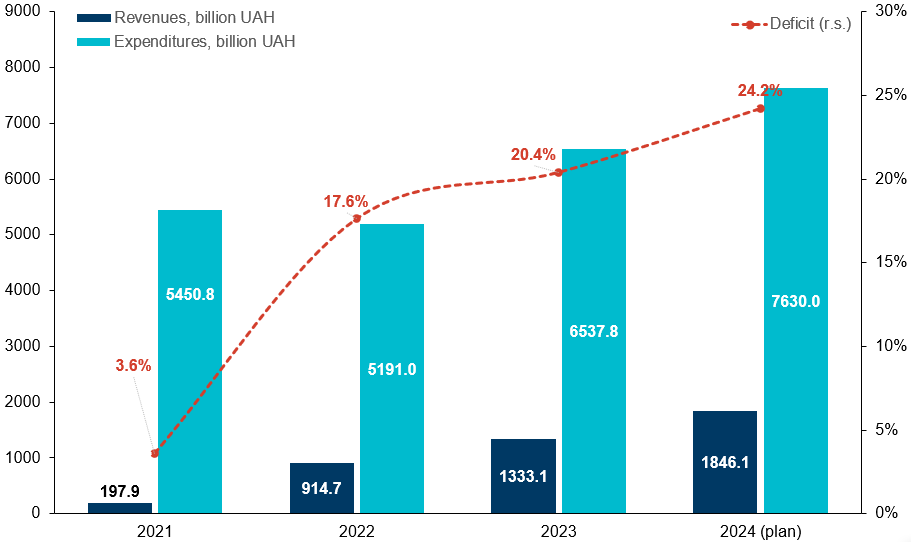

Due to Russia’s full-scale invasion of Ukraine in February 2022, our financial system faced significant challenges. A substantial increase in budget expenditures, primarily for military needs, along with a simultaneous decline in revenues, led to a rise in the state budget deficit from 3.6% of GDP in 2021 to 20.4% in 2023. In 2024, the deficit may reach 24.2% of GDP (Figure 1).

Figure 1. Revenues, expenditures, and the state budget deficit of Ukraine in 2021-2024

Source: openbudget.org.ua; National Bank of Ukraine

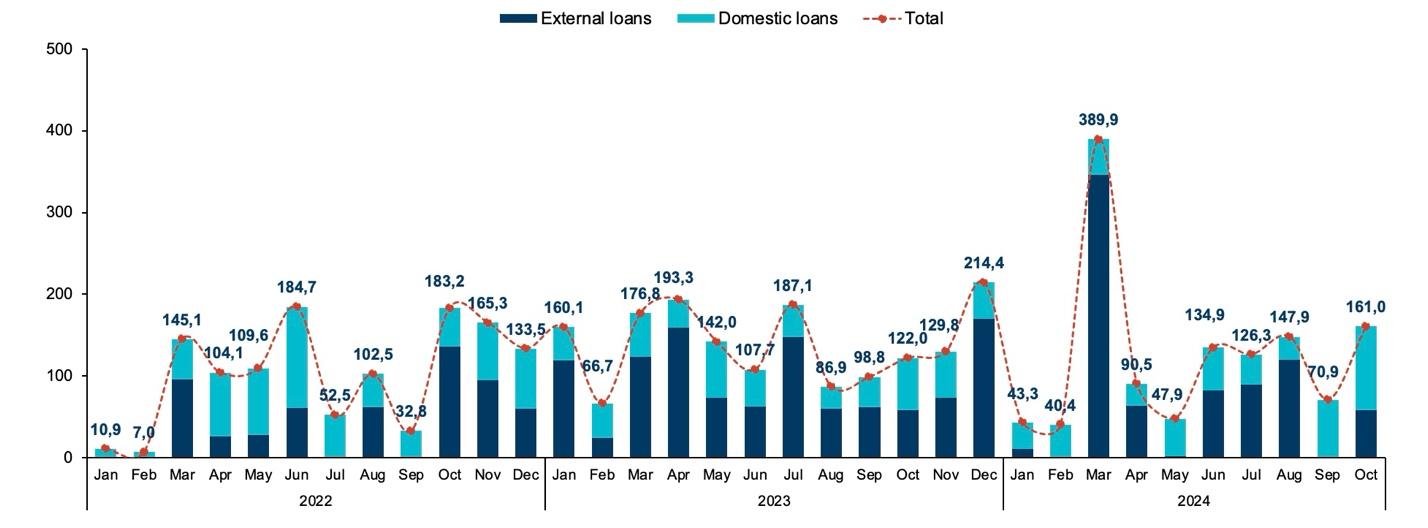

It is clear that to cover such a deficit, we need additional financial resources. These have come from external borrowings and grants provided by foreign partners, as well as domestic borrowings through the sale of government bonds, including military bonds (Figure 2).

Figure 2. Volumes of external and internal borrowings (government bonds) in 2022-2024*, billion UAH

*As of October 30, 2024

Source: Ministry of Finance of Ukraine

Since financial support from foreign partners can only be used to finance non-military expenditures, attracting funds from government bonds has become one of the key sources of financing for defense and security spending. Between 2022 and 2024, the authorities managed to raise a total of UAH 1.7 trillion (gross borrowings) through the placement of government bonds. The largest resource deficit was felt in the first year of the full-scale invasion, which prompted the government to resort to emissions, i.e., the direct purchase of domestic government bonds by the National Bank of Ukraine for UAH 400 billion in 2022.

During the full-scale war, the amount of funds accumulated in government bonds increased by 68% compared to 2021. The government has been able to raise significant funds from bond sales due to their high yield. In 2022, the average annual yield of Hryvnia government bonds was 18.3%; in 2023, it was 18.7%; for the first 10 months of 2024, it was 16.2%, while in 2021 it was only 11.3%. Despite the decrease in the interest rate in 2024 due to the reduction of the NBU’s key rate, the yield on domestic government bonds was higher than the interest rates on bank deposits (which peaked at 13.9% in 2023). An essential advantage of government bonds is that the income from them is not subject to personal income tax or the military levy.

To stimulate the government bond market, the National Bank of Ukraine (NBU) allowed banks to cover part of their own reserves using benchmark domestic government debt securities (benchmark bonds). As a result, during the first 10 months of 2024, UAH 92.8 billion was accumulated (19.3% of the total volume of bonds placed during this period).

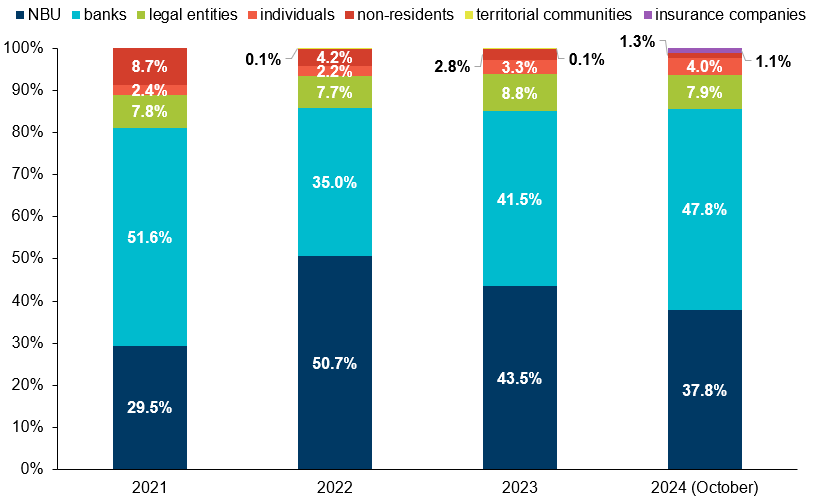

The distribution of government bonds by ownership has shifted slightly compared to 2021. Banks remain the largest holders, owning 47.8% of domestic government debt. However, their share has decreased somewhat compared to 2022 (51.5%), when, due to bond emissions, a larger portion was held by the NBU. The NBU’s share in its portfolio grew from 29.5% in 2021 to 50.7% at the end of 2022. Since 2023, the NBU’s share has gradually decreased, reaching 37.8% by the end of October 2024.

The share of government bonds owned by legal and physical persons remains small: for individuals, it increased from 2.4% in 2021 to 4% in October 2024, while for legal entities, it has remained stable at 7.9%. At the same time, the share of government bonds owned by non-residents has significantly decreased over the past three years—from 8.7% at the end of 2021 to 1.3% at the end of October 2024 (Table 1, Figure 3).

Table 1. Domestic government bondholders, billion UAH

| Domestic Government Bondholders | December 31, 2021 | December 31, 2022 | December 31, 2023 | October 31, 2024 |

| NBU | 312.6 | 704.6 | 690.0 | 677.6 |

| Banks | 547.1 | 485.7 | 657.9 | 857.0 |

| Legal entities | 83.1 | 107.3 | 139.2 | 142.2 |

| Private individuals | 25.2 | 30.7 | 53.0 | 71.6 |

| Non-residents | 92.7 | 58.8 | 43.9 | 23.4 |

| Territorial communities | 0.1 | 1.9 | 2.0 | 0.8 |

| Insurance companies | 0.0 | 0.0 | 0.0 | 19.3 |

| TOTAL | 1,060.8 | 1,388.9 | 1,586.1 | 1,791.9 |

Source: National Bank of Ukraine; data as of October 31, 2024

Figure 3. Structure of domestic government bondholders in 2022-2024, %

Source: National Bank of Ukraine

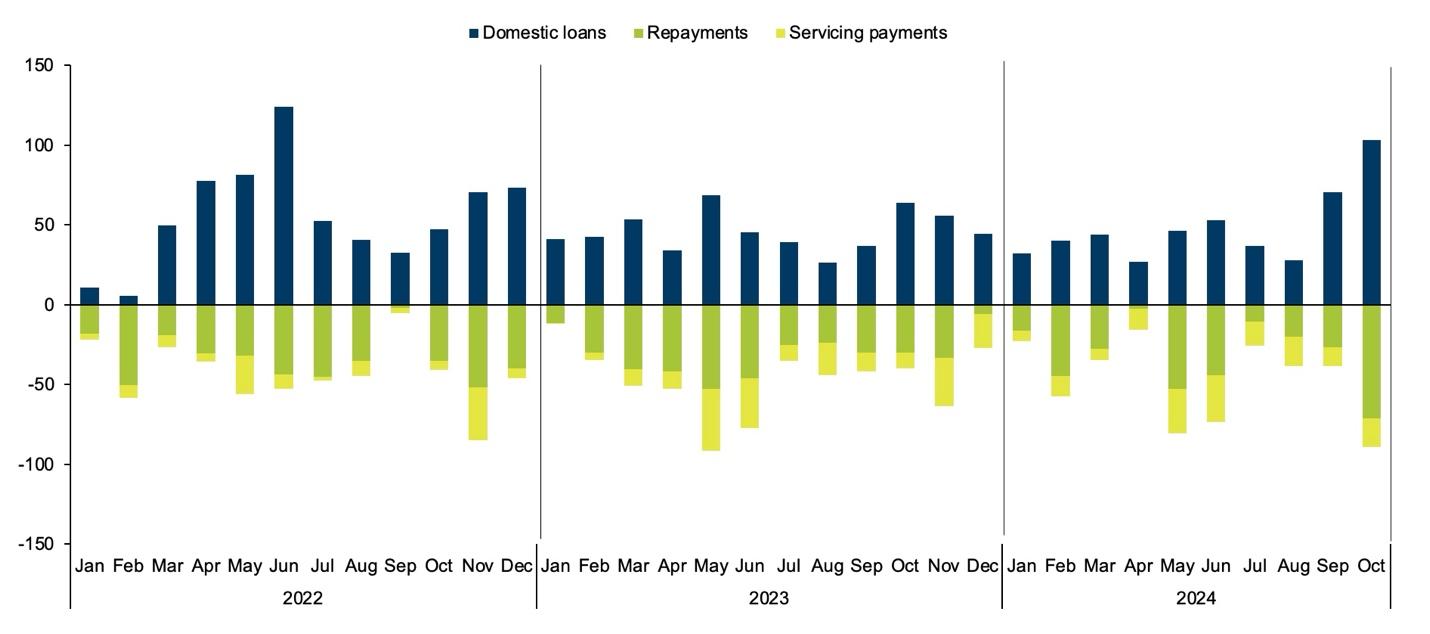

The volumes of domestic borrowings remain pretty high (Figure 4). However, when compared to the amounts of state debt repayments, it turns out that only 7.9% of the funds raised from the sale of domestic government bonds were directed toward financing state budget expenditures. The rest went towards the repayment and servicing of domestic state debt. The difference between the funds raised from domestic government bonds (UAH 1.7 trillion) and the costs of repaying and servicing domestic state debt (UAH 1.6 trillion) amounted to only UAH 134.8 billion: UAH 147.2 billion (due to emissions) in 2022, UAH 16.9 billion in 2023, and UAH 4.6 billion for the first 10 months of 2024.

Figure 4. Domestic borrowings during 2022-2024, billion UAH

Source: Ministry of Finance of Ukraine

Due to the continuous attraction of new loans at high interest rates, a so-called “financial avalanche” has formed (where taking on new loans leads to increased liabilities, making it increasingly difficult to cover them with additional borrowings). This avalanche will continue to grow larger.

At the beginning of 2024, Ukraine’s partners delayed the supply of military aid. This forced the government to direct significant budget resources towards defense needs, resulting in an increase in the state budget deficit and the search for additional sources of financing. To address this, Parliament raised the internal borrowing plan for 2024 by UAH 216.1 billion, from UAH 525.9 billion to UAH 742 billion. In the first 10 months of 2024, the government raised UAH 480.5 billion through the sale of domestic government bonds, and according to the latest data, in November, the inflows amounted to UAH 78.9 billion. Therefore, to fully meet the domestic government bond borrowing plan, UAH 182.6 billion must be raised in December 2024.

The sharp increase in the volumes of funds raised from the placement of domestic government bonds in September-October 2024 indicates that the government managed to find compelling arguments to convince potential creditors (primarily banks) to invest more in these bonds rather than in NBU deposit certificates. Specifically, starting from September 20, 2024, the interest rate on three-month deposit certificates was reduced from 16.5% to 15.5% (while the rate for overnight deposit certificates remains equal to the NBU’s key rate). At the same time, the NBU made the decision to increase the mandatory reserve ratio that banks can cover with benchmark bonds from 50% to 60%, effective October 11. These decisions allowed the government to raise UAH 70.5 billion in net non-emission income from the sale of domestic government bonds in September and UAH 103.1 billion in October (2.1 times more than the average monthly raised amount in 2024). In addition to relatively favorable interest rates and the government’s request, buying government bonds provides banks with an opportunity to minimize corporate income tax payments for 2024, as the tax rate for banks was increased from 18% to 50%.

However, the liquidity of the banking system is limited, even though it is currently higher than in 2023-2022 (as of November 15, 2024, there were UAH 270.5 billion in banks’ correspondent accounts, while on the same date in 2023, there were UAH 184.5 billion, and in 2022, UAH 74.5 billion). Therefore, it will become increasingly difficult for banks to increase their domestic government bond portfolio. Moreover, the more banks invest in these bonds, the less funds they have available for lending to the economy, which may negatively impact its growth.

Conclusions

Domestic government bonds were crucial in supporting defense capabilities and maintaining fiscal stability throughout 2022. With UAH 147.2 billion in net domestic borrowings (comprising UAH 667 billion in borrowings, UAH 401.9 billion in repayments, and UAH 117.9 billion in servicing), these bonds financed 5.8% of the 2022 budget expenditures, excluding the costs associated with servicing state debt.

However, by 2023, this instrument began to lose its effectiveness as a reliable source of financing budget expenditures. The costs of repaying and servicing domestic debt have been steadily increasing. In the first 10 months of 2024, 99% of the total amount raised from the sale of domestic government bonds was used for servicing and repaying domestic debt.

A possible scenario is the formation of a debt “avalanche,” where previous obligations are paid exclusively through new ones, with the newly raised funds failing to fulfill their primary function—financing expenditures. This issue is tied to the fact that, in 2022-2024, the government mainly issued bonds with maturities ranging from 1 to 3.5 years (365-1260 days). Therefore, the government should consider issuing long-term bonds with maturities exceeding 4 years to defer debt payments. However, it remains uncertain how popular such instruments would be among investors. Additionally, increasing the sale of government bonds to individuals and legal entities holding a small share of government securities might be a potential strategy. However, it is unlikely to generate significant funds.

Thus, the government will inevitably need to raise tax revenues to continue financing defense and security needs. This will require not only increasing tax rates but also enhancing tax administration to prevent evasion. Tax administration reform could pave the way for progressive taxation, which citizens would view as fairer than, for example, raising VAT.

Photo: Olena Vladyko/ Press Center of the NBU

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations