In the first half of September, reforms barely moved forward. For the first time since the beginning of 2015, Reform Index – index for monitoring of reforms – dropped to +0.2 points. Some progress was observed only in governance reform. A few reforms occurred in the areas of public finance and business environment but they received low grades. No reforms were registered in monetary policy and energy sector.

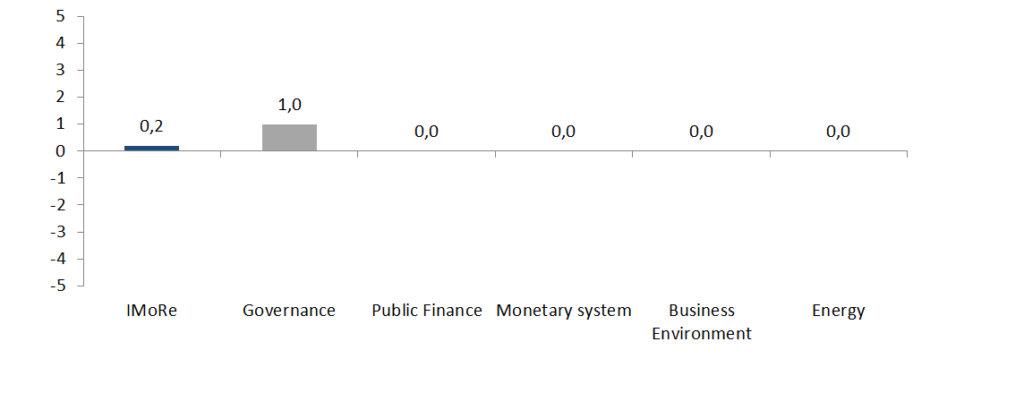

Chart 1. Reform Index dynamics*

* Reform Index team considers index value of at least 2 an acceptable pace of reform

Reform Index experts positively evaluated the Cabinet of Ministers’ regulation on remuneration of state and private bailiffs. Experts also assessed moderately positively the decision to suspend housing and utility subsidies if the number of people registered in an apartment/house increases; at the same time, they noted the lack of systemic actions for the verification of subsidies. The decision to raise export duties on metal scrap received controversial grades.

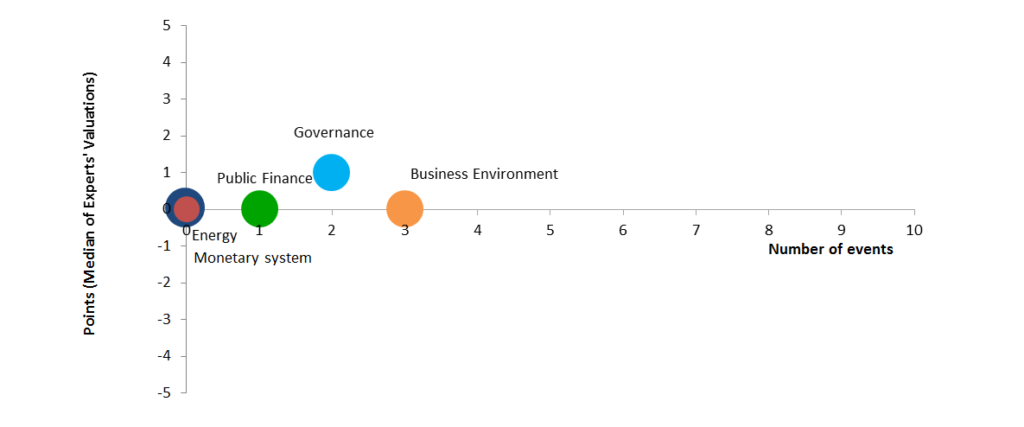

Chart 2. Reform Index and its components in the current round**

**Titles of components were shortened for convenience, while their content remained the same

Important developments

1. The Cabinet of Ministers adopted the regulation on remuneration of state and private bailiffs, +2 points

The development of the procedure regarding bailiffs’ remuneration is a part of judicial reform.

The state monopoly on enforcement of court decisions had existed in Ukraine for a long time. The enforcement system was inefficient. According the Minister of Justice Pavlo Petrenko, only 20% of court decisions were enforced. A party winning a case could wait for years for implementation of a court decision; these delays have allowed corruption to fester within the judicial system.

In June 2016, a large-scale reform was launched in this sphere. The laws 1403-VIII and 1404-VIII dated 02.06.2016 introduced a mixed system of a court decisions enforcement and an institute of private bailiffs. It is expected that more court decisions will be implemented, and the process will become faster.

The government decree № 643 of 08.09.2016 is the next step introducing the rules for state and private bailiffs’ remuneration. Specifically, a state bailiff will receive 2 percent of the value of recovered assets, while the head of the state enforcement agency will get 0.5 percent of the asset value. A private bailiff will receive 10% of the value of recovered assets.

Reformer’s comment:

Today, extremely low financial incentives for state bailiffs is one of major reasons for weak performance of the State Executive Service. Low remuneration causes many problems in the State Executive Service in the country. This factor is the reason for understaffing (about 20% of vacant positions across the country), for high workload of current staff (over 160 cases per officer per month) and sometimes leads to relatively low qualification of enforcement officers, high attrition rate and low interest in quality of their work. Clearly, we cannot expect improvements within the system without changing remuneration rules.

Hence, the Decree aims to resolve this problem by increasing remuneration (the variable component of it) that will directly depend on the performance of each bailiff. The result-based remuneration grounded on market economy principles is expected to significantly increase efficiency of the State Executive Service. It is important that remuneration will be distributed between a bailiff and his/her supervisors. It will guarantee the aspiration to achieve the best results at each level of the Service structure and significantly reduce corruption risks.

10% remuneration for a private bailiff ensures equality between state and private enforcement systems. This remuneration for the private bailiff besides the honorarium should cover the cost of performing his professional duties (rent and office supplies, recruitment, registry services etc). For a public enforcement officer all expenses are covered by the state and should be compensated from the enforcement fees set at the same 10% level. Hence, in our opinion this remuneration system will be balanced and fair.”

— Sergiy Shklyar, The Ministry of Justice of Ukraine

Expert’s comment:

“Good news is that a state bailiff can get remuneration even in case of partial recovery of assets. There are cases when a state bailiff conducted all necessary enforcement measures, but a debt and an enforcement fee were recovered only partly. Previously in such a case no remuneration was paid as the court decision was not implemented. At the same time, a remuneration payment procedure remains bureaucratic envisaging writing both a remuneration request and a payment submission which de-facto duplicate each other. This procedure should be streamlined and improved.”

— Oleksandr Wolf, partner in law company “Spanta”

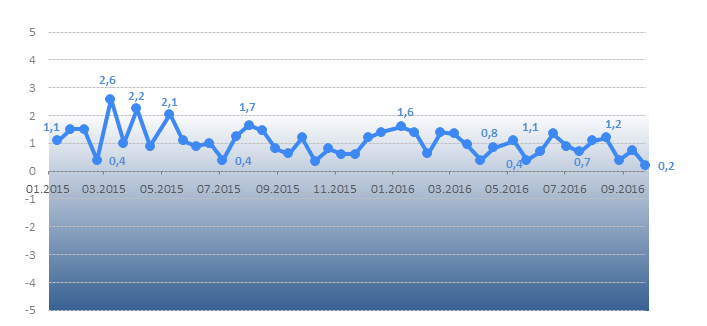

Chart 3. Value of Reform Index components and number of events September 12-25, 2016

2. The government decided to suspend housing and utility subsidies when the number of people registered in an apartment/house increases, +0.5 points

The Minister of Social Policy expects that 60% of households will get housing and utility subsidies this winter. The existing system of subsidies has many drawbacks, such as widespread fraud. The issue of subsidies verification has been raised many times, but so far the problem has not been approached in a systematic manner.

The CMU decree #635 of 08.09.2016 amends the procedure for calculation of total household income for the purpose of granting housing and utility subsidies. Specifically, from now on if the number of people registered in one apartment/house increases, the subsidy is suspended.

Reform Index experts paid a special attention to this measure because a systemic review of procedures and criteria for granting of subsidies is a pressing issue. This decree received low but positive grades since it is a point solution for a fraud reduction. At the same time, experts noted that this decision may adversely affect people in need.

Expert’s comment:

“The new regulation adjusting the procedure for granting housing and utility subsidies is an ad-hoc measure aimed at fraud reduction. The revision of total income taken into account when assessing the eligibility of a household for the subsidy is expected to reduce fraud. However, it might also hurt those who are in a real need (e.g., because of unemployment). A restitution of special commissions for subsidies’ decisions is doubtful taking into account that traditionally these commissions do not work very well (and a little has changed in the local social policy departments).

Overall, this decision again raises the issue of importance and urgency for the full-scale social welfare reform, including provision of social assistance, subsidies and privileges. The government should finally propose a modified social welfare system that will become a long-term solution to its current problems.”

— Oleksandra Betliy, Institute of Economic Research and Policy Consulting

3. Export duties on scrap metal were raised from EUR 10 to EUR 30 per ton for one year, 0 points

Reform Index experts evaluated this event differently. Some of them assessed the law positively since it supports Ukrainian metal producers, others – negatively as it violates Ukraine’s obligations vis-a-vis the EU and the WTO.

Metal scrap is an input for steel producers. Obviously, the local steelmakers would like to buy it within the country at an understated price, while scrap exporters would like to sell it at the world prices.

The increase in export duties on metal scrap was initiated by a group of MPs representing Radical Party, People’s Front, Petro Poroshenko Bloc, “People’s freedom” group, and “Samopomich” party.

Their initial draft law foresaw an increase in the duty to EUR 35 per ton for three years. The MPs justified this increase by the needs of Ukrainian steelmakers, machine-builders and national security in a time of war. Despite the fact that the draft law violated Ukraine’s obligations to the WTO and the EU, it was adopted and sent to the President for the endorsement. The President vetoed the document on the ground that it violates the Ukraine-EU Association Agreement and proposed a compromise, namely an increase in the duty to EUR 30 for one year. This compromise eventually became the law 1455-VIII of 12.07.2016 which has been recently signed by the President.

Reformer’s comment:

“It is important to consider the situation within the time perspective. Previously, all contracts for export of metal scrap had to be registered. It was an implicit mechanism for export quotas. This approach was unpredictable, non-transparent and created opportunities for corruption. In fact, the total annual export quota as well as its distribution between exporters were defined at the discretion of officials.

These and other norms have actually led to the destruction of the scrap-metal industry.

Law 1455-VIII of 12.07.2016 cancels this corruption scheme, simultaneously introducing an increase in the duty for one year. Temporary duty increase is aimed at softening the transition period for the scrap-metal market.

The market becomes predictable, and the level playing field is created for all of its participants. It is very important that a duty increase is indeed a temporary measure, is not extended after its expiration date and is reduced to the level foreseen by Ukraine’s international obligations.”

— Denis Hutenko, Ministry of Economic Development and Trade of Ukraine

Expert’s comment:

“In fact, the country has violated its obligations not only to the EU but to the WTO as well, since it promised not to raise export duties on ferrous metals scrap. Metal producers will benefit from this law. They are now suffering from low global metal prices and are not ready to pay the world price for raw materials. The decision was justified, in particular, by a critical shortage of raw materials for the industry and its critical importance for the economy (Article XI GATT). However, the strategic nature of these raw materials raises certain questions. One of the arguments for the duty increase was the needs of military machine-building, but then it is not clear why metal export is not prohibited.”

— Veronika Movchan, Institute for Economic Research and Policy Consulting

“The law #1455 covers not only an increase in an export duty for scrap metal. The main purpose of the law is a deregulation of the scrap export (namely via cancellation of export licensing). During the draft law development, it was recognized that the increase in export duties is a controversial measure as for the membership of Ukraine in WTO and its obligations under the Association Agreement with the EU. However, the temporary nature of the duty increase is a compromise between the interests of the industry and Ukraine’s trading partners. Therefore, this law is reasonable. However, the attention of all interested parties will be focused on how to avoid speculations on the necessity to prolong an increased duty.”

— Taras Kachka, International Renaissance Foundation

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations