Reforms sped up considerably at the year’s end. Over three months, we identified more than half a hundred significant economic changes related to the land market, non-bank financial sector regulation, the judiciary, and other industries. The only antireform resolution in the fourth quarter was the one by the Cabinet of Ministers designed to regulate salaries at healthcare institutions since it undermined the hospitals’ autonomy gained from healthcare reform. Read on for more details.

Among the regulations, iMoRe experts identified 57 potential game-changers for the country’s economy. It is significantly more than in the previous quarter when we counted 39 important changes.

Among the 57 reforms, 52 got positive reviews from experts, four received zero points, and one was anti-reform. The average event score in the fourth quarter is +1.0 points in the range from +5 to -5, the same as in the previous quarter.

Key changes

In the fourth quarter, only one event got more than +2.0 points, which we think separates significant reforms from less important ones. According to experts, the law about the Fund for partial loan guarantees in agriculture affects both the country’s monetary system and business environment, so it scored as high as +3.3. Seven more reforms stopped at +2.0 points. Below is a description of key reforms in the fourth quarter.

Land market and supporting farmers

The main reform of the last months of 2021 was the law establishing a fund for partial guarantees for agricultural loans (iMoRe No.173, +3.3 points), designed to revive lending to farmers. With the land market opening, farmers’ need for financial resources increased. Still, banks reluctantly lent to them because of a lack of sufficient collateral and farmers’ dependence on weather, pests, and other hardly predictable factors. The newly created Fund will offer guarantees covering 50% of the debt for up to 10 years. This will considerably reduce the lending risk for financial institutions and, therefore, increase lending.

Another long-awaited change was the law 1720-IX on the simultaneous transfer of land and real estate rights (iMoRe No.175, +2.0 points). It addresses a common issue when the object on sale is private real estate located on communal or state-owned land. Before, the property’s new owners had to start a complex process of terminating the lease of land by his predecessor and then draw up a lease for themselves. Now, new owners will automatically have the right to use or own the land on which their property is located.

In late September, the President signed Law 1720-IX and another law similar to it (1174-IX), which created a legal collision because of two similar regulations. Law 1720-IX came into force in December 2021 replacing Law 1174-IX, which had been valid for two months. Because of confusion and uncertainty, this law entered the Index later.

Financial services and the National Bank

At the year’s end, Parliament passed an insurance law (iMoRe No.175, +2.0 points) updating previous outdated regulations adopted over 25 years ago. As insurance companies came the supervision of the NBU in line with the law on split adopted in 2019, a need arose to clarify their rules of operation. The new law introduces requirements regarding corporate governance, risk management, transparent ownership structure, assessment of insurers’ stability, and solvency in line with the European Solvency I and Solvency II directives.

An important change was the NBU resolution requiring that non-bank financial institutions disclose the full cost of consumer loans on their websites and in their ads (iMoRe No.170, +2.0 points). It is an important regulation because an annual rate of 15,000% can hide behind a “not-so-scary” daily rate.

In the fourth quarter of 2021, they also adopted a law improving the NBU’s activities (iMoRe No.173, +2.0 points). The law aims to address several issues regarding the functions of and interactions between the NBU Council and the Board. It supplements the qualification requirements for these bodies’ members, specifies their powers, and allows the NBU Board to develop an employee code of ethics. The law also “abolishes the NBU’s obligation to provide the government with forecasts for the hryvnia exchange rate, fully in line with the general logic of the NBU’s flexible exchange rate policy in recent years,” says Vitaliy Vavryshchuk, head of macroeconomic research at ICU.

Judicial and law enforcement systems

At the year’s end, the authorities continued to overcome the infamous decision on the unconstitutionality of anti-corruption legislation regarding declaring income and property that the Constitutional Court made in 2020, which became the biggest antireform in the Index’s history. In November, the President signed a law to bring NABU’s status in line with the Constitution (iMoRe No.173, +2.0 points). In particular, the agency’s status was updated from a “state law enforcement body” to a “central executive body with special status,” with its head now to be appointed not by the President but by the Cabinet of Ministers.

A step forward was adopting the law on mediation (iMoRe No.175, +2.0 points), which should be an alternative to litigation. Mediation can now be used to resolve any dispute by mutual agreement between the parties, including criminal proceedings.

Digitization

Easier registration of a new residence (iMoRe 174, +2.0 points) received very positive reviews. After adopting all bylaws, it will be possible to register your place of residence online or in the Diia app.

Zeros

Over the last three months, four documents got mixed reviews from experts, earning 0 points. These include the law limiting undue influence of oligarchs, the law on tax conditions for Diia City residents, amendments to the law on industrial parks, and a Cabinet of Ministers resolution.

✓ Amendments to the law on industrial parks (iMoRe No.170, 0.0 points) expand the list of incentives for their residents. Full or partial compensation for the interest rate on loans for operating within the park and non-refundable budget assistance for building roads, communication lines, and arranging the supply of water, electricity, and gas. The possible size of the park has also been increased (from 15-700 to 10-1000 ha). Experts believe this law might result in ineffective budgetary spending, as has been the case so many times before.

✓ Law on limiting oligarchs’ undue influence (iMoRe No.172, 0.0 points) stipulates that a register of oligarchs be created requiring the listed oligarchs to submit electronic declarations each year. Businesspersons on the register are prohibited from participating in large-scale privatization and financing political parties. However, Ruslan Sydorovych, a partner at Ario Law Firm and a member of the Ukrainian Bar Association, notes that the law creates opportunities for abuse: Entrusting the NSDC with deciding on whether a person is an oligarch and entering them into a register is dubious. Classifying a person as not possessing an unblemished business reputation is also debatable. In particular, because of Ukrainian sanctions imposed on such a person. A vicious circle emerges. For instance, the National Security and Defense Council takes sanctions against someone and then applies the “oligarch law’s” effects on them.

✓ Law on special tax conditions for Diia City residents (iMoRe No.176, 0.0 points) stipulates that residents of the Diia City legal framework can choose one of two options to pay corporate tax: the 9% exit capital tax or the 18% income tax. Special tax conditions apply to these companies’ employees: 5% personal income tax, the unified social contribution of 22% of the minimum wage, and the 1.5% military tax. “Potential regulatory issues include institutionalizing a sectoral approach to taxation and neutralizing the strongest political and economic players who defend the possibility of working with individual entrepreneurs of Group 3. This might be a preparation for abolishing freelance in other industries,” warns Volodymyr Dubrovskyi, senior economist and Supervisory Board member at CASE Ukraine.

✓ Exempting entrepreneurs in rural areas from the mandatory use of cash registers (iMoRe No.176, 0.0 points). “It is a logical step, given that the entrepreneurs’ turnover there rarely exceeds 167 minimum wages per year. Besides, the quality of the Internet is not always good enough to use cash registers,” explains Ilona Solohub, scientific editor at Vox Ukraine.

Anti-reform

In the fourth quarter, we identified only one antireform, namely the resolution eliminating the disparity between the salaries of healthcare institutions’ employees and heads (iMoRe 175, -0.5 points). Despite its noble goals of reducing inequality and raising health workers’ wages, it has considerable flaws interfering with the health facilities’ autonomy and undermining the idea of healthcare reform regarding the self-regulation of hospitals.

What has changed in key areas?

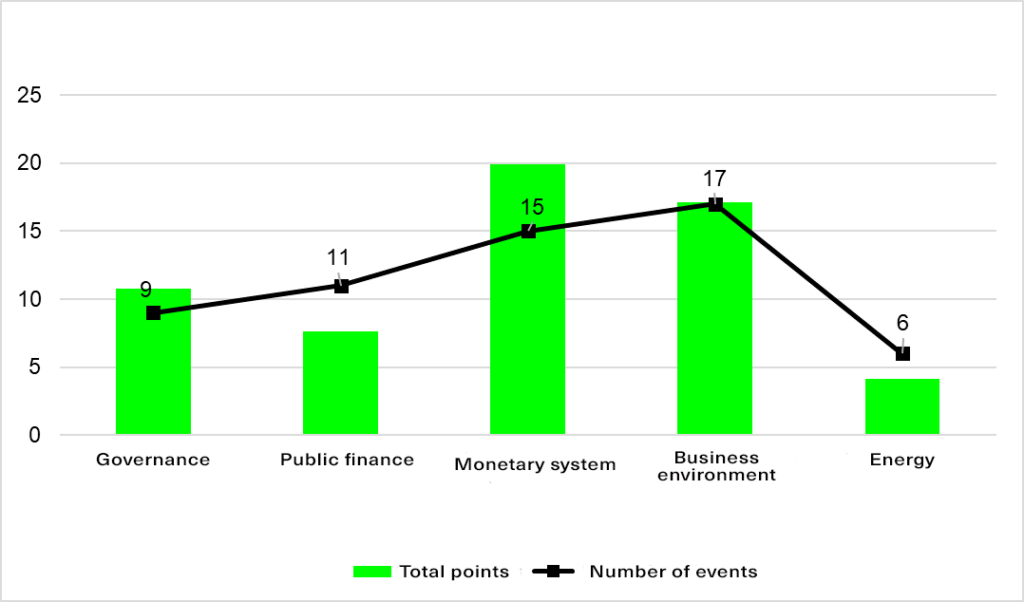

In the fourth quarter of 2021, we saw changes in all the areas we observed. Most of them occurred in the business environment (17) and the fewest in energy (6). Yet, the monetary system ranked first based on the adopted regulations’ importance.

Graph 1. Total points by area: 4th quarter of 2021

Source: iMoRe No.170-176. The total number of reforms for the period is 57. However, the total number of events in this graph is 58, since one reform (establishing the Fund offering partial loan guarantees in agriculture) is reflected in two directions.

Next, let us look at the areas making the most progress in implementing reform.

Monetary system

At the year’s end, we identified 15 essential changes in the monetary realm. The National Bank of Ukraine initiated ten, the Verkhovna Rada four, and the Cabinet of Ministers of Ukraine one.

Besides the above regulations, several other important changes occurred in this area. In particular, the Cabinet of Ministers extended the “5-7-9% affordable loans” program to include financial leasing agreements (MoRe No.173, +1.5 points) to support small and medium-sized businesses by providing partial compensation of actual costs of basic remuneration package under such agreements.

Securities settlements came under the regulations of the NBU (iMoRe No.174, +1.0 points), and requirements were set for the market participants offering such settlements. Transactions are carried out based on the “delivery versus payment” principle via the NBU’s Electronic Payment System. The National Bank also approved several documents regulating the activities of banks and other financial institutions.

The rules for licensing and registration (iMoRe No.176, +1.3 points), preparing and submitting reports by non-bank financial institutions (iMoRe No.174, +1.3 points), as well as approaches to supervision over non-bank financial groups (iMoRe No.175, +1.0 points) were updated.

Banks received new requirements for verifying sources of regulatory capital (MoRe No.176, +1.3 points), calculating the minimum market risk (iMoRe No.176, +1.8 points), and acquiring the right to open foreign currency accounts for the Central Depository and clearing institutions (iMoRe No.175, +0.5 points). The NBU also clarified the rules for disclosing bank secrecy (iMoRe 170, +1.0 points) and introduced requirements to avoid discrimination in pay at the banks (iMoRe 175, +0.5 points).

Business environment

We identified 17 significant changes here. This time, the Verkhovna Rada initiated eight reforms, the Cabinet of Ministers seven, and the NBU and the Ministry of Infrastructure one each.

Several reforms concern the transport sector. In December, the President signed a law on multimodal transportation (iMoRe No.175, +1.8 points), allowing for a single transportation document for several modes of transportation. The Ministry of Infrastructure barcodes all carrier permits (iMoRe No.176, +1.0 points) to enhance its control over carriers. Before, drivers filled out permits themselves. Now, permits will be issued bearing carriers’ names, vehicles, and barcodes. At the year’s end, another law was signed to update pricing principles in the road industry (iMoRe No.175, +1.0 points). The state abandoned person-hours and Soviet standards, passing the right to create its own pricing system on to the Ministry of Infrastructure, which is responsible for road construction.

We have also identified several sectoral changes in this area.

The law on reforming defense industry enterprises (see iMoRe No.170, +1.0 points) transforms the state concern “Ukroboronprom” into a joint-stock company and its related entities into business companies. It also introduces corporate governance principles for defense enterprises in line with OECD guidelines.

The law speeding up registration of medicines (iMoRe No.173, +1.3 points) makes it possible to quickly register drugs, vaccines, and other preparations used during emergencies and quarantine.

Law harmonizing legislation in the baby food industry (iMoRe No.173, +1.3 points) sets requirements for the quality of baby food. It specifically prohibits the use of flavors, dyes, and preservatives in its production, providing definitions for terms related to baby food and limiting advertising possibilities. Once the law goes into force, such advertising will be allowed only in specialized publications, provided that ads contain scientifically sound statements.

Amendments to the law on advertising (iMoRe No.170, +1.0 points) define the terms “discriminatory advertising” and “discriminatory advertising based on sex” prohibiting the use of such advertising.

Governance

Over three months, the authorities adopted nine public administration reforms. Of these, the Verkhovna Rada initiated seven reforms, and the Cabinet of Ministers and the President one reform each. The key changes include laws on electronic registers and mechanisms for returning property to its owners in case of overturning its seizure or transfer to the National Asset Recovery and Management Agency (ARMA), as well as the above laws on mediation, NABU, and online residence registration.

The law on public electronic registers (iMoRe No.175, +1.0 points) introduces the concept of “basic registers” (i.e., those holding key information about Ukrainians) and divides their “areas of responsibility.” For example, the Unified State Demographic Register will serve as the source of someone’s correct name, surname, and age. This law is vital for Ukraine’s transition to a digital census, as announced by the Cabinet of Ministers.

Amendments to the law on ARMA (iMoRe No.176, +0.5 points) eliminate inaccuracies making it possible to return seized property to the owner based on a prosecutor’s or court’s decision to cancel the seizure of managed assets or their transfer to the National Asset Recovery and Management Agency.

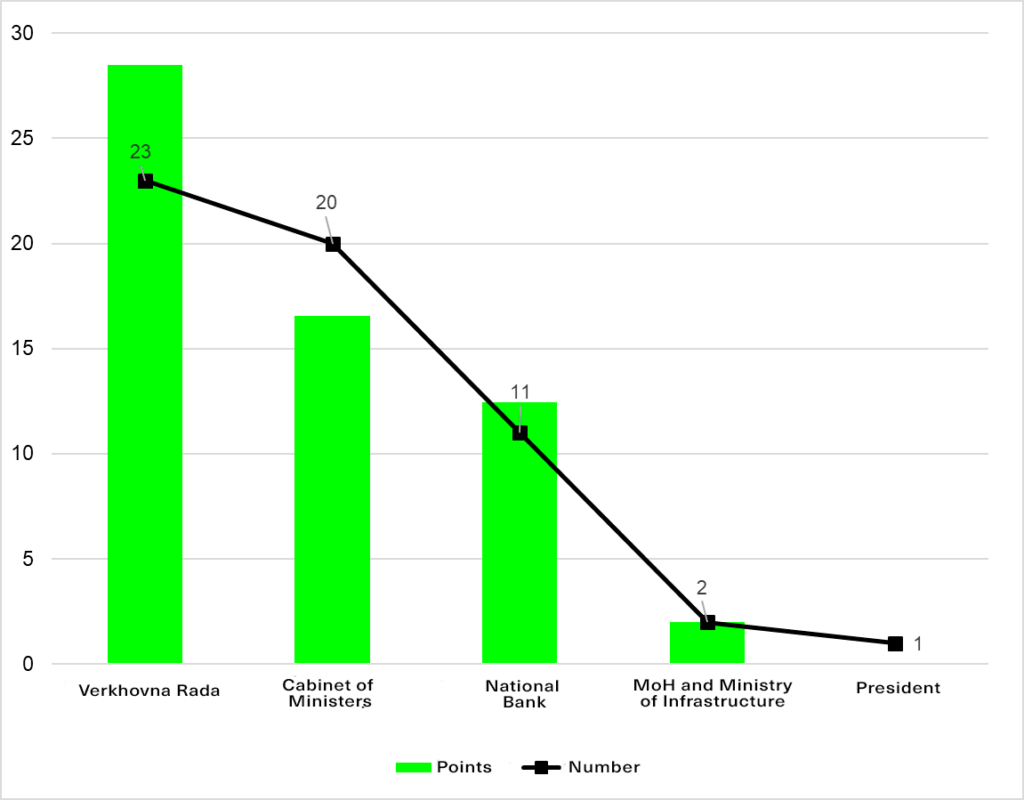

Who is the biggest reformer?

The Verkhovna Rada became the reform leader adopting 23 regulations in the fourth quarter. Then came the Cabinet of Ministers (20 important resolutions) and the NBU (11 resolutions). The President, the Ministry of Education and Science, and the Ministry of Infrastructure initiated one reform each.

Graph 2. Initiators of reforms in the 4th quarter of 2021

Source: iMoRe No.170-176

Compared to the previous quarter, in the fourth quarter of 2021:

- important regulations’ numbers increased by a third (from 39 to 57 per quarter);

- the average score of the round rose from 0.7 to 0.8 points;

- the average event score remained at +1, ranging from -5 to +5.

At the end of the year, government officials and parliamentarians initiated many sectoral reforms. The focus was on the financial sector, the land market, and the transport sector, where we have seen the most remarkable progress. However, there were also failures. The laws preventing oligarchs’ undue influence and the extra incentives for creating industrial parks bear a significant risk of misuse of power and public funds. Attempts to introduce cash registers for small businesses’ operations still face infrastructural and technical problems. Therefore, easing the requirements for their use seems to be a necessary but insufficient step. A mild attempt to institutionalize the activities of IT specialists through Diia City also raises concerns among experts since putting excess pressure on this area may result in the emigration of professionals instead of gaining extra budget revenue.

In 2022, it is important that the authorities not lose the balance between the increased requirements for businesses to reduce the shadow sector and creating a comfortable regulatory environment for entrepreneurs.

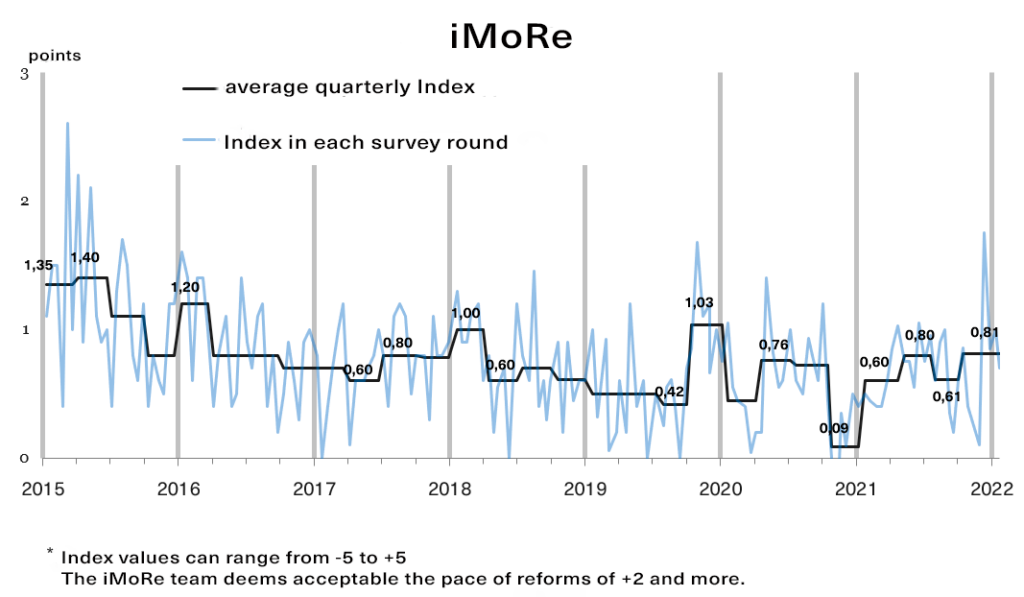

Graph 3. iMoRe quarterly average

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations