On May 30, the Ministry of Finance of Ukraine announced the first technical default on $665 mln payment to GDP warrant holders. And while it was planned and legal, it reminded everyone of the elephant in the room: while external borrowing is a lifeline now, repayment will be a challenge later — it will affect pensions, public wages, and reconstruction. The question is simple but urgent: where will the resources to repay this debt come from?

International trade is often cited as the key source for external debt repayment. Some studies show a clear link between trade deficits and external borrowing (Lane and Milesi-Ferretti 2000, Beyene and Kotosz 2020), while others find no consistent relationship, especially in developing economies (Chaudhary and Awar 2001, Omar and Ibrahim 2021).

To test this relationship in the Ukrainian context I conducted an econometric study using monthly data from 2013 until 2024. Can international trade be the main solution to the debt issue in Ukraine? Let’s figure it out.

How severe is the external debt issue in Ukraine?

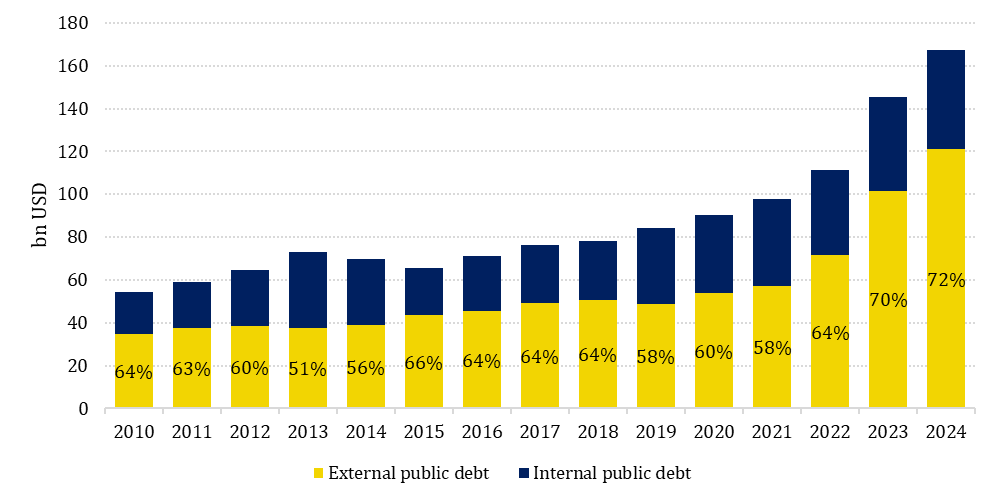

Ukraine has been using external borrowing as an important source of financing since gaining independence. By the end of 2010 the external public debt reached $34.8 bn, which was 25% of Ukraine’s GDP and 64% of its total public debt at that time. Since then, the foreign debt had been steadily growing until 2022 (see Figure 1), and debt to GDP ratio declined from 80% in 2014 to 50% in 2019.

The full-scale Russian invasion provoked a sharp increase in external borrowing resulting in $120.8 bn of external public debt stock by the end of 2024, which is 91% of Ukraine’s GDP. The IMF has set a long-term debt limits through its debt‐sustainability framework within the Extended Fund Facility. This shows that our international partners are also worried about the issue.

Figure 1. External public debt in Ukraine’s gross public debt (end of the year) structure dynamics

Source: Ministry of Finance of Ukraine

The problem with high levels of external borrowing lies in a country’s ability to repay the debt. Unlike internal obligations, external debt is mostly denominated in foreign currencies. Only 1% of Ukraine’s external obligations are denominated in hryvnia. This makes it impossible for the government to repay the debt by “printing money,” which could be a solution for internal obligations. Thus, to ensure debt security, the country must generate sufficient resources for debt repayment and be able to convert these resources into the payment currency, usually USD or EUR. Therefore, international trade becomes essential for the sustainability of external public debt because it is the main source of foreign currency inflow.

The policy of positive trade balance

The trade balance of a country is the difference between exports and imports. Export transfers the domestically produced products abroad while bringing in the foreign currency and import works vice versa. Positive trade balance means that export exceeded import, i.e. we earned more than we spent on the international market. Negative trade balance is the opposite situation. The conclusion is simple: to repay our debt we need to maintain a positive trade balance to get the surplus that can be transferred to our creditors. Thus, the negative trade balance is undesired as it requires increasing external borrowing to pay for the gap if we cannot compensate it with foreign investment or remittances.

This perspective is a basis for protectionist policies that have been implemented for centuries all over the world. They imply introducing economic, regulatory or legal barriers to constrain imports and thus spend less on the international market. One of the recent examples of such solutions are tariffs introduced by Donald Trump, but these can also include quotas, certifications, import restrictions etc.

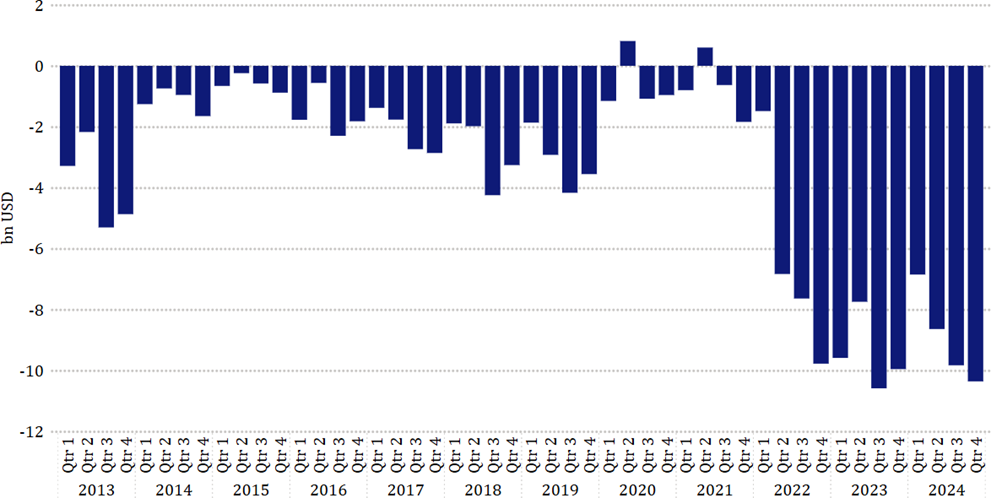

However, in most cases the positive trade balance is rather an unachievable dream than a realistic objective. For example, for the last 11 years Ukraine had a positive trade balance only in two quarters in 2020 and 2021, which was mostly caused by restrictions introduced during the COVID-19 pandemic (Figure 2). The full-scale Russian invasion caused severe damages to Ukrainian domestic production which resulted in a highly negative trade balance. This, in turn, can lead to the external debt accumulation (other factors are budget deficit and hryvnia devaluation).

If so, following the protectionists’ logic, today we should work on reducing the trade deficit to keep the external debt sustainable. However, what would be the effectiveness of this solution in real life, especially in the war-time economy?

Figure 2. Trade balance dynamics in Ukraine, billion USD

Data source: National Bank of Ukraine.

What really drives Ukraine’s external debt?

To assess the possible link between Ukraine’s trade balance and its external public debt, I conducted an econometric analysis using the Auto-Regressive Distributed Lag (ARDL) approach on monthly data from 2013 to 2024. Besides the trade balance, the model included several macroeconomic indicators that could potentially influence debt accumulation, such as the budget balance (difference between the government incomes and expenditures), external debt service, international reserves, inflation, and the exchange rate (see Annex). Additionally, the analysis controlled for broader economic variables such as GDP, trade openness (exports plus imports), and structural shocks (identified with statistical tests).

Contrary to the common assumption that trade deficits are one of the primary causes of external borrowing, the results indicate that the trade balance did not have a statistically significant effect on the accumulation of external public debt over the considered period. This suggests that, in Ukraine’s case, fluctuations in exports and imports do not directly translate into changes in external borrowing (probably because foreign trade is performed mostly by the private sector rather than the state).

Instead, the analysis showed that the budget balance and inflation are the most significant contributors to external debt growth. Periods of fiscal deficit were strongly associated with increased external borrowing, which is a straightforward result since the govenment covers fiscal deficit mostly with borrowing. Inflation was also found to have a long-term impact on the external public debt since when inflation increases, budget expenditures for both intenal programs and debt sericing increase).

Another key finding was the role of international reserves in debt security. An increase in reserves was associated with a significant reduction in external borrowing. Higher reserves provide greater flexibility in meeting foreign currency obligations allowing to avoid more expensive short-term loans.

These findings highlight that while trade remains important for broader economic development and foreign currency inflows, it is not the primary mechanism through which Ukraine’s external debt evolves.

How can international trade help repay the external debt?

The analysis revealed that reducing trade balance deficit is unlikely to solve the external debt problem. In fact, policies aimed at reducing imports can be counterproductive. Limiting imports may lead to shortages in the domestic market and increase inflation. This, in turn, would exacebate the problem it aims to solve, as inflation has been shown to be one of the main causes of debt accumulation.

This does not mean that international trade policy is irrelevant in terms of external public debt. While trade balance as a single metric may lack a strong statistical link to external debt, elements of trade policy continue to influence the broader economic environment in important ways. One of the most obvious examples is the connection between exports and the country’s foreign currency reserves.

Ukraine’s international reserves are managed by the central bank through operations in the domestic currency market. The supply of foreign currency in this market is shaped primarily by exporters who convert their revenues into hryvnia. Therefore, even if the trade balance itself does not directly affect debt levels, the strength and stability of export sectors play a critical role in building and maintaining foreign exchange reserves. And as the analysis shows, higher reserves are strongly associated with reduced external borrowing.

Therefore, improving export performance should remain a key objective — not as a direct cure for debt, but as a strategic element in strengthening the country’s financial position. This includes addressing both formal trade barriers, such as tariffs and quotas, and informal ones, such as complex licensing regimes or misaligned technical regulations. Continued integration into the European and global markets can enhance Ukraine’s ability to generate foreign currency income in a sustainable manner.

In conclusion, the path to external debt sustainability lies not in a single policy lever, but in coordinated and forward-looking economic management. Trade policy should focus on encouraging a competitive, export-oriented economy while avoiding protectionism. At the same time, strengthening fiscal discipline, maintaining low inflation, and building international reserves are essential for Ukraine’s debt sustainability. If these efforts are implemented in a balanced and practical way, they can help Ukraine manage its debt obligations without negatively impacting its economic recovery and long-term development.

Annex. Estimation results

Table 1. Short-run coefficients estimation results

| Variable | ARDL model specification | |||||

| (1,0,0,0,0,0,0) | (2,0,0,0,0,0,0) | (2,0,0,0,0,0,1) | (1,0,0,0,0,0,1) | (3,0,0,0,0,0,0) | (1,0,0,0,0,1,1) | |

| (Intercept) | -0.021 (0.297) |

0.056 (0.309) |

0.046 (0.307) |

-0.034 (0.296) |

0.115 (0.324) |

-0.072 (0.300) |

| Trade balance | -0.116 (0.101) |

-0.115 (0.104) |

-0.103 (0.104) |

-0.105 (0.101) |

-0.120 (0.108) |

-0.112 (0.101) |

| Budget balance | -0.489*** (0.068) |

-0.488*** (0.069) |

-0.495*** (0.069) |

-0.496*** (0.068) |

-0.486*** (0.069) |

-0.492*** (0.069) |

| External debt service | -0.163 (0.162) |

-0.149 (0.163) |

-0.144 (0.162) |

-0.158 (0.161) |

-0.156 (0.165) |

-0.140 (0.163) |

| Reserves | -0.661*** (0.048) |

-0.670*** (0.050) |

-0.673*** (0.050) |

-0.663*** (0.048) |

-0.671*** (0.050) |

-0.663*** (0.048) |

| Inflation | 0.114** (0.045) |

0.114** (0.045) |

0.114** (0.045) |

0.113** (0.045) |

0.113** (0.045) |

0.089 (0.056) |

| Exchange rate to EUR | -0.005 (0.010) |

-0.008 (0.011) |

0.092 (0.066) |

0.094 (0.065) |

-0.010 (0.012) |

0.101 (0.066) |

Note: * p < 0.10, ** p < 0.05, *** p < 0.01.

Table 2. Long-run coefficients estimation results (extended)

| Variable | ARDL model specification | ||||||

| (1,0,0,0,0,0,0) | (2,0,0,0,0,0,0) | (1,0,0,0,0,0,1) | (2,0,0,0,0,0,1) | (3,0,0,0,0,0,0) | (1,0,0,0,0,1,1) | (1,1,1,1,1,1,1) | |

| (Intercept) | -0.02 (0.28) |

0.05 (0.30) |

-0.03 (0.28) |

0.05 (0.30) |

0.11 (0.33) |

-0.07 (0.29) |

-0.07 (0.29) |

| Trade balance | -0.11 (0.11) |

-0.11 (0.12) |

-0.10 (0.11) |

-0.10 (0.12) |

-0.12 (0.12) |

-0.10 (0.12) |

-0.08 (0.12) |

| Budget balance | -0.46 (0.09)*** |

-0.47 (0.09)*** |

-0.46 (0.09)*** |

-0.48 (0.09)*** |

-0.48 (0.10)*** |

-0.46 (0.09)*** |

-0.51 (0.09)*** |

| External debt service | -0.15 (0.14) |

-0.14 (0.15) |

-0.15 (0.14) |

-0.14 (0.15) |

-0.15 (0.16) |

-0.13 (0.15) |

-0.01 (0.21) |

| Reserves | -0.62 (0.07)*** |

-0.65 (0.09)*** |

-0.62 (0.07)*** |

-0.65 (0.09)*** |

-0.66 (0.11)*** |

-0.62 (0.07)*** |

-0.65 (0.07)*** |

| Inflation | 0.11 (0.03)*** |

0.11 (0.04)*** |

0.11 (0.04)*** |

0.11 (0.04)*** |

0.11 (0.04)*** |

0.12 (0.04)*** |

0.12 (0.04)*** |

| Exchange rate to EUR | -0.00 (0.01) |

-0.01 (0.01) |

-0.00 (0.01) |

-0.01 (0.01) |

-0.01 (0.01) |

-0.00 (0.01) |

-0.01 (0.01) |

Note: * p < 0.10, ** p < 0.05, *** p < 0.01

References:

- Beyene, Sisay Demissew, and Balázs Kotosz. 2020. “Macroeconomic Determinants of External Indebtedness of Ethiopia: ARDL Approach to Co-integration.” Society and Economy 42, no. 3: 313–332.

- Chaudhary, Muhammad Aslam, and Sabahat Awar. 2001. “Debt Laffer Curve for South Asian Countries.” Pakistan Development Review, 40, no. 4II (December 1): 705–20.

- Lane, Philip R., and Gian Maria Milesi-Ferretti. 2000. “The Transfer Problem Revisited: Net Foreign Assets and Real Exchange Rates.” IMF Working Paper, no. WP/00/123. International Monetary Fund.

- Omar, Zahir Mohamed, and Mohamed Isse Ibrahim. 2021. “Determinants of External Debt: The Case of Somalia.” Asian Development Policy Review 9, no. 1: 33–43.

Photo: depositphotos.com/ua

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations