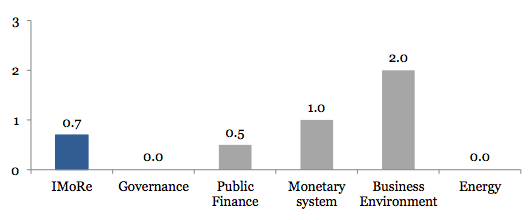

Reform Index is +0.7 points on a scale of -5.0 to +5.0 for the period from October 30 – November 12 , 2017 (+0.3 in the previous round). Certain positive developments were recorded in legislation regarding public finance, the monetary system and the business environment. There were no reformist legislative changes affecting governance and the energy sector.

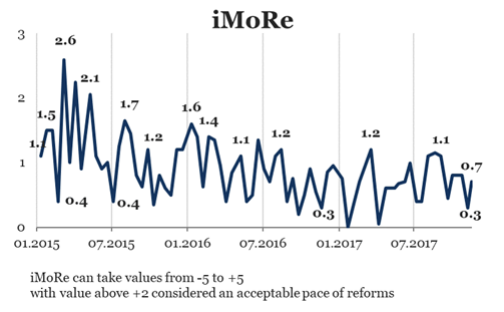

Chart 1. Reform Index dynamics*

Chart 2. Reform Index and its components in the current round

The major event of the release

The law that approximates the requirements for financial reporting to EU standards, +2.0 points

According to the Association Agreement with the EU, Ukraine has undertaken the obligations to implement European standards of financial reporting. In the EU, the financial reporting standards are regulated by the Directives on annual financial statements, consolidated financial statements and related reports of certain types of undertakings from June 26, 2013 # 2013/34 / EU.

It establishes conditions for the compilation, presentation and public disclosure of financial and consolidated financial statements, as well as the new procedure for the acceptance and assessment of certain types of assets and liabilities, income and expenses.

Law # 2164-VIII has implemented the main Directive provisions into the national legislation.

Expert’s Comment

“Changes to the law should make large entities in Ukraine more transparent and understandable to foreign partners, investors and lenders, and help attract investments and loans.

First of all, amendments to the law broaden the list of enterprises that have to prepare financial statements in accordance with International Financial Reporting Standards (IFRS) and maintain accounting in accordance with accounting policies that meet the requirements of IFRS. The law also requires public disclosure of annual financial statements, together with an audit report on its own website. It concerns enterprises that meet the criteria of a “large entity” and entities engaged in mining activities of national importance (gas, oil, major ores, coal, etc.).

In our opinion, for a large number of private companies, the requirement to disclose their IFRS financial statements will be a major challenge as they still consider that the financial statements are highly confidential and they are not prepared to disclose all the information required by IFRS. This can have a decisive impact on the completeness, quality and reliability of the financial information that will be made public. However, I hope that the benefits of switching to IFRS reporting and disclosure of financial information to the interested individuals will convince owners and executives of the need to take a step toward the public disclosure of complete and reliable financial information. Independent auditors who will audit IFRS financial statements will also play an important role, and will be responsible for the quality of the work performed and the reports provided.

It should also be noted that transitional provisions to the law contain some “blank spots”. For example, the law does not set the date of IFRS first application for those companies that need to transfer to IFRS to comply with the law. This may lead to different companies reaching different conclusions about the date of the first application. At least two scenarios are possible:

- transfer to IFRS from January 1, 2017 and have a complete IFRS financial statements for the year 2018 (with the comparative information for 2017), or

- transfer to IFRS from January 1, 2018 and have only prior IFRS financial statements for the year 2018 (without comparative information), but full financial statements – only for 2019.

This, in turn, could lead to misunderstandings with the tax authorities, because now the financial accounting is the basis for calculating the income tax. Depending on the scope of the company activity that has to be transferred to IFRS, the differences in accounting policies between IFRS and Generally Accepted Accounting Principles (GAAP) may have a significant tax effect. Meanwhile, the Tax Code does not contain norms regulating the issue of taxation of those accounting adjustments that will be made at the time of transition to IFRS. Consequently, regulators need to further elaborate these issues, and companies that transfer to IFRS should take the transition extremely seriously. ”

— Vladimir Dabizha, EY in Ukraine

“Adoption of the Law is not only another step towards the adaptation of domestic legislation to the European one, but also a very useful step.

So, expanding the range of entities that are required to compile their financial statements in accordance with the international standards will enhance the quality and informative value of such reporting. By the way, as our experience shows, the transition to international standards and the corresponding improvement of the skills of accountants has a positive impact on the regulation of business processes in general.

Moreover, the introduction of the Management Report will increase the level of understanding between business and investors, since the provision of nonfinancial information that characterizes the state and prospects of enterprise development and reveals the main risks and uncertainties of its activities is no less important to the “readers” of reporting than traditional “dry” financial values.

It should also be noted that this Law also eliminates certain anachronisms – in particular, a purely formal approach to the registration of the essentials of primary documents, where a minor flaw, such as an incorrectly placed coma, could invalidate the entire document.

At present, for the full implementation of these provisions, the Ministry of Finance is expected to approve the taxonomy of financial reporting according to the international standards, and we hope for the efficiency of the main financial department in publishing the official translations of IFRS. ”

— Alexander Pochkun, Baker Tilly

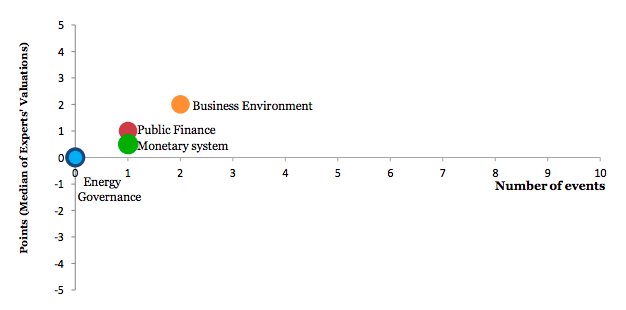

Chart 3. Value of Reform Index components and number of events

(Please see other charts on the website)

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations