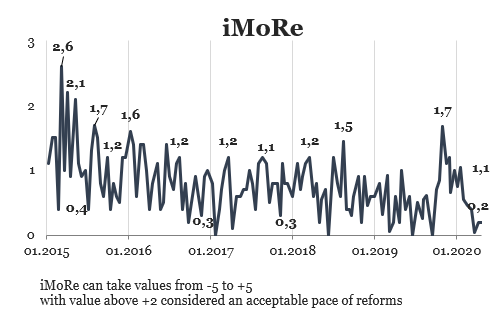

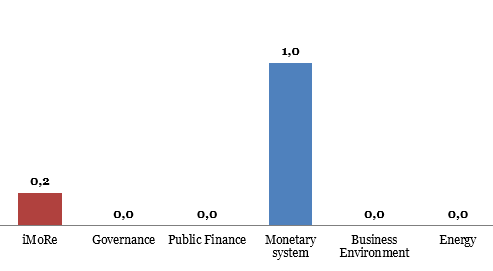

Reform Index is +0.2 points for the period from April 6 to April 19, 2020, out of possible range from -5.0 to +5.0. The index for the previous round was +0.2 points as well.

Chart 1. Reform Index Dynamics

Chart 2. Reform Index and its components in the current round

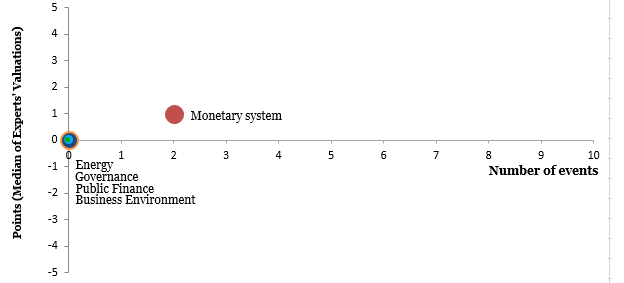

New criteria and requirements for writing off bad financial assets

Two resolutions of the National Bank of Ukraine regulating the write-off of “bad” assets were included in this issue of iMoRe. Resolution №52 obliges banks to develop internal bank documents for writing off impaired financial assets (debt write-off provisions). Such documents should contain criteria that allow the bank to determine the financial asset cannot be recovered. Resolution №49 allows banks to write off non-performing loans from reserves for expected losses provided they meet the following key criteria:

- debt repayment is overdue for more than 3 years;

- for the previous 3 years the bank did not receive significant payments on this loan (more than 10% of the carrying amount of such an asset);

- the bank failed to sell this asset three times or did not receive significant proceeds from the sale of collateral.

Important to note: the write-off does not equal debt forgiveness and the bank may continue to demand debt repayment.

Chart 3. Value of Reform Index components and number of events

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations