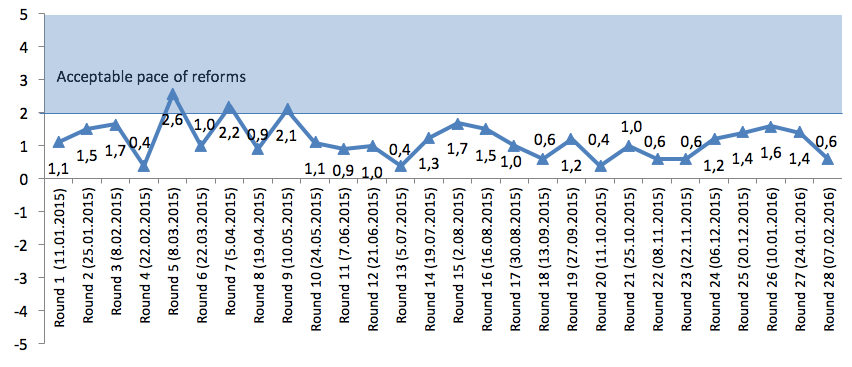

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas. Reform Index value for the 28th monitoring period (January 25 – February 7, 2016) stood at +0.6 point out of the possible range from -5.0 to +5.0 points.

After several eventful rounds, the Index value slid considerably as experts noted only sporadic progress. Political developments overshadowed progress in economic reforms.

Chart 1. Reform Index dynamics

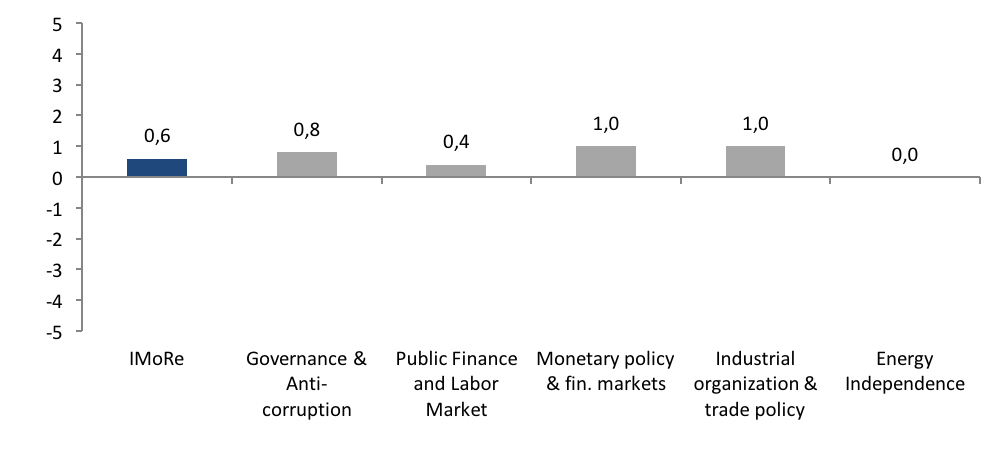

Chart 2. Reform Index and its components in the current round

Issue 28: Political events overshadow reforms

Two events received +2.0 points, which is the highest score in the round. One of them, changes in the regulation regarding mandatory medical examination of drivers (State Regulatory Service order 4 of 06.11.2015), has received positive feedback from experts in anticorruption and deregulation spheres. The order revokes special permits, which health care provider was previously required to obtain to be able to carry out medical examinations of drivers.

Another +2.0 points were given to CMU decrees (16 and 17 of 18.01.2016), which entitle local authorities to provide nutrition of children in preschools, schools and vocational-technical schools from local budgets. This positive step towards decentralization and higher efficiency of public spending was initiated by the budget package laws adopted earlier.

Several positive changes in technical regulation boosted score of Industrial Organization and Trade Policy direction to +1.0. They include the abolition of compulsory certification of agricultural machinery (+1.5 points, Ministry of Economic Development and Trade order 1699 of 17.12.2015) and adoption of new technical regulations relating to the making-up by weight or by volume of certain prepackaged products corresponding to similar EU regulation (+1.0 point, CMU decree 1193 of 16.12.2016).

A number of small positive developments in banking sphere substantiated +1.0 score for Monetary Policy and Financial Markets direction. These developments comprise a requirement to accelerate banks’ minimum capital accumulation (NBU Resolution 58 of 04.02.2016), somewhat tightened requirements for eligible collateral for credit operations used for the calculation of loan loss provisions (NBU Resolution 38 of 28.01.2016), and the settlement of certain issues concerning regulation of banking groups’ activities (NBU resolution 15 of 19.01.2016).

The news that NBU required banks to verify the authenticity of transactions on transfer of funds abroad (NBU letter 25-02002/101317 of 18.12.2015) received +1.0 point. Olena Bilan from Dragon Capital noted:

In developed countries banks check clients and their transactions. However, NBU regulation created many problems for businesses as it was applicable to numerous standard operations.

Dmytro Yablonovskyy from GfK Ukraine also mentioned that

control procedure is not described accurately enough, so there can be issues on implementation upon examination.

Accordingly, some easing of requirements (NBU letter 25-0005 / 8349 from 29.01.2016) was also positively assessed by experts at +1.0 point.

At the same time, tightened eligibility criteria for banks servicing salaries to budget sector employees, pensions and social benefits (CMU decree 37 of 20.01.2016) was negatively assessed by experts. The event scored -0.5 point, since the regulation significantly limits competition.

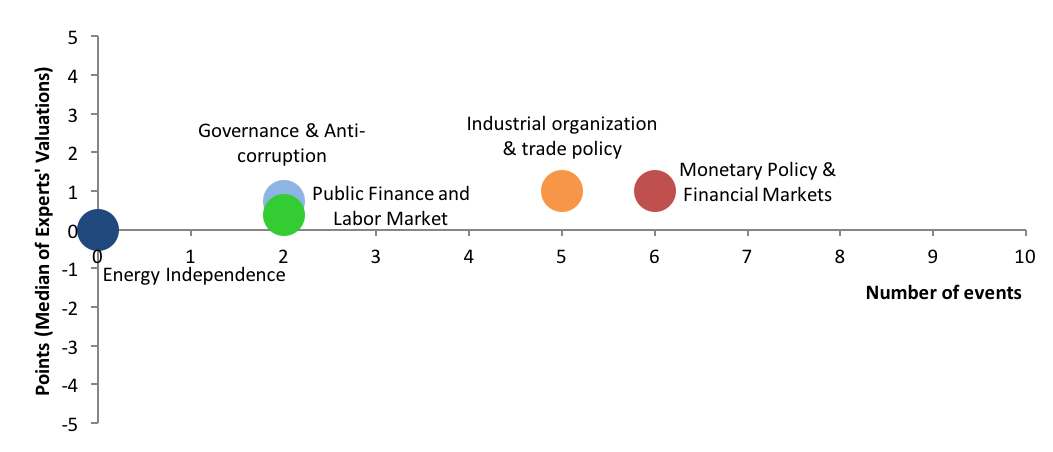

Overall, Monetary Policy and Financial Markets, as well as Industrial Organization and Trade Policy directions received +1.0 point each. Governance and Anti-Corruption sector scored +0.8 point, while Public finance and Labor Market direction [1] was given +0.4. Finally, in the absence of any significant events the assessment of Energy Independence sector constituted 0.0 points.

Notes

[1] The title of Public Finance sector was changed to Public Finance and Labor Market, which more precisely reflects the content of the category.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Chart 3. Value of Reform Index components and number of events January 25 – February 7, 2016

Main media partner Project partners

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations