The Government of Ukraine is planning to fundamentally change corporate taxation in Ukraine. A draft law for introducing an “Exit Capital Tax” (ECT), effectively taxing the distributions of profits and capital by companies instead of taxing financial profits as before, has been approved by the Cabinet of Ministers of Ukraine and is supported by the President. Introduction of the new tax hence appears quite likely and to be an issue of time only.

However, the analysis of the probable effects of introducing the ECT by the German Advisory Group in cooperation with IER Kyiv and Otten Consulting as well as international experience with such taxes comes to mixed conclusions about the pros and cons of this tax. A matter of concern is the negative short run fiscal impact of ECT introduction. As only profit distributions are taxed by the ECT, companies can defer their tax burden to later years. This gives rise to a potential short-run fiscal shortfall of between UAH 37 bn to UAH 47 bn, corresponding to 1.2% to 1.5% of Ukrainian GDP for the years following ECT introduction. In view of Ukraine’s still fragile macroeconomic and financial situation, introduction of the ECT should under all circumstances be accompanied by a comprehensive plan for compensating the negative fiscal effects. Furthermore, a change of the corporate tax systems does not at all alleviate the need for the more pressing reform in this domain: The fundamental overhaul of tax administration in Ukraine, increasing the capacity and fighting corruption at the State Financial Service (SFS).

Note: This article is based on several publications of the German Advisory Group written in cooperation with IER Kyiv and Otten Consulting on the topic of the possible ECT introduction, which cover specific aspects in far greater detail, please see the list of references below for the individual papers.

Political impulses for a reform of the corporate tax

Reform of corporate taxation has been a subject of debate in Ukraine for many years and several attempts to implement it were taken. During recent years, the reform of tax administration became a principal objective, aimed at improving the State Fiscal Service (SFS) from a cumbersome, capacity-challenged and intransparent administration branch into a modern, effective and transparent government service, reconciling the fiscal needs of the state with the requirements of companies for low administrative burdens and tax risks. However, progress with SFS reform to date has been slow until now. This led a group of experts and lawyers to propose a fundamental reform of the corporate profit tax (CPT), to be replaced by an “Exit Capital Tax” (ECT). This initiative, driven principally by the Chairperson of the Verkhovna Rada Committee on Taxation and Customs Policy, Nina Yuzhanina, has since gained strong political momentum. A draft law on ECT introduction, based on work by lawyers Oleksandr Shemiatkin and Tetiana Shevtsova and subject to a consultation process in a working group at the Ministry of Finance was submitted to the Cabinet of Ministers in July 2017. The Cabinet of Ministers approved the Draft in October and sent it for the review of the National Reform Council.

A different tax altogether

Introducing the ECT would amount to a fundamental reform of corporate taxation in Ukraine. Economically, the ECT basically is a tax on distributed profits: dividends and equivalent transactions rather than financial profits as in the corporate profit tax. The name “Exit Capital Tax” instead of “Tax on Dividends” reflects that, in order to prevent tax avoidance, all outflows of capital from ECT taxpayers to non-ECT taxpayers will be taxable under the ECT. The ECT is based on an internationally non-standard type of corporate taxation that was first introduced in Estonia in 2000. Although a small number of countries experimented with this type of tax in the meantime (Macedonia and Moldova introduced and subsequently abolished variants of this tax), Estonia is the only country with a long history of this tax. Georgia has introduced a very similar tax to the Estonian corporate tax in 2017.

Two main motivations exist for the proposed fundamental change of the system:

- Increasing investments. As retained profits used for investments are not taxed, this should favour investment.

- Administrative facilitation. As the tax base shifts from the financial profits to transactions, it is claimed that a transaction based tax rather than an accounting based tax gives rise to lower administrative burdens for companies and tax authorities alike.

A key difference between the proposed ECT and the present CPT is that the tax base– the underlying values of taxpayers subject to taxation – is no longer made up by the adjusted financial profits of companies, but by individual, taxable transactions. This is quite a radical difference for tax administration, as tax enforcement would now focus on individual transactions instead of auditing the entirety of taxpayers’ financial accounts.

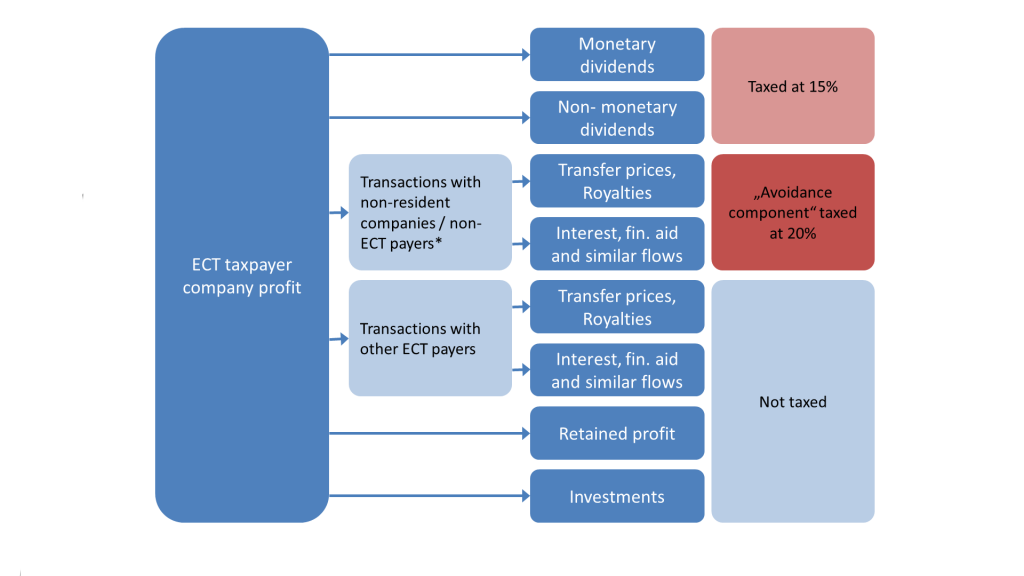

Tax rates and tax base

The ECT would feature two main tax rates: A 15% rate for outright profit distributions and a 20% rate for disguised profit distributions (“deemed dividends”), hence providing an incentive for taxpayers to use “normal” dividends for profit distributions. Although these rates appear to have the current CPT rate of 18% as their average, the ECT would on balance also imply a decrease of tax rates on distributed profits. As no withholding tax (effectively Personal Income Tax) and “military duty” will be charged on dividends any longer, it would amount to a rate decrease of up to 11% for profits distributed to individuals through dividends (but a tax rate increase of 2% on deemed dividends).

Tax base of the ECT

Source: Berlin Economics. Note: This is a simplified illustration of the ECT base, see German Advisory Group, PB/12/2017 “Estimation of the short run fiscal impact of introducing an Exit Capital Tax” and TN/02/2017 “Estimation of the short run fiscal impact of introducing the Exit Capital Tax: Methodology and further calculations” for a more detailed description of the ECT base

Companies subject to the ECT would only have to report taxable transactions instead of a tax statement based on the entirety of their financial accounts. Dividends/transactions with capital exit and equated payments are to be reported quarterly if specific transactions falling under this concept took place. The tax authorities shall have access to a range of data including the quarterly and annual financial reports of companies and are empowered to conduct tax audits on the basis of reports by taxpayers, financial reports and accounting reports and further documentation related to decisions on profit distributions and calculation of payments and transaction that equate to a capital exit. Most anti-avoidance concepts used under the CPT, such as transfer pricing controls or the monitoring of interest payments to related parties, remain relevant under the ECT.

No major defects of present CPT system

The current CPT system operated by Ukraine is quite standard in international comparison, in contrast to the still rather exotic ECT. With its tax base and tax rate fully within the range of normal international practice, the CPT is unlikely to have particularly harmful effects on investment. Indeed, company surveys indicate that businesses and investments are not constrained by the tax system, but by institutional problems, notably corruption, lack of trust in the judiciary and complicated tax administration. Although some of this is related to the fact that CPT enforcement is a demanding and complex task, experience from a multiplicity of countries shows that it can be solved in a satisfactory way through institutional, not tax reform.

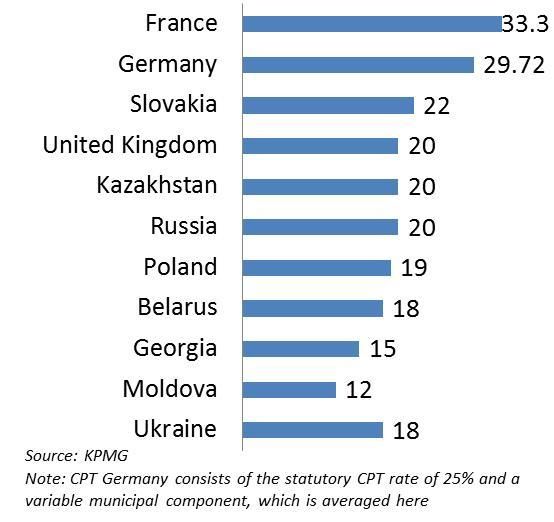

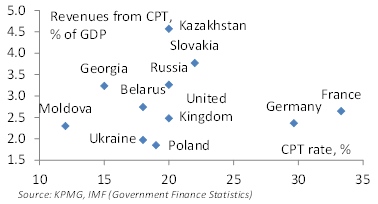

International average CPT rates in comparison

CPT rates and revenue shares of GDP in different countries, 2015

Fiscal revenues from the CPT in 2016 amounted to 7.7% of consolidated fiscal revenues, corresponding to 2.6% of GDP; however, they were relatively low in international comparison (CPT revenues in Germany in 2015 equalled to 2.4% of GDP, but to 2.8% of GDP in Belarus and 3.2% of GDP in Georgia). The relatively weak fiscal performance of the CPT in relation to comparable countries was due to a combination of losses accrued by taxpayers in previous years, legal tax avoidance and capacity deficits of the SFS.

Limited impact of ECT on investment, potential for administrative facilitation

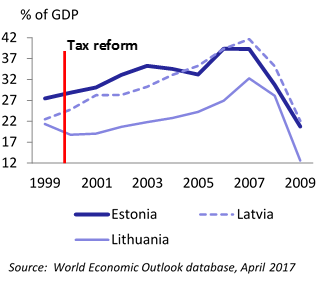

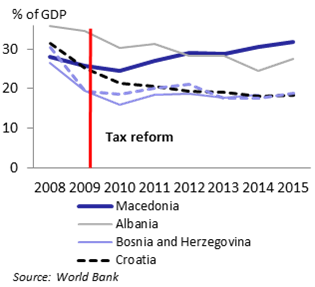

Our analysis indicates that only limited immediate impact of ECT introduction should be expected concerning investments. As the tax system is not ranked by companies as a major impediment to investment at present, changing it can only have limited impact on investments. Also, the difference between ECT and CPT with regards to the tax treatment of investments is smaller than appears at first sight. In particular, the ECT would only significantly improve the investment possibilities of companies who are honest taxpayers, do not have large tax losses carried forward and have a large share of equity-financed investments in categories other than equipment (which can be quickly deducted from the CPT using accelerated depreciation rules). International experience confirms this limited impact: Of three countries analysed for their experience with similar forms of corporate tax reform – Estonia, Macedonia and Moldova – only Macedonia experienced significantly higher investment than benchmark countries following the tax reform, although it is disputed whether the tax reform or other beneficial factors drove investment growth in the respective period.

Investments as % of GDP following tax reform in Estonia

… in Macedonia

However, moving from the CPT to the ECT has the potential for administrative simplification, which may translate into long-run improvement of business climate and hence investments: Administration of a transaction-based tax could in principle be simpler than that of the current system as some difficult issues that can crucially affect the financial profits of companies (and hence their CPT burden) such as fair-value assessments for assets or provisions for liabilities and that highly challenge the capacities of the SFS at present, would no longer play a role. Other difficult aspects, such as transfer pricing rules etc. would however remain relevant. Also, if tax audits can be confined to auditing individual transactions rather than the entirety of companies’ financial accounting, this has the potential for significantly reducing administrative costs for companies and authorities alike. However, these potential gains require a substantial and fundamental reform of the SFS to take place before ECT introduction: Without significantly improved capacities and integrity of the service, the transition challenges will prove immense and the potential for simplified administrative procedures will not be seized.

Negative short run fiscal impact necessitates solid budget planning

Our analysis shows that negative short-run fiscal effects must be expected from ECT introduction. The tax allows companies to defer their tax burden by deferring the distribution of profits – the mechanic that, as supporters argue, will favour investments. We have conducted an in-depth analysis of the possible fiscal effects of the ECT in the first years following its introduction. Our results show that, depending on scenario assumptions, the fiscal shortfall – the difference between the foregone revenues of the then abolished CPT system and the new revenues of the ECT system – would account for 1.2%-1.5% of GDP in the first year of the ECT.

We should note, that UAH bn results were calculated for the ECT introduction in 2018, which followed the discussed timing for the decision. However, the Law on the ECT introduction was not approved in 2017, which explains currently discussed introduction in 2019.

Fiscal impact of the ECT, UAH bn

| Optimistic result | Pessimistic result | |

| Foregone revenues from CPT system | 74.7 | 74.7 |

| – ECT Revenue | 36.9 | 27.4 |

| = Fiscal Shortfall | 37.8 | 47.3 |

| % of GDP | 1.2% | 1.5% |

Source: Own calculations. Note: Calculated for introduction in 2018

We calculated the expected ECT revenues by first taking existing data on the transactions volumes forming the new tax base of the ECT, extrapolating it to 2018 values and then applying the ECT tax rates to these transactions volumes. Note that data was not available for 8 out of 18 constituent transaction types; however, the volumes in these types are expected to be very small, hence not leading to a severe underestimation of ECT revenues. We then considered two types of reactions by taxpayers to the new tax:

- Reaction to (mostly) lower tax rates. Using empirical values for the elasticity of taxable income of the corporate tax base to tax rate changes, we calculated the “optimistic result”, as this reaction leads to increased taxable transactions and hence tax revenues.

- Reaction to the new tax base. Taxpayers are likely to react to the new tax base by reducing profit distributions to benefit from retained or reinvested profits not being taxed. Assuming a reduction of dividend and deemed dividend payments by 20% and of profit distributions of SOEs to the state budget by 10%, we calculated the “pessimistic result” for the realistic range of first-year ECT revenues.

Negative short run fiscal effects do not imply a tax reform should not be undertaken. However, they imply that solid fiscal and budgetary planning is required. Especially in Ukraine’s still vulnerable macroeconomic situation, budgetary planning should be based on realistic revenue expectations and should be robust to revenues following pessimistic scenarios.

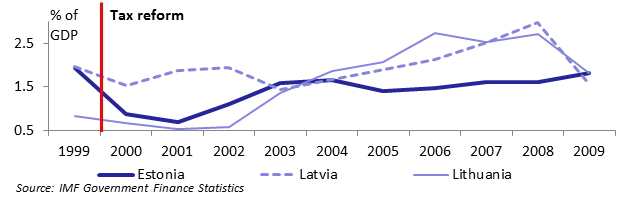

Less optimistic than other studies, but in tune with international experience

Compared with several other estimates of ECT fiscal revenues in the first year (mostly calculated for 2018, as previously, introduction in 2018 was expected), our results are on the lower side of these estimations. All estimates indicate fiscal losses in the first year after ECT introduction. However, the magnitude of losses varies due to different assumptions. For example, the Ukrainian Institute for the Future (UIF) estimates fiscal losses of UAH 23 bn – less than half of our pessimistic assumption of UAH 47.3bn. The UIF estimate is based on the assumption of extremely substantial de-shadowing of income (30% and more of currently hidden profits being de-shadowed due to ECT introduction) and large increases of investment. Both assumptions are excessively optimistic in our view. International experience is also consistent with our expectation of a significant fiscal shortfall after this type of tax reform.

Corporate tax revenues in Estonia and benchmark countries, % of GDP

Results for Estonia show a clear decline of corporate tax revenues as a share of GDP following the introduction of a dividend tax. Past data from Moldova and Macedonia shows the same results and preliminary data from Georgia, where a similar tax was introduced at the beginning of this year, also indicates that initial revenues from the new tax fall significantly short of the previous tax revenues.

One more difference between our estimates and the estimates of the UIF is the assumption on the behaviour of banks after the ECT introduction. In particular, according to the current Draft Law the banks would have a right to choose whether to remain at CPT or shift to ECT until 2020. We assumed that all banks would remain at CPT in the first year after the ECT introduction. However, if part of banks shifts to ECT right away, fiscal losses would actually increase from our current estimates.

Government should persevere with SFS reform and have robust budget plans

With introduction of the ECT now being planned for 2019, there is some, but limited time to create conditions conducive for the tax reform to contribute to Ukraine’s economic development. Most important is to redouble efforts towards reform and upgrading of the SFS. The main problem of Ukraine’s tax system is not the tax system, but deficient tax administration. Measures to improve the capacity and institutional culture of the SFS are crucial. Corruption at the State Fiscal Service should be combatted. This is already indicated by problems the SFS faces with the administrating transfer pricing. The ECT introduction would under no circumstances substitute the need for a comprehensive overhaul of the SFS. Without SFS overhaul, any possible benefits from ECT introduction are likely to be minimal.

Equally important is that the government should take a cautious approach to fiscal policy. The Government should make sure that revenue shortfalls expected in the first years – also worst-case results – are properly compensated with expenditure cuts or tax increases. Without compensating measures, the overall impact of an ECT introduction would be clearly negative as it would put additional strain on a still difficult fiscal situation. The additional time until 2019 should also be used to refine ECT fiscal impact assessments: The SFS should collect comprehensive data on the new ECT tax base (including the components on which no data exists at present) over one full year to allow a more precise estimate revenue estimate. Furthermore, present estimates do not yet fully reflect the timing overlaps of CPT and ECT revenues in the year of ECT introduction. Some CPT revenues are only collected in the first quarter of the year following the tax year they are charged on. Hence, the budgetary impact of the ECT will be effectively phased in over the first two years. Solid revenue expectations incorporating these timing effects are required to enable prudent budget planning.

References

This article is based on several materials produced by experts of the German Advisory Group in cooperation with the Institute for Economic Research and Policy Consulting and Otten Consulting

1. Policy Study “Corporate Profit Tax vs. Exit Capital Tax: Analysis and recommendations”

2, Policy Briefing “Corporate Profit Tax vs. Exit Capital Tax: Analysis and recommendations – Summary of results”

3. Policy Briefing ‘Taxation of distributed profits: International Experience”

4. Policy Briefing “Estimation of the short run fiscal impact of introducing an Exit Capital Tax”

5. Technical Note “Estimation of the short run fiscal impact of introducing the Exit Capital Tax: Methodology and further calculations”

About the German Advisory Group

The German Advisory Group on Economic Reforms, which has been active in Ukraine since 1994, advises the Ukrainian Government and other state authorities such as the National Bank of Ukraine on a wide range of economic policy issues and on financial sector development. Our analytical work is presented and discussed during regular meetings with high-level decision makers. The group is financed by the German Federal Ministry for Economic Affairs and Energy.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations