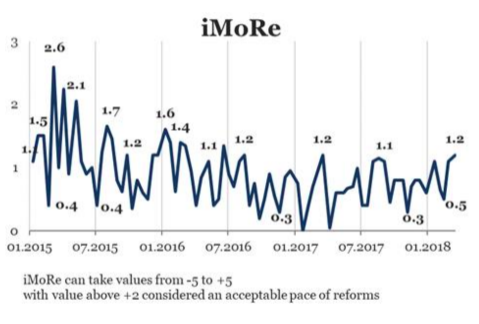

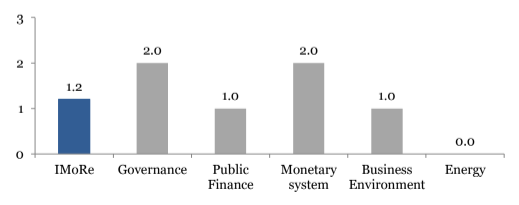

Reform Index is +1.2 points for the period from February 26 – March 11, 2018 (+1.1 in the previous round on a scale of -5.0 to +5.0). Positive developments were recorded in legislation regarding governance, public finances, the monetary system and business environment. The major events of the round are the law on privatization and the creation of the NBU credit register.

Chart 1. Reform Index dynamics*

Chart 2. Reform Index and its components in the current round

The major events of the release

Law on privatization

In Ukraine, the state owns 3444 enterprises, most of which are detrimental. According to the results of 2016, the losses of state enterprises amounted to 3% of GDP. According to the estimates of the Ministry of Economic Development, the budget emits funds on their maintenance amounting to half of what is spent on the army every year.

Last year, the Ministry of Economic Development and Trade made the so-called “triage” (medical sorting) and defined which state-owned enterprises should remain state-owned for a long-term, be transferred to a concession, privatized or liquidated. However, privatization has not started yet.

For the past three years, UAH 17 billion income from privatization was pledged to the state budget, but this plan has never been fulfilled by more than 5 per cent.

Law 2269-VIII of January 18, 2018 is another attempt to launch a large-scale privatization. It also introduces clear, transparent and simple rules for the privatization of small objects using electronic platforms.

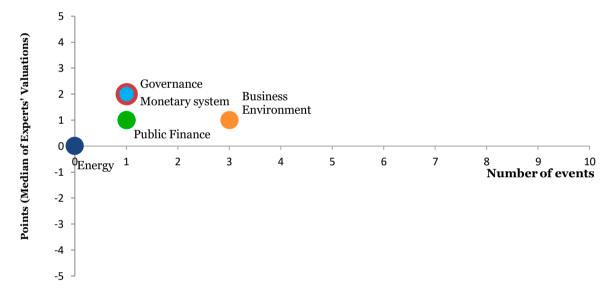

Chart 3. Value of Reform Index components and number of events

Law on the NBU credit register

Today, several credit history bureaus that operate in Ukraine, accumulate information on loans to individuals and legal entities. However, the existing system proved insufficient for banks to effectively assess the degree of customer risk due to the lack of a well-functioning exchange of such information.

In order to ensure such monitoring, as well as the needs of banks for analyzing their credit risks, the law on the creation of the NBU credit register (2277-VIII of 06.02.2018) was adopted. This register will co-exist with the credit private history bureaus. Banks will have to provide information to bureaus about large loans (more than 100 minimum wages, today it is about 370 thousand UAH). If necessary, banks will get information about their clients from this register, as well as individuals and legal entities will be able to access their personal information the register contains.

Please see other charts on the website.

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations