Progress in natural gas market reform and reduction of tax service pressure on business make a positive impact on Reform Index. Index continues to grow slowly, while the reform pace remains unsatisfactory: +1,2 points in this round. Reform Index experts note some progress in the reforms of energy sector, business environment, public administration and monetary system, as well as the lack of change in public finance.

In the first half of August, Reform Index grew slightly to +1,2 points (from +1,1 points in the previous round). Reform Index experts highly graded the government decisions on the approval of Naftogaz restructuring plan and reduction of opportunities for tax authorities to initiate criminal investigations. Additionally, experts praised the government decisions to launch the interregional customs office.

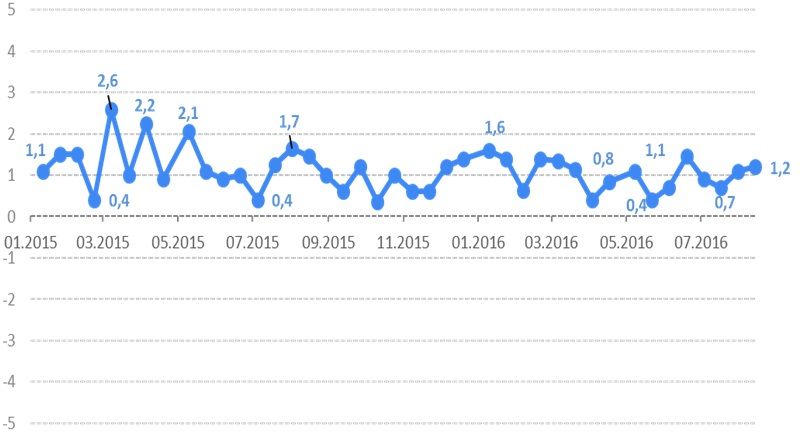

Chart 1. Reform Index dynamics*

* Reform Index team considers index value of at least 2 an acceptable pace of reform

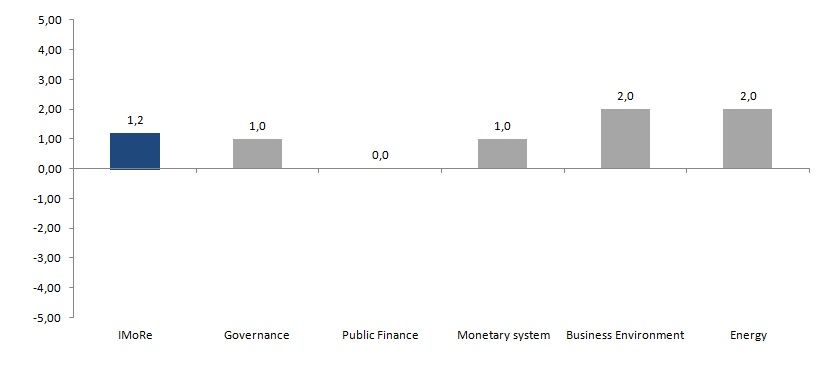

Chart 2. Reform Index and its components in the current round**

**Titles of components were shortened for convenience, while their content remained the same

The Most Important Positive Developments

1) The Cabinet of Ministers approved Naftogaz restructuring plan: +4.8 points

By issuing regulation № 496 of 1.07.2016 the Cabinet of Ministers approved Naftogaz restructuring plan and defined the model for unbundling of natural gas transmission and storage activity. The plan will be implemented in cooperation with the EBRD and experts of the Energy Community Secretariat.

Having joined the Energy Community, Ukraine has taken on the obligation to implement key EU energy legislation. The Third Energy Package requires unbundling gas transmission, production and distribution. In Ukraine these legislative norms are introduced by the Law “On the Natural Gas Market”.

According to the plan, the independent gas transmission operator JSC “Main Gas Pipelines of Ukraine” and gas storage operator JSC “Underground Gas Storage Facilities of Ukraine” will be created. These companies will be owned by the state of Ukraine, and the Ministry of Energy and Coal Industry will be responsible for the corporate governance of the companies. The assets are necessary for gas transportation and storage will be transferred to this companies.

The timeframe for this plan remains ambiguous. While the litigation between Naftogaz and Gazprom continues at the Arbitration Institute of the Stockholm Chamber of Commerce, the assets of Naftogaz cannot be transferred. The plan implies that the assets will be transferred to the new companies after the decision of the arbitration.

Stakeholder comments:

Oleksii Khabatiuk, NJSC Naftogaz of Ukraine:

«In general, the fact of the plan approval is an important step in the unbundling of transmission system operator, as the Third Energy Package and the Law “On the Natural Gas Market” require. The implementation of the plan is another important step in the Ukrainian gas market reform.

The plan defines the sequence timing of unbundling. Some dates are provisional. In particular, the assets’ transfer to “Main Gas Pipelines of Ukraine” and “Underground Gas Storage Facilities of Ukraine” can be done only after the final decision on the claims between Naftogaz and Gazprom, which is currently considered by the Arbitration Institute of the Stockholm Chamber of Commerce, is implemented.

From the organizational and legal perspective, all the preparatory work should be done before the arbitration trial is resolved: JSC “Main Gas Pipelines of Ukraine” creation, drafting of its management structure, analysis of all types of assets which the company needs, procedures and term of the asset concession agreement.

At the same time, the plan concerns not only Naftogaz, but also other institutions, one of them being the Ministry of Energy and Coal Industry. The paragraph 4 of the plan states that the Ministry should prepare necessary documents for the transfer of its responsibilities on the corporate governance of certain companies, including the electric power ones, before October 1 this year.»

Reform Index experts assigned high grades to this event and noted that this long-awaited decision is a step forward in fulfilling commitments to the EU. It will contribute to the increase in efficiency of the gas sector. After the plan implementation, the independent gas transportation and storage operators will provide nondiscriminatory access for all market participants.

Reform Index expert comments:

Roman Nitsovich, DiXi Group:

«Adoption of the Naftogaz restructuring model is a key decision for the natural gas market liberalization. It is aimed at implementation of Ukraine’s obligations to the Energy Community and within the framework of the EU-Ukraine Association Agreement. The decision is a compromise between two competitive models lobbied for by the Ministry for Energy and Naftogaz, the SWOT analysis of which was performed by Dixi group.

The model implies unbundling of transportation and storage functions and creation of the new state owned companies which will be governed by the Ministry of Energy and Coal Industry. Naftogaz will produce and supply gas, which maintains its market advantages.

At the same time, the assets transfer to the new companies-operators depends on the arbitrage trial with Gazprom – the factor which does not depend on the government or Naftogaz. It can make difficult the unbundling process and the transition period.»

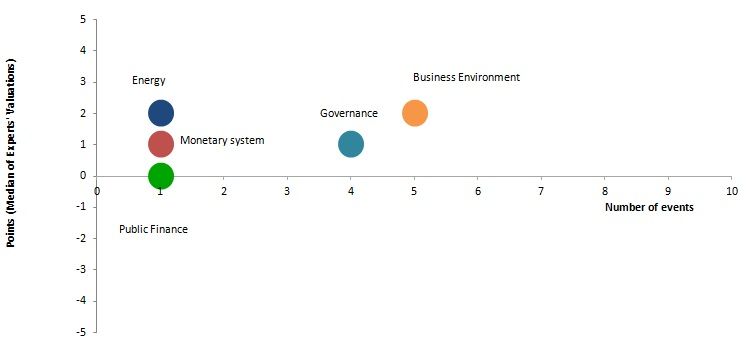

Chart 3. Value of Reform Index components and number of events August 1 – 14, 2016

2) The power of tax authorities to initiate criminal proceedings was reduced: +4,0 points

The State Fiscal Service (SFS) regulation №633 of 18.07.2016 concerns transferring of tax audit files to the tax police. Having made this decision, the SFS stopped the practice of criminal proceedings initiation prior to the completion of administrative and court appealing procedures.

Before the regulation has come into the effect, the SFS initiated criminal proceedings even prior to presenting real proofs of companies‘ violations. According to the Business-ombudsman Council report, pre-trial investigation authorities have commenced 1748 criminal proceedings in 2015, while only 55 ended up with the actual “act of conviction” being filed with courts. This means that more than one and a half thousand companies had to suffer sanctions while only several dozens of them had actually violated the Law.

Reform Index experts assigned a high grade to this measure, since it is aimed at improvement of the business environment. However, they noted that the regulation is a temporary solution of the problems of business, which should be solved by a comprehensive reform of the tax police. The new tax police should be invisible for honest taxpayers.

Reform Index expert comments:

Taras Kachka, Ukraine Reforms Communication Taskforce

«The regulation resolves the situations when criminal proceedings are initiated based on tax audit results. Explicit recommendations should eliminate the situations when criminal proceedings are initiated right after the tax investigation, prior to the completion of appeal procedures. These criminal cases have been one the most common complaints about the SFS activities. The key question is how this regulation is implemented. Therefore, the problem of the legislative regulation of this issue does not disappear from the agenda.»

3) The government creates interregional customs office to fight smuggling: +2,0 points

Regulation №495 of 8.08.2016 launched the interregional customs office of the State Fiscal Service creation.

The Ministry of Finance plans that the office will contribute to effective crackdown on customs rules violations and fighting smuggling and corruption at the customs. Employees of the interregional customs office will be analyzing risks in customs operations. If necessary, they will be able to visit any customs office without a prior notice to intervene into its operations promptly. In this case the employees of this customs office are suspended from duty. The interregional customs office is authorized to carry out full-scale customs control, to check data in customs declarations, cross-check calculated duties, detect and to stop the violation of the law by companies and employees of the SFS on duty.

Reform Index experts noted, that creation of this unit will help to improve the control over the local custom offices, fight corruption and improve the quality of the service for the customers. The detailed statement about this unit should answer the main questions about its usefulness and efficiency. Some experts emphasized that this measure looks like traditional “patching holes” approach. Additionally, the risk of the power abuse may take place.

Reform Index expert comments:

Veronika Movchan, The institute of Economic Research and Policy Consulting, Editorial board, VoxUkraine

«The Cabinet of Ministers adopted the regulation on the establishment of a interregional custom office; however, its functions and mandate have yet to be defined. The Ministry of Finance is responsible for adopting the respective legal act. It is expected that the aim of this unit will be to fight smuggling and corruption. A lot will depend on efficiency and transparency of the new institution, which may have significant powers creating risks of their abuse. The customs reform is more complex issue. It means not only the establishment of the new unit, but also proper implementation of the recently launched “single window” system, a creation of the authorized economic operators and many other important measures»

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations