There can be two general approaches to the monetary policy – using rules and using discretion. The discussions among leading economists about the best approach are still hot. How to choose the right rule when performing economic analysis is problematic due to a very short time span of data, as it is in Ukraine?

There can be two general approaches to the monetary policy – using rules and using discretion. The discussions among leading economists about the best approach are still hot. However, it appears that central banks around the world tend to see more and more benefits in relying on rules: the FED, Bank of England, Bank of Canada are already using rules in monetary policy conduct.

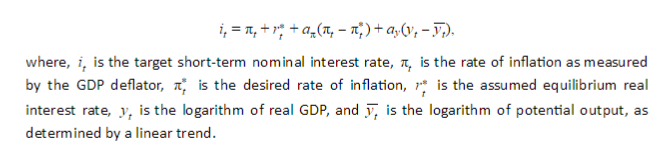

What would those two approaches look like? Let us start with rules. Following the general economics theory, a rule can be defined as “nothing more than a systematic decision process that uses information in a consistent and predictable way.”[1] The most famous monetary rule is the Taylor rule, which defines the relationship between the short-term nominal interest rate and changes in output and the inflation.

This relationship could be depicted by the following equation:

The discretionary policy is explained as an economic policy based on the ad hoc judgment of policymakers as opposed to policy set by the predetermined rule. Thus, discretion does not make any commitment to future policy actions.

Someone can be confused by the unclear difference between very popular among central bankers inflation targeting and using a policy rule. It is important to emphasize that they are not the same. Inflation targeting by itself is rather a goal setting approach; it neither describes certain mechanisms to achieve the goal, nor specifies any set of actions to be implemented.

Both policy by rule and by discretion have their own pros and cons – the pros of one policy is simultaneously the cons of the other. The major advantage of policy rules is their transparency as well as time consistency, while discretionary policies are more flexible and may incorporate a much wider array of information.

Whereas it is clear how to quantitatively compare policies conducted by two different rules, it’s not obvious how to compare the policy by rule to a discretionary approach since if we attempt to model discretion, it automatically becomes a rule. We develop the methodology on how to do this properly.

Considering the monetary policy in the US, we determined the periods when the FED followed the Taylor rule or used discretion through measuring the deviation of the actual FED funds rate from the one suggested by the Taylor rule. Using the Markov Switching Model, we endogenously split the sample into periods of low and high deviation that correspond to rules and discretion eras respectively. For example, 1970th and aftermath of 2011 can be characterized as discretion policy eras; 1980s and 1990s — as the rules eras. Next, we define a loss function that depends on (the sum of) inflation and the unemployment rate, which are in the main focus of the FED. Interestingly, during the rule-driven periods the value of the loss function is consistently lower compared to the discretion periods.

Other lectures at the NBU Conference

Price Selection, Inflation Dynamics, and Sticky-price Models, lecture by Oleksiy Kryvtsov

Prudential Regulation: Are Government Bonds Safe, lecture by Igor Livshits

Moreover, we found that rules that favor the inflation response coefficient over the output gap response coefficient are the most successful.

In the light of these findings, I suggest the National Bank of Ukraine to select and then rely on a policy rule that they find useful in order to strengthen the social trust to the NBU as an institution and reduce the political pressure on it. A rule-driven policy doesn’t mean that the NBU will not anymore take active part in executing monetary policy or that it will lose its independence, rather – that it will provide more transparency to the process and make it predictable to businesses. Of course, in cases of significant exogenous shocks the central bank might need to depart from or rethink the chosen rule, thus exercising discretion. In that case, the NBU governor will have to testify in the Rada and explain the reasons for the departure. This will help making the monetary policy decisions more clear and open to the public.

How to choose the right rule when performing economic analysis is problematic due to a very short time span of data, as it is in Ukraine? Taylor (2000) provides the guidelines for emerging and developing economies. When it comes to the choice of the left-hand-side policy variable, the two popular options are the monetary aggregates and the interest rate. It is suggested to use money supply when there is uncertainty about real or equilibrium interest rates, large shocks to net export and investments, or high and volatile inflation. However, I personally hope that the Ukrainian economy is past that stage now, so the second option of using the short-term lending rate is preferable. Regarding the choice of the right-hand-side arguments that should enter the monetary policy reaction function, it is common to enhance the standard Taylor rule with the real exchange rate for countries other than the U.S. However, research shows that this is not necessary because simple two-variable Taylor rule with the inflation rate and unemployment slack results in robust performance even when dealing with small open economies. Hence, the classical 1993 Taylor rule is expected to work well for Ukraine.

VoxUkraine is grateful to KSE student Hanna Onyshchenko for writing down this lecture

Notes:

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations