According to the plans of the Ministry of Digital Transformation, the main bill on Diia City is to be enacted at the end of June 2021. Diia City is a special legal framework for the IT industry (both for existing companies and for startups). The plan is to get companies involved with Diia City starting in January 2022.

Two key reasons account for the need to create Diia City. The first is an attempt to “legalize” IT professionals, the vast majority of whom work as individual entrepreneurs today (with their employers not paying the unified social contribution (USC) for them). The second reason is a desire to attract as many international IT players as possible to work in Ukraine and stimulate the creation of new Ukrainian IT companies.

In this article, we will focus on the second goal only – that is, whether Diia City will help encourage investors to come into the Ukrainian IT industry? So let us see what tools the country employs to attract venture capital.

The three main factors influencing investment decisions are:

1) the quality of the investment climate, i.e. transparency in the judicial system, legal guarantees for investors, ease of doing business, political and economic stability, infrastructure, etc.;

2) tax incentives for investments, i.e. lower effective tax rates;

3) non-tax incentives for investments such as direct financing of investment on the part of the state (grants, loans, subsidies). Such tools are widely used in many OECD countries. However, they carry an increased corruption risk.

According to the study on investment incentives conducted by World Bank analysts for 55 countries, the quality of the investment climate is the most powerful factor in making investment decisions. Especially when it comes to direct foreign investments. The effect from lowering the effective tax rate is eight times greater for countries with good investment climates that rank high in the Doing Business Index (these would include most OECD countries, as well as countries such as Georgia or Singapore). In contrast, if tax incentives are provided in unattractive investment climate conditions, they have hardly any effect at all (as seen from the experience of Serbia, Russia, Argentina, Brazil, Kenya, etc.).

Despite the differences in efficiency, the fact remains the same – nearly all countries employ tax incentives in one form or another.

What does Diia City offer?

- Possibility to choose between the 9% exit capital tax (ECT) and the 18% income tax (standard rate). Companies thus have an opportunity not to make tax payments on reinvested earnings. In opting for ECT, the residents’ expenses for purchases of goods (works, services) from a unified tax payer (including IEs of group 3) should not exceed 20% of the total costs. Otherwise, the 9% ECT will need to be paid. At the same time, there is a transition period for introducing this provision until 2025, meaning that no such restrictions will apply until 2024. In 2024, the payments should not exceed 50%.

- Preferential labor tax rates. Diia City residents will be able to select and hire workers by signing labor agreements (contracts) with them, collaborate with gig workers or engage contractors and providers, including individual entrepreneurs.

| Criterion | For Diia City residents | For Diia City non-residents | ||

| IE | Gig contract | Employee | ||

| PIT | 5% | 5% | 5% | 18% |

| Military contribution | – | 1.5% | 1.5% | 1.5% |

| USC | 22% of the minimum wage | 22% of the contractually specified USC assessment base, within a range of minimum and maximum USC base values established by law | 22% of the minimum wage | 22% of income, within a range of minimum and maximum USC base value, established by law |

- 0% of the personal income received as dividends, if they have not been distributed for 2 years or more;

- 0% of the personal income on the sale of shares in a Diia City company, if the company has been owned for over a year;

- Reducing personal taxable income by the amount of investments in a Diia City resident company if such expenses were incurred by the taxpayer before the company became a Diia City resident or during the period when this resident’s income did not exceed the income limit for unified tax payers of IE group 3 (currently, UAH 7.002 million).

Besides tax incentives that are central to the Diia City project, the Ministry of Digital Transformation proposes measures to improve investment climate conditions for the residents, specifically:

- Before taking action against a Diia City resident, law enforcement is required to submit a written inquiry. Furthermore, the Ministry of Digital Transformation assures that 98% of cases can be closed by providing an answer to the inquiry.

- All procedural decisions concerning Diia City residents will be agreed upon at a level not lower than the regional prosecutor. According to the Ministry, this will complicate the procedural action against residents preventing abuse on the part of law enforcement.

- If adopted, the Diia City legal regime will be introduced for at least 15 years with no right to make changes.

- According to the Ministry, the mechanism of gig contracts will enhance the attractiveness of the Ukrainian IT industry to foreign investors who believe that investing in Ukrainian companies that are using IEs is quite risky: the latter are not proper employees and there is a risk of restructuring existing work arrangements into the considerably more costly employment relationship. Flexible gig contracts should fix low tax rates for IT professionals in the legal field, which will make the system for attracting industry professionals more transparent. However, according to the EBA IT Committee, the “raw and incomprehensible gig scheme” carries even greater risks of restructuring.

- It is prohibited to seize the property of Diia City residents if this leads to suspending work or significantly restricts operations. Law enforcement will bear criminal responsibility for abuse of power or authority against Diia City residents.

The main bill also addresses the right of resident companies to establish non-for-profit, self-rule organizations that can be funded by membership fees and other sources not prohibited by law. There is widespread fear among businesses that, in practice, membership in such organizations will be mandatory and membership fees will be burdensome.

What tax instruments are most frequently used by other countries?

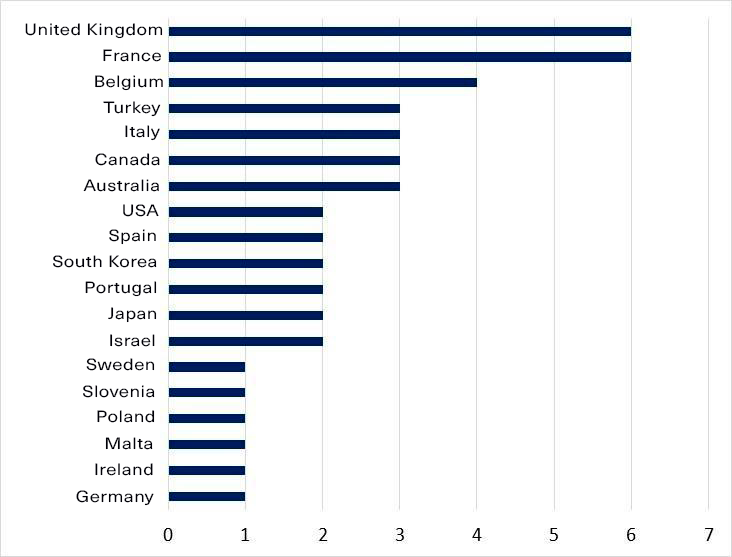

Overall, the EU and OECD provide 46 different tax incentives (Figure 1). 13 countries, mainly the most developed ones, employ different tools simultaneously.

Figure 1. The number of tax incentives for venture capital investments in different countries of the world applied simultaneously

Developed countries’ experience shows that the most effective tax incentives are those aimed at long-term investment, which is also addressed by the Diia City bill. The most common tax incentives are described below.

Tax credit allows individuals and companies to deduct a certain percentage of investment expenses from their tax liabilities. For example, if your annual tax liability is UAH 200,000 and you have bought UAH 60,000 worth of stock in a young innovative company, you can pay less in taxes to the state – minus the same amount.

Usually, countries set a percentage threshold on the amount of investments or tax liability, by which taxes can be reduced thanks to investments. One notable case is in Israel’s Angels Law, which offers 100% tax credit with the investment threshold of ILS 5 million (about EUR 1.24 million). This is one of the most generous offers to investors.

In the United States today, the tax credit is mostly applied to investments in green technology. And, for example, in Canada, everything depends on province regulations. In Newfoundland, investors are allowed to claim a non-refundable tax credit equal to 30% of the amount invested in the Qualifying Venture Capital Fund. The maximum tax credit that a qualified investor can receive is $75,000. Usually, the funds are channeled into information technology, environmental technology, etc.

Tax exemptions are lower or zero tax rates applied if a company meets certain criteria. This tool is also available in the Diia City project.

For example, in the US, investments are stimulated through reduced tax rates – to 23.8 % – on capital gains from investments of over one year. Capital gains from investments within the year are taxed at rates up to 40.8%. Capital gain is the profit one earns on the sale of a capital asset, such as stocks, enterprise, land, or works of art. This tax applies if an investor sells a previously acquired asset at a higher price, thus making a profit.

Tax deferral is delaying paying taxes to some point in the future.

Loss relief is reducing taxable income or capital gains by the amount of losses incurred in the event of assets being sold for a cheaper price than when they were bought.

The last two instruments are used, in particular, in the UK.

Tax deduction is reducing the taxable income by the expenses of certain categories.

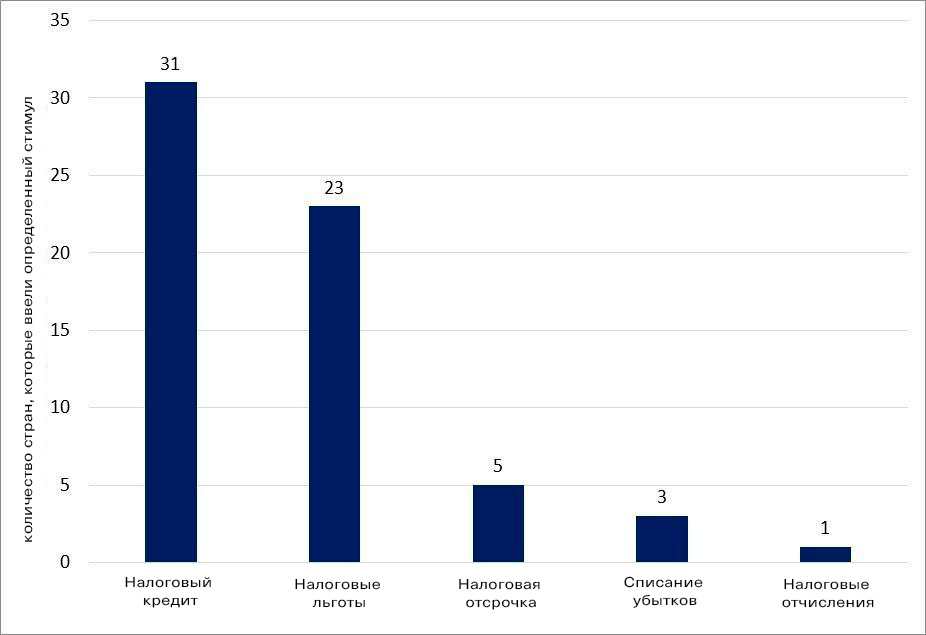

Figure 2. Prevalence of tax incentives

Figure 2 shows how many countries employ the most common tax incentives. Being the world’s most common instrument, the tax credit is not yet used in Ukraine to foster investment. However, a similar tool – tax exemption – is provided for by the Diia City legal regime to stimulate angel investments.

Conclusion

If Ukraine introduces the Diia City regime, a set of measures will be implemented for the first time in the country’s history to encourage investment in the IT industry. The tools proposed by the Ministry of Digital Transformation are generally in line with international practice.

Meanwhile, several important factors can hinder the desired efficiency of the new legal regime. The main issues lie with the investment climate: non-transparency of the judicial and law enforcement systems, high administrative costs of businesses, macroeconomic instability – all this cannot be compensated for by low tax rates, as international experience has shown. This is also evidenced by the fact that Ukraine ranked 64th in the ease of doing business rankings in 2020, falling in behind all neighboring countries.

The Diia City bill provides for measures that, if properly implemented, can improve the residents’ and investors’ perception of the investment environment in Ukraine. These measures are essentially an attempt to protect businesses from the potentially adverse influence of the state. However, without profound and systemic institutional reform in various areas of governance, there is a significant risk that the effect of Diia City will be close to that of similar reforms conducted in countries with unattractive investment climate conditions, that is – rather weak (according to the study, in countries with unattractive investment climate conditions, reducing the effective tax rate by 20% increases FDI as a share of GDP by 1%, whereas this effect is eight times greater for countries with a good investment environment).

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations