For 50 years (1960-2010), South Korea GDP per capita at constant prices (i.e. excluding inflation) at Purchasing Power Parity (PPP) increased 25-fold. South Korean development started on par with China, and now its GDP at PPP per capita is $36.6 thousands. Today, it’s a highly-developed country and a member of the G-20, and its economy is the 11th biggest the world. This significant and sustained growth certainly sparked interest of the economists. It may seem strange to the public, but in today’s economic theory, there’s no consensus on what helped Korea become so successful.

The Republic of Korea, or South Korea, as it has been often called after the Korean War of 1950-1953, is unique in terms of economic growth. For 50 years (1960-2010), the country’s GDP per capita at constant prices (i.e. excluding inflation) at Purchasing Power Parity (PPP) increased 25-fold. South Korean development started on par with China [1], and now its GDP at PPP per capita is $36.6 thousands. Today, it’s a highly-developed country and a member of the G-20, and its economy is the 11th biggest the world.

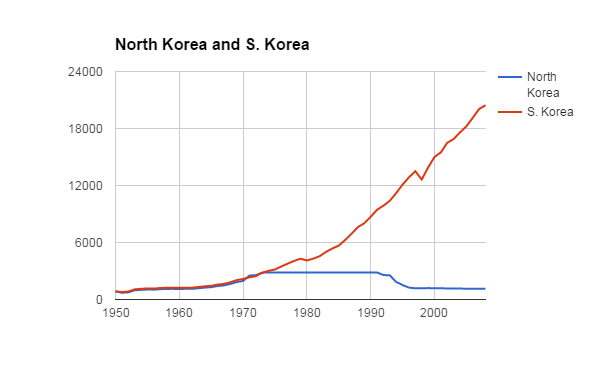

Fig. 1. GDP per capita (in constant 1990 $US), North and South Korea, 1950-2008

Source: Maddison Project Database

This significant and sustained growth certainly sparked interest of the economists. It may seem strange to the public, but in today’s economic theory, there’s no consensus on what helped Korea become so successful. This article is an attempt to describe factors and policies, which had an impact on the Korean economic development, and draw a lesson for Ukraine.

The Korean economic development is usually divided into three periods: import substitution, export orientation, and industrialisation.

First Period, 1953-1961, Import Substitution

After the war, South Korea was poorer than most African countries, not to mention Europe. Prior to the independence, the majority of capital and land was owned by Japanese colonisers. After the WWII, these assets were confiscated by the state and privatised. Often, they were bought by powerful, well-connected family groups. [2]

The first attempt to promote economic growth was a then popular idea that import substitution would lead to “self-sufficiency” of the economy. To achieve this goal, the government increased import tariffs up to 77%. Importers had to receive a special permit to import products, and there were several exchange rates at the same time. This helped several powerful businessmen, which later formed “family corporations” or chaebols, to become rich. However, this policy failed. Back then, the average growth rate was 5.5%, which is very low for a country that is being rebuilt after the war. Even non-repayable financial, technical, and humanitarian aid from the US didn’t help, though it amounted to 10% of Korean GDP per year — from 1954 to 1960, more than two-thirds of annual imports were financed by the US.

In 1960, the presidential (and vice presidential) elections were held. The 85-year-old Syngman Rhee received an overwhelming majority of the votes. The elections were held with significant violations and led to mass student protests (the army opened fire on protesters, killing 180 and wounding thousands of civilians), which in turn lead to the overthrow of Syngman Rhee. The result was a short lived “second Korean Republic”. In a year, it was overthrown by a military junta led by Park Chung-hee, who seized power in the country.

Second Period, 1962-1972, Export Orientation

Park Chung-hee was an implacable opponent of communism, which didn’t prevent him from actively introducing economic interventionism, creating and implementing five-year plans, and illegally persecuting his political opponents. First, he tried to fight corruption and punish businessmen close to the previous government. However, he didn’t manage to put many people into prison, and the ties between big business and government only grew stronger. From the failed import substitution policy, the focus shifted to export orientation.

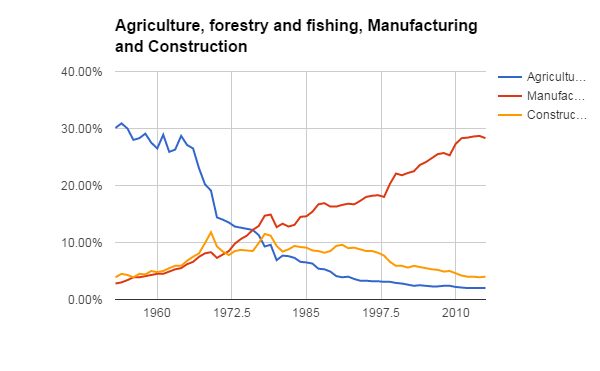

Fig. 2. Construction, agriculture, and manufacturing, value added, %

Source: Statistics Korea, own calculations

It’s important to understand the geopolitical situation in the early 60s. Korea has improved relations with its former coloniser — Japan (which was paying a multimillion-dollar compensation), and in exchange for military and political support of US actions in Vietnam it got access to the US procurement for its campaign. For example, according to Kim (cited according to this source, the original 1970 article isn’t available online), Korean revenues from contracts related to the Vietnam War in 1967 amounted to $185 million, or about 4% of GDP of that year.

Procurement didn’t only provide currency for the purchase of modern imported equipment, but also created a guaranteed market and helped get skills which could be later used in other projects. According to Glassman and Choi, 21% of construction works in 1965-1969 were commissioned by the US. Projects were implemented by civilian companies that made part of chaebols. For example, Hyundai built the Narathiwat-Pattani highway in Thailand in 1965. It had to be used for movement of troops and supplies to Vietnam. As a result, the source of 40% to 60% of the gross fixed capital formation (GFCF) were public procurement contracts by the US, as well as the US financial and humanitarian assistance in the late 1960s.

The new government continued to actively intervene in the economy, but the emphasis shifted. Import tariffs were reduced, while companies that met export quotas received access to subsidized loans and other benefits. Until 1967, there was a list of goods allowed for import. Other goods were prohibited and could be imported only with special permits, and there were restrictions on the purchase of hard currency for this purpose. However, under external pressure since 1967 the government made a U-turn on this policy, and issued a list of prohibited goods.

Loans were issued to exporters by foreign banks under state guarantees and by the state through renationalised banks. The industry mostly developed through labour-intensive production, which could attract labour from agriculture.

If in 1963 agriculture accounted for 43.1% of GDP and employed 63.4% of the workforce, in 1970, these figures were 26.7% and 50.4%, respectively. Export promotion was successful both in absolute and in relative terms — the export grew from $55 million in 1962 (2.4% of GDP) to $1.6 billion in 1972 (15% of GDP). Export structure shifted from agricultural products and minerals to the light industry — textiles (40.8% of exports), plywood (11%), and wigs (10.8%) were the top three export products in 1970. Overall, labour-intensive light industry products accounted for 70% of exports — the country used its competitive advantage in full compliance with the classical theory of international trade. Korea’s main trading partners were the US (47.3%) and Japan (28.1%).

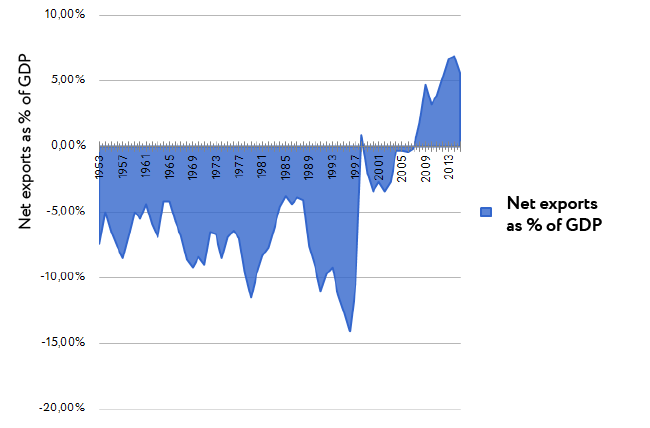

Fig. 3. Net exports as % of GDP

Source: Statistics Korea, own calculations

Exports grew at a fast pace — in 1963-1969, the average annual growth was 35%, while imports grew by an average of 22% annually. However, it’s worth noting that during all this time net exports remained negative with the average level of -6.9% of GDP in 1962-1971, because the initial level of imports was significantly higher than of exports. Maintaining such a permanent and significant trade deficit required the inflow of foreign capital — first, financial aid, then — direct investment and debt.

Because it’s necessary to have large volumes of production and exports to get assess to most state incentives, there was concentration of businesses and development of chaebols. Government credit support wasn’t always successful, and often required spending additional resources to rescue failed projects. To generate income for such spending, the government protected successful companies by limiting the entry of new participants into the market. Four attempts to change the law in favour of deregulation and competition failed.

In the 1960s, Korean companies actively invested into new assets — the growth rate of gross fixed capital formation increased from 10.5% a year in the first half of the decade to 33.2% in the second half. The companies didn’t have enough funds for such investments, so they actively built up debts — the ratio of their net worth to total assets fell from 51.6% in 1965 to 23.3% in 1970. There appeared many companies with a positive cash flow, but critically dependent on the extension of credit lines and their own treasury bills. When companies had no available bank loans, they borrowed on the domestic unregulated financial market [3], often at considerable interest.

Third Period, 1973-1979, Development of Heavy and Chemical Industry

In July 1971, the Federation of Korean Industries (which represented interests of major companies), addressed to the President Park Chung-hee with a request to buy out debts of troubled companies. The last straw that broke the camel’s back was 17% devaluation of won in the previous month, leading to increased cost of servicing foreign currency loans. The possibility of bankruptcy of these firms was considered, but for fear of stopping foreign investment in a case of high-profile bankruptcy a more expensive, but more politically acceptable approach was chosen. It took a little over a year before the government issued a decree (called the “August 3 Decree”), according to which old debts of the companies against the unregulated financial market were replaced with flat rate debts (1.35% per month). These debts had to be repaid within 5 years after a 3-year grace period.

Short-term bank debts were replaced by a unified debt (8% annually, 3-year grace period, 5-year repayment period). Real interest rates were virtually equal to zero or negative — the annual inflation in 1971-1974 amounted to 13.5%, 11.7%, 3.2%, and 24.3% respectively.

Fig. 4. Gross fixed capital formation as % of GDP

Source: Statistics Korea, own calculations

This redistribution of value in favour of the borrowers through formal and informal financial sector benefited big companies, while small and medium companies had limited access to bank credits. However, it brought only temporary relief to the big business — reduction of credit payments led to opportunistic debt accumulation.

In addition to the direct credit support of the big companies, the government introduced a moratorium on debt servicing companies against unofficial financial markets. The companies that didn’t want to directly invest in the sectors selected by the state didn’t just lose their access to financing (the banking system was controlled by the government), but had problems with tax agencies and restrictions on licenses, which closed their access to promising markets. Many companies created excess capacity, which they couldn’t use due to the lack of demand for their products.

In January 1973, Park Chung-hee declared the Heavy and Chemical Industry Drive, or HCI. The 1970s saw the peak of state intervention in the activities of corporations. Before, the state didn’t choose the industries to support. The transition to direct support of the industries was the result of three main factors (according to Anne O. Krueger, 1995):

1) reduction of the US military presence, which led to the need to develop South Korean own military-industrial complex;

2) increase in wages due to the overall economic growth, which made labour-intensive exports less competitive. The growth of neighbouring countries with similar labour-intensive industries;

3) the large account deficit of the current balance of payments, despite the export promotion using imported resources in production.

Reduction of the US financial support meant that it was necessary to urgently reduce the trade deficit, because its funding source disappeared.

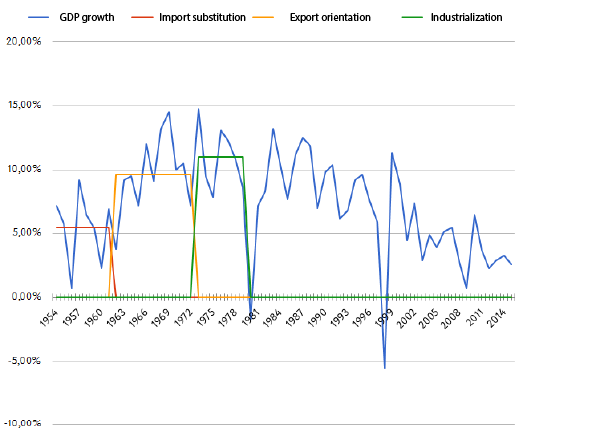

Fig. 5 The growth of real GDP, annual %

Source: Statistics Korea, own calculations

State owned industrial companies were established, a famous example being that of POSCO (Pohang Iron and Steel Company), the money for the construction of which was provided by Japan following an agreement between the former colonial power and its colony. The agreement to provide South Korea with loans, financial, and technical assistance was signed in 1969, and POSCO began production in 1972. The company was privatised in the late 1990s, and now it’s the world’s fourth largest steel producer.

During this period, South Korean GDP grew at fastest rate (11% annually in 1973-1979 vs. 9.6% in 1963-1972). However, opponents of state intervention note that this increase was mainly due to export orientation of the economy, and its pace could have been higher without state intervention. It should be noted that in 1980, GDP declined for the first time in almost thirty years. Of course, the assassination of Park Chung-hee and the second oil shock had an impact on this, but the slowdown was evident even before these events.

1979-2017: Correction of Errors

In 1979, a series of events led to a crisis and forced the government to move from the support of specific companies to creation of more equal opportunities — a process that continues through to this day. First, there was the second oil shock that struck the chemical industry — a sector largely supported by the state. Second, inflation accelerating to 18.3% in 1979 and 28.7% in 1980 due to large fiscal and trade deficit and price distortions by the government policy led to shortages of many consumer goods. Third, on 26 October 1980, President Park Chung-hee, dictator who almost single-handedly solved tactical and strategic issues of economic development, was assassinated. Fourth, because of the 1980 drought the harvest that year was very poor, and GDP declined by 1.7% for the first time since 1953.

Another group of soldiers, headed by general Chun Doo-hwan, seized power in the country. Fearing a renewal of military conflict with North Korea, they declared state of emergency. It resulted in increased protests of students and ordinary citizens against political dictatorship and domination of chaebols, such as the Kwangju Uprising in May 1980, which was brutally repressed by the army and resulted in death of over a hundred people. Later, it was the turn of trade unions to rebel against the government. Protesters succeeded only in 1996, when former President Chun Doo-hwan was sentenced to life in prison on multitude of changes, including for excessive use of force to suppress the protests.

At the beginning of 1980, Korean GDP per capita in constant 1990 $US was approximately the same as in contemporary Ukraine. Advisers of Chun Doo-hwan explained the futility of continuing the policy of active intervention in the economy — back then, Korea approached the technology frontier, and its economy got so complicated that it was impossible to predict the success of any intervention. That’s why a gradual economic liberalisation took place. It didn’t prevent further economic growth — from 1981 to 1997 (the year of the Asian financial crisis), the average annual GDP growth accounted for 9.1%. Import duties were lowered, new public projects in industry were not launched, and the business got more equal access to loans.

However, as it became clear, especially after the 1997 Asian Financial Crisis, the country still had significant structural imbalances. Its banking system still had problems with large loans granted under government pressure to big corporations, some of which, like Daewoo, went bankrupt. The chairmen of chaebols were accused of bribery, financial fraud, tax evasion, and government ties. In recent years, the heads of major companies like Samsung, SK, Hyundai, Hanwha, and Lotte were interrogated. However, the chairmen of large chaebols are often pardoned — as it was with Lee Kun-Hee of Samsung or Chung Mong-Koo of Hyundai. In late 2016, Park Geun-hye, the first female President of South Korea, was impeached on charges of corruption.

1953-1979: Three Decades of State Intervention

There’s no unified view about whether this policy had a positive impact on economic growth. Most agree that intervention at the stage of import substitution had a negative impact, as evidenced by moderate GDP growth despite massive external financial assistance. Government import restrictions failed to reduce the trade deficit and didn’t lead to significant industrial growth. The situation changed only after reorientation to external expansion.

The periods of export orientation and heavy industry development are similar in that the state actively intervened in the economy in both periods. However, the intervention mechanisms differ significantly. In the first case, any exporter could receive preferences for compliance with export plans — loans with lower rates, hard currency, and tax benefits. That’s why the industries developed according to market laws — the country specialised in light industry goods, where it had a competitive advantage — cheap labour. When the state started developing heavy and chemical industries, its main goal was not to maximise the profits, but to increase its defence capacity. That’s why the policy of direct support of chosen industries and companies was introduced — these industries enjoyed lower prices of materials, were provided with engineers and other skilled workers. This led to control of consumer prices, emergence of consumer goods deficit and a black market, and eventually to slower economic and export growth.

It should be said that division into opposing groups according to the views on the role of the state in Korean development doesn’t reflect the division by economic schools or nationality of the authors. Thus, among bright proponents of the state’s role in the Korean development was Alice Amsden (author of the book Asia’s Next Giant: South Korea), and, to some extent, even representatives of the World Bank (their research welcomes state intervention only in cases if there’s a market failure, such as asymmetric information, problems to achieve economies of scale under competition, etc.).

Opponents argued that if calculated according to world prices, productivity of heavy and chemical industries remained lower than productivity of light industry, whose development was hindered in 1970 (Yoo Jung-ho, 1990). Imports from South Korea to OECD countries increased in the 1970s less than imports from Taiwan that had similar export structure, but didn’t have significant state involvement at that time. It’s difficult to evaluate alternalives because of the lack of a perfect “control version” to which Korea may be compared. All counter-historical estimates are based on assumptions that can’t be clearly proven.

In general, we can determine the following factors that had a significant impact on the economy of South Korea:

- Even with significant state intervention, in the long-term market economy wins over administrative-command system — in 1950, the gap between GDP per capita in South and North Korea was minimal. In 2008 (the latest available estimates for North Korea), South Korean GDP per capita was 18 times higher than that of North Korea.

- State intervention has determined the economic structure of the Korean economy and industry. It’s impossible to say whether the structure would have been better or worse, but it certainly would have been significantly different.

- Significant foreign aid from the US and Japan and the opening of these markets for Korean goods. The influx of external funds allowed South Korea to have a permanent trade deficit in 1950-1997.

- Significant investments into infrastructure. Value added in construction in 1953-1979 was on average 7.8% of all value added in the economy, during the development of heavy industry — 11%. In Ukraine in 2001-2010, this figure was 3.6%.

- Significant growth in the quality of the labour force due to the development of education, health care, and social security.

- High level of (compulsory) domestic savings, which, together with the external capital, allowed to finance capital capacity of the economy. Absence of a pension fund [4] forced many people to save for retirement. Real rates on deposits of the population in the 1960-70s were mostly negative because of the rate restrictions and high inflation. Sometimes the state intervened with redistribution in favour of the debtors (see the January 3 Decree above in the text).

Economists distinguish two types of economic growth — extensive and intensive. The first is based on increase of resources — capital, labour, and so on. The second envisages a more efficient use of resources. European countries and North America have developed mainly by intensive growth — the emergence of new, more efficient technologies. The USSR in the industrialisation period was a classic example of extensive growth — due to crowding people out to work in industrial cities (including rationing system), squeezing out private savings (Torgsin buying gold during the famine), forced savings, and buying Western factories and other modern capital. The problem with extensive growth is that production factors are limited. Of course, you can double the workforce by involving women in the economy, improve its quality through education programmes and literacy classes. But you can hardly expect to involve everyone — from infants to elderly people — in manufacturing or studying to a PhD degree. Therefore, after the exhaustion of resources economic growth in the USSR slowed down, which eventually led to the fall of the Soviet empire.

In the 1970-1980s, a significant part of Western economists considered the East Asian Miracle a repetition of the Western way, i.e. efficiency increase. But in the 1990s, after Japanese growth stopped and Korean financial problems began, an idea spread that their success resulted from favourable conditions (including political) of the foreign trade, combined with a significant mobilisation of resources. Just as in the USSR, such mobilisation allowed temporary rise of economic growth simply by increasing inputs.

Lessons for Ukraine

Ukraine is unlikely to copy the experience of South Korea because of the following economic and political constraints:

- Lack of a reserve army of labour. There’s no significant number of young people who would leave the less productive agriculture and start working in the industry. It’s unlikely that young people will agree to work for 10-12 hours a day for little pay. In Korea in 1980 (i.e., after the end of substantial direct state intervention) agriculture employed 34% of workers, in 1963 — 63.4%; in Ukraine in 2012-2015, this figure was 17.3%.

- Significant level of social spending, which requires significant tax burden. If preferences are introduced for industries and firms, the burden on the rest of the economy will grow. The aging population will require additional increase in social and healthcare costs.

- Low savings rate and a low probability of forced savings mobilisation.

- Absence of significant external support — Korean economy had a trade deficit thanks to the help of the US from 1953 to 1997 and foreign direct investment in the later period, as well as thanks to access to the US and Japanese markets.

- Political unacceptability of dictatorship and subsequent fusion of the state and big business.

Notes:

[1] About $1000 of GDP per capita. For comparison, GDP per capita at PPP in Ukraine in 2015 amounted to almost $8000.

[2] The Americans at first put high requirements on the sale of seized Japanese assets in Korea, and very few citizens met those requirements, that’s why the property was transferred to the new Korean government. The government initially put up the banks for sale in 1954, setting limits on the source of funds and trying to prevent selling the banks to insiders, but received no offers. The government scaled down their requirements. Using political connections, large industrial capitalists borrowed money from banks to buy them. When privatisation was completed in 1957, all major commercial banks were controlled by industrial capitalists. According to a study, the proportion of insider loans of such banks exceeded 50%. Buyers financially supported the Liberal Party of President Syngman Rhee (according to the work of Phillip Wonhyuk Lim, Path Dependence in Action: The Rise and Fall of the Korean Model of Economic Development).

[3] In addition to commercial banks and state-controlled “deposit banks”, there was a considerable unregulated domestic market, which provided mainly short-term loans. By 1972, the loans of the unregulated market amounted to KRW 346 billion, the loans of commercial banks — to KRW 646 billion, the loans of deposit banks — to KRW 823 billion (see p. 166 of the book Financial Development in Korea, 1945-1978).

[4] It was founded only in 1988. Prior to this, there were funds available for civil servants and the military, but they covered a small part of the population.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations