The government cost сalculation of gas produced domestically in Ukraine is inaccurate. Moreover, this number seriously, unreasonable and poorly overstates the real price. The issue is even bigger than just a calculation mistake: it lies in the inefficiency of extreme Ukrainian public policy.

VoxUkraine has already written several posts arguing that the low gas price for households and heating utilities leads to the huge deficit of Naftogaz, a state-owned gas monopoly. It is funded by the National Bank of Ukraine, which results in higher prices and weakening of hryvnia, a Ukrainian national currency.

Ukrgazvydobuvannia PJSC (UGV), a subsidiary company of Naftogaz, submitted its own calculation economic cost of domestic (Ukrainian) gas production. It turned out to be $319.4 per 1,000 cubic meters. It is estimated at the rate of UAH17 per $1. At the rate of UAH8 per $1 it would be $678.7 per 1,000 cubic meters (initial calculation is in UAH). Why do we need this calculation? At least two objectives are clear. First, to justify the high cost of domestic gas and thereby create arguments for reducing a rent transfer into the budget after the gas price for population will increase.

The second possible objective: to justify high gas cost for population and explain that it should be compensated with high prices. Everything in this logic is turned upside down and calls for a reasonable suspicion that a “market railing” transition in gas market functioning is just a cover of continuing inefficiencies and fraud.

The gas market, Naftogaz activity, subsidies to population – these are several different, though interrelated, issues that demonstarted tremendous inefficiency, misunderstanding of objectives and public policy instruments of the Government which tried to solve them.

1. Gas Market

The primary matter that should have been precisely set is how the Government portrays the gas market. The first option is the following: it is namely the market, though not quite so “perfectly” competitive, but still the market with a market price. This market should be transparent, with a single price for all the categories of consumers (of course, adjusted for the cost on downstream – delivery and distribution). Such kind of the market should be organized properly. There should be some (many) suppliers presented. It also should include the Russian gas supplied through the Naftogaz, the domestically produced gas supplied by both public and private production companies and the gas purchased from the other sources (e.g. in Europe or in other regions, including the liquefied natural gas). The most important thing in this “market” approach is that there should be an absolutely free market access for all the suppliers, transparent pricing and unified price.

If we observe excess market power in the market, the government can take over the price regulation. There is a special regulatory body for this. There is nothing wrong with the state regulation of prices (in case of a significant impact on the market of individual participants), although there is always a risk of actual capture over the regulatory body by the object under control.

Transparency and unified price form a foundation of efficiency. An obscure market with multiple prices is a fertile soil for theft, fraud and loss of efficiency. Therefore, it is necessary to start from this point.

2. Subsidies

If there is a unified and clear gas price on the transparent market (or, alternatively, a state-regulated market price on the monopoly market), the size of subsidies is quite clear. If, for example, the market price (or state-regulated price) is $350 per 1,000 cubic meters and population pays $80, then the size of the subsidy is equal to $270, and the cost of extraction is not important when determining the size of the subsidy. One should decide which sources to finance the subsidy from, whether it is reasonable to do at all (or raise the price for consumers), and how to finance, for example, the targeted subsidies.

3. Stimulating domestic production

The cost overstating is a bad way to encourage a domestic production. In particular, it is not a way to stimulate a production, but rather to leave the resources at the disposal state-owned company that are not controlled effectively. If we want a domestic production to grow, the first necessary step should also be transparent pricing (regardless of whether it is a market or state pricing). Not untill this stage one should think about the amount of taxes (including rental payments) whether they stimulate or vice versa, depress domestic production.

4. Management of the state-owned companies

There is no doubt that mining companies (UGV, Ukrnafta) should be separated from the Naftogaz by means of privatization or even as an interim solution through the formation of independent public companies. A national joint-stock company in its current form is a tangle of conflicts of interest, a huge pond with muddy water, opening unlimited possibilities for fraud and inefficiency.

5. Rent

The cost may be crucial if we consider the amount of rent payments to the budget. Assuming the market price is $350 and the production cost of 100% -state-owned company is $100, the state should decide how to use the remaining $250. This may be a direct transfer to the budget, price backing for population (not a bad goal, in fact, although not so suitable for our financial situation) or investments in domestic production. It depends on the priorities. But it should be clear and understandable decision. No need to obscure the issue and say that the cost equals to $319 if it actually equals to $100 in real, unlesse senior management of state-owned company is intends to decrease the payments to the budget. Formally, 100% state-owned company should not care about how the profit is paid to the budget, whether it is done by means of dividends, taxes or rent payments.

6. Calculation of the cost of gas

The cost calculation of UGV turned out to be a tangle of seemingly “correct” concepts and outrageous incorrecness of their application, pursuing one single goal, which is to justify the cost at the rate of “more than $300”.

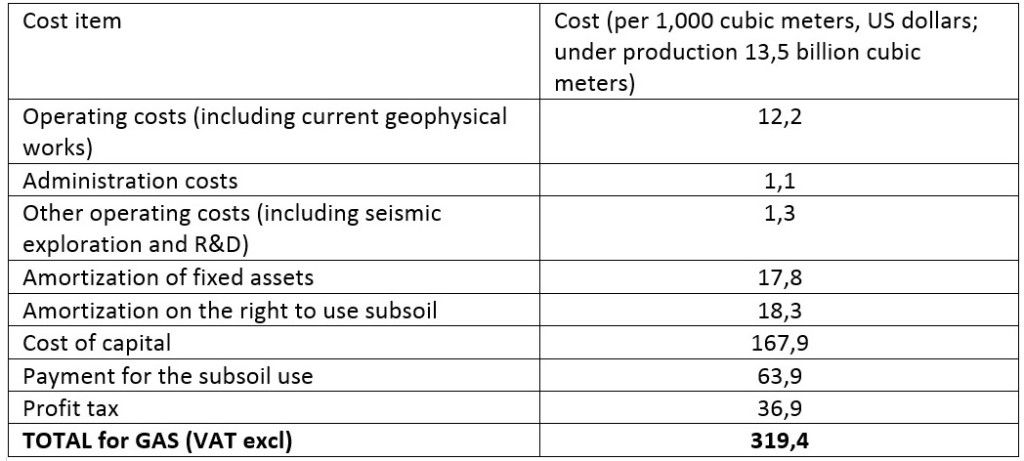

Summary of calculation is as follows:

One by one:

(1) Operating costs. The operating costs in dollars are growing from $10,9/1,000 cubic meters in 2014 to $14,6/1,000 cubic meters in 2015. There is no strong argument explaning why do they grow . Let this remain on the conscience of the developers of the document, as this item takes a small percentage in the total amount.

(2) Other operating costs. Comparing to the year of 2013, the costs for seismic and R&D services are almost doubled. This is actually a good purpose. All exploration plans and R&D in the UGV over the past 10 years have failed. The remaining question is who exactly will monitor the execution of planned works under this item?

(3) Amortization of fixed assets. The main trick is an “adjustment factor to the fair (market) cost of fixed assets”. Methodology of coefficient determination is very obscure (“according to world PPI”, without specifying the goods and the prices in question). The cost reduction of fixed assets and depreciation to the “fairly” based value is correct, but it should be done accurately in order to assess the cost fairly without overstating, and to include into amortization only the costs of those assets used in production.

(4) «Amortization on the right to use subsoil». Here we simply go to another reality comparing to the preceding paragraph. The reserves are not amortized, it is an economic nonsense taking into account how it is calculated. The analogy is as follows: imagine I have $100,000 in cash, and I spend $10,000 every year. It is necessary to calculate my costs per year. The correct answer is, of course, $10,000, and there is nothing to talk about. And my answer is no, my costs are actually $20,000 per year: $10,000 of direct expenses + $10,000 of amortization of assets, as now I have $100,000, and in 10 years I won’t. Here are some simple tricks. The amortization of resources has been taken into account based on this principle. In other words, $18,3 per 1,000 cubic meters should be excluded from the calculation.

(5) Cost of capital. The most extensive cost item equals to $167,9 per 1,000 cubic meters. The inclusion of the cost of capital to the economic production cost is itself justified both in terms of theory and price regulation practice of natural monopolies (so-called “stimulating tariff” when a price includes a return on regulated asset base). But there are some very important comments. First, the composition of assets on which return is calculated. One should only consider those assets that are directly used in production. The cost of resources cannot be included herein. These are not created assets. The value of reserves in the calculation is big – $10,7 billion. (even without taking cyclicality into account – when the cost of resources is based on the price, and the price depends on the value of the reserves). In other words at least $118,9 from the calculated cost should be excluded ($10,7 billion * 15% / 13,5 billion cubic meters = $118,9). The other assets that are not related to production should be excluded but we do not have enough detailed information on them. Second, at what cost the assets are taken into account? Ideally, at a “fair market” price considering an economic deterioration. Third, the rate of the cost of capital (more precisely – a required return on capital). The rate deserves a separate item.

(6) In public joint-stock company calculation the rate of required return on capital equals to 15%. It is justified (if it does) most likely by some kind of “modified” version of the CAPM model considering the country risk premium. The logic behind this approach is to consider the return of alternative investments with the same level of risk (to a private investor with a diversified portfolio). There is a serious logical problem. Why do we do the calculation? If we want to calculate the (social) cost of a 100% state-owned company, then, in general, one should take the social discount rate. We do not calculate the stake cost when selling it to a private investor.

(7) Tax and payment for the subsoil use. There is a cycle in both cases (dependence on a price).

(8) Production volume. In calculation the production volume is taken at level of 13.5 billion cubic meters per year. Why not 15, as it was in 2013 (data was not released to the public till 2014)? This is the denominator, which directly affects the calculation.

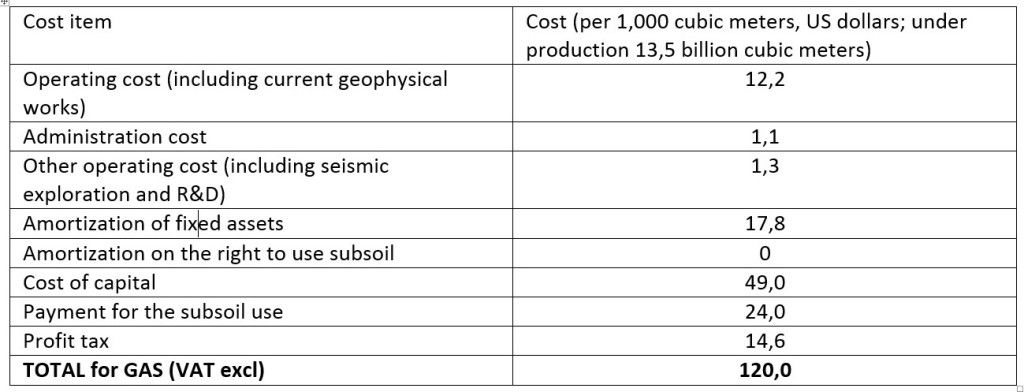

As a result, even a “soft” way of recalculation (leaving incomprehensible overstating cost of assets, overstating operating costs, 15% rate of return on capital and understated production of 13.5 billion cubic meters) will provide the drastically different results:

But even in the “soft” way of conversion of $ 120 000 per 1,000 cubic meters differs drastically from $ 319,000.

7. Results

As a result, we would like to recommend the Government to abstain from the tricks in “correct” price calculation of domestically produced gas. If one needs a cost calculation – to regulate a price or adjust the size of the rent – it should be done in accordance with the common practice, current legislation, under the supervision of the regulator, and perhaps by an independent auditor.

First of all it is necessary to focus on the effective policy implementation.

– Organization of the gas market (facilitating market access, equal conditions for mining companies, transparency of the market);

– Management of state property (effective system of corporate governance, Naftogaz restructuring, including, for example, the transformation of UGV into an independent company);

– Creation of efficient and transparent subsidy policy aimed at truly needy population;

– Transparency of public finances, including financial statements of state enterprises (Naftogaz has not published the auditor’s report for 2012, 2013 and so far);

– Efficient and responsible prioritization of public policy, clearly distinguishing the subsidies and tax incentives (industrial policy).

And, finally, one should limit the opportunities for fraud.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations