Since independence Ukraine’s economic development looks like a bumpy road – periods of downturns change with relatively short recoveries before the next disruption. Obviously, the recent economic path is far from the country’s potential and far from the ideal many Ukrainians thrive for when they empower a new strand of politicians via elections. Ukraine is often named as a country of great unleashed potential, yet it still develops at a far slower pace than it could.

Why has Ukrainian economic transformation failed at bringing desirable growth outcomes to date? What are the missing elements for sustainable economic development and rapid convergence towards its Eastern European neighbors in terms of living standards? It seems like during the transition to a market economy many Ukrainian authorities overlooked the importance of elements needed to make the whole system more sustainable. Ukraine’s economic history is full of examples when government actions hampered entrepreneurship evolvement and favored preservation of ineffective low value-added industries. Lack of fair competition in many markets and weak judiciary meant the economy failed to develop the strong foundation of small and medium enterprises necessary to sustain continuous progress.

Economy is an evolving system

Economic systems like any live ecosystems undergo constant changes through their life span responding to varying conditions. A forest fire or an earthquake causes tremendous changes of the landscape and forces all the inhabitants to either die or adapt to the altered environment. Similar processes may occur in economic systems when they are hit by different shocks. The latter could be both positive (technological advances, demand/supply growth etc) and negative (armed conflicts, financial crisis or disease outbreaks) but they do bring about transformation and reallocation of resources within the system. As a result of different shocks, the structure of the economy changes as economic agents adapt to new conditions and find innovative ways to produce goods and services. However, there usually are losers and winners down the road.

What is creative destruction?

A famous Austrian economist Joseph Schumpeter referred to the process of constant economic change as ”creative destruction” that yielded qualitative alteration of economic structure from within due to opening up of a new commodity, new market or technology[1].

During creative destruction innovations brought by entrepreneurs create new ways of production and lead to destruction of value of established firms or industries. In other words, Schumpeter explained that sustained economic growth and progress come at a cost of stagnation and decline of firms/industries that could not compete with more productive market participants/technologies.

According to Schumpeter, competition and entrepreneurship are important pillars of productivity gains and economic development. It takes decades for Schumpeterian transformation to become visible, although rapid globalization and technological advances sped up “creative destruction” in recent times. As a result, some technologies swiftly conquer the world regardless of the countries’ income level and help to boost productivity and growth in developing countries shifting their production possibility frontiers.

Giants give place to newcomers…

Dynamic change of the gross value-added structure in a rapidly developing country or the evolution of the top global corporations over several decades can be used as illustrations of creative destruction. For instance, in less than 30 years South Korea witnessed major restructuring of its economy from mostly agricultural in the 1960s (with about 40% of GDP attributed to agriculture and only 11% of value added derived from manufacturing) to highly industrialized by 1990s (with manufacturing contributing more than 30% to the country’s GDP, while agriculture share fell to about 5%).

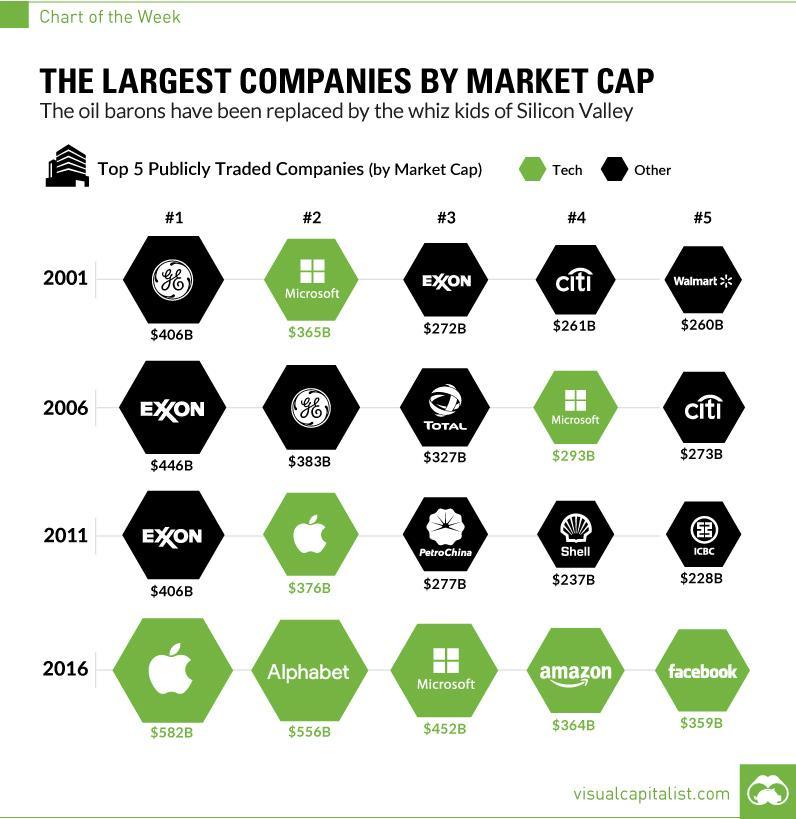

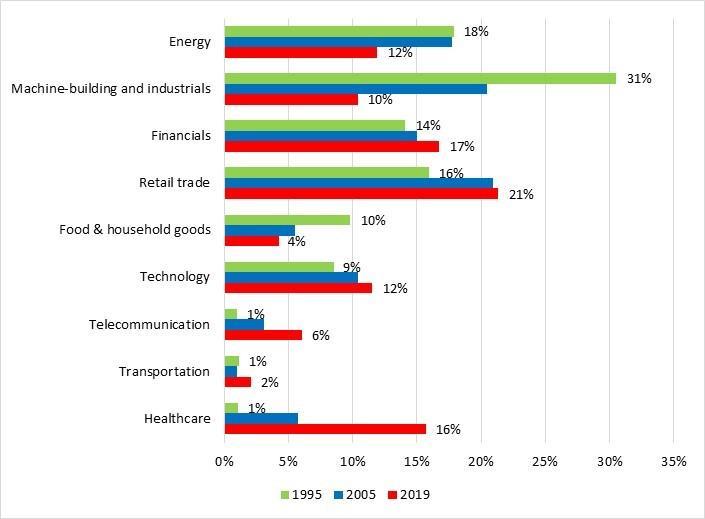

The sectoral representation of the largest public corporations in the USA have seen major transformation over the last 30 years. Petroleum and manufacturing corporations at the top of the Fortune 500 (figures 1 and 2) list were shifted down by technology and consumer services stocks (by market capitalization). However, the top corporations by their revenue were still retailers and energy giants rather than technology stocks. Such corporate giants as Walmart, Exxon Mobil, General Motors and Chevron managed to stay at the top regardless of the crises and demand/supply swings largely due to constant changes and productivity improvements. In 2019 almost half of the new start-up companies valued at more than $1 bln, the so-called unicorns, were launched in the USA and most of them were technology companies[2].

Figure 1. The largest companies by market capitalization

Source: visualcapitalist.com

Figure 2. Sectoral structure of top 50 US companies, % of total revenue

Source: fortune.com/fortune500/

…but not in Ukraine

Corporate landscape in Ukraine has not seen similar tremendous changes over the last 20 years and it is far less diverse than in Poland. By and large either the state-owned natural monopolies or the oligarch-owned enterprises still dominate the list of Ukraine’s largest companies.

The firm-level study revealed that oligarch-owned enterprises are less efficient than other private firms – yet they absorb about 15-20% of employment and turnover. Together with the state-owned and municipally owned enterprises, which are also far from exemplary in terms of efficiency and productivity, it appears that substantial resources are tied up in subpar entities, thus keeping the overall economy in low gear.

The wealth is highly concentrated in the hands of a small group of oligarchs – in 2017 the cumulative net worth of Ukraine’s top three richest individuals was estimated at more than six percent of GDP, while the same indicator was at less than two percent in Poland[3]. Small enterprises in Ukraine produce about 16% of GDP, while in Poland the role of small business is estimated at more than 30% of gross value added of the non-financial part of the economy. Moreover, small enterprises in Ukraine rarely grow into medium or large ones. This can be explained by the taxation system as well as by barriers to entry erected by incumbents with the help of officials.

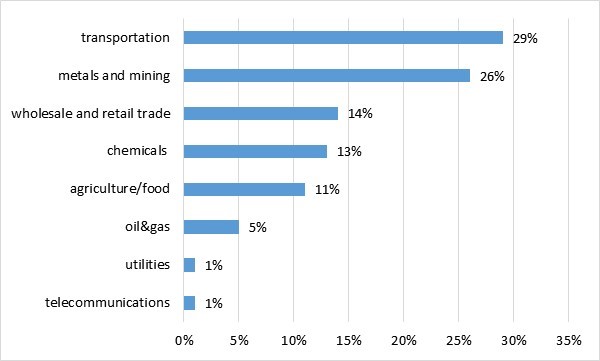

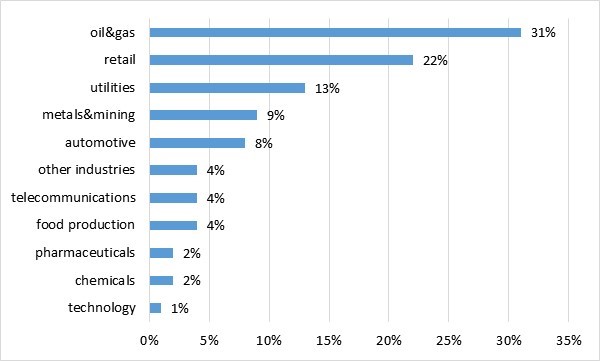

The sectoral distribution of the top enterprises in Ukraine has not changed much since 2000 with enterprises from energy, metallurgy, agriculture and trade sectors remaining among the leaders if ranked by revenue. Only a few companies in the top 200 enterprises are representing new sectors like ICT (figure 3).

In the post-Maidan period, Ukraine’s gross value-added structure has inevitably changed as the country lost control over industrialized part of Donbas, thus shares of mining and manufacturing value added diminished. At the same time, shares of agriculture, trade and information technology sectors went up.

This shift in gross value-added structure only partially could be attributed to the creative destruction process. Most of the change, unfortunately, was due to physical destruction of industrial facilities in Donbas. Rapid development of Ukrainian ICT sector that increased its footprint in the economy basically from scratch to about 4% of GDP and 15% of total services exports over the recent decade is an illustration of creative destruction at work – e.g. a flow of human and capital resources from industry and agriculture toward the ICT sector.

At the current stage Ukraine is rather an outsourcing destination, but with certain changes in the environment and boosting entrepreneurial spirit it has potential to grow into the land of “unicorns”. According to the survey by DOU portal, every second IT developer works for an outsourcing company, while every third of them has a plan for their own project, and every fourth has already implemented it.

Figure 3. Ukraine’s sector structure of the top-50 enterprises by revenue, 2018

Source: biz.censor.net.ua

Poland: sector structure of the top 30 enterprises by revenue, 2018

Source: Coface CEE Top 500

Relatively less diverse corporate landscape in Ukraine is an aftermath of the established cronyism that still keeps government weak and distorts business environment. Hence, the process of creative destruction is hampered – reallocation of resources from less productive entities to more efficient new entrants is much less dynamic than it could have been if the operating environment was favorable.

Instead of making productivity enhancing investments, large Ukrainian enterprises owned by oligarchs concentrated their efforts on rent-seeking – lobbying special privileges or non-monetary preferential treatment by the authorities to alleviate competitive pressures. The same schemes are observed on the regional level, when local businessmen or top management of municipal enterprises become local council members to lobby certain preferences for their business. Corrupt judiciary system led to weak property rights protection and contract enforcement, thus undermining growth of businesses without political connections and entry of new market players.

While sector-wide tax privileges and subsidized energy tariffs sank into oblivion, Ukrainian government still grants state support to those who are not in the highest need of such support. For instance, every year the four largest agricultural holdings absorb more than half of the state resources allocated to agricultural sector. On a regular basis the government provides support to state-owned coal mines, most of which are loss making but remain large regional employers, spending large sums of taxpayers money [4] instead of transforming coal-depended regions into alternative economic development areas. The latter, however, requires comprehensive efforts of the government and local community to manage the process of unprofitable coal mine closures and reallocating labor resources into other sectors.

Having obvious limitations in the quantities of production factors due to demographic decline and finite natural resources, Ukraine has to rely on productivity gains to get on a sustainable growth path. According to the World Bank estimates Ukrainian economy may well grow at 7% annually if total factor productivity increases by 2-3% every year implying investment ratio of 26% of GDP (of course, under assumption that investments go into productive activities).

Productivity is a complex concept that has several dimensions linked to (1) the allocation of resources between the different economic agents (from low to high-productivity enterprises), (2) productivity changes within the existing firms as a result of technology adoption and human capital improvements, and (3) the entry of new highly productive and innovative enterprises [5]. The latter component of productivity function is referred to as innovation effect, which is linked to Schumpeterian view on the decisive role of entrepreneurship in creative destruction process and boosting economic progress [6]. Thus, for developing countries to succeed it is vital to encourage competition and to nurture entrepreneurship and innovations.

Why Ukraine lags behind in terms of productivity?

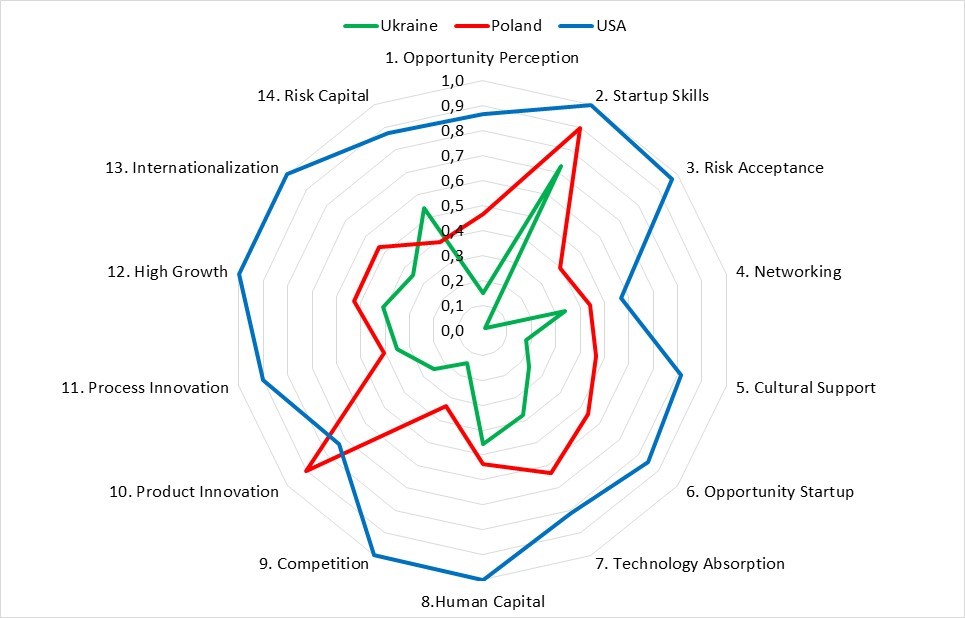

Every country has some percentage of people with entrepreneurial spirit, but not in every country an entrepreneur can succeed. The Global Entrepreneurship and Development Institute (GEDI) has developed a composite indicator to assess the quality of entrepreneurial environment in a given country – the so-called ‘entrepreneurial ecosystem’ – that takes into account institutional framework indicators, social norms and cultural preferences as well as education, financial and business conditions. The Global Entrepreneurship Index (GEI) is based on 14 different elements of the entrepreneurial ecosystem important for effective support of entrepreneurial activity.

Although Ukraine’s entrepreneurial ecosystem is far from ideal, its strengths give hope for quick wins if problem areas are fixed. Among 137 assessed countries by GEDI, Ukraine ranks 73rd, while Poland is at the 30th place. The top 10 countries are all developed economies with the USA ranked 1st as the country with a well-functioning entrepreneurial ecosystem. Assessment of GEI components for Ukraine reveals that risk acceptance, opportunity perception, cultural support and competition are problem areas that hold the whole ecosystem back and require improvements. In fact, these are components that are linked to the general attitude towards entrepreneurship in the country. It may be that is Ukrainians need some analogue of an “American dream” when entrepreneurship would be perceived as one of the paths for merit-based social mobility.

At the same time, Ukraine’s scores on the elements related to entrepreneurial abilities and growth aspirations such as quality of human capital, startup skills, process innovations and risk capital are close to those in Poland (figure 4).

Figure 4. Global Entrepreneurship Index components, 2018

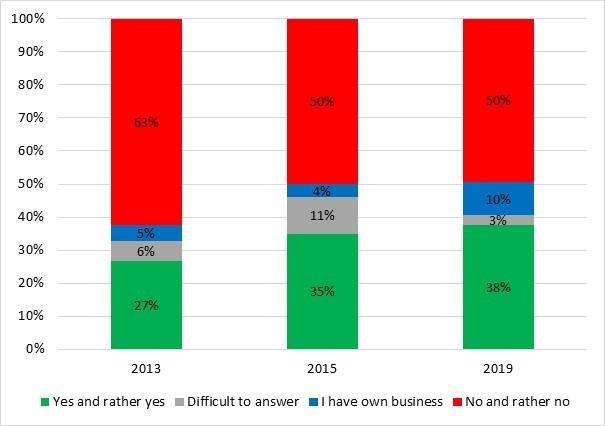

Entrepreneurship as a career path is not a popular option in Ukraine but the entrepreneurial spirit is on a rise, especially among the young generation. According to a poll results, 38% of Ukrainians would like to start their own business and 10% have already owned a business in 2019, which is a considerable increase relative to 27% and 5% in 2013 respectively (figure 5).

The promising fact is that 61% of young people (18-35 years old) are willing to start an entrepreneurial career. For instance, in the USA entrepreneurial spirit is high among high school graduates (72% of them are willing to start their own business at some point), and 62% of college graduates consider starting business as a desirable career for themselves.

Globally, people in India, Vietnam and China have the highest entrepreneurial aspirations — there, almost 90% of respondents consider starting their own business as a desirable career opportunity. It is fair to say, though, that underlying motivation of people willing to become entrepreneurs in South-Asian countries is out of necessity to make up for living rather than due to recognition of technological and business opportunities.

Figure 5. Would you like to start your own business/become entrepreneur?

Source: Rating Group, author’s calculations

Successful realization of entrepreneurial desire requires encouraging environment, knowledge and skills which are not always present in developing countries. For instance, in Ukraine only 15% of people think they have necessary skills and resources to start their own business relative to 37% in the EU countries as per Amway Global Entrepreneurship Report 2018. Except for regulatory environment and rule of law, the list of determinants of entrepreneurial activity has expanded to human capital, psychological and cultural characteristics necessary to drive productivity enhancing experimentation and risk taking associated with starting new business [7].

The risk acceptance and societal support of entrepreneurial efforts in Ukraine are generally low. Only 7% of respondents are ready to accept the risk of failure in Ukraine compared to 41% in the EU and 74% in the USA according to Amway Global Entrepreneurship Report 2018. It may be because Ukrainians attribute this risk to exogenous factors like corruption/raiding rather than failure due to their miscalculations (lower than expected demand or higher costs relative to competitors). The strength of the exogenous factors is something that makes Ukrainian business environment different from the one of the developed countries.

Not only has a long history of corruption, political instability and macroeconomic volatility diminished risk acceptance and experimentation drive among Ukrainians, but the education system is built on stigmatizing failure and intolerance to new ideas/experiments from a young age. Also, limited opportunities to find well-paid jobs after unsuccessful business endeavors prevent people from pursuing entrepreneurial careers until they earn a financial airbag.

The state should concentrate its efforts on leveling the playing field for all market participants, stimulate competition and correct for market failures. It is also important to maintain macroeconomic stability and invest into the entrepreneurial ecosystem development and encourage innovation-driven startups via modernizing education system, easing access to financing, flexible labor market rules, technology absorption etc.

Although there is evidence about clusters of productivity in ICT sector, entrepreneurship in Ukraine remains subdued and the government has yet to resolve problems such as lack of rule of law, corruption, unfair market competition, unstable regulation.

It is important to continue productivity enhancing structural reforms including land reform, privatization, reforms of public administration and education. For many SMEs business education is not easily accessible and there is rationale for the local authorities to invest into business education programs to promote SMEs growth and job creation. In this regard, decentralization reform was the one that empowered local authorities and municipalities to pursue their own policies to promote local business development. In the midst of the ongoing pandemic-induced crisis the governments of advanced economies allocated substantial rescue packages for small businesses because they acknowledge that this segment is an important source of productivity gains and entrepreneurial activity.

Will quarantine measures speed up creative destruction?

Surveys already show that some small businesses closed due to the quarantine, and many have been damaged. However, there is a famous quote that a crisis also implies an opportunity. Can Ukrainian business utilize this opportunity, or there will be just the ‘destruction’, without the ‘creative’ part? Much depends on the government policy.

Like in many other quarantine-hit countries, small business is hit the most in Ukraine. All offline HoReCa and non-food retail are closed for 2 months with a high probability of being closed for another month or longer. The business does its best to survive. For example, open markets migrate to messengers or retail online platforms.

The state responded to the crisis with measures to reduce taxes, extend tax payment deadlines, abolish tax inspections and some types of fines for SMEs. In addition, government develops a new program of loans to businesses.

Although it is important to provide critical support for people and businesses to survive through the quarantine times, we think it is crucial to think also about the potential prospects of business development – how to make destruction creative to the extent possible.

Employees and entrepreneurs who are or will be out of job or business should be incentivized to think of a startup. To do so in the midst of a crisis means that one should remain eligible for unemployment and other benefits in addition to being able to receive a startup loan while making first steps as an entrepreneur or looking for new market niches.

The state may direct the efforts of startupers to maximise social value – e.g. supporting ideas aimed at helping those isolated (elderly people) or online education (while no offline education is available).

Besides monetary incentives, the state should work with real and perceived barriers, including gaps revealed by Global Entrepreneurship index.

Despite being distressed, people should be encouraged not to give up and look for entrepreneurship opportunities instead. An online business training, coaching, assistance with taxes and accounting and legal support can be offered with this respect.

The ongoing pandemic-induced crisis is clearly a destruction. The state should not only try to minimize its negative consequences. It can also creatively look for ways to restore the economic activity. Boosting the entrepreneurial spirit among Ukrainians could be one opportunity, which will also pave the way for transformation of the economy after the crisis.

Notes

[1] In his book “Capitalism, Socialism, and Democracy” (1942) Joseph Schumpeter expressed his ideas on how businesses operate in capitalist society and named the process of incessant economic restructuring when old industries incessantly being replaced by the new ones as creative destruction. For more details see Chapter 7.

[2] Unicorns are defined as privately held successful start-ups valued at $1 bln and more, usually at the vanguard of the industries they operate in. As at 31 March 2019, there were 326 unicorns around the world, mostly from the USA, China and the UK.

[3] World Bank. 2018. Ukraine Growth Study: Faster, Lasting, Kinder.

[4] According to the audit report by the Accounting Chamber of Ukraine, in 2019 state support of the coal industry absorbed UAH 5.5 bln in 2017-18 and 1st quarter of 2019, though the majority of state support beneficiaries are loss-making enterprises and their output was constantly declining over the recent years. Recent changes to the state budget in the middle of pandemia crisis will result in additional UAH 1.6 bn expenditures on salaries to coal miners in 2020.

[5] Cusolito A.P. and Maloney W. F. 2018. Productivity revisited. Shifting Paradigms in Analysis and Policy. The World Bank. Washington D.C.

[6] Zoltán J. Ács et al. 2020. Global Entrepreneurship Index 2019. Global Entrepreneurship and Development Institute (GEDI), Washington DC, USA

[7] For more information see Chapter 4 in Cusolito A.P. and Maloney W. F. 2018. Productivity revisited. Shifting Paradigms in Analysis and Policy. The World Bank. Washington D.C.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations