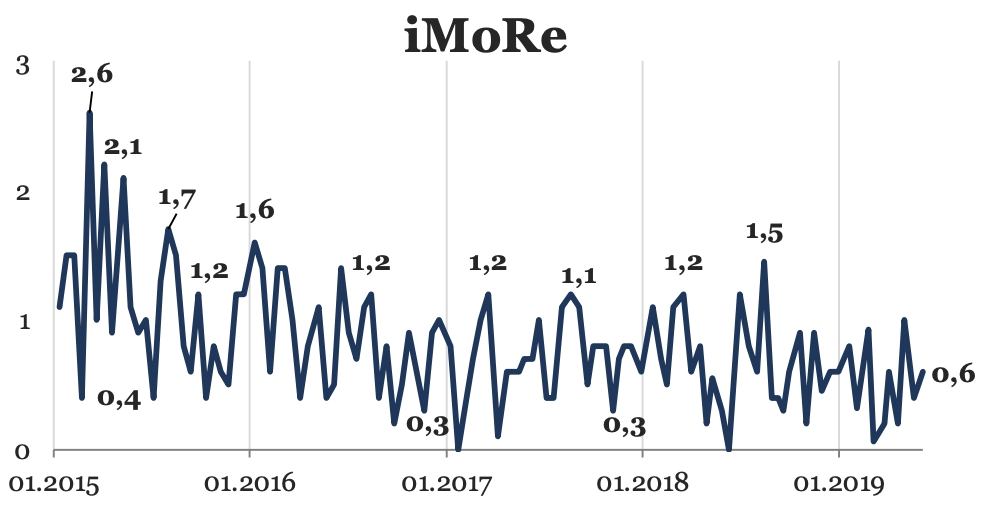

Reform Index made up +0.6 points in the period from May 13 to May 26 out of the possible values from -5.0 to +5.0. In the previous round the index equaled +0.4 points.

The main events of this round are as follows: the law on green auctions and the change in the deadlines for payments in export and import operations.

Diagram 1. Reform Index Dynamics

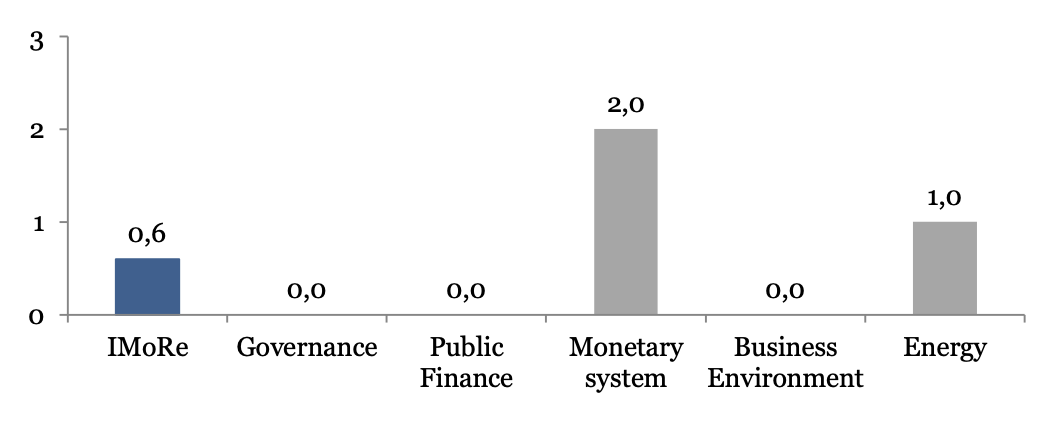

Diagram 2. The values of Reform Index and its components in the current round of evaluation

Events of the round

The Law On Green Auctions, +1.0 point

Pre-history

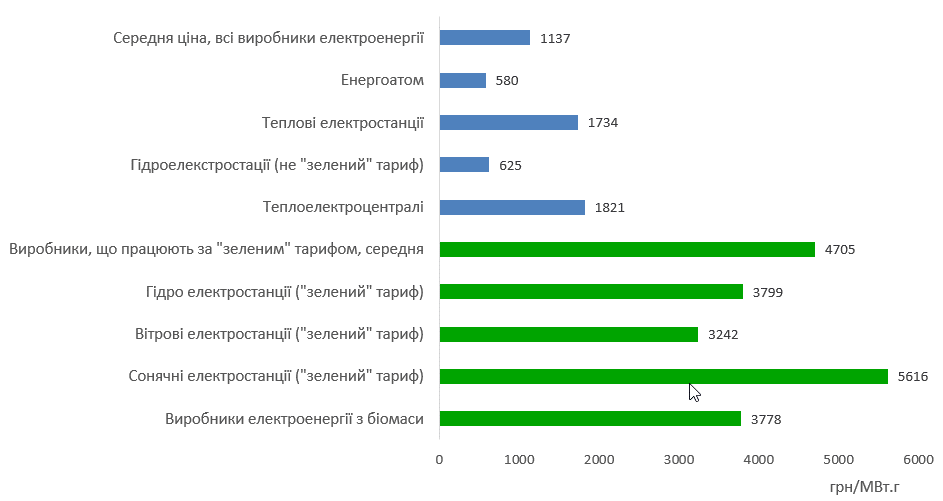

‘Green’ tariff has been introduced in Ukraine to stimulate renewable energy. Electricity produced out of solar, wind energy, biomass, etc. costs much more than other energies (table 1). The most expensive is solar energy.

Diagram 3. The price of electricity sales on the wholesale market in May 2019, UAH/MWh

Source: SE Enerhorynok

This business turned out to be highly profitable. ‘Green’ tariff in Ukraine is one of the highest in Europe, and the cost of such energy generation is going down. In particular, the prices of solar panels have significantly decreased. Due to this the field has become attractive for investors.

However, this advantage has a reverse side – Ukraine needs to secure payment at the higher tariff for those producers. Already now this payment makes up 9% of the turnover in the energy market, though only 2% of all energy in Ukraine is produced from renewable sources of energy. Renewable energy plants are being launched at a quick pace. Payment for electricity produced by already built capacities and the ones intended to be put into operation in the current and following year since 2021 will be 40 bln. UAH annually (in 2018 – 16 bln,). Also, energy market shall run the costs of regulation of imbalances of those power plants, which may additionally equal from 10 to 35 bln. UAH.

What is the law about

In order to avoid uncontrolled rise in the costs of renewable energy, a different model of development stimulation is required for the sector.

Law 2712-VIII as of April 25, 2019 replaced ‘green’ tariffs with ‘green’ auctions for large producers of renewable energy. Under it, the investor offering the lowest tariff will get the right to build a power plant. This tariff will be valid for 20 years from the date the plant is put into operation.

In general, the new model enables to solve the problems with uncontrolled rise of the costs of ‘green’ tariffs. Transition of large producers to the ‘auction’ model will be gradual.

Thus, new large producers (wind power plants with the capacity exceeding 5 MW or solar ones with the capacity over 1 MW) will be subject to getting state support only via a ‘green’ auction. Auctions will be launched since July 1, 2019 and will be held up to December 31, 2029. However, law allows the following producers to get a ‘green’ tariff:

- who put plants into operation by January 1, 2020,

- who conclude agreements of electricity purchase-sale at the ‘green’ tariff by December 31, 2019 and put solar plants into operation within 2 years or wind plants within 3 years from the date of agreement conclusion.

While for large already working producers as well as for any small producers till 2030 there will function the current system of ‘green’ tariff support.

The opportunities for getting a ‘green’ tariff by large producers for 4 more years have become subject to expert criticism.

Also, law has limited the opportunities for getting a ‘green’ tariff by private households that have installed ground solar panels. This issue evokes many discussions. Since, according to the information provided by the Ministry of Energy and Coal Industry, many private solar power plants are installed not to make up for own load, but only to earn money at the expense of other consumers. In proficit energy districts that leads to deteriorating electricity quality indicators and supply security.

Developers of the law and other deputies have filed several draft laws which aim to remove this restriction for domestic ground solar power plants (10357, 10318, 10343).

Expert’s comments

“When the first draft law was being elaborated, its goal was to introduce an effective competitive support system for the facilities generating electricity from renewable sources of energy.

The system was meant to change the size of the ‘green’ tariff set in legislation, which provided a strong impetus for the development of electricity generation from RES, but it appeared to be ineffective in the conditions of a drastic decrease in the prime cost of the generating equipment, in particular, solar panels.

To put it simply, due to high ‘green’ tariffs, investors started getting unreasonably high income at the expense of electricity consumers.

In the course of draft law processing, among other things, analysis of the effect of RES stimulation was made [RES – renewable energies, ed.] on the cost of electricity over the next three years. According to the calculations, already on the basis of the results of 2020 electricity produced from RES will cost more than 40 bln. UAH for consumers. If we apply a comprehensive approach to the situation, it becomes clear that Ukrainian economy cannot afford such additional costs. Probably, that could become the reason for partial default under the commitments in payments at the ‘green’ tariff, with all that it implies (lost arbitration court proceedings, investment climate deterioration, capital cost increase, etc.).

It was necessary to give an opportunity to the government to influence the volume of financial commitments undertaken by Ukraine. That could be done through establishment of certain limits of payments for new investors. The idea was, however, not supported.

Indirect control over the volume of costs was achieved through establishment of the participants duty to take part in an auction where they would compete for a quota (the capacity within which support is provided) established by the Cabinet of Ministers of Ukraine. Such mechanism is effective only in case investors who have not won the auction cannot implement all their projects at the ‘green’ tariff. That is why the Law sets that the size of the facilities that may receive the ‘green’ tariff starting with January 01, 2020 may not exceed 1 MW for sun and 5 MW for wind. Thus, we have tried to stabilize the overheated RES sector, without violating the commitments undertaken by Ukraine, in line with the Law of Ukraine On Alternative Sources”.

– Illia Poluliakh, Dixi Group

Table 1. Assessment of all the events and the progress of the reforms by directions

| Public governance | 0.0 |

| Public finance | 0.0 |

| Monetary system | +2.0 |

| Deadlines for payments in a number of export and import operations cancelled | +2.0 |

| Business environment | 0.0 |

| Law on ‘green’ auctions | |

| Energy | +1.0 |

| Law on ‘green’ auctions | +1.0 |

The deadlines for payments in a number of export and import operations have been cancelled, +2 points

With its Resolution No. 67 as of May 14, 2019 the National Bank of Ukraine simplified its currency supervision over compliance with the deadlines for payments in a number of foreign economic operations.

Experts’ comments

‘The Resolution takes foreign economic contracts for a number of goods and services out of the effect of currency restrictions. Now payments under such contracts don’t need to be completed within 365 days, the gap between the date of commodity/service supply and the date of payment is not regulated and may be set at the discretion of the parties to the contract. This restriction was one of the most painful for business when it was 90, and then 180 days – companies had to re-conclude agreements every three months or every half a year not to violate payment deadlines, otherwise they became subject to sanction imposition.

In particular, the following are taken out of the effect of the restrictions: (1) complex goods for space rocket complexes, aviation and military industrial complex – development and production of such goods may well exceed a year, and restrictions for them are too strict (2) goods under agreements on product distribution (3) procurements of medications and medical services of the Ministry of Health (4) goods and services– they were taken out of the effect of currency control back in 2016 by a special law as the ones that cannot be controlled and the ones it is inexpedient to control, while the Law on Currency did not record that, and now the National Bank is returning liberal regime for his market.’

– Mariya Repko, Centre for Economic Strategy

‘Resolution No. 67 as of May 14, 2019 approves the list of exceptions from the regime of control of the deadline for payments in export and import operations. To put it simply, this reduces the load on banks and allows not to demand extra documents from clients for the operations indicated in the list.

Along with that, for a part of service export (the most wide-spread operations out of the ones mentioned in the list) this resolution is just status quo restoration. Back before the adoption of the Law On Currency these operations were excluded from the regime of control of payment deadlines. That enabled banks not to demand acts of service provision, which it was difficult to sign with foreign customers (in 2016 respective amendments were made in the Law On the Procedure of Making Payments in Foreign Currency for the sake of service export facilitation, mainly in IT).

The Law On Currency cancelled this exception along with the Law On the Procedure of Making Payments in Foreign Currency and entitled the Cabinet of Ministers of Ukraine and the National Bank of Ukraine to determine such exceptions or peculiarities with their acts. After the Law On Currency took effect and before resolution No. 67 was adopted, the banks and clients worked in a more rigid regulation regime in service export than before adoption of the Law of Ukraine On Currency – banks started requiring acts of service provision, signed with foreign customers, from their clients again. The situation was improved with adoption of resolution No. 67’.

– Olena Korobkova, Independent Association of Banks of Ukraine

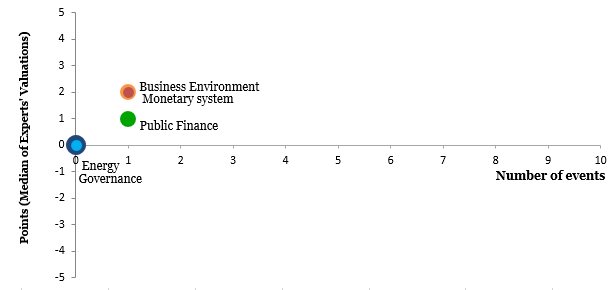

Diagram 4. The values of some components of the Index and the number of events

Reform Index aims to provide a comprehensive assessment of the efforts taken by the Ukrainian authorities to implement economic reforms. The index is based on expert assessment of the changes in the regulatory environment in five directions:

- Public governance

- Public finance

- Monetary system

- Business environment

- Energy

More detailed information about the Index and calculation methodology may be obtained on the site reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations