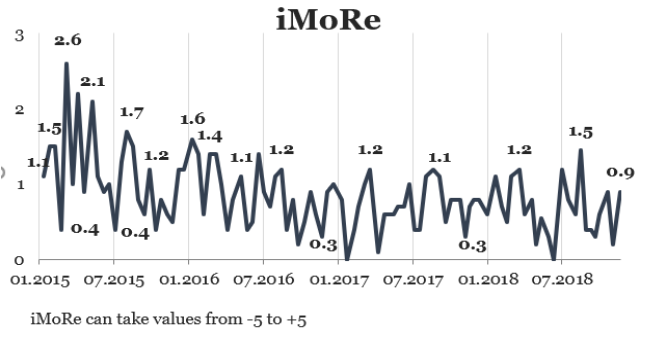

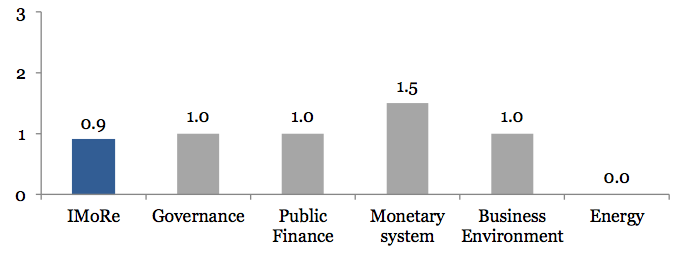

Reform Index is +0.9 points for the period from October 29 – November 11, 2018 on a scale of -5.0 to +5.0. In the previous round the index was 0.2 points.

Among the events of this round are laws on reforming Supervisory Councils at state banks (+4.0 points) and a resolution that allows bank customers to remotely open bank accounts through the BankID System of the NBU (+2.3 points).

Chart 1. Reform Index dynamics

Chart 2. Reform Index and its components in the current round

The major event of the round

Law on reforming Supervisory Councils at state banks, +4,0 points

According to the current law on banks and banking, there should be Supervisory Councils at state banks, where 100% of the statutory capital is owned by the state. These councils are the highest governing body of the bank and control the activities of the board. The members of the Supervisory Councils were appointed by the Verkhovna Rada, the President and the Cabinet of Ministers. The Supervisory Councils could also include representatives of executive authorities.

This creates conditions for political influence on the members of the Supervisory Councils and, accordingly, on the operational activities of the banks and allows to use state banks for populist and political purposes. In particular, they can be used to lend enterprises under special conditions. Such Supervisory Councils were not effective, which created opportunities for corrupt schemes in the activities of banks.

The law (2491-VIII of 05.07.2018) sets new rules for the appointment of members of the Supervisory Councils. They should consist of nine members: six independent and three representatives of the state. Independent members will be chosen by the Competition Commission set up by the Cabinet, and other members of the council will be appointed by the President, the Government and the Verkhovna Rada.

Resolution allowing to remotely open accounts through the system BankID, +2,3 points

Resolution of the NBU Board dated November 1, 2018 #116 introduces the mechanism of remote identification of clients through the BankID System of the National Bank. For the first time, the bank which is the participant of the system should identify an individual. After that, the person will be able to use the services of banks on the website of any company or bank connected to BankID. The identification of the person will be carried out by banks remotely. This, for example, will enable clients to remotely open accounts without having to visit the bank’s branches.

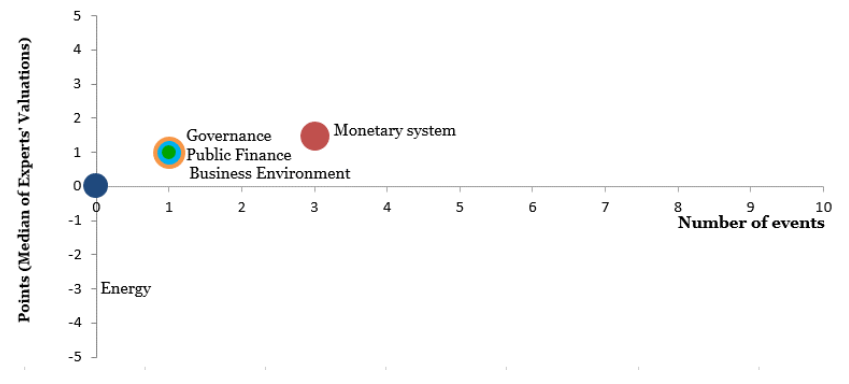

Chart 3. Value of Reform Index components and number of events

(Please see other charts on the website)

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations