After years of mismanagement and looting, Ukraine faces a number of economic challenges. The situation is so critical that weak economic performance in the next few years could undermine the very independence of the country. Just yesterday, President Poroshenko signed a degree setting up the National Council for Reforms to design and coordinate reforms in Ukraine. While the focus on what should be done to transform the country in the medium and long run is understandable, one should not ignore the current difficulties.

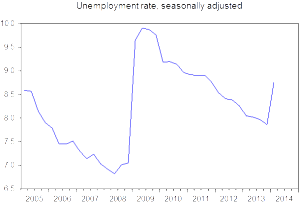

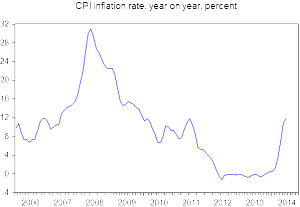

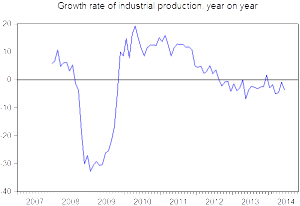

Indeed, the broad consensus is that Ukraine’s economy is likely to experience a deep contraction in 2014 (e.g., the IMF projects a more than six percent decline in real GDP). The unemployment rate is quickly rising. Industrial production has been in decline for over two years. In the first quarter of 2014, investment fell by 25 percent. The fiscal deficit might exceed 10 percent of GDP (this includes quasi-government sector) in 2014. After the hryvnya—the national currency—depreciated by more than 50 percent, inflation accelerated and the National Bank of Ukraine predicts that the inflation rate in 2014 could hit 19 percent.

Despite the dismal state of the economy, there has been no real discussion about macroeconomic stabilization. This silence contrasts sharply with how much policy in the U.S. and other countries was focused on countercyclical policies during the Great Recession. Furthermore, instead of fighting the recession, the government in Ukraine appears to be concerned with balancing its budget by cutting spending and raising revenue while the central bank has increased the policy interest rate. So, both fiscal and monetary policies in Ukraine currently appear to be contractionary.

We know that recessions are bad. Deep, prolonged recessions like the one Ukraine is having right now are very, very bad (e.g., they can lead to persistent long-term unemployment). Why would anyone want to make a deep, prolonged recession even deeper and longer by not trying to stimulate the economy? I’ve heard several arguments.

Argument #1: Ukraine has a large debt and it has to do a fiscal consolidation. I have several reactions to this argument. First, fiscal consolidations in recessions are ill advised because fiscal multipliers are large so that fiscal consolidations in weak economies are likely to plunge these economies into more difficulties. Even the IMF has acknowledged that pursuing fiscal austerity during downturns is likely to be counter-productive. A better policy is to implement fiscal consolidation when the economy is strong. Credible promises to do consolidations in the future may be the way to go. Second, government debt as a share of GDP was as low as 40% until recently but rose to 60% after the hryvnya depreciated as a big chunk of public debt is denominated in foreign currency. While significant, this level of debt is far from critical and remains well below debt levels of most advanced economies. If structural reforms are successful, Ukraine is likely to grow very fast in the medium and long run so that the country can outgrow its debt. In other words, one should focus on how to make the denominator in this ratio grow. Third, the country is in a recession and in war with Russia. If there is ever a time to borrow, now is the time. In the worst case scenario, the country could default and thereby limit its liability.

Argument #2: the government does not have the resources to spend more. While this could be a constraint if one plays by the book, one can get more resources by being more creative. First, war bonds have been popular historically and could serve as a tangible source of new funding. Second, Ukraine received loan guarantees from the U.S. government and paid the U.S. government rate + 30 basis points on its $1 billion loan. In light of the current situation in which Ukraine is alone in fighting a war to preserve the world order, foreign governments should be willing at least to pay for it if they do not want to send troops to fight the war. Third, there is no reason not to organize a conference of donors. They could be willing to give funds to pay for education, healthcare, reforms and free up resources for other types of spending. Georgia was in a similar situation in 2008 (fiscal crisis, war with Russia, energy problems) and it raised more than $4 billion. Ukraine can get a lot more. Fourth, Ukraine can sell 3G/4G licenses or similar items to raise revenue. Finally, by fighting corruption and reducing waste, the government can find additional resources.

Argument #3: inflation is rising and, given Ukraine’s history of high inflation, any monetary stimulus can trigger inflation scares. I agree that one has to be careful with inflation expectations but this argument appears to be weak. First, the increased inflation rate in Ukraine is largely due to the depreciation of the hryvnya. One can think of this as a one-time event that should not permanently affect inflation rates. Indeed, the experience of other countries and previous episodes of currency depreciation in Ukraine suggests that inflation from this type of event can subside quickly. Second, the slack in the economy appears to be large and rising. The unemployment rate almost hit 9% and is increasing. It is unlikely that anything like tight labor markets and high capacity utilization is going to generate inflation in Ukraine any time soon. Third, people pulled out their deposits from banks after a bank run earlier this year and hold a lot of resources outside the banking system. Furthermore, because of increased counter-party risks, the credit market is largely frozen. As a result the money multiplier has fallen. With low multipliers, “printing” more money is unlikely to translate into serious inflation.

Argument #4: monetary stimulus can lead to further depreciation of the hryvnya and, since many people and businesses borrowed in foreign currency, the balance sheet effect of such policies could backfire. This concern is potentially important but it does not mean that it’s going to overwhelm the positive effects of a monetary stimulus. First, borrowing in foreign currency was particularly popular among exporters. But because their revenues are also in foreign currency, the balance sheet effect would be quite limited for these firms. Second, even if the currency depreciates, such depreciation will boost exports and thus offset any adverse balance sheet effects. In any case, the evidence on contractionary devaluations is pretty mixed and, if anything, appears to suggest that the expenditure switching (i.e., cut import and increase export) dominates the balance sheet effect. Third, even after the 50% depreciation, the value of loans issued in foreign currency by banks in the total value of loans is about 40% (before the depreciation it was a little over 30%). Given that the share of non-performing loans in the total loan portfolio is about 13%, which is relatively low, any additional losses stemming from more non-performing loans due to further depreciation would impose only limited losses on the banking system.

Argument #5: any monetary stimulus is ineffective because the monetary transmission mechanism is weak in Ukraine (financial markets are underdeveloped in Ukraine). If the central bank cannot use standard open market operations to move interest rates, one could readily get around this issue by employing alternative tools. First, if private banks are unwilling to lend, state banks can be directed to lend. Like many other countries in the CIS, Ukraine has several large state banks. While the government should not direct state banks to lend in normal times, it can certainly do so in an emergency. Second, bank lending may be insensitive to interest rate movements at the interbank or some other short-term lending market, but there are other margins that can affect lending. For example, the banks may be taxed for holding excess reserves. If the counterparty risk is a big concern, the government could cover a fraction of losses if a borrower defaults. Third, the government can temporarily increase the ceiling on deposit insurance so that banks do not have to hold too many resources in liquid assets to defend themselves from bank runs. Fourth, the government can inject more capital into banks (similar to TARP in the U.S.) or loan “long” funds rather than focus on short term refinancing of banks.

In summary, the popular arguments for why it’s optimal to do nothing do not appear terribly convincing. On the other hand, the current recession has already inflicted large costs on the Ukrainian population, and these are likely to rise further if nothing is done. On balance, the country is likely to benefit from an aggressive macroeconomic stimulus.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations