of these funds (UAH 8.8 billion) were earmarked for the Ministry for Development of Communities and Territories of Ukraine under the compensation program for destroyed property. These expenditures were to be financed, among other sources, through domestic borrowing (domestic government bonds, OVDPs), the plan for which was not fulfilled.

November was one of the weakest months in terms of expenditure plan execution (only 80.4% of the plan was executed); however, in December the government significantly exceeded expectations and covered existing financing gaps in certain sectors. The high level of planned expenditures became possible due to the budget amendments adopted in October, which provided an additional UAH 303 billion under the general fund to finance the defense and security sectors, primarily for military remuneration payments. Initially, these funds were expected to be distributed evenly between November and December, but the full amount was accumulated only in December, resulting in historically record-high expenditure levels.

- Funding for the defense and security sector remained the largest in December, with its main spending units—the Ministry of Defense and the Ministry of Internal Affairs—planned to receive UAH 216.3 billion and UAH 51 billion, respectively (in practice, likely more). In the civilian sphere, the Ministry of Social Policy was expected to receive the largest allocation—UAH 37.6 billion, primarily for pension payments and related supplements (UAH 20 billion). The Ministry of Health was planned to receive UAH 19.7 billion, of which UAH 16.6 billion was allocated to the state medical guarantees program. Expenditures on debt servicing were planned at UAH 97.9 billion.

Figure 5. Actual distribution of general fund state budget expenditures, UAH billions

Source: Ministry of Finance of Ukraine

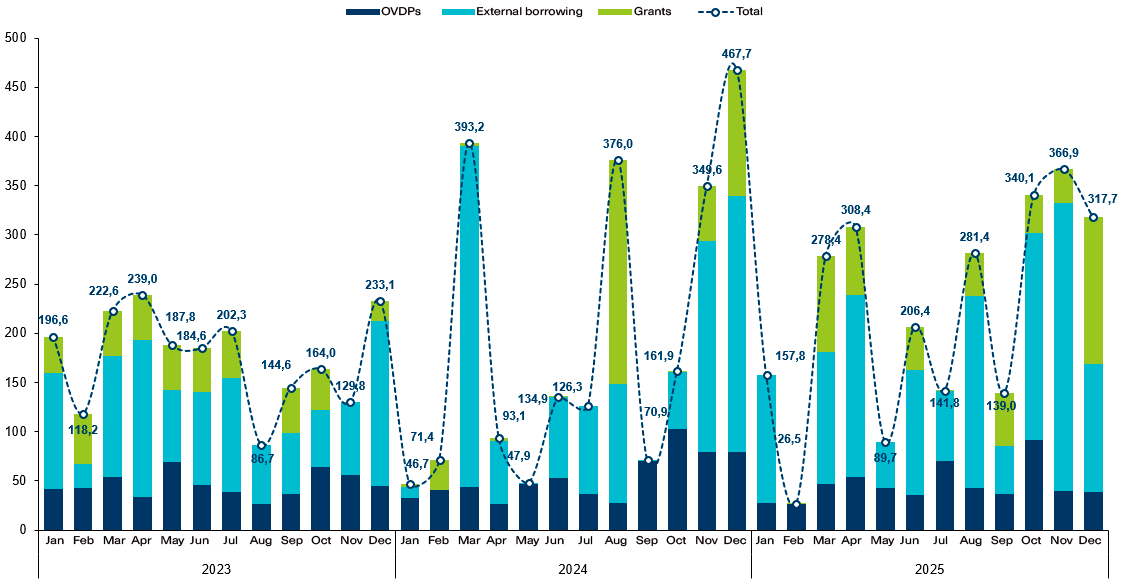

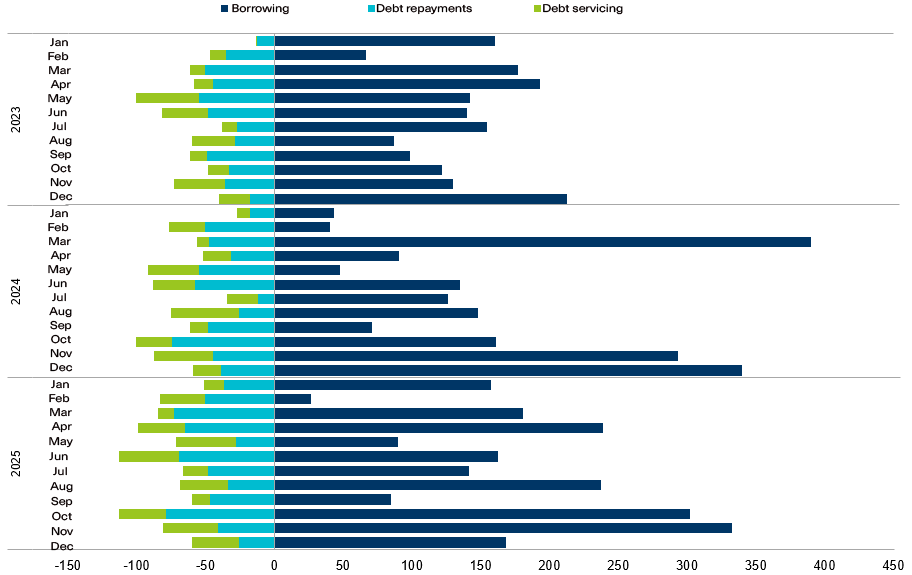

Deficit and debt

- In December, the deficit of the general fund of the state budget was planned at UAH 31.4 billion. The Ministry of Finance did not disclose the actual size of the general fund deficit in its operational reporting. Based on our approximate estimates (assuming that in December all loan amounts envisaged under the plan for the general fund were both provided and repaid—namely, UAH 1.3 billion in loan repayments and UAH 8.3 billion in loans issued), the state budget under the general fund was most likely executed with a deficit of UAH 327.6 billion, which is 10.4 times higher than planned. This gap between actual and planned figures may be explained by the fact that in December expenditures were 29.6%, or UAH 148.6 billion, higher than planned, while actual revenues, by contrast, were 30.9%, or UAH 147.6 billion, lower than planned. Overall, according to preliminary estimates, the general fund of the state budget in 2025 may have been executed with a deficit of UAH 1.5 trillion, corresponding to 101.3% of the planned level.

- Over the full year 2025, the state budget received UAH 2.1 trillion in external assistance in the form of loans and grants (equivalent to USD 50.5 billion), including UAH 1.6 trillion in loans (USD 37.8 billion) and UAH 530.4 billion in grants (USD 12.7 billion).

Figure 6. Financing of the general fund of the budget, UAH billions

Source: Ministry of Finance of Ukraine

- In December, the state budget received UAH 129.6 billion in external assistance in the form of loans (equivalent to USD 3.1 billion), including:

- UAH 103.7 billion (EUR 2.1 billion) from the European Union under the Ukraine Facility

- UAH 12.3 billion (USD 290 million) under the World Bank project Resilient, Inclusive, and Sustainable Enterprise (RISE) in support of the private sector, of which UAH 3.4 billion (USD 80 million) was provided under guarantees of the Government of Japan

- UAH 8.3 billion (USD 196.3 million) under the project Supporting Reconstruction through Smart Fiscal Governance (SURGE)

- UAH 4.5 billion (USD 105.7 million) under the project Lifting Education Access and Resilience in Times of Need in Ukraine (LEARN)

- UAH 0.8 billion (USD 19.5 million) under the health sector project Transforming Healthcare through Reform and Investments in Efficiency (THRIVE)

- On December 24, Ukraine announced the successful completion and settlement of the GDP warrant restructuring operation, which was supported by 99% of investors. Under the terms of the restructuring, GDP-linked warrants with a notional amount of USD 2.635 billion were exchanged for new Series C bonds maturing in 2032 with a total value of USD 3.498 billion, as well as for Series B bonds maturing in 2030 and 2034, with USD 16.9 million issued in each series. All GDP-linked warrants were cancelled. According to estimates by the Ministry of Finance, without this restructuring, payments on GDP warrants in 2025–2041 could have amounted to between USD 6 billion and USD 20 billion, depending on the pace of economic growth. Accordingly, the restructuring is of critical importance for ensuring financial and economic sustainability and eliminates significant risks to Ukraine’s public finances. The completed operation improves budget predictability, strengthens debt sustainability, and helps preserve state budget resources.

- In December, UAH 38.8 billion was raised to finance the state budget deficit through the placement of domestic government bonds (OVDPs[4]), of which 32.7%, or UAH 12.7 billion, was attracted through placements of OVDPs denominated in foreign currency. No funds were raised in December from the sale of benchmark OVDPs that banks may include in the coverage of required reserves. The weighted average yield on hryvnia-denominated OVDPs in December stood at 14.6%, which was 2.6 percentage points lower than in November and the lowest level recorded since the beginning of the year. The average annual yield in 2025 amounted to 16.4%, which was 0.5 percentage points higher than in 2024. Overall, in 2025 a total of UAH 551.5 billion was directed toward financing the state budget deficit through OVDP placements, which represents only 72.2% of the planned amount. The main reason for the shortfall relative to the plan was most likely overly ambitious targets following budget amendments, as well as inflows of international assistance, which made it possible to finance necessary expenditures without increasing the volume of domestic borrowing.

- In addition to traditional OVDP placements, in December the Government issued OVDPs in the amount of UAH 30 billion, which were subsequently exchanged for shares from an additional equity issuance of PJSC Ukrainian Financial Housing Company and acquired into state ownership. As in previous years, this transaction constituted a recapitalization of the company, which operates the subsidized mortgage lending program eOselya (eHousing).

- During December, the volume of OVDPs in circulation held by banks increased by UAH 13.6 billion and reached UAH 937.1 billion at the end of the month, accounting for 47.7% of the total volume of bonds outstanding (UAH 2 trillion). Banks remain the largest holders of OVDPs in Ukraine. The second-largest holder is the National Bank of Ukraine, which held 33.8% of OVDPs outstanding, totaling UAH 664.5 billion, of which UAH 400 billion consists of military bonds purchased directly from the government by the NBU in 2022. During December, the share of OVDPs held by individuals increased by 0.1 percentage points compared to November and reached 5.7% of all OVDPs in circulation. The value of OVDPs held by individuals rose to UAH 112 billion at the end of December, up from UAH 107.2 billion at the end of November. Overall, throughout 2025 the ownership structure of OVDPs remained broadly unchanged, with only minor shifts in favor of one holder category or another.

- In 2025, net borrowing from OVDP placements amounted to UAH 62.7 billion, including UAH 23.6 billion in December. Overall, according to preliminary estimates, expenditures on the repayment and servicing of domestic public debt in 2025 exceeded the amount of funds raised by UAH 189.8 billion.

- In total, UAH 59.8 billion was spent in December on the repayment and servicing of public debt, of which 68.6%, or UAH 41 billion, related to domestic debt. Overall, inflows exceeded expenditures on debt repayment and servicing by UAH 108.6 billion. According to preliminary estimates, in 2025 the amount of funds raised exceeded expenditures on the repayment and servicing of public debt by UAH 1,172.8 billion (UAH 2,123.5 billion raised versus UAH 950.7 billion spent).

Figure 7. Volume of borrowing, repayment, and servicing of Ukraine’s public debt, UAH billions

Source: Ministry of Finance of Ukraine

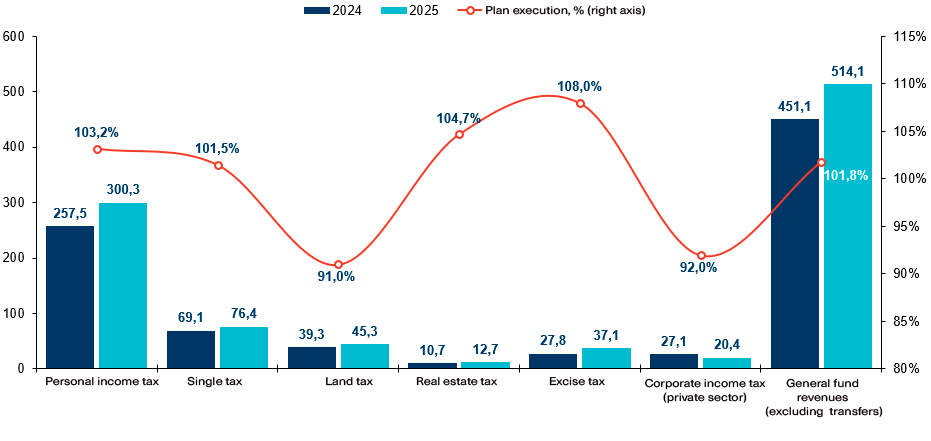

Local budgets

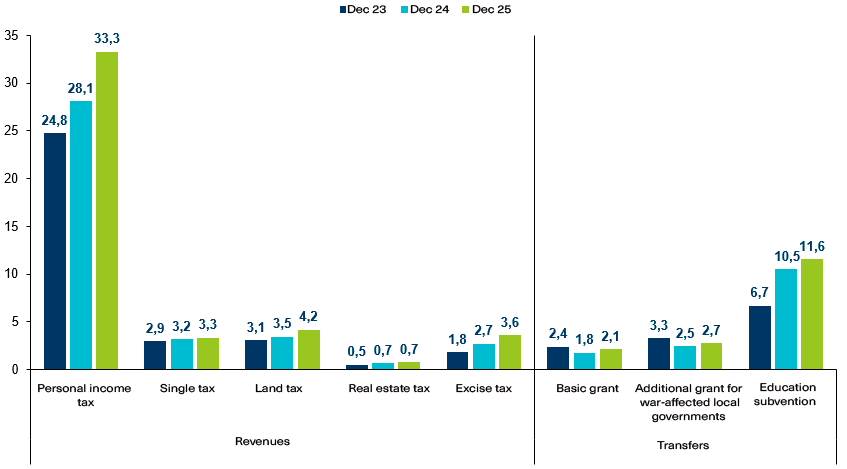

- In 2025, revenues of the general fund of local budgets excluding interbudgetary transfers increased by 14% compared to 2024 and amounted to UAH 514 billion, indicating broadly stable revenue growth at the local level. The key driver remained personal income tax, with receipts increasing by 16.6% to UAH 300.3 billion. At the same time, a number of regions recorded growth of more than 20%, with declines observed only in the Donetsk and Luhansk regions. Revenues from other taxes also increased: the single tax rose by 10.6% to UAH 76.4 billion, land payments by 15.3% to UAH 45.3 billion, the real estate tax by 19.3% to UAH 12.7 billion, and the excise tax by 33.1% to UAH 37.1 billion. Meanwhile, corporate income tax revenues declined significantly—by 24.8% to UAH 20.4 billion—primarily due to midyear changes that redirected part of banks’ corporate income tax revenues (UAH 8 billion) from the budget of the city of Kyiv to the general fund of the state budget. Overall, annual revenue targets for the general fund of local budgets were executed at 101.8% of plan (personal income tax at 103.2%, the single tax at 101.5%, and excise tax at 108%), although the plan was not met for certain revenue items, in particular land payments (91%) and corporate income tax (92%). At the same time, in 2025 interbudgetary transfers to local budgets were financed at 96.1% of the approved schedule (UAH 203.5 billion), with full execution for the basic grant (UAH 25.5 billion), additional grants (UAH 19.9 billion), and the education subvention (UAH 107.5 billion), alongside transfers of the reverse grant to the state budget (UAH 15.2 billion) and the return of unused balances of other subventions (UAH 7.6 billion).

Figure 8. Revenues from major taxes credited to the general fund of local budgets in 2024–2025 (UAH billions) and the level of plan execution in 2025

Source: Ministry of Finance of Ukraine

- In December 2025, almost UAH 46.9 billion was credited to the general fund of local budgets (excluding interbudgetary transfers), which was UAH 5.5 billion more than in December of the previous year. The main revenue sources were:

- UAH 33.3 billion from personal income tax (+18.6% year over year)

- UAH 3.3 billion from the single tax (+5.8%)

- UAH 3.6 billion from the excise tax (+33.6%)

- Interbudgetary transfers amounted to UAH 23.6 billion, of which the general fund accounted for UAH 22.4 billion (100% of plan), including a basic grant of UAH 2.1 billion, additional grants totaling UAH 3.2 billion, and an education subvention of UAH 11.6 billion.

- Cash balances on the accounts of local budgets and budgetary institutions under the general and special funds as of January 1, 2026 amounted to UAH 97.1 billion, which was UAH 24.8 billion less than as of January 1, 2025, and UAH 14 billion less than as of January 1, 2024.

Figure 9. Main sources of local budget revenues, UAH billions

Source: Ministry of Finance of Ukraine

Social funds

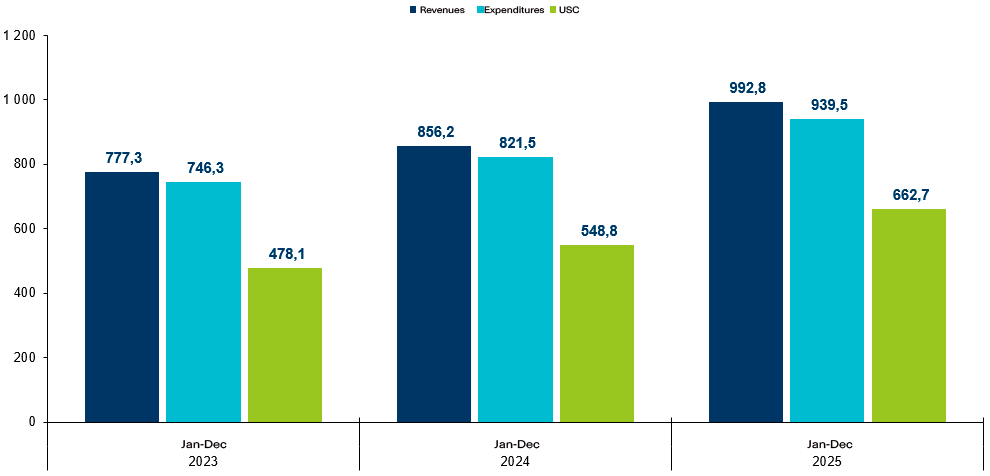

- In 2025, total revenues from the unified social contribution (USC) amounted to UAH 662.7 billion, which was UAH 113.9 billion higher than in 2024 (+20.8%) (Figure 11). In December 2025, revenues totaled UAH 69.6 billion, exceeding the level of December 2024 by UAH 10.7 billion (+18.2%). Several factors contributed to the increase in revenues:

- As of January 1, 2025, payment of the unified social contribution was introduced for all categories of sole proprietors (FOPs)[5]

- The maximum base for calculating the USC was increased from 15 to 20 minimum wages (up to UAH 160,000) for civilians, and as of August 1, 2025 was set at the level of 15 minimum wages for military personnel and police officers

- The average wage subject to the USC increased by 18.9%, primarily due to labor shortages

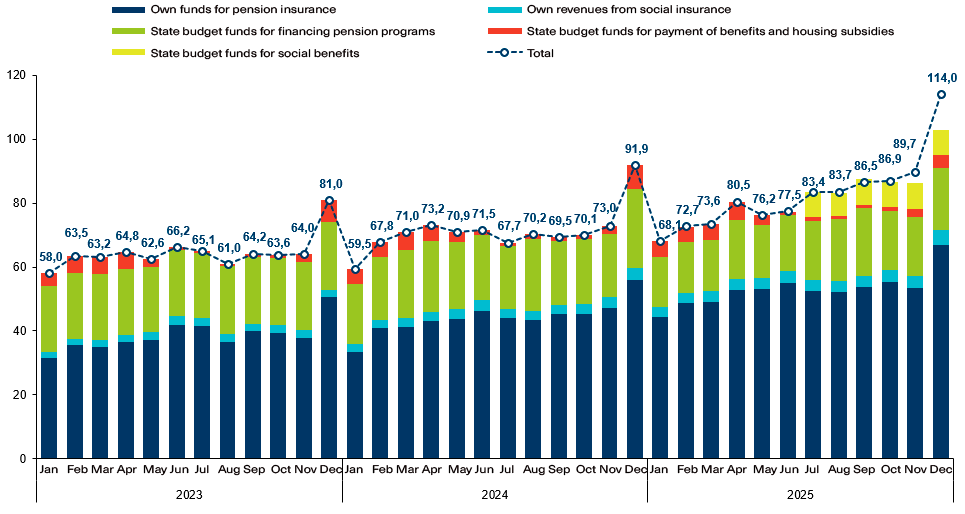

- In December 2025, revenues of the Pension Fund of Ukraine (PFU) amounted to UAH 114.0 billion, which was UAH 22.1 billion higher than in December of the previous year (+24.1%) (Figure 9). In December, the total volume of transfers from the state budget to the PFU for all payments it administers amounted to UAH 31.5 billion (–1.8% compared to December 2024). The main share of Pension Fund revenues consisted of resources directed toward pension payments. Of these, transfers from the state budget amounted to UAH 19.5 billion (–21.1% compared to December 2024[6]), while own revenues totaled UAH 71.5 billion (+19.6% compared to December 2024). To finance social assistance payments, the Pension Fund received UAH 7.8 billion from the state budget, while UAH 4.2 billion was allocated for housing and utility subsidies and benefits (–43.2% compared to December 2024). Social insurance payments financed from own revenues (the USC and other sources) amounted to UAH 4.6 billion (+15.9% compared to December 2024).

- In 2025, revenues of the Pension Fund of Ukraine (PFU), including transfers from the state budget to finance pension payments, subsidies, and other social assistance, amounted to UAH 992.8 billion, which was UAH 136.7 billion higher than in 2024 (+16%) (Figures 9 and 11). The main driver of growth was an increase in own revenues, 99% of which consisted of USC receipts. In 2025, the Pension Fund’s own revenues increased by UAH 114.1 billion (+20.2%) compared to 2024, reaching UAH 680.1 billion. Growth in the Pension Fund’s budget was also driven by the fact that, from the second half of 2025, the Fund began paying more than 40 types of social assistance that had previously been administered by social protection authorities. To finance these payments, the Pension Fund received UAH 47 billion from the state budget in 2025. At the same time, PFU revenues earmarked for housing and utility subsidies and benefits declined[7] by UAH 3.8 billion (–9.6%) compared to 2024, amounting to UAH 35.9 billion.

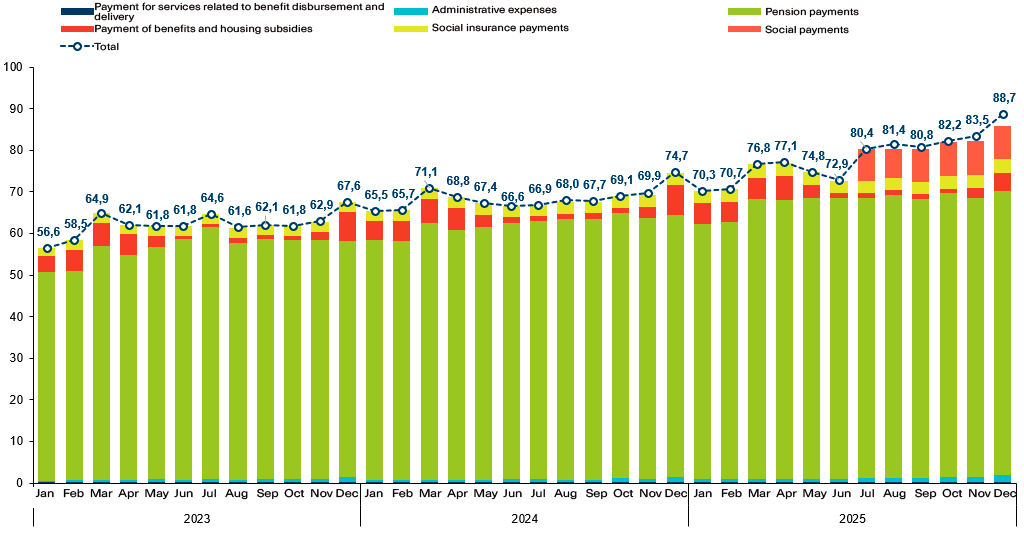

- The expenditures of the Pension Fund in December 2025 amounted to UAH 88.7 billion (+18.8% compared to December 2024), of which UAH 68.3 billion was directed to pension payments, exceeding the December 2024 level by UAH 5.3 billion (+8.4%) (Figure 10). In 2025, total PFU expenditures amounted to UAH 939.5 billion, which was UAH 118.0 billion higher than in 2024 (+14.4%) (Figures 10 and 11). The main driver of this increase was higher spending on pension payments, which reached UAH 799 billion—up by UAH 62.7 billion (+8.5%) compared to 2024—due to pension indexation and recalculations.

Figure 10. Dynamics and structure of revenues of the Pension Fund of Ukraine, UAH billions

Source: Pension Fund of Ukraine; calculations by the Center

Figure 11. Dynamics and structure of expenditures of the Pension Fund of Ukraine, UAH billions

Source: Pension Fund of Ukraine; calculations by the Center

Figure 12. Revenues and expenditures of the Pension Fund and aggregate revenues from the unified social contribution, UAH billions

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Planned and actual execution of the state budget (general fund), January–December 2025*, UAH billions

| January | February | March | April | May | June | July | August | September | October | November | December | Total | ||||||||||||||

| Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | Plan | Actual | |

| Revenues, incl. | 117.7 | 128.2 | 141.0 | 132.6 | 305.4 | 320.8 | 250.8 | 274.7 | 205.3 | 204.8 | 227.0 | 241.2 | 148.8 | 163.5 | 252.3 | 242.9 | 174.3 | 208.4 | 209.0 | 186.4 | 278.4 | 229.3 | 477.0 | 329.4 | 2,786.9 | 2,662.3 |

| Personal income tax | 20.6 | 24.1 | 23.1 | 26.3 | 24.4 | 27.2 | 25.0 | 29.7 | 27.3 | 30.4 | 27.2 | 30.1 | 28.5 | 32.4 | 29.7 | 30.7 | 31.2 | 30.0 | 31.1 | 32.1 | 38.8 | 31.6 | 66.7 | 38.3 | 373.6 | 362.9 |

| Corporate income tax | 2.0 | 2.3 | 9.5 | 11.2 | 81.2 | 86.0 | 3.1 | 5.6 | 43.1 | 45.4 | 4.6 | 5.2 | 3.1 | 4.8 | 50.5 | 51.1 | 6.4 | 8.1 | 3.7 | 4.6 | 51.3 | 53.0 | 20.5 | 7.4 | 279.1 | 284.7 |

| Rent payments for subsoil use | 2.3 | 2.0 | 3.7 | 2.7 | 5.6 | 3.4 | 4.0 | 3.2 | 5.6 | 4.4 | 3.9 | 3.0 | 4.0 | 3.3 | 5.8 | 5.4 | 4.2 | 4.1 | 4.1 | 3.4 | 5.9 | 4.7 | 4.6 | 3.8 | 53.7 | 43.4 |

| Excise tax | 14.0 | 15.9 | 17.3 | 21.5 | 21.7 | 22.6 | 23.2 | 24.2 | 23.9 | 24.2 | 24.0 | 24.4 | 26.6 | 26.8 | 27.6 | 26.8 | 24.6 | 24.2 | 22.0 | 22.0 | 26.8 | 22.4 | 43.8 | 25.9 | 295.4 | 280.9 |

| Domestic VAT (net) | 33.5 | 37.5 | 19.1 | 21.6 | 21.1 | 26.1 | 25.9 | 27.6 | 23.2 | 21.7 | 22.6 | 21.7 | 25.7 | 27.0 | 27.1 | 23.4 | 25.1 | 25.1 | 23.8 | 24.2 | 30.4 | 22.6 | 40.5 | 28.2 | 318.0 | 306.5 |

| Import VAT | 36.3 | 36.6 | 38.0 | 37.4 | 42.8 | 44.9 | 44.4 | 40.6 | 46.0 | 42.3 | 47.8 | 43.5 | 49.9 | 49.1 | 53.9 | 46.0 | 56.3 | 49.9 | 57.4 | 50.3 | 59.5 | 46.0 | 61.5 | 55.8 | 593.8 | 542.4 |

| Import and export duties | 4.1 | 4.2 | 4.4 | 4.0 | 5.2 | 4.4 | 4.4 | 4.1 | 4.6 | 4.3 | 4.7 | 4.4 | 5.1 | 4.9 | 5.4 | 4.6 | 5.5 | 5.4 | 5.7 | 5.5 | 5.1 | 4.5 | 5.8 | 4.9 | 60.1 | 55.2 |

| Expenditures | 284.3 | 214.1 | 390.9 | 324.1 | 303.2 | 317.7 | 355.9 | 329.9 | 397.0 | 352.8 | 362.0 | 337.4 | 288.9 | 295.8 | 271.9 | 333.6 | 307.7 | 312.6 | 369.3 | 346.8 | 460.7 | 374.1 | 501.4 | 650.0 | 4,293.1 | 4,188.9 |

| Deficit (–) / surplus (+)** | -166.8 | -85.4 | -249.2 | -190.3 | 2.6 | 3.5 | -103.4 | -53.7 | -189.2 | -145.7 | -133.7 | -95.8 | -139.6 | -131.8 | -18.3 | -89.5 | -132.9 | -103.7 | -159.0 | -158.9 | -180.5 | -142.5 | -31.4 | -327.6*** | -1,501.4 | -1,521.2 |

| Sources of deficit financing | ||||||||||||||||||||||||||

| Net borrowing | 73.1 | 121.4 | 205.2 | -23.9 | 1.1 | 107.5 | 65.8 | 173.9 | 187.1 | 62.0 | 58.5 | 93.0 | 65.1 | 93.7 | 57.1 | 203.8 | 210.8 | 38.2 | 236.7 | 223.0 | 246.8 | 291.6 | 269.8 | 142.6 | 1,677.1 | 1,526.7 |

| Borrowing | 110.8 | 157.8 | 268.4 | 26.5 | 70.3 | 180.6 | 123.7 | 239.2 | 244.8 | 89.7 | 103.2 | 162.5 | 117.7 | 141.7 | 100.3 | 237.4 | 257.3 | 85.1 | 311.9 | 302.1 | 287.9 | 332.5 | 277.9 | 168.4 | 2,274.3 | 2,123.5 |

| Repayments | -37.7 | -36.4 | -63.2 | -50.4 | -69.2 | -73.1 | -57.9 | -65.3 | -57.7 | -27.7 | -44.8 | -69.6 | -52.7 | -48.1 | -43.3 | -33.6 | -46.4 | -46.9 | -75.2 | -79.1 | -41.1 | -40.9 | -8.1 | -25.8 | -597.3 | -596.7 |

* Data adjusted following clarifications by the Ministry of Finance.

** The deficit does not equal the arithmetic difference between revenues and expenditures, as it is additionally affected by the volume of loans extended from the state budget and their repayment.

*** Calculations by the Center

Source: Ministry of Finance of Ukraine; calculations by the Center

Table 2. Key indicators of state budget financing, UAH billions

| Indicators | January | February | March | April | May | June | July | August | September | October | November | December |

| Total received, UAH billions, including: | 157.8 | 26.5 | 180.6 | 239.2 | 89.7 | 162.5 | 141.7 | 237.4 | 85.1 | 302.1 | 332.5 | 168.4 |

| as % of plan (for the full period) | 142.4 | 9.9 | 257.0 | 193.3 | 36.6 | 157.5 | 120.4 | 236.6 | 33.1 | 96.9 | 115.5 | 60.6 |

| From OVDP placements, UAH billions, including: | 27.1 | 26.5 | 46.7 | 53.8 | 42.6 | 35.8 | 70.5 | 42.6 | 36.8 | 91.2 | 39.2 | 38.8 |

| in hryvnia, UAH billions | 27.1 | 15.8 | 30.1 | 45.8 | 33.2 | 35.8 | 53.4 | 26.4 | 24.7 | 70.5 | 25.4 | 26.1 |

| in foreign currency, converted into UAH billions (USD million + EUR million) | – | 10.7

($255) |

16.6

($195 and €188.8) |

8.0

($192) |

9.4

(€200) |

– | 17.1

($211.8 and €168.9) |

16.2

($386.2) |

12.1

($203.6 and €80.6) |

20.7

($500) |

13.8

($320.9 and €6.7) |

12.7

($145.5 and €128.5) |

| From external sources, UAH billions | 130.7 | 0.0 | 133.9 | 185.4 | 47.1 | 126.7 | 71.2 | 194.8 | 48.3 | 210.9 | 293.3 | 129.6 |

| Public debt repayment payments, UAH billions | 36.4 | 50.4 | 73.1 | 65.3 | 27.7 | 69.6 | 48.1 | 33.6 | 46.9 | 79.1 | 40.9 | 25.8 |

| as % of plan (for the full period) | 96.5 | 79.7 | 105.7 | 112.8 | 47.9 | 155.4 | 91.3 | 77.6 | 101.0 | 105.1 | 99.6 | 317.4 |

| Debt servicing payments, UAH billions | 14.5 | 32.7 | 11.3 | 34.0 | 44.1 | 43.2 | 18.6 | 34.8 | 13.0 | 33.6 | 40.0 | 34.0 |

| as % of plan (for the full period) | 54.0 | 77.4 | 70.3 | 83.8 | 54.2 | 119.1 | -* | -* | 105.1 | 135.8 | 88.4 | 34.7 |

*Debt servicing expenditures were not planned

Source: Ministry of Finance of Ukraine; calculations by the Center

Table 3. External sources of financing*, January–December 2025

| Sources | Amount, UAH billions (USD million; EUR million; CAD million) |

| European Union, incl. | 1,331.8

(€28,220) |

| ERA | ₴854.9

(€18,120) |

| Ukraine Facility | ₴476.9

(€10,100) |

| Canada under ERA | ₴142.7

(CAD 4,800) |

| IMF | ₴38

($900) |

| Council of Europe Development Bank under the project Supporting Internally Displaced Persons in Ukraine (HOME) | ₴9.7

(€200) |

| World Bank, incl. | ₴49.8

($1,185.5) |

| Funds from the IBRD under the SURGE project | ₴19.9

($476.3) |

| Funds from the IBRD under the RISE project | ₴12.3

($290) |

| Funds under the DRIVE project | ₴8.0

($190.8) |

| Funds under the LEARN project | ₴4.5

($105.7) |

| Funds under the THRIVE project | ₴4.1

($99.5) |

| Funds under the Social Assistance System Modernization Project | ₴0.96

($23) |

| Funds under the HOPE project | ₴0.008

($0.21) |

*Excluding grants

Source: Ministry of Finance of Ukraine

[1] All planned indicators in the Budget Barometer are presented in accordance with the State Budget 2025 schedule as of December 31, 2025.

[2] Operational data of the Ministry of Finance as of the end of the day on December 30, 2025.

[3] The data were obtained in response to a request to the Ministry of Finance of Ukraine.

[4] In December, UAH 39.9 billion was raised through OVDP placements; however, due to the public debt accounting rules established by Ministry of Finance Order No. 42 of January 28, 2004, the amount of funds directed toward financing the state budget was lower than the amount raised

[5] Exceptions: FOPs under the simplified tax system who are simultaneously employed, provided that their employer already pays the USC on their behalf; FOPs with disabilities who receive social benefits; FOPs who are pensioners; and FOPs under the general taxation system with no income.

[6] Starting in 2025, part of pension payments and lifetime monetary allowances for individuals receiving pensions under special laws (civil servants, researchers, judges, prosecutors, persons affected by the Chornobyl disaster, and others) is financed from the solidarity pension system, whereas previously these expenditures were fully covered by the state budget.

[7] In September 2025, the government adopted Resolution No. 1152, which reduced expenditures on housing and utility subsidies and benefits by UAH 2.7 billion and reallocated these funds to pension payments.

Photo: depositphotos.com/ua/

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations